What Is Crundle (CRND) Crypto: Everything You Need To Know About It

The cryptocurrency market continues to be shaped not only by established players like Bitcoin and Ethereum but also by the explosive rise of meme coins. Crundle (CRND), a meme coin that operates on the Solana blockchain, has recently emerged as one of the latest meme coins capturing the attention of traders and speculators.

But what exactly is Crundle (CRND)? Is it legitimate and safe? This article provides a comprehensive overview of Crundle (CRND), covering its tokenomics, features, and safety considerations. By combining available data and expert insights, the article aims to help readers understand the potential and risks of engaging with this emerging digital asset.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Crundle (CRND)?

Crundle (CRND) is a meme coin launched on the Solana blockchain in September 2025. The project’s central theme is based on the narrative that its existence was predicted by the animated television series, The Simpsons, combining imagery of the character Homer Simpson with a figure referred to as “Crumble Man.” This initiative was undertaken by an anonymous founder or group of founders, and no team members have been publicly disclosed. Such anonymity is a prevalent characteristic within the meme coin sector.

CRND was deployed as an SPL token (Solana standard fungible token) on September 15, 2025. The token’s launch utilized Moonit, a platform specifically designed for deploying new tokens on the Solana network. Later that same day, an initial liquidity pool for CRND was established, pairing it with Solana’s native token (SOL) on the Meteora decentralized exchange.

To coincide with its launch, the project’s official X account (@CrundleonSOL) was also created in September 2025. Its initial liquidity pool is hosted on Meteora decentralized exchange, and its contract is publicly accessible; trading pairs include CRND/SOL. The value of this token is primarily influenced by community engagement, social media trends, and speculative trading activities occurring on decentralized exchanges.

[TRADE_PLUGIN]DOGEUSDT,PEPEUSDT[/TRADE_PLUGIN]

CRND Tokenomics

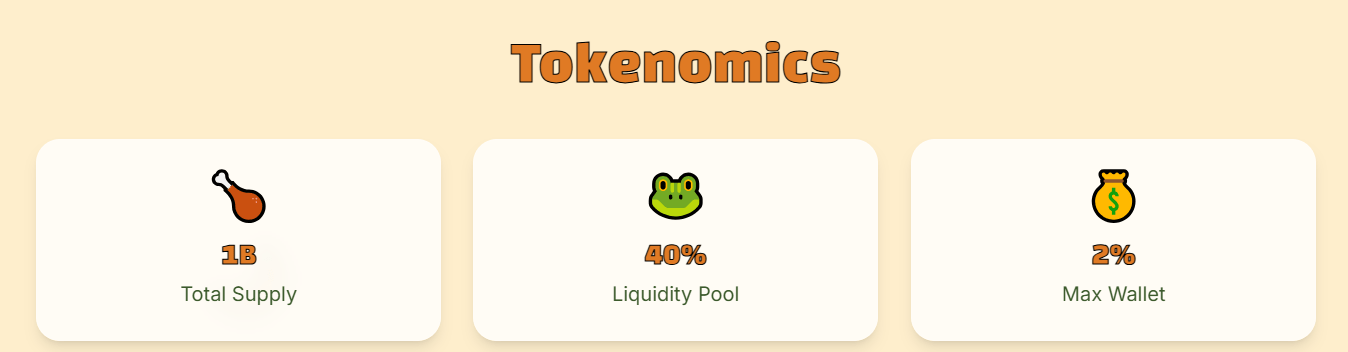

Crundle’s tokenomics is carefully designed to promote decentralised distribution and prevent any single entity from controlling a significant proportion of the supply.

The total and circulating supply are both approximately 1,000,000,000 CRND, meaning no locked or undistributed supply is clearly documented at this time. This also implies that the risk of inflation via new token minting is low, since the supply appears fixed.

Tokenomics at a Glance

- Total Supply: 1 billion CRND tokens

- Liquidity Pool: 40% of the supply is locked for liquidity

- Max Wallet: 2% per wallet to encourage fair distribution

To promote wider token distribution, the project implemented an anti-whale mechanism. This limits the maximum amount of CRND that a single wallet can hold to 2% of the total supply — equivalent to 20,000,000 CRND. This measure is intended to prevent large-scale investors (‘whales’) from amassing a controlling stake that could be used to manipulate the market price.

[TRADE_PLUGIN]DOGEUSDT,PEPEUSDT[/TRADE_PLUGIN]

Key Features of Crundle (CRND)

- Meme Narrative and Community Engagement: Crundle’s main appeal lies in its storytelling, including the Simpsons prophecy and ‘Crumble Man’ imagery, as well as its strong meme culture, known as the ‘Crundle Army’. These elements drive social attention, virality and speculative flows. Such narratives often lead to rapid adoption in terms of the number of holders, but also correspondingly sharp volatility.

- Decentralization Measures: As previously mentioned, the token’s smart contract includes features that promote decentralisation, such as the inability to mint new tokens, the absence of blacklist functions, the burning of LP and the relatively low developer holdings. These features help to build trust among potential holders who fear rug pulls or centralised control.

- Low Barrier Entry & Liquidity Pools: As CRND is available on smaller Solana-based DEXs, it provides easy access for smaller investors and speculators. Trades can be executed almost immediately, but the downside is low liquidity and higher slippage risk. This pattern is typical of many small meme coins: high volatility and rapid price movements, but also high risk.

- High Volatility & Risk Exposure: The price is extremely sensitive to community sentiment, social media mentions and short-term news. The token is unverified on many platforms. Even minor changes in investor behaviour or liquidity can result in significant price fluctuations (in either direction).

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Is Crundle (CRND) Legit and Safe?

While CRND has some credible features as a meme coin, such as a fixed supply, a disabled mint authority, burned LP and transparent contracts, it still lacks formal disclosures. The team is anonymous and there is little documentation of the roadmap or development beyond basic community-driven media. In crypto terms, it is neither obviously fraudulent nor institutionally verified.

The audits for Crundle (CRND)’s smart contract are limited or informal. While some automated tools report ‘no immediate issues’, these do not constitute full audits. Liquidity is relatively low, meaning large trades may experience slippage. Also, the absence of a formal development team means responsibility for bug fixes or governance is uncertain. Meme coins are typically highly correlated with overall crypto sentiment rather than fundamentals.

Meme coins tend to be highly correlated with overall crypto market sentiment rather than fundamentals. When macro market conditions worsen, speculative tokens often perform badly. Regulatory risk is also a factor: meme coins with anonymous or opaque governance may face more scrutiny. Furthermore, due to its small size, CRND is more susceptible to exchange delistings, drying up of liquidity, and sell-offs by holders.

[TRADE_PLUGIN]DOGEUSDT,PEPEUSDT[/TRADE_PLUGIN]

Crundle (CRND) Price History

Since its launch in September 2025, Crundle has had a very small market capitalisation, but unusually high turnover.

The token currently changes hands at around $0.0004. Daily trading activity has already reached over $1.5 million, an impressive figure given its small size. These figures demonstrate how quickly meme coins can generate attention, with community enthusiasm creating rapid spikes in liquidity even when the project itself is little more than a joke.

At the same time, however, price movement has been extremely volatile. During the first few days of trading, Crundle surged and then corrected sharply, experiencing significant value fluctuations. Fewer than 3,500 wallets currently hold CRND, meaning even modest buy or sell orders can dramatically impact the market.

The combination of a small market capitalisation, concentrated ownership and speculative energy means that Crundle’s early chart resembles a rollercoaster ride more than a stable investment trend. Investors should view current performance as a reflection of meme-driven hype rather than sustainable growth.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Crundle (CRND) Price Prediction

With Crundle trading at approximately $0.0004, its future remains highly speculative. As a meme coin, its performance is influenced more by hype and community momentum than by fundamental factors.

Predicting the prices of meme coins can be challenging due to their strong dependence on social sentiment. However, by analyzing market indicators alongside community growth, we can derive both short-term and long-term insights.

- Bullish Scenario: Should Crundle succeed in maintaining its initial hype and garner broader attention on social media or through influencer endorsements, the token could witness another significant rally. A rise to $0.001 would elevate its market capitalization to around $1 million, while an increase toward $0.01 would suggest a valuation of approximately $10 million. Such price levels are not unattainable within the realm of meme coins, where viral trends often lead to short-term surges.

- Moderate Scenario: More realistically, Crundle may continue to oscillate within its current range of $0.0002 to $0.0006 as early investors engage in buying and selling activities. Trading volume might remain relatively high given the coin’s size; however, without new catalysts for growth, it is likely that the coin will stabilize around its present valuation. This scenario reflects a niche token driven by community engagement that continues to circulate without achieving mainstream recognition.

- Bearish Scenario: Like many meme coins, there exists a substantial risk of collapse. If interest wanes or if several large holders decide to liquidate their positions simultaneously, Crundle could swiftly drop below $0.0001—resulting in a significant loss of market value. In such an event, the project may become dormant with price charts indicating only minimal trading activity and limited real liquidity.

[TRADE_PLUGIN]DOGEUSDT,PEPEUSDT[/TRADE_PLUGIN]

What Drives Crundle (CRND)’s Growth Potential?

The value of Crundle (CRND) is affected by several dynamic market forces, including:

Meme Virality – For any meme coin, cultural relevance and online traction are paramount. The reach and engagement of the Crundle (CRND) project across platforms such as X and Telegram will play a decisive role in sustaining long-term growth.

Exchange Listings – Securing listings on major centralized exchanges (CEXs) is critical for boosting $CRND’s price. Platforms like Kraken—or potentially Binance Futures—would significantly enhance liquidity, accessibility, and credibility.

Broader Market Sentiment – The general condition of the crypto markets will act as an overarching influence. A bullish environment would likely attract greater investor interest—particularly in meme coins—providing strong momentum for $CRND’s growth.

Adoption – Whether the demand for more Crundle (CRND)increases or decreases depends greatly on growing adoption. Wider adoption of Crundle (CRND) by businesses and individuals could drive the price up.

Tokenomics and vesting schedule – Strategic token distribution and allocation discourage immediate selling pressure and incentivize holding. A controlled release schedule (vesting) also prevents a price crash by slowly introducing tokens into the market.

Regulations – Government regulations around cryptocurrency can significantly exert profound influence on the price of cryptos, including Crundle (CRND) token.

[TRADE_PLUGIN]DOGEUSDT,PEPEUSDT[/TRADE_PLUGIN]

How to Buy the CRND Token?

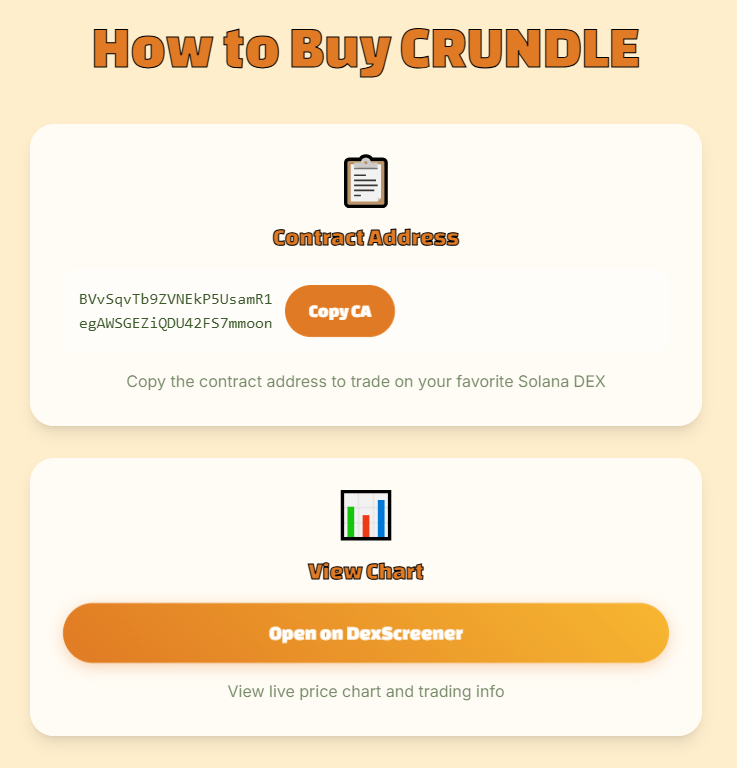

The project’s on-chain assets are managed by several key smart contract addresses on the Solana network.

- Token Contract Address: BVvSqvTb9ZVNEkP5UsamR1egAWSGEZiQDU42FS7mmoon

- Token Creator Wallet: auYCowSLAT7sp37zvgHha9ckPadMpSpWHkbrKujUcff

- CRND/SOL Pair Address (Meteora): 7nbTHY3pafVEbwLJ4g3oE5VxDRK5phz1Qx913Ghm4LNZ

These addresses allow for the tracking of token transactions, holder distribution, and liquidity pool status on Solana block explorers.

Those familiar with Solana-based tokens will find it straightforward to trade Crundle crypto. However, beginners should take the time to familiarise themselves with the process before getting started. Here is a detailed guide to get started:

- 1. Obtain a Solana Wallet: Download a compatible wallet, such as Phantom.

- 2. Fund Your Wallet: Transfer SOL (the native token of the Solana network) into your wallet, as it is required for transaction fees.

- 3. Copy the Contract Address: Ensure accuracy by using Crundle’s official contract address.

- 4. Utilize a Solana DEX: Platforms like Raydium allow you to paste the contract address and exchange SOL for CRND seamlessly.

Currently, CRND Token is not available on BTCC platform. However, it is worth mentioning that BTCC supports trading for large variety of popular meme coins, such as PEPE, DOGE, SHIB, BONK, etc. If you are interested in these popular meme coins, you can make a purchase on BTCC exchange with highest security level and a most competitive fee.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

Crundle (CRND) is an extremely speculative new entrant to the meme coin market. It offers many of the attributes that meme coin enthusiasts look for, such as a strong narrative, a fixed supply, safeguard mechanisms and community energy. However, it also carries significant risks, including low liquidity, anonymous developers, minimal utility and vulnerability to sentiment swings.

For those who believe in meme culture and are comfortable with high-risk investments, there may be profit potential in short-term speculation. However, expecting long-term sustainable value or substantial gains without utility or broader adoption is unrealistic. For CRND to become more than just a flash in the meme coin crowd, it needs to deliver on its compelling story with utility, transparency and stronger infrastructure.

In any case, all investors should always do their own research, verify the contract details and tokenomics, and treat CRND as high-risk speculation rather than a stable investment.

That’s all the information about Crundle (CRND). If you want to know more information about Crundle (CRND) meme coin and other cryptocurrencies, please visit BTCC Academy.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

FAQs about Crundle (CRND)

What is Crundle meme coin?

Crundle is a meme-based cryptocurrency built on the Solana blockchain, often referred to as the “crumbliest, dankest coin,” with a strong emphasis on community engagement.

Who is the Founder of Crundle meme coin?

The project was developed by a community inspired by predictions from The Simpsons and the broader meme culture.

How many Crundle tokens exist?

There is a total supply of 1 billion CRND tokens, accompanied by specific regulations regarding liquidity and wallet limits.

Is Crundle a good investment?

As with most meme coins, investing in Crundle carries high speculation. It primarily revolves around community culture rather than assured financial returns.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Why Choose BTCC?

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

VWA Crypto Price Prediction 2025, 2026 And 2030: Is It A Good Investment In 2025?

How To Buy VWA Crypto: A Comprehensive Guide For All Traders

Monad Airdrop Guide: How To Claim Your MON Token?

Arctic Pablo Coin (APC) Review & Analysis: Next 100x Token?

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Gold-Backed Cryptocurrency Explained: What Are The Best Gold-Backed Cryptocurrencies In 2025?

Best Crypto & Bitcoin Casinos Australia 2025

Top Crypto & Bitcoin Casinos Canada 2025

Best Cryptos To Mine In 2025: A Complete Guide For Beginners

Best Crypto Trading Bots Australia 2025

Best Free Crypto Sign-Up Bonus Australia 2025

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

Toshi (TOSHI) Price Prediction 2025, 2026 And 2030: Can TOSHI Hit $1?

How To Stake XYO For Earning $XL1: A Useful Guide For All Users

Zexpire (ZX) Coin Review & Analysis: Next 100× Big Token?

DeepSnitch AI (DSNT) Coin Review & Analysis: Next 100x Gem?

BullZilla ($BZIL) Meme Coin Review & Analysis: Everything You Need To Know About It

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

What Is Hemi (HEMI) Crypto: Everything You Need To Know About It

Pendle (PENDLE) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can PENDLE Hit $10?

Aerodrome Finance (AERO) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can AERO Hit $2?

Pepe Heimer ($PEHEM) Review & Analysis: Next 100x Meme Coin on Ethereum?

Kanye West Launches YZY Crypto: Everything You Need To Know About It

Sapien (SAPIEN) Price Prediction: How High Can SAPIEN Go Post Binance Listing?

OKZOO (AIOT) Price Prediction 2025, 2026 And 2030: Can AIOT Hit $5?

Layer Brett ($PEPENODE) Review & Analysis: Next 100x Meme Coin?

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

SKALE (SKL) Price Prediction 2025 To 2030: Can SKL Hit $1?

Bullish Stock Price Prediction: Will It Explode Post IPO?

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

What Is Rizenet ($RIZE) Crypto: Everything You Need To Know About It

UnitedHealth (UNH) Stock Price Target & Forecast 2025 To 2030: Is UNH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Anoma Roadmap Explained: Is an Airdrop Coming?

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

UPTOP Goes Live on Binance Alpha: Everything You Need to Know About This Crypto and Its Airdrop

Yala (YALA) Debuts On Binance Alpha: Everything You Need To Know About This Crypto And Its Airdrop

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager