Gemini Crypto Australia 2026: A Full Review Of Its Pros, Cons And Best Alternative

The popularity of cryptocurrency trading has grown rapidly, and with it, a lot of exchanges have emerged. Finding a reliable and secure crypto exchange is no easy task, especially if you’re based in Australia. With strict regulations and a limited selection, it can be frustrating trying to find one.

Gemini has stood the test of time, evolving into a top-tier crypto trading exchange offering 70+ cryptocurrencies. Gemini is a crypto exchange that you may be considering. To help you decide whether Gemini is right for you, we’ve written this Gemini review. Read our detailed Gemini exchange review to discover its key features, security measures, supported trading pairs, and how it stands out in the competitive crypto exchange market.

Table of Contents

- What is Gemini: A Quick Overview

- Pros & Cons of Gemini: A Brief Summary

- Cryptocurrencies Available on Gemini

- Gemini Fees

- Is Gemini Legit and safe?

- Gemini Customer Service

- Gemini Key Features

- Best Gemini Alternatives

- How to Trade Cryptos on Gemini?

- Final Thoughts

- FAQs about Gemini Exchange

- About BTCC

\Unlock Up To 30,000 USDT In Welcome Rewards!/

What is Gemini: A Quick Overview

|

|

| Name | Gemini |

| Launched | 10/2015 |

| Website | https://www.gemini.com/ |

| Blog | https://www.gemini.com/blog |

| https://twitter.com/Gemini | |

| Maker Fees | 0 |

| Taker Fees | 0 |

| Perpetual Trading volume(24h) | $ 2.2M |

| Perpetual Trading Pairs | 45 |

| Spot Trading volume(24h) | $ 78.1M |

| Spot Trading Pairs | 136 |

| Fiat Supported | USD, AUD, CAD, EUR, GBP, SGD, HKD |

| Update Time | 2025-12-22 11:41:43 |

Founded in 2014 by Cameron and Tyler Winklevoss, Gemini is a regulated US-based cryptocurrency exchange with global access in 70+ countries and just as many digital coins and tokens. With over a 10-year history in the market, Gemini offers a significant selection of products. Furthermore, regulation and compliance are pillars of Gemini’s business model. The exchange is licensed in the United States and undergoes regular audits, positioning itself as one of the more trusted exchanges in a market where regulatory oversight varies widely.

Gemini is a top platform for those looking to start investing in cryptocurrency. Beginners can use the brokerage platform to instantly purchase cryptocurrencies with traditional payment methods, while day traders can access more advanced trading tools via the spot exchange. Crypto trading veterans looking to delve deeper will appreciate the exchange’s strong security offerings, trading platform and Gemini Staking.

Gemini launched its initial public offering (IPO) on Nasdaq in September 2025. The crypto exchange has now launched in Australia. Although Australia lacks a dedicated crypto framework such as the EU’s Markets in Crypto Assets (MiCA) regulation, Gemini has registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) for its latest rollout. Elsewhere, Gemini is expanding its presence in Europe.

Related Article: Gemini Space Station (GEMI) Stock Price Prediction 2025, 2026 And 2030: Will It Skyrocket Post IPO?

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Pros & Cons of Gemini: A Brief Summary

While we liked the user-friendliness of the platform and its compliance with the law, there are a number of areas of the Gemini exchange that we think could be improved. If you don’t have time to read the full review, here is a brief summary to help you get to know the exchange.

| Pros | Cons |

|

|

Cryptocurrencies Available on Gemini

With support for over 70 coins and tokens, Gemini lags behind many other exchanges. It focuses on markets with deep liquidity and high trading volumes, meaning that most of the available cryptocurrencies have large market capitalizations.

However, experienced traders seeking cross-currency pairs may find the selection limited. Available markets include ETH/BTC, DOGE/BTC and LTC/BTC. While the selection of markets is modest, one of Gemini’s biggest advantages is its fiat-denominated pairs. Rather than trading the best cryptocurrencies against stablecoins, pairs incorporate USD.

Major digital assets such as Bitcoin (BTC) and Ethereum (ETH) are also paired with other fiat currencies such as EUR, GBP and SGD. This benefits non-U.S. investors, who can buy and sell cryptocurrencies without incurring currency exchange fees.

In terms of meme coins, the exchange features Dogwifhat (WIF), Book of Meme (BOME), Shiba Inu (SHIB) and Dogecoin (DOGE), as well as other market leaders. Please note that all supported assets are available via the instant buy feature, as well as the more advanced spot exchange.

\Unlock Up To 30,000 USDT In Welcome Rewards!/

Gemini Fees

Compared to some other cryptocurrency exchanges, Gemini’s trading fees are complex. However, the trading fees for web- and mobile-based orders are straightforward, which may encourage beginning traders to use the platform. Fees for web orders vary according to the order amount, costing at least $0.99 per trade but potentially reaching 1.49% of the order value. However, these fees are expensive compared with those of other exchanges.

|

Web Order Amount

|

Transaction Fee

|

|

$0.00 to $10.00

|

$0.99

|

|

$10.01 to $25.00

|

$1.49

|

|

$25.01 to $50.00

|

$1.99

|

|

$50.01 to $200.00

|

$2.99

|

|

$201.00+

|

1.49% of web order value

|

For users of the Gemini ActiveTrader platform, the exchange follows the common maker-taker model used by most exchanges and brokers in the industry. ActiveTrader has lower trading fees compared to Gemini’s exchange and mobile platforms. The platform operates on a maker/taker fee structure based on your 30-day gross trading volume and is calculated daily. The higher your trading volume, the less you’ll pay in fees.

Maker fees range from 0.00% to 0.20%. Taker fees range from 0.03% to 0.40%. Mobile traders are also charged an additional 0.5% convenience fee on all trades. Orders that add liquidity (maker) are charged slightly less than orders that take away liquidity (taker). The fees drop to almost zero if you’re trading more than $50 million each month. Here’s how Gemini’s ActiveTrader fees break down based on trading volume.

| 30-day trading volume | Maker | Taker |

|---|---|---|

| $0 | 0.20 percent | 0.40 percent |

| $10,000+ | 0.10 percent | 0.30 percent |

| $50,000+ | 0.10 percent | 0.25 percent |

| $100,000+ | 0.08 percent | 0.20 percent |

| $1,000,000+ | 0.05 percent | 0.15 percent |

| $5,000,000+ | 0.03 percent | 0.10 percent |

| $10,000,000+ | 0.02 percent | 0.08 percent |

| $50,000,000+ | 0.00 percent | 0.05 percent |

| $100,000,000+ | 0.00 percent | 0.04 percent |

| $250,000,000+ | 0.00 percent | 0.03 percent |

In terms of other fee, Gemini charges a 3.49% fee on debit card purchases and a 15% fee on its staking services.

Fortunately, users won’t have to worry about incurring excessive fees when making deposits with Gemini. Users can make wire transfers from their bank account to Gemini free of charge (make sure the bank doesn’t charge a processing fee), and they can also deposit cryptocurrencies free of charge. However, if you use PayPal, expect to pay a 2.5% fee on the total amount.

Is Gemini Legit and safe?

Gemini is widely regarded as a legitimate and regulated cryptocurrency exchange. It complies with the stringent licensing requirements of U.S. regulatory frameworks and other global jurisdictions. Gemini prides itself on its ‘security-first’ mentality and fiduciary status, and here are some of the most important elements designed to keep you and your assets safe.

While most online trading platforms offer two-factor authentication, Gemini’s 2FA is provided through Authy and requires users to enter a password and confirm their identity using an alternative method. Some options include a passkey or fingerprint recognition. It’s common for users to have to opt in to 2FA, meaning they can choose not to activate it.

Gemini is different in that 2FA is mandatory for all users. This is their way of doubling down on security, which can definitely protect you and other advanced traders. For example, if your phone were lost or stolen, a thief wouldn’t be able to access your account through the Gemini app without your fingerprint. Without your fingerprint, a thief wouldn’t be able to access your account through the Gemini app.

Passkeys are even more secure than 2FA measures because they can’t be phished. Gemini supports passkeys on both Apple and Android devices. However, you will need to set up your own passkeys, since Gemini doesn’t provide them.

However, it is worth noting that the Gemini platform experienced a significant data breach in 2022, in which an unverified third party accessed 5.7 million users’ personal information (including email addresses and phone numbers).

Gemini Customer Service

Gemini offers subpar customer service. The ‘live chat’ icon only connects with an automated bot, and users must submit a support ticket to request a live human. The same support ticket system is used when users click the ‘Contact Us’ button. Although it provides a U.S. telephone number available 24/7, this is only accessible to Gemini credit card holders.

| Support offered | Wait times | |

|---|---|---|

|

Contact Us form

|

✅

|

Under 2.5 hours on average

|

|

Live chat

|

✅

|

Live chat is offered, but it’s a bot that directs users to other support lines.

|

|

Email

|

✅

|

At least 24 hours after receiving the email on average.

|

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Gemini Key Features

Crypto Trading

Crypto trading is easy on both Gemini Exchange and Gemini ActiveTrader. Trades are speedier if you use ActiveTrader. With both options, you’ll have access to up-to-date pricing and recurring orders.

Tokenized Stocks

In addition to cryptocurrencies, Gemini offers tokenised stocks. These digital financial instruments represent company equities and are traded and stored on the blockchain. This structure means that holders do not own company shares. Instead, they gain exposure to stock price movements.

Crypto Staking

Gemini used to offer more crypto staking options than it does now. That’s due to some regulatory issues that required them to scale back staking.

As of press time, Gemini offers these assets for staking:

- Monad (12% APR)

- Solana (6.% APR)

- Ether (3% APR)

All APRs are subject to change at Gemini’s discretion. There’s no minimum account balance. Staking rewards are split across all participants.

Huge Research & Education Recources

All Gemini users have access to a library of resources. It includes:

- Cryptopedia, their guide to all things crypto

- Trust Center, where Gemini discloses financials and audit results

- Help Center, which includes relevant articles and resources, plus answers to dozens of Frequently Asked Questions

Advanced Charting Tool

If you choose to use Gemini ActiveTrader, you will have access to advanced charting options, which are not available when trading on the Gemini Exchange.

You can also create dual market comparison charts to compare prices in markets around the world.

| Feature | Gemini Exchange | Gemini ActiveTrader |

| Cryptocurrencies | 160+ | 160+ |

| Staking | Y | Y |

| Access to Gemini Custody® | Y | Y |

| Advanced Charting | N | Y |

| Research & Education | Y | Y |

Best Gemini Alternatives

Gemini excels in several key areas, including regulation, ease of use and robust security features. However, it falls short of the industry average in terms of the limited selection of tradable coins, fees, and customer service. When looking for the best Gemini alternative, interested investors are recommended to consider the options below:

Binance

As the largest crypto exchange by trading volume, Binance’s main global platform offers more competitive prices. It charges an entry-level commission of 0.1%, reducing fees for users who hold BNB or trade large amounts. Although Binance lacks the same regulatory foundation as Gemini, it has re-entered the crypto market with its robust trading features.

Coinbase

Both Gemini and Coinbase are popular crypto exchange platforms used by retail traders and institutional investors alike. While the platforms are similar, they differ slightly in terms of cryptocurrency selection and fees. Coinbase is a better option for investors looking for greater flexibility in terms of the types of investment available (it offers over 200 cryptocurrencies).

BTCC

Both Gemini and BTCC are beginner-friendly crypto-trading platforms offering user-friendly apps and websites, as well as educational resources. However, the two platforms offer drastically different fee structures, investment options and trading tools. BTCC is better suited to investors looking to trade a large number of cryptocurrencies (300+) alongside traditional securities such as stocks and commodities.

With a mission of providing a trading platform that is fair and reliable in every sense, BTCC platform supports spot trading for over 360 cryptocurrencies, crypto futures trading with leverage up to 500x, crypto copy trading that allows users to follow experienced traders, demo trading accounts pre-loaded with $100,000 in virtual funds, and tokenized futures for stocks and commodities. Boosting such trading features, BTCC is better than Gemini for both crypto beginners and advanced traders.

\Unlock Up To 30,000 USDT In Welcome Rewards!/

How to Trade Cryptos on Gemini?

Here is a step-by-step walkthrough on how to use Gemini.

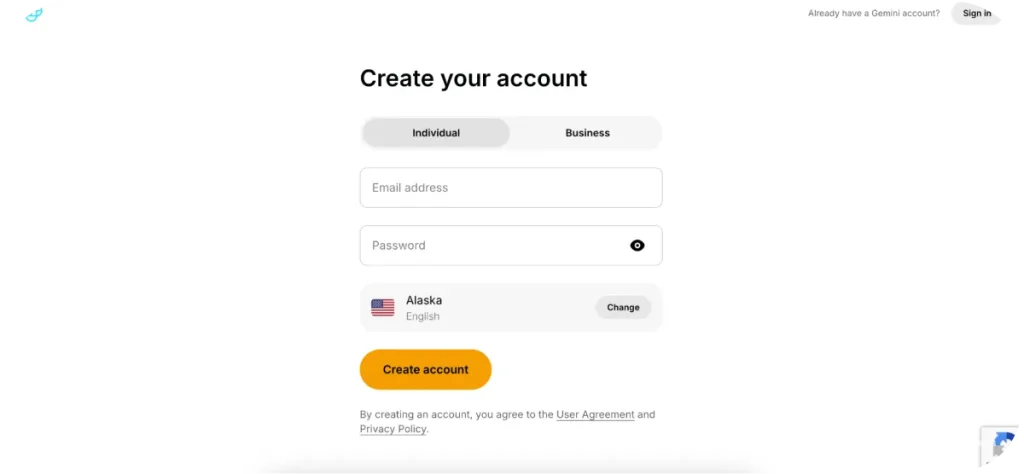

Step 1: Creat a Gemini Account

Visit the Gemini website to open an account.

Enter your full name, nationality, date of birth, and social security number (or local equivalent).

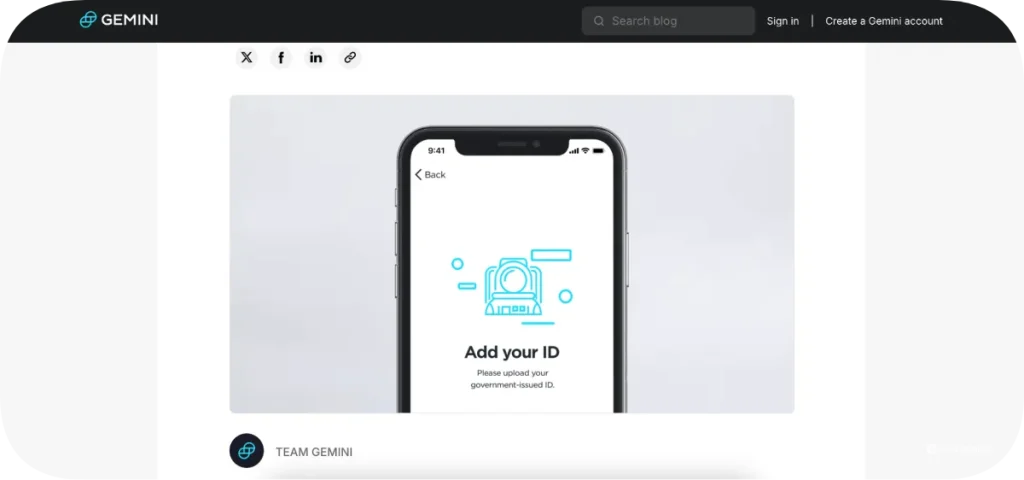

Step 2: Complete KYC Onboarding

You cannot deposit funds until you have completed the KYC process. To do this, upload a government-issued document such as a passport, driving licence or state ID card.

Non-U.S. clients must also provide proof of address. Our research shows that most Gemini users get verified in minutes. In rare cases, the exchange may require a few days to verify documents.

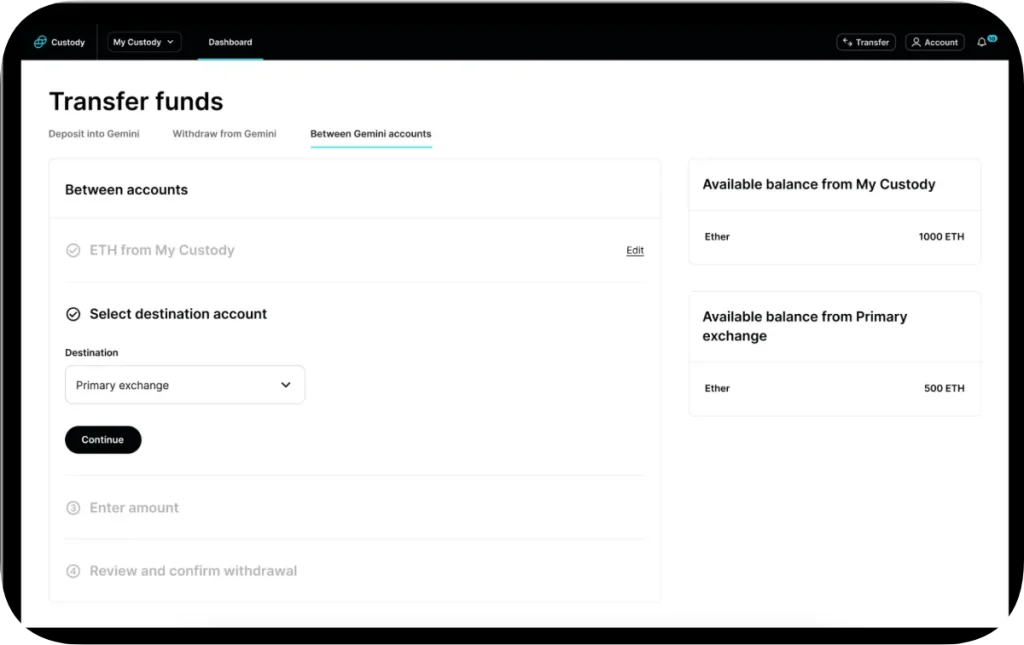

Step 3: Deposit Funds

Use the instant buy feature to purchase crypto instantly with a debit or credit card, or an e-wallet. Bear in mind that Gemini charges high transaction fees for instant purchases, so bank transfers are a better option.

Once your Gemini account has been verified, you can deposit funds. We recommend using local banking methods since these are free of charge. US clients use ACH or domestic wires, while Europeans use SEPA. UK traders can deposit via the Faster Payments Network.

Gemini provides its bank account details and your unique customer reference. Ensure you provide the reference when you make the transfer to avoid delays.

Account holders may also deposit crypto. Click the crypto and network, and Gemini generates a unique deposit address.

Step 4: Buy Crypto

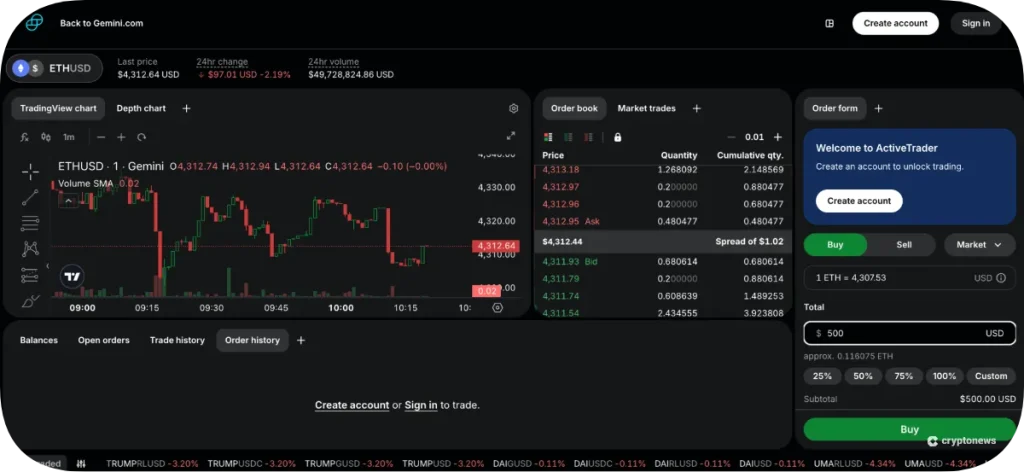

Although the basic Gemini platform is the most beginner-friendly, we recommend using ActiveTrader. You will save significantly on fees, since the basic platform charges a trading commission and convenience fee of 2.49%. With ActiveTrader, the maximum commission is just 0.4%.

Click the ‘ActiveTrader’ button, followed by ‘BTCUSD’, to view the available markets. Search for the digital asset you wish to purchase and select your preferred currency pair.

The order dashboard can be found to the right of the pricing chart. Beginners can change the order type from ‘Limit’ to ‘Market’. Then enter the total purchase amount and confirm.

The order will execute instantly, so go back to your Gemini account to view the purchased cryptocurrency.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Final Thoughts

Gemini is a good cryptocurrency exchange for beginners who want a straightforward trading process with little learning curve and a great customer experience. More advanced traders can benefit from Gemini ActiveTrader, which provides access to a variety of trading pairs, staking and advanced charting tools.

However, Gemini falls short in terms of its fee structure and customer support. If Gemini isn’t the right exchange for you, Binance, Coinbase and BTCC are the best alternatives.

FAQs about Gemini Exchange

Is Gemini legal in Australia?

Yes. Gemini operates legally in Australia as it has been registered as a Digital Currency Exchange (DCE) with AUSTRAC since August, 2019.

Who owns Gemini?

Gemini is an independent company, co-founded by the Winklevoss twins, Cameron and Tyler of early Facebook fame.

Do I have to pay taxes on my Gemini transactions in Australia?

Yes. In Australia, your transactions on Gemini or other platforms are subject to capital gains tax and ordinary income tax.

\Unlock Up To 30,000 USDT In Welcome Rewards!/

About BTCC

BTCC is a trusted and well-respected exchange in Australia thanks to its unwavering commitment to security and transparency. Since its establishment in 2011, BTCC has boasted an impeccable security track record, with zero reported hacks or breaches. Holding licenses in the U.S., Canada, and Europe, BTCC provides a comprehensive suite of trading features within a secure and regulated platform.

With a mission of providing a trading platform that is fair and reliable in every sense, BTCC platform supports spot trading for over 360 cryptocurrencies, crypto futures trading with leverage up to 500x, crypto copy trading that allows users to follow experienced traders, demo trading accounts pre-loaded with $100,000 in virtual funds, and tokenized futures for stocks and commodities. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC Benefits⇓

BTCC offers a sign-up bonus for new users. Register now and start trading to receive your welcome rewards of up to 30,000 USDT. Additionally, VIP menbers can enjoy more benefits. Please note that your VIP level will increase based on your deposit amount. The more you deposit, the higher your level will be.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading Security

- High Leverage Of Up To 500x

- High Liquidity & Volume

- Extremely Low Fees

- High and Rich Bonus (up to 10,055 USDT)

- Excellent Customer Service

\Unlock Up To 30,000 USDT In Welcome Rewards!/

BTCC Guide:

How to Earn Your 10,055 USDT Welcome Bonus on BTCC: A Complete Guide To Maximize Your Crypto Return

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Best Non KYC Crypto Exchanges In December 2025

How to Earn Free $20 No Deposit Crypto Bonus in Australia: A Beginner’s Guide

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

How To Get Free Bitcoin & Other Cryptos Instantly No Deposit: A Complete Guide in 2026

Best Free Crypto Sign-Up Bonus Australia 2025

Coinsquare Review 2025: A Comprehensive Guide For All Canadian Crypto Traders

Newton Crypto Review 2025: Best Platform For Crypto Trading In Canada?

Bitbuy Review 2025: Best Crypto Exchange In Canada?

NDAX Review 2025: A Full Breakdown of its Services, Safety, Fees, and Canadian Alternatives

Top Free Crypto Sign-Up Bonuses In Canada For December 2025

Top Free Crypto Mining Apps for Android and iOS Canada 2025

8 Types of Crypto Scams to Avoid in 2025

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

Top Legit 100x Leverage Crypto Trading Platforms Canada 2025

Best Crypto Exchanges With Lowest Fee In Canada (2025 Guide): Which One Is Your Best Pick?

Top Free Crypto Sign-Up Bonuses In Canada For December 2025

Best Crypto Trading Bots In Canada For December 2025

Best Free Bitcoin Accelerators 2025

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

BTCC vs. Bybit vs. eToro:which is the best choice for you?

BTCC vs. Coinbase vs. Crypto.com

Compare BTCC vs. Binance: Which is a Better Choice for Canadian Traders in 2025?

Compare BTCC vs.OKX (2025): Which One is a Better Choice in 2025?

Compare BTCC vs. BitMart 2025: Which is a Better Choice for Your Demand

Compare BTCC vs Pionex: Crypto Exchange Comparison 2025

Compare BTCC vs Gate.io: Which is Best in 2025

BTCC vs. NDAX: which is a better choice for crypto trading in Canada?

BTCC vs. CoinJar: Which One Is A Better Crypto Exchange For Australians In 2025?

BTCC vs. CoinSmart: Which One Is A Better Platform For Crypto Trading?

Coinbase VS. CoinSpot: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]