What Is Enzyme (MLN): Is MLN Crypto a Good Investment In 2025?

Enzyme is a decentralized blockchain-based asset management infrastructure that operates on the Ethereum network. Despite the current weakness of the crypto market, its native MLN token experienced a significant price rally, attracting the attention of a large number of crypto enthusiasts. As we head towards the end of 2025, many traders are asking whether MLN provides a compelling investment opportunity or if it will remain a niche tool in the DeFi infrastructure space.

This article provides a comprehensive overview of Enzyme (MLN), covering what it is, how it works, MLN token details, tokenomics, and price history, as well as short- and long-term predictions, thus analyzing whether it might be a smart investment in 2025.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Enzyme?

Enzyme is a decentralized asset management infrastructure built on Ethereum, which allows users to create, manage, and invest in fund-like strategies via smart contracts. Originally created and launched under the name Melon, Enzyme’s ticker was MLN. Although the project did not change the ticker, the name of its ecosystem was rebranded to Enzyme. Melon was launched in 2016 by a private company. The founders of both Enzyme Finance and Melon are the mathematician Rito Trinkler and Mona El Isa. El Isa is a former vice president of Goldman Sachs.

Enzyme aims to decentralize traditional asset management, a field that has historically been the domain of professional financial advisors and firms. It offers innovative features and strategies to help network users and participants build, create and manage their portfolios. It enables projects to access a tried-and-tested suite of contracts at low cost without having to worry about developing and maintaining the underlying smart contract infrastructure.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

How does Enzyme Work?

The Enzyme architecture consists of a set of smart contracts built on the Ethereum network. The project uses its own software and protocol to provide asset management features and functionality while using Ethereum’s computational power to run the network. As Ethereum powers the Enzyme asset management infrastructure, fees and transactions on the protocol are paid in ETH, Ethereum’s native cryptocurrency.

Enzyme aims to enable depositors to connect with Vaults in a non-custodial and trustless manner. It offers a range of services, including managing users’ treasuries, building, testing and using various Vault strategies, creating their own indexes and making the underlying vault shares transferable. Users get to build, scale and monetize strategies, regain full control of their assets at all times and access the broader DeFi sector.

The infrastructure layer forms part of an ecosystem that is controlled by Enzyme’s decentralized autonomous organization, known as the Enzyme Council (previously the Melon Council). The protocol’s utility token, MLN, helps to manage digital investments. It also serves a purpose in the voting mechanism and network governance, for example, for voting on inflation rate proposals. It is also used for fund management execution.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is the MLN Token?

The MLN token is the utility token of the Enzyme ecosystem, being integral to its functionality and governance. It is used to pay protocol fees, incentivize participation, and facilitate decentralized governance. Holding MLN tokens enables users to participate in key governance decisions, such as proposing and voting on protocol upgrades or parameter changes.

The MLN token also serves as a fee mechanism that ensures the platform’s sustainability. Users pay MLN to access certain features and services, and this fee structure helps to maintain economic equilibrium within the ecosystem. These mechanisms not only power transactions but also help shape the future direction of the protocol, thereby reinforcing a community-driven model.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

MLN Tokenomics

Supply & Circulation: Circulating supply is relatively low (under ~3 million tokens in some data sets) compared to total supply metrics.

Burn Mechanisms: Usage of vaults (fees) results in MLN being collected and burned; for example, in August 2022, 54,669 MLN tokens were automatically burned. Over time, the burn rate has extended governance transparency.

Inflation & Minting: Enzyme’s minter contract allows up to 300,600 new MLN tokens minted each calendar year, dedicated to protocol development, grants and growth initiatives. Unused tokens are generally burned.

Utility & Allocation: MLN is used for protocol access, staking, governance; its value depends on vault AUM growth, ecosystem adoption and integration across DeFi.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Enzyme (MLN) Price History

The price history of MLN reflects its niche role in DeFi infrastructure, as well as broader cycles in the crypto market. According to CoinGecko, MLN reached an all-time high of around US$258 in January 2018, after which it experienced significant drawdowns.

Its price movement shows a sharp decline from the 2018 peak, followed by a prolonged consolidation phase. The relative lack of trading volume and liquidity compared to larger tokens is a contributing factor.

However, recent data also suggests positive price movements and bullish sentiment. According to CoinMarketCap’s chart, MLN is currently trading at $11.54, which is up by over 40% in the last 24 hours and outperforms larger altcoin rotations.

The following sets forth the MLN to USD Chart

Enzyme (MLN) Price Prediction

Due to the rapid changes in the cryptocurrency market, there is a great deal of uncertainty surrounding the future price of $MLN. Bearing this in mind, we have produced short- and long-term forecasts for MLN based on a variety of scenarios.

Short-Term Enzyme (MLN) Price Prediction

If Enzyme significantly increases its Vault AUM, integrates new protocols and attracts institutional usage, and if MLN burns accelerate, MLN could reach a peak of $20 by the end of 2025. However, if adoption stalls and macroeconomic conditions deteriorate, the price of MLN could fall to a minimum level of $4 by the end of the year.

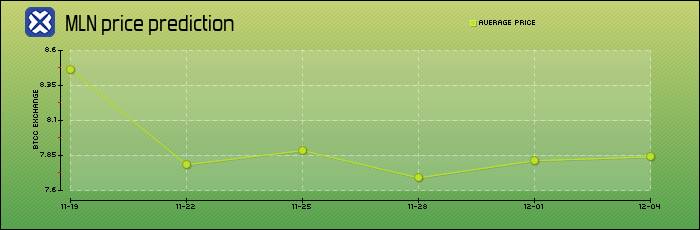

Based on BTCC’s technical analysis, here are the possible prices we predict for $SMLN in the next half month:

| Date | Price Prediction | Change |

| 11-19 | $ 8.4607 | 0.00% |

| 11-22 | $ 7.7840 | -8% |

| 11-25 | $ 7.8846 | -6.81% |

| 11-28 | $ 7.6900 | -9.11% |

| 12-01 | $ 7.8127 | -7.66% |

| 12-04 | $ 7.8398 | -7.34% |

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Long-Term Enzyme (MLN) Price Prediction

Explore potential price predictions for Enzyme (MLN) between 2026 and 2050. By examining bullish and bearish market scenarios, we aim to offer a balanced view of the future of this digital currency. Based on BTCC’s technical analysis, here are our projected highs and lows for MLN from 2026 to 2050:

| Year | Yearly Low | Yearly Average | Yearly High |

| 2026 | $ 12.6823 | $ 20.9696 | $ 22.3636 |

| 2027 | $ 16.0085 | $ 18.7697 | $ 19.9540 |

| 2028 | $ 16.0631 | $ 18.8133 | $ 19.8413 |

| 2029 | $ 28.2013 | $ 40.8109 | $ 46.7303 |

| 2030 | $ 23.9943 | $ 36.6453 | $ 41.8626 |

| 2031 | $ 22.1243 | $ 35.1493 | $ 42.3371 |

| 2035 | $ 25.3303 | $ 39.6892 | $ 47.7925 |

| 2040 | $ 41.4383 | $ 57.2682 | $ 65.6352 |

| 2045 | $ 36.5807 | $ 57.5032 | $ 71.7344 |

| 2050 | $ 42.3509 | $ 65.1879 | $ 77.5088 |

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Is MLN Crypto a Good Investment in 2025?

Deciding whether MLN Crypto is a good investment requires carefully weighing both the growth opportunities and the potential risks. Below are key benefits and risks for investors to consider:

| Benefits | Risks |

| Enzyme fills a clear niche: DeFi infrastructure for tokenized assets and vault management, which arguably has long-term relevance.

If adoption accelerates, MLN has upside potential given its relatively low current price base and deflationary burn mechanics. For traders who believe DeFi infrastructure will grow and institutional adoption of on-chain asset management increases, MLN could be an early mover play. |

MLN is highly dependent on actual platform usage and vault growth — if these stall, token value may stagnate.

Tokenomics show inflationary elements (annual minting) and relatively low circulating supply/liquidity — this could mean high volatility and risk of being thinly traded. The broader crypto market remains volatile, and infrastructure tokens often lag speculative hype tokens in short term. Competition is high. Other protocols offering similar tokenized free-flows or asset-management platforms may erode Enzyme’s potential market share. |

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

How to Buy the MLN Token?

Since the launch of the MLN token, MLN is now widely listed and traded across most major centralized exchanges (CEX) such as Binance, Coinbase, MEXC, OKX, Bybit, etc., where interested investors can trade this promising project.

Currently, the $MLN token is not available on BTCC platform. However, it is worth mentioning that BTCC supports trading for a large variety of popular coins, such as BTC, ETH, DOGE, SHIB, BONK, etc. If you are interested in these popular coins, you can make a purchase on BTCC exchange with the highest security level and a most competitive fee.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

Enzyme (MLN) is an intriguing infrastructure token within the DeFi ecosystem. However, its valuation and potential depend heavily on execution, including vault adoption, integrations, token burn dynamics, and ecosystem growth.

Looking for the rest od 2025, MLN token presents an opportunity for speculative investment with significant potential returns, but also carries considerable risk. If you’re optimistic about DeFi infrastructure and willing to accept volatility, MLN could be a good addition to your portfolio.

However, the crypto market is volatile. Could Enzyme (MLN) be the next crypto asset to explode in popularity? Only time will tell. As always, all investors are advised to conduct thorough research and exercise great caution before making any decisions regarding Enzyme (MLN).

\Unlock Up To 10,055 USDT In Welcome Rewards!/

About BTCC

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Unich Airdrop Guide: How To Earn $UN Tokens?

Barron Trump Crypto: How Dose He Amass $150 Million Fortune From Crypto?

Layer Brett ($LBRETT) Review & Analysis: Next 100x Meme Coin?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

VWA Crypto Price Prediction 2025, 2026 And 2030: Is It A Good Investment In 2025?

Monad Airdrop Guide: How To Claim Your MON Token?

Aster Airdrop Guide & Tips: How to Claim The AST Token?

How To Buy VWA Crypto: A Comprehensive Guide For All Traders

Best Free Crypto Sign-Up Bonus Australia 2025

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Toshi (TOSHI) Price Prediction 2025, 2026 And 2030: Can TOSHI Hit $1?

How To Stake XYO For Earning $XL1: A Useful Guide For All Users

Zexpire (ZX) Coin Review & Analysis: Next 100× Big Token?

DeepSnitch AI (DSNT) Coin Review & Analysis: Next 100x Gem?

BullZilla ($BZIL) Meme Coin Review & Analysis: Everything You Need To Know About It

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

What Is Hemi (HEMI) Crypto: Everything You Need To Know About It

Pendle (PENDLE) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can PENDLE Hit $10?

Aerodrome Finance (AERO) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can AERO Hit $2?

Pepe Heimer ($PEHEM) Review & Analysis: Next 100x Meme Coin on Ethereum?

Kanye West Launches YZY Crypto: Everything You Need To Know About It

Sapien (SAPIEN) Price Prediction: How High Can SAPIEN Go Post Binance Listing?

OKZOO (AIOT) Price Prediction 2025, 2026 And 2030: Can AIOT Hit $5?

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

SKALE (SKL) Price Prediction 2025 To 2030: Can SKL Hit $1?

Bullish Stock Price Prediction: Will It Explode Post IPO?

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

What Is Rizenet ($RIZE) Crypto: Everything You Need To Know About It

UnitedHealth (UNH) Stock Price Target & Forecast 2025 To 2030: Is UNH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Anoma Roadmap Explained: Is an Airdrop Coming?

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

UPTOP Goes Live on Binance Alpha: Everything You Need to Know About This Crypto and Its Airdrop

Yala (YALA) Debuts On Binance Alpha: Everything You Need To Know About This Crypto And Its Airdrop

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager