Euler (EUL) Review & Analysis: Everything You Need To Know About The Binance’s 51st HODLer Airdrops Project

On October 13, Binance announced to add Euler (EUL), a decentralized lending protocol on Ethereum designed for flexible, risk-aware borrowing and lending of crypto assets through modular, permissionless markets, as its 51st HODLer Airdrops program.

Following this announcement, Euler (EUL) has attracted significant attention from crypto enthusiasts. But what exactly is Euler (EUL)? Could it be a smart investment choice for 2025? This article provides a comprehensive overview of the Euler (EUL) project, including what Euler is, its key features, the EUL token and its tokenomics, airdrop, as well as its growth potential in the crypto market.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Euler?

Euler is a modular lending platform built on Ethereum that allows users to deploy and chain together customized lending markets in a permissionless manner. Euler reimagines DeFi lending by blending permissionless innovation with institutional-grade risk management. Euler’s modular design and institutional-grade security empower builders to create and manage custom lending markets in a fully permissionless way, tailored precisely to their needs.

Euler addresses inefficiencies in traditional DeFi lending by enabling the permissionless creation of tailored lending markets. Unlike rigid platforms, it enables users to deploy isolated pools for niche assets (e.g. long-tail tokens or yield-bearing derivatives), thereby reducing contagion risks. This flexibility supports strategies such as leveraging collateralised debt positions (CDPs) to increase capital efficiency. Overall, Euler simplifies and streamlines the lending and borrowing process, giving users the freedom to explore new opportunities in DeFi.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Key Features of Euler

Euler comprises two main elements: Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC). These enable developers to deploy customized lending vaults on the blockchain, providing users with the following features:

Modular & Permissionless Lending Markets

One of Euler’s key features is its facilitation of permissionless deployment of lending markets. Any token, subject to risk classifications, can be incorporated as a market, enabling users to lend or borrow under parameters established by the community. This approach democratizes market creation and has the potential to foster niche or long-tail token markets.

Due to the interconnectivity of vaults through EVC (Euler Vault Connector), deposits in one vault can serve as collateral in another—enhancing capital utility and minimizing idle collateral. This cross-vault linkage aims to improve utilization rates while reducing the drag associated with overcollateralization.

Deep Liquidity & Custom Market Capability

Euler is committed to providing robust liquidity for its markets. Its design promotes deep liquidity through a capital efficiency model. The integration of trading and lending functionalities, along with modular markets, could attract liquidity from both traders and yield-seeking participants.

Each market’s customizable nature allows participants to adjust risk parameters—such as collateral factors and interest rate curves—in accordance with asset dynamics. This capacity for fine-tuning aligns closely with real-world asset risk variations.

Multi-Chain Presence & Broad Reach

By deploying across Ethereum, BNB Smart Chain, Base, and Arbitrum, Euler effectively lowers barriers for users operating within different networks who wish to engage with its ecosystem. This strategy reduces bridging friction and ensures that markets and vaults are accessible across various chain environments.

This cross-chain approach may enable Euler to capture liquidity from multiple ecosystems, thereby providing it a competitive advantage over protocols limited to a single chain.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is the EUL Token?

| Cryptocurrency | Euler |

| Token | EUL |

| Price | $ 12.6880 |

| Rank | 188 |

| Market Cap | $ 250.1M |

| 24H Trading Volume | $ 1.2M |

| All-time High | $ 15.6605 |

| All-time Low | $ 1.4287 |

| 24 High | $ 4.4514 |

| 24 Low | $ 4.1782 |

| Cycle High | $ 4.1954 / 2025-11-19 12:18:51 |

| Cycle Low | $ 4.1782 / 2025-11-19 12:17:31 |

| Update Time | 2025-11-19 12:23:01 |

EUL is an ERC20 token that acts as the native governance token of the Euler protocol. EUL tokens are used in Fee Flow auctions, serve as rewards on the platform, and represent voting power to effect change over the Euler protocol code or the Euler DAO treasury.

Specifically, the utility of the EUL mainly includes:

- Governance: EUL tokens grant holders the ability to vote on protocol changes and treasury management.

- Fee Flow Auctions: The EUL token captures platform revenue through the unique Fee Flow mechanism. This system enables users to bid EUL in order to claim a portion of the protocol’s fees, which are then paid out in stablecoins. This process puts continuous deflationary pressure on the EUL supply.

- Rewards: EUL is distributed as rewards to users for participating in the protocol.

Notably, EUL is deployed across multiple chains: BNB Smart Chain (BEP20), Ethereum (ERC20), Base, and Arbitrum. This multi-chain deployment allows token liquidity and use across diverse environments.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

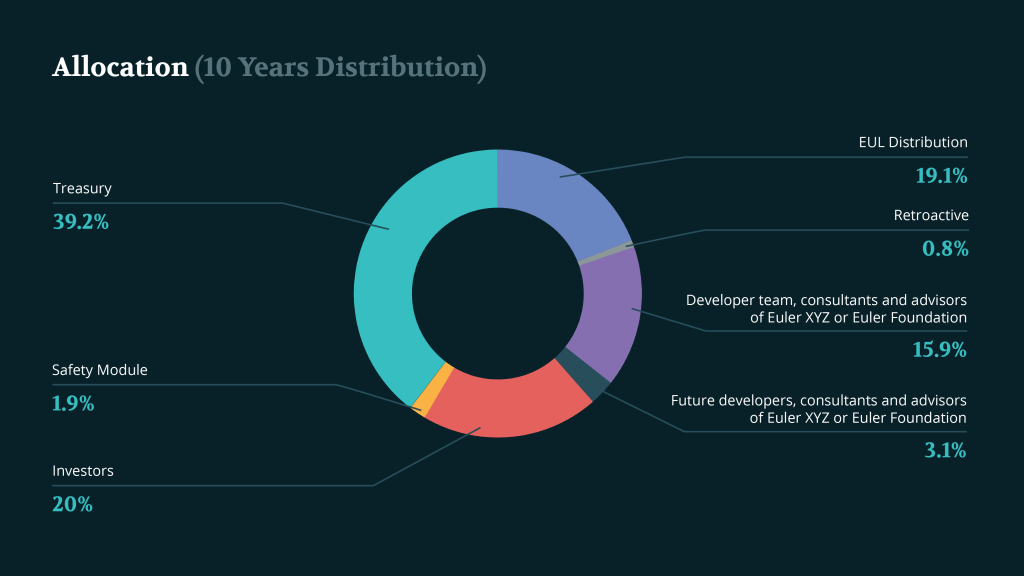

$EUL Tokenomics

The total supply of EUL is 27,182,818 (in homage to Euler’s number, e). At the Binance listing, the circulating supply stands at 19,809,653 EUL, which represents approximately 72.87% of the total genesis supply. This high initial circulating figure provides substantial liquidity from launch. Below is the allocation breakdown:

| Category | Percentage |

|---|---|

| Treasury | 39.2% |

| Safety Module | 1.9% |

| Investors | 20% |

| EUL Distribution | 19.1% |

| Retroactive | 0.8% |

| Developer team, consultants and advisors of Euler XYZ or Euler Foundation | 15.9% |

| Future developers, consultants and advisors of Euler XYZ or Euler Foundation | 3.1% |

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Euler (EUL) Airdrop

Euler (EUL) is the 51st project to be featured on Binance HODLer Airdrops with a “Seed Tag” applied. As part of Binance’s 51st HODLer Airdrop, Euler offers a retroactive rewards program to BNB holders. Users who subscribed BNB into Simple Earn (Flexible or Locked) or On-Chain Yields between October 4 and October 6, 2025 (UTC) are eligible for EUL tokens.

- Total Airdrop: 543,657 EUL (2% of total supply) via the HODLer Airdrop.

- Marketing Allocation: 67,957 EUL initially, with 271,828 EUL reserved for future campaigns in six months.

- Hard Cap: Any individual BNB balance exceeding 4% of the pool average will only be counted up to the 4% limit for reward calculation.

- Binance Listing Date: 2025-10-13 14:30 (UTC).

- Trading Pairs: EUL/USDT, EUL/USDC, EUL/BNB, EUL/FDUSD, and EUL/TRY.

Euler (EUL) Price Analysis & Prediction

As of writing the article, EUL coin is traded at $ 12.6880, boasting a market cap of $ 250.1M, and witnessing a 24-hour trading volume of $ 1.2M. EUL Token saw a 24-hour change of -2.36%, with minor fluctuations of -0.37% in the past hour.

The following sets forth the EUL to USD Chart

As the EUL token has just been listed and is in its earliest phase, price predictions are speculative. Due to the limited circulating supply and distribution via airdrop, EUL could experience an initial price increase of 2–5 times the starting price, particularly if market conditions are favorable. However, due to the Seed Tag and high speculation sentiment, volatility will be high.

Based on BTCC’s technical analysis, here are the possible prices we expect for $EUL in the next half month:

| Date | Price Prediction | Change |

| 11-19 | $ 12.6880 | 0.00% |

| 11-22 | $ 14.4226 | 13.67% |

| 11-25 | $ 14.6041 | 15.1% |

| 11-28 | $ 14.5787 | 14.9% |

| 12-01 | $ 13.6437 | 7.53% |

| 12-04 | $ 13.8632 | 9.26% |

Due to the rapid changes in the cryptocurrency market, there is a great deal of uncertainty surrounding the future price of $EUL. With this in mind, we have made both more bullish and more bearish forecasts for $EUL based on a variety of different scenarios.

Based on BTCC’s technical analysis, here are our projected highs and lows for EUL crypto from 2026 to 2050:

| Year | Yearly Low | Yearly Average | Yearly High |

| 2026 | $ 11.3154 | $ 15.9662 | $ 17.6983 |

| 2027 | $ 9.3245 | $ 13.6673 | $ 16.1248 |

| 2028 | $ 10.3382 | $ 14.4783 | $ 16.3255 |

| 2029 | $ 16.8908 | $ 23.4969 | $ 26.6979 |

| 2030 | $ 13.2194 | $ 20.0928 | $ 23.9756 |

| 2031 | $ 12.5360 | $ 19.5460 | $ 24.3424 |

| 2035 | $ 16.3726 | $ 25.7837 | $ 31.9585 |

| 2040 | $ 31.4602 | $ 43.4195 | $ 50.7557 |

| 2045 | $ 43.7675 | $ 62.6051 | $ 70.8676 |

| 2050 | $ 44.7356 | $ 71.0028 | $ 89.2039 |

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Is Euler (EUL) a Promising Investment?

Euler reimagines decentralized finance (DeFi) lending by blending permissionless innovation with institutional-grade risk management. Its modular design supports a range of activities, from retail yield farming to institutional real-world asset (RWA) collateralisation. While Euler (EUL)’s prospects are compelling, they are not without considerable risks. The chart below sets forth the benefits and risks of Euler (EUL) project.

| Benefits | Risks |

| Strong launch backing via Binance’s HODLer Airdrop program lends initial credibility, liquidity, and marketing exposure.

Innovative architecture focused on modular lending, cross-vault linking, and capital efficiency could attract DeFi builders and yield seekers. Multi-chain deployment enables broader participation and reduces barrier to entry for users of different ecosystems. Fee capture and governance incentives align long-term holders with protocol success, potentially driving sustainable demand for EUL. |

Volatility & Seed Tag: Binance’s Seed Tag signals high-risk listing, meaning price swings post-listing may be extreme.

Competition: Many lending and DeFi protocols (Aave, Compound, Osmosis pools, etc.) already exist—Euler must differentiate and deliver reliability. Tokenomics transparency: While the initial allocations are disclosed, longer-term vesting schedules, unlocking, inflation/deflation mechanisms, and staking rewards remain to be fully revealed. Execution risk: The modular vault system and vault interlinking add complexity; any flaw in risk models or liquidation mechanisms can lead to systemic losses. |

Taking these factors into account, Euler (EUL) could be a high-risk, high-reward speculative investment for 2025–2026, particularly for users who participate in the airdrop and support its roadmap. However, it should be treated as a high-risk, early-stage DeFi infrastructure investment rather than a safe or guaranteed one.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

How to Buy the EUL Token?

The EUL token is now widely listed and traded across most major centralized exchanges (CEX) such as MEXC, Binance, Coinbase, Kraken, etc., where interested investors can trade this promising project.

Unfortunately, $EUL coin is not available on BTCC platform at present. However, it is worth mentioning that BTCC supports trading for large variety of popular coins, such as BTC, ETH, SOL, PEPE, etc. If you are interested in these popular coins, you can make a purchase on BTCC exchange with highest security level and a most competitive fee.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

Euler (EUL) launches under strong auspices as Binance’s 51st HODLer Airdrop project, offering a compelling mix of token incentives, modular DeFi architecture, and cross-chain reach. With 543,657 EUL airdropped (2% of supply) and seed-tagged listing status, Euler will attract speculative attention from launch.

For investors and enthusiasts willing to remain engaged with the project, Euler (EUL) offers an exciting opportunity. Nevertheless, it is important to note that the cryptocurrency landscape is highly volatile. All investors are strongly advised to conduct thorough research and exercise caution before making any decisions regarding Euler (EUL).

That’s all information about Euler (EUL). If you want to know more information about Euler (EUL) coin and other cryptocurrencies, please visit BTCC Academy.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Why Choose BTCC?

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Barron Trump Crypto: How Dose He Amass $150 Million Fortune From Crypto?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

VWA Crypto Price Prediction 2025, 2026 And 2030: Is It A Good Investment In 2025?

Monad Airdrop Guide: How To Claim Your MON Token?

Aster Airdrop Guide & Tips: How to Claim The AST Token?

How To Buy VWA Crypto: A Comprehensive Guide For All Traders

SuperVerse (SUPER) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can SUPER Hit $5?

What Is Plasma (XPL) Crypto: Everything You Need To Know About It

What Is Hemi (HEMI) Crypto: Everything You Need To Know About It

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

Pendle (PENDLE) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can PENDLE Hit $10?

Aerodrome Finance (AERO) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can AERO Hit $2?

Sapien (SAPIEN) Price Prediction: How High Can SAPIEN Go Post Binance Listing?

OKZOO (AIOT) Price Prediction 2025, 2026 And 2030: Can AIOT Hit $5?

Layer Brett ($LBRETT) Review & Analysis: Next 100x Meme Coin?

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

SKALE (SKL) Price Prediction 2025 To 2030: Can SKL Hit $1?

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

Bullish Stock Price Prediction: Will It Explode Post IPO?

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

What Is Rizenet ($RIZE) Crypto: Everything You Need To Know About It

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Anoma Roadmap Explained: Is an Airdrop Coming?

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is Redakciya.info Crypto: Is It Legit Or A Scam?

What Is Swapfone: Everything You Need To Know About This US-Based Crypto Exchange

Eli Regalado Crypto: Who Is He & Why Is He Involved In The Crypto Scam?

FaZe Banks Crypto: Who Is He & Why Is He Involved In The Crypto Scadal?