Linea (LINEA) Airdrop & Price Prediction: How High Will LINEA Go In 2025?

Linea is a Layer 2 scaling solution for Ethereum that uses zk-rollups to deliver faster and cheaper transactions. Recently, SWIFT, the global messaging platform that connects over 11,000 financial institutions, is reportedly partnering with Linea to explore blockchain technology for interbank payments.

The news of the partnership led to a positive market response, with Linea’s token price skyrocketing by over 14% shortly after the announcement. As it gains more traction, Linea (LINEA) is expected to see a steady increase in price in the future. So, what is Linea (LINEA)? Is it a good investment for 2025? Next, let’s take a closer look at this innovative crypto project and analyse its future outlook.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Linea?

Linea is a Layer-2 scaling solution built on Ethereum, designed to improve transaction speed and reduce costs while maintaining Ethereum’s security. Rather than processing every transaction directly on Ethereum, Linea processes them off-chain and then submits a validity proof back to the network. This approach helps to reduce congestion on Ethereum while still benefiting from its security. As Linea is EVM-equivalent, developers can redeploy existing Ethereum smart contracts to Linea with minimal effort. This distinguishes the network from EVM-compatible blockchains, which may require changes and adjustments.

Linea was founded in 2025 by the core team at ConsenSys, a globally recognized blockchain software company behind MetaMask and other foundational Ethereum infrastructure. The team is led by Joseph Lubin, Ethereum co-founder and ConsenSys CEO, alongside a consortium of organizations including Eigen Labs, ENS Domains, SharpLink Gaming, and Status. Their collective expertise spans blockchain engineering, cryptography, and decentralized finance.

Since its inception, Linea zkEVM has achieved several milestones, including surpassing $1 billion in total value locked (TVL) in DeFi applications, launching its mainnet, and securing strategic partnerships with leading projects in the Ethereum ecosystem. The project gained significant attention after announcing its unique tokenomics and airdrop structure, establishing LINEA as a leading innovator in the Ethereum scaling sector.

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

Linea Ecosystem

The Linea ecosystem consists of several interconnected products designed to provide a seamless experience for developers, users, and liquidity providers:

- Linea Mainnet: At the heart of the ecosystem lies Linea Mainnet, a Layer 2 network powered by zkEVM technology. It enables fast, low-cost, and highly secure transactions while maintaining full Ethereum compatibility. This combination of scalability and security has attracted thousands of developers and secured millions in total value locked (TVL).

- Linea Bridge: The Linea Bridge facilitates smooth asset transfers between Ethereum and Linea. By using advanced cryptographic proofs, it significantly reduces risks and transaction costs, making cross-chain interactions both efficient and user-friendly.

- Linea Ecosystem Fund: Managed by the Linea Consortium, the Ecosystem Fund plays a critical role in driving growth and innovation. It provides support for dApp development, liquidity incentives, and community reward programs, ensuring the long-term sustainability of the network.

Together, these components create a robust and self-sustaining environment where LINEA functions as the core utility and incentive token, powering interactions across the ecosystem and fostering continuous expansion.

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

What is the LINEA Token?

The LINEA token is the native token of the Linea network and is designed to support both Linea and Ethereum. In practical terms, the LINEA token’s initial role is primarily ecosystem-oriented: staking/utility mechanisms were not launched as typical gas tokens (gas remains paid in ETH on Linea), and much of the early allocation is directed toward builders, users, and airdrop claimants.

ConsenSys emphasized that a large portion of tokens would be distributed to participants, with a smaller portion retained in treasury to support long-term development. The token isn’t tied to governance and doesn’t have special allocations for insiders, investors, or the team. Instead, LINEA is given directly to users and builders as rewards, helping to grow the ecosystem in a more open and community-driven way.

Linea also introduces a dual-burn mechanism. Since gas fees are paid in ETH, part of the network’s net profits is allocated to reduce the token supply. 20% of net ETH profits are used to burn ETH, while the remaining 80% are used to burn LINEA. This system creates a direct connection between activity on Linea and the scarcity of both tokens.

LINEA USDT-margined perpetual futures contract with a leverage of up to 50x is available on BTCC, you can directly click the button below to buy LINEA coin⇓

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

\Unlock Up To 10,055 USDT In Welcome Rewards!/

LINEA Tokenomics

LINEA boosts a total supply of 72,009,990,000. This 1,000x the genesis supply of ETH on Ethereum. The supply will be allocated according to the below table:

| Category | % of supply | Details |

|---|---|---|

| Ecosystem | 85% | 75% for a long-term Ecosystem Fund, and 10% for early contributors. |

| Consensys treasury | 15% | Locked (non-transferrable) for five years. Consensys will hold the tokens long-term for alignment and to support Linea and its ecosystem. |

Apart from the initial allocation to Consensys, which is locked for five years, no funds are allocated to private investors, insiders or employees and team members. Instead, value is channelled straight into the ecosystem by the builders who are bringing it to fruition and the community members who are engaging with it.

At the time of the token generation event (TGE), 22% of the LINEA supply will be in circulation, divided between a user and builder airdrop, ecosystem activations and liquidity provisioning.

All other allocations will be locked at the TGE or will vest according to various schedules.

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

Linea (LINEA) Airdrop

Linea’s airdrop was one of the largest and most widely advertised in 2025. An airdrop eligibility checker was released by Linea on September 3. The LINEA token is scheduled to distribute to three major buckets: early users, ecosystem participants, and the Consensys treasury.

On September 8, 2025, Binance announced LINEA as the 37th project on the Binance HODLer Airdrops. Users who subscribed their BNB to Simple Earn and/or On-Chain Yields products from August 25 to 28 were eligible to receive LINEA airdrops.

Total LINEA supply reaches 72,009,990,000 tokens, with HODLer Airdrops allocating 720,099,900 tokens representing 1% of maximum supply. Circulating supply at launch is 15,482,147,850 tokens, approximately 21.5% of total supply.

Additional allocations include 180,024,975 LINEA for marketing campaigns post-listing and another 360,049,950 tokens reserved for six months later. These distributions will be announced separately through dedicated campaigns.

Eligible participants must complete KYC verification and reside in approved jurisdictions. Several regions, including the U.S., U.K., Canada, and Australia, are excluded from HODLer Airdrops participation.

The LINEA token generation event (TGE) took place on September 10, at which point any eligible airdrop participants could begin the claim process. Eligible parties will have up to 90 days to claim their LINEA tokens. After that time, any unclaimed LINEA tokens will be added to the ecosystem fund and subsequently distributed by the Linea Consortium.

The token was initially trade on Binance Alpha before full spot market integration. Users can transfer LINEA between Alpha and Spot accounts, with automatic transfers occurring within 24 hours of spot listing.

The Binance exchange listed LINEA on Sept. 10 at 4 p.m. UTC with trading pairs against USDT, USDC, BNB, FDUSD, and TRY. Deposits open Sept. 9 at 2 p.m. UTC, with the seed tag applied to the new listing. What’s more, Binance has also announced the listing of Linea (LINEA) as a borrowable asset and the availability of trading pairs LINEA/USDT and LINEA/USDC, effective September 11, 2025.

The exchange also introduced 1–50x leveraged LINEA/USDC perpetual contracts, expanding options for traders engaged in the growing Linea ecosystem. The addition of Linea to Binance’s platform follows its emergence as a Layer 2 solution on the Ethereum network, designed to enhance scalability and reduce transaction costs for developers and users.

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

Linea (LINEA) Price History

The long-awaited LINEA token was officially launched on 10 September 2025. As part of the airdrop, a total of 9.36 billion tokens were distributed to 749,000 eligible wallets. The total supply of the token was set at 72 billion, with an initial circulating supply of approximately 15.8 billion — roughly 22% of the maximum.

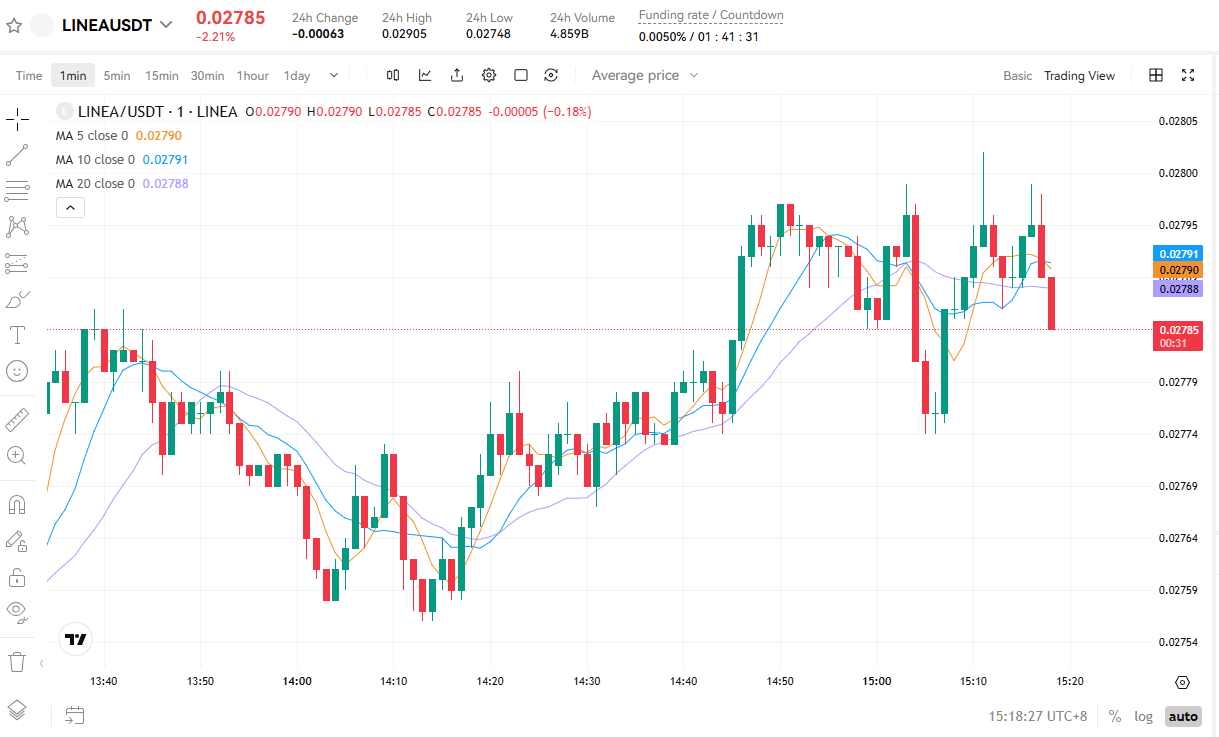

Trading began immediately on major exchanges, including Binance, OKX, Bybit, Bitget, KuCoin and MEXC. The first day was highly volatile. LINEA initially spiked to a high of around $0.1723, with reports of brief surges as high as $0.32 or even $1.17. However, within hours, the price had collapsed by 85–93%, settling at around $0.023–$0.024. This dramatic debut reflected intense speculation and the challenges of price discovery for a newly launched token.

Recently, SWIFT — the global messaging platform connecting over 11,000 financial institutions — reportedly partnered with Linea, an Ethereum-based network, to explore blockchain technology for interbank payments. The aim of this collaboration is to enhance SWIFT’s existing infrastructure by integrating blockchain technology to enable faster, cheaper and more efficient cross-border transactions.

News of the partnership led to a positive market response, with the price of Linea’s token increasing by over 14% shortly after the announcement.

As of press time, the LINEA token is traded at around $0.028.

The following sets forth the LINEA to USD Chart

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Linea (LINEA) Price Prediction 2025, 2026 and 2030: What Do Experts Say?

Linea (LINEA) Price Prediction 2025

DigitalCoinPrice predicts modest growth for Linea in 2025. They predict a maximum price of $0.0598 and a minimum price of $0.0242.

PricePrediction.net is more cautious, suggesting that Linea could trade at between $0.0259 and $0.0291.

CoinCodex offers a wider range. They predict a high of $0.0289, but also a low of $0.02.

Linea (LINEA) Price Prediction 2026

DigitalCoinPrice projects steady growth in 2026. They predict a peak of $0.0715 and a low of $0.0592.

PricePrediction.net anticipates a similar trend, with forecasts ranging from $0.0373 to $0.0446.

CoinCodex is more optimistic, predicting a maximum of $0.0798 and a potential minimum of $0.0197.

Linea (LINEA) Price Prediction 2030

Looking further ahead to 2030, DigitalCoinPrice predicts that the price of Linea could climb to $0.15, with a minimum of around $0.13.

PricePrediction.net is more optimistic, suggesting that Linea could reach a peak of $0.2141, with a minimum of $0.1759.

CoinCodex also anticipates significant growth, projecting a maximum price of $0.1249, though it could fall to a minimum of around $0.0605.

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Is Linea (LINEA) a Good Investment in 2025?

Linea comes at a time when interest in Ethereum Layer 2 solutions is growing, driven by concerns over network congestion and high gas fees. With its focus on low-cost, high-speed transactions, Linea is well-positioned to compete with other Layer 2 solutions, such as Arbitrum and Optimism.

SWIFT, the global messaging platform connecting over 11,000 financial institutions, is reportedly partnering with Linea, an Ethereum-based network, to explore the use of blockchain technology for interbank payments. Linea’s zero-knowledge proofs protect sensitive data in SWIFT’s blockchain test network. This suggests that investors have strong confidence in Linea project’s potential success.

Market analysts have highlighted the potential impact of the partnership with SWIFT, noting that could drawing more attention of crypto enthusiasts . The project benefits from strong backing by ConsenSys and Ethereum integration, which adds credibility. However, as a new token, volatility is high. Investors who believe in Ethereum’s Layer 2 growth could see upside, but risks remain significant in the short term. Investors should therefore employ clear position sizing and monitor actual usage metrics before increasing their exposure.

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

How to Buy the LINEA Token?

The LINEA token is now available on major exchanges like BTCC, Binance, Bybit, Gate, Bitget, Kraken, Upbit, Bithumb, etc., where interested investors can trade this promising coin.

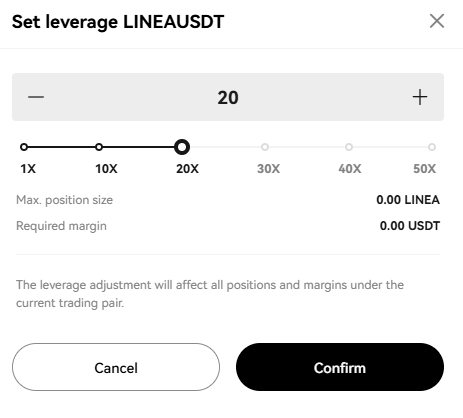

LINEA USDT-margined perpetual futures contract with a leverage of up to 50x is available on BTCC, the following sets forth the guidance for trading LINEA USDT-margined perpetual futures contract on cryptocurrency exchange BTCC:

Step 1: Create a BTCC account

Step 2: Complete BTCC’s identity verification

Step 3: Fund your BTCC account

On the BTCC official homepage, choose “Deposite”, and then fund your account with your preferred method

Step 4: Place your crypto futures order on BTCC

Go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find LINEAUSDT trading pair.

You can also directly click the button below to enter the LINEA order page⇓

[TRADE_PLUGIN]LINEAUSDT,LINEAUSDT[/TRADE_PLUGIN]

Then, choose the contract trading order type. Futures contract orders on BTCC platform include market orders, limit orders and SL/TP orders.

- Market Order: users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit orders are a type of order to buy or sell futures at a price more favourable than the market price. When you buy at a price lower than the market price or sell at a price higher than the market price, the order will be in the form of a limit order.

- SL/TP Order: SL/TP orders are a type of order to buy or sell futures at a price less favourable than the market price. When you buy at a price higher than the market price or sell at a price lower than the market price, the order will be in the form of a SL/TP order.

Next, adjust the leverage multiple.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

Choose the lot size and set the SL/TP price. After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Traders should remind that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform.

Finally, click the buy or sell button, and the LINEA coin futures contract order is completed.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

The partnership of Linea and SWIFT is a landmark event for the Ethereum Layer-2 ecosystem. The protocol’s strong developer positioning and extensive airdrop distribution create growth potential and significant early volatility. Investors should temper their enthusiasm for Layer-2 adoption with caution regarding immediate supply dynamics. They should also practise prudent position sizing and monitor the chain’s real usage metrics before committing large sums of capital.

That’s all the information about Linea (LINEA). If you want to know more information about Linea (LINEA) coin and other cryptocurrencies, please visit BTCC Academy.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Why Choose BTCC?

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

Investing Guide:

What Is Holoworld AI (HOLO) Crypto: Next 100× Token Post Binance Listing?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Vision (VSN) Price Prediction: Can VSN Hit $1?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

Best Free Bitcoin Accelerators 2025

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

SKALE (SKL) Price Prediction 2025 To 2030: Can SKL Hit $1?

Klarna Stock Price Prediction: How High Will It Go Post IPO?

Figure (FIGR) IPO Price Prediction: Will It Explode After IPO?

QMMM Holdings Limited (QMMM) Stock Price Prediction 2025, 2026 And 2030: Is QMMM Stock A Buy Now?

Eightco (OCTO) Stock Price Prediction 2025, 2026 And 2030: Is OCTO Stock A Buy Now?

American Bitcoin (ABTC) Stock Price Prediction 2025, 2026 And 2030: Is ABTC Stock A Buy Now?

Bullish Stock Price Prediction & Forecast 2025 To 2030: Is BLSH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Best Crypto & Bitcoin Casinos Australia 2025