Bitcoin Rainbow Chart Explained: Everything You Need To Know About It

The Bitcoin Rainbow Chart is a visual tool designed to help investors interpret Bitcoin’s price trends over time. By leveraging historical data, it provides insights into periods when Bitcoin may be undervalued or overvalued, helping investors to identify potential entry or exit points.

In this guide, we’ll explore the workings of the Bitcoin Rainbow Chart and outline practical strategies for incorporating it into your investment decision-making process.

Table of Contents

- What is Bitcoin Rainbow Chart?

- How does the Bitcoin Rainbow Chart Work?

- The Bitcoin Rainbow Chart and Bitcoin Halving

- How to Use the Bitcoin Rainbow Chart in Trading Strategy?

- Conclusion

- About BTCC

- How to Trade Crypto Futures on BTCC?

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Bitcoin Rainbow Chart?

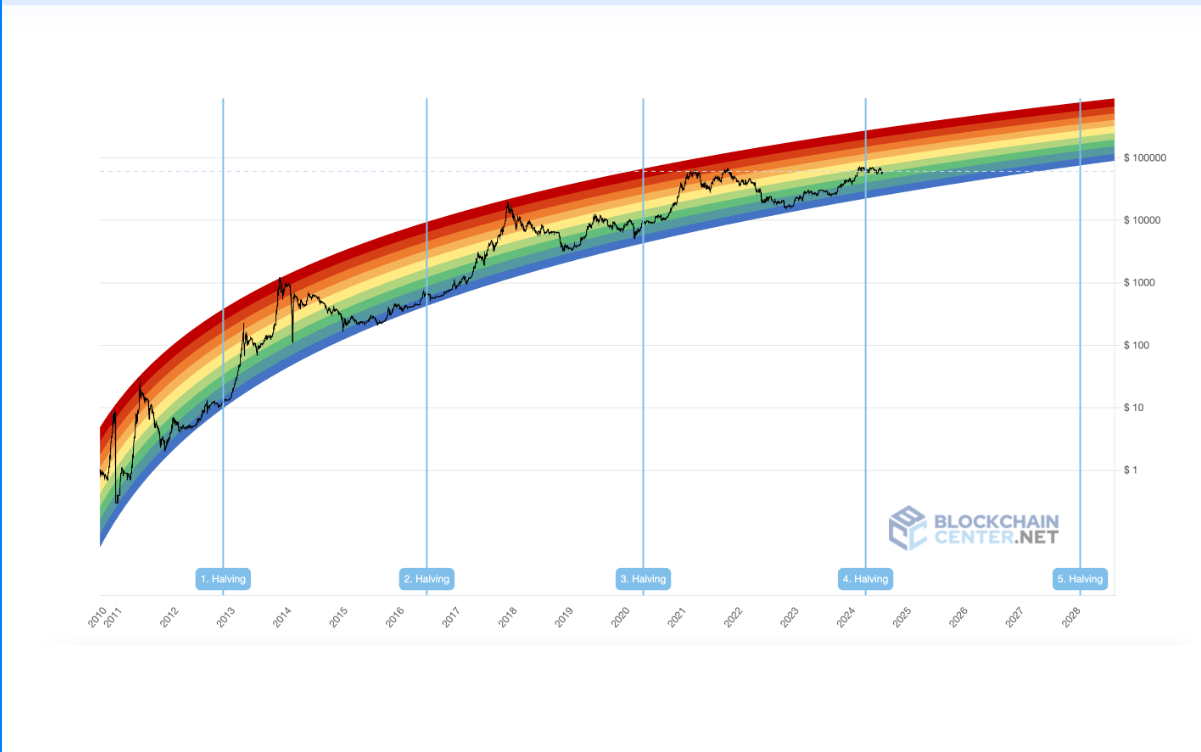

The Bitcoin Rainbow Chart functions as a long-term valuation tool that visually maps Bitcoin’s historical price movements using a spectrum of colors. Each color band corresponds to a specific price range, with cooler colors like blue indicating lower price levels and warmer tones such as dark red reflecting higher valuations.

The chart is based on the observation that Bitcoin has historically followed recognizable growth patterns over extended periods. By translating these trends into an easy-to-read color gradient, the Rainbow Chart helps investors gauge Bitcoin’s current price relative to its long-term trajectory. This visual aid simplifies the assessment of market conditions, allowing users to identify periods of potential undervaluation or overvaluation at a glance. As a result, the chart has gained popularity among long-term investors and newcomers seeking to better understand Bitcoin’s historical price dynamics and cyclical nature.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

How does the Bitcoin Rainbow Chart Work?

The Bitcoin Rainbow Chart operates by analyzing years of historical price data and applying a logarithmic regression curve to model Bitcoin’s long-term growth trajectory. This curve is then divided into color-coded bands, ranging from blue at the lowest price levels to dark red at the highest.

By observing where Bitcoin’s current price falls within these bands, investors can quickly assess prevailing market sentiment and evaluate potential risk or opportunity. Each color band corresponds to a different valuation zone, offering a visual indication of whether Bitcoin may be historically undervalued, overvalued, or trading near its fair value. This approach allows investors to make more informed decisions by placing current price action within a broader historical context.

- Red signals that Bitcoin is highly overvalued, indicating an increased likelihood of a price correction.

- Orange suggests that Bitcoin is approaching overbought levels, warranting caution from investors.

- Yellow reflects a more neutral market stance, where prices may consolidate or stabilize.

- Green represents a favorable buying zone, implying that Bitcoin is undervalued relative to historical trends.

- Blue and Purple highlight deep undervaluation, often viewed as attractive entry points for long-term investors seeking significant upside potential.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

The Bitcoin Rainbow Chart and Bitcoin Halving

The Bitcoin Rainbow Chart also takes the impact of Bitcoin halving events into consideration. Bitcoin halving occurs approximately every four years, cutting the block rewards miners receive by 50%. This reduction in new Bitcoin supply introduces scarcity, which can potentially drive prices higher over time.

Historically, halvings have often been followed by significant price increases, with Bitcoin frequently climbing toward the chart’s upper bands—sometimes even entering the red “overvalued” zone—before undergoing a correction. In many cases, prices have hovered within the lower bands around the time of a halving, gradually rising in the months and years that follow. However, with only three halvings having occurred to date, this historical pattern, while notable, should not be considered a guaranteed predictor of future performance.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

How to Use the Bitcoin Rainbow Chart in Trading Strategy?

The cryptocurrency market is notorious for its extreme volatility, with prices that can surge or plummet within mere hours. For traders and investors, the Bitcoin Rainbow Chart serves as a valuable tool to help navigate this inherent instability by offering a long-term perspective on Bitcoin’s price trends.

However, it’s important to view the Bitcoin Rainbow Chart as a long-term reference rather than a short-term trading signal. While Bitcoin’s price may experience sharp fluctuations in the short run, the chart encourages investors to focus on broader trends and avoid getting distracted by daily price swings.

To maximize the chart’s usefulness, investors should integrate it into a comprehensive market analysis strategy. It should not serve as the sole basis for investment decisions but rather complement other analytical tools. By combining insights from the Rainbow Chart with additional technical indicators and fundamental analysis, investors can build a more informed view of market dynamics. Moreover, considering the broader economic environment, including macroeconomic trends and breaking news, is essential for a well-rounded approach.

Here are several practical steps to effectively use the Bitcoin Rainbow Chart:

- Regularly monitor the chart to track Bitcoin’s position within the color bands.

- Compare current price behavior to historical patterns to identify potential trends.

- Use the chart alongside other technical analysis tools for a more complete market assessment.

- Stay up-to-date on market sentiment, regulatory developments, and major news events that could impact Bitcoin’s price.

- Be flexible and ready to adjust your investment strategy as new insights emerge from your ongoing analysis.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

The Bitcoin Rainbow Chart offers a visual framework for analyzing Bitcoin’s price movements over time. By interpreting the different color bands, investors can gain valuable insights into prevailing market sentiment and better assess potential opportunities or risks.

While the chart provides helpful historical context and visually highlights distinct market phases, it is not a definitive tool for predicting Bitcoin’s future price movements. Therefore, it should be used as a supplementary reference in combination with other technical indicators, fundamental analysis, and broader market research to support well-informed investment decisions.

As with any investment strategy, ongoing education, continuous monitoring, and a deep understanding of market dynamics are essential for long-term success in the cryptocurrency space.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

About BTCC

Founded in 2011, BTCC has established itself as a trusted and reputable exchange, distinguished by its unwavering commitment to security and transparency. With over 9.1 million users worldwide, BTCC offers market-leading liquidity and exceptional security, boasting an impeccable safety record that spans 14 years.

With a mission of providing a trading platform that is fair and reliable in every sense, BTCC platform supports spot trading for over 360 cryptocurrencies, crypto futures trading with leverage up to 500x, crypto copy trading that allows users to follow experienced traders, demo trading accounts pre-loaded with $100,000 in virtual funds, and tokenized futures for stocks and commodities. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms for crypto trading in Canada. The reasons why we introduce BTCC for you set forth as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

How to Trade Crypto Futures on BTCC?

BTCC supports trading for USDT- M Perpetual Futures contracts with a leverage of up to 500×, you can trade over 300 cryptocurrencies on BTCC at the most competitive price and highest security.

The following sets forth the step-by-step guidance for crypto futures trading on cryptocurrency exchange BTCC:

Step 1: Create a BTCC account

Step 2: Complete BTCC’s identity verification

Step 3: Fund your BTCC account

On the BTCC official homepage, choose “Deposite”, and then fund your account with your preferred method.

Step 4: Place your crypto futures order on BTCC

Go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find the crypto trading pair that you want to trade.

Then, choose the contract trading order type. Futures contract orders on BTCC platform include market orders, limit orders and SL/TP orders.

- Market Order: users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit orders are a type of order to buy or sell futures at a price more favourable than the market price. When you buy at a price lower than the market price or sell at a price higher than the market price, the order will be in the form of a limit order.

- SL/TP Order: SL/TP orders are a type of order to buy or sell futures at a price less favourable than the market price. When you buy at a price higher than the market price or sell at a price lower than the market price, the order will be in the form of a SL/TP order.

Next, adjust the leverage multiple.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

Then, choose the lot size and set the SL/TP price. After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Traders should remind that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform.

Finally, click the buy or sell button, and the crypto futures contract order is completed.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

Coinbase VS. CoinSpot: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

HODL’s Meaning Explained: A Crypto Trader’s Guide In 2025

Crypto Slang Explained: Understanding FOMO, FUD, REKT And More

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

Binance Introduces Spark (SPK) As 23rd HODLer Airdrop Project: Everything You Need To Know About It

How To Use Copy Trading Strategy To Maximize Your Crypto Profits

Bybit Hack: Everything You Need To Know About It

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

What is Etherions.com Tech: Something You Need To Know About It

Gold-Backed Cryptocurrency Explained: What Are The Best Gold-Backed Cryptocurrencies In 2025?

Top Crypto & Bitcoin Casinos Canada 2025

Top Free Crypto Sign-Up Bonuses In Canada For November 2025

Top Anonymous Crypto Wallets Canada 2025: Full Guide

Buy Bitcoin Canada: A Complete 2025 Guide

A Beginner’s Guide: How To Buy Meme Coins In Canada In 2025

A Beginner’s Guide: How to Trading Crypto in Canada in 2025

Top Canadian Crypto Stocks to Buy in 2025

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

How to Sell Pi Coin in Canada: A Complete Guide for 2025

How To Use Pi Network’s Mainnet In Canada: An Ultimate Guide In 2025

Pi Network Mainnet Launch Now Goes Live: Pi Network Price Prediction Post Mainnet Launch

Coinbase vs. Crypto.com: A Complete Comparison Guide In 2025

Compare BTCC vs Pionex: Crypto Exchange Comparison 2025

Compare BTCC vs Gate.io: Which is Best in 2025

BTCC vs. NDAX: which is a better choice for crypto trading in Canada?

BTCC vs. CoinJar: Which One Is A Better Crypto Exchange For Australians In 2025?

BTCC vs. CoinSmart: Which One Is A Better Platform For Crypto Trading?

Coinbase VS. CoinSpot: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]