What Is Yield Basis (YB): Everything You Need To Know About The Binance’s 53rd HODLer Airdrops Project

On October 14, 2025, Binance revealed its 53rd HODLer Airdrop project: Yield Basis (YB), a DeFi protocol that enables users to provide liquidity to automated market maker (AMM) pools without experiencing impermanent loss.

Following this announcement, Yield Basis (YB) has attracted significant attention from crypto enthusiasts. But what exactly is Yield Basis (YB)? Could it be a smart investment choice for 2025? This article provides a comprehensive overview of the Yield Basis (YB) project, including what Yield Basis is, its ecosystem, the YB token and its tokenomics, airdrop, as well as its growth potential in the crypto market.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Yield Basis?

Yield Basis is a decentralized finance (DeFi) protocol that allows users to provide liquidity to automated market maker (AMM) pools without incurring impermanent loss. Founded in 2025 by Michael Egorov, the creator of Curve Finance — a leading DeFi protocol renowned for its robust AMM infrastructure and governance models—Yield Basis aims to solve the problem of sustainable, risk-mitigated yield for Bitcoin and other major assets by leveraging advanced AMM technology and decentralized governance within the Yield Basis platform.

Yield Basis’s mission is to solve the problem of achieving sustainable, risk-mitigated yields for Bitcoin and other major assets by leveraging advanced AMM technology and decentralized governance within the Yield Basis platform. It achieves this via a 2x compounding leverage mechanism built on Curve Finance’s infrastructure. Users deposit crypto assets and receive YieldBasis LP tokens representing their share of the liquidity pool.

The protocol maintains a constant 2x leverage ratio by borrowing crvUSD against LP positions through a dedicated collateralized debt position (CDP). When price movements occur, a specialized Rebalancing-AMM and VirtualPool architecture enables arbitrageurs to automatically restore the target leverage ratio. This mechanism ensures that Yield Basis LP tracks the underlying crypto asset price movements at a ratio of 1:1 while generating trading fees from the underlying Curve pool.

Yield Basis offers liquidity providers two earning strategies: unstaked Yield Basis LP holders earn trading fees directly from pool activity, and staked Yield Basis LP holders receive YB token emissions. The protocol implements a dynamic admin fee formula that adjusts based on staking participation, splitting trading fees between unstaked LP holders and veYB governance participants.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Yield Basis Ecosystem

The Yield Basis ecosystem comprises several interconnected products that offer a comprehensive solution for Bitcoin and Ethereum holders seeking yield:

Yield Basis AMM Platform

At the core of the ecosystem is an Automated Market Maker (AMM) platform that enables users to deposit Bitcoin (in the form of wrapped BTC or CBcoin) into single-asset pools. The Yield Basis protocol utilizes Curve’s crvUSD stablecoin to apply leverage while maintaining a 200% collateralization ratio. Automated bots continuously rebalance positions in order to track Bitcoin’s spot price, effectively eliminating impermanent loss and allowing users to earn trading fees or YB token rewards.

veYB Governance System

Yield Basis employs a vote-escrow (veYB) model, wherein users lock their YB tokens to participate in governance decisions within the Yield Basis protocol and receive a share of protocol fees. This system aligns incentives for long-term engagement and empowers the community to influence key parameters such as pool settings and emissions.

Curve DAO Integration

Through a strategic partnership with Curve DAO, Yield Basis has secured access to a $60 million crvUSD credit line, which enhances liquidity and facilitates deeper, more stable yield opportunities for Yield Basis (YB) users. This integration also fosters cross-protocol governance and supports overall ecosystem growth.

These components work synergistically to create a robust, user-driven environment where YB functions as both the utility and governance token, facilitating all interactions and incentives within the Yield Basis network.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is the YB Token?

The YB token is the native utility and governance token of the Yield Basis protocol. It plays several key roles, including governance, revenue sharing, emission allocation and incentive alignment.

Gauge Voting for Emissions: veYB holders vote on gauge weights to determine how YB token emissions are distributed across different liquidity pools. Each gauge’s emission share is proportional to the votes it receives, with weights updating instantly. This system allows the community to direct incentives toward preferred pools, with a 10-day cooldown period between vote changes.

Protocol Revenue Sharing: veYB holders receive a portion of protocol revenue through the dynamic admin fee mechanism. As more YieldBasis LPs get staked, the admin fee increases non-linearly, allocating more trading fees to veYB holders. This creates revenue sharing opportunities for long-term token holders committed to governance participation.

Liquidity Mining Incentives: the YB tokens are distributed as emissions to users who stake their YieldBasis LP tokens. The emission schedule follows an exponential decay curve with a maximum emission rate controlled by the GaugeController contract. The total supply is capped at 1 billion tokens.

YB tokens can be locked for up to four years to create veYB (vote-escrowed YB) positions, which provide voting power for protocol governance. This includes the right to vote on proposals for parameter updates, feature additions and protocol upgrades. This voting power decays linearly over the lock duration unless the tokens are max-locked for four years.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

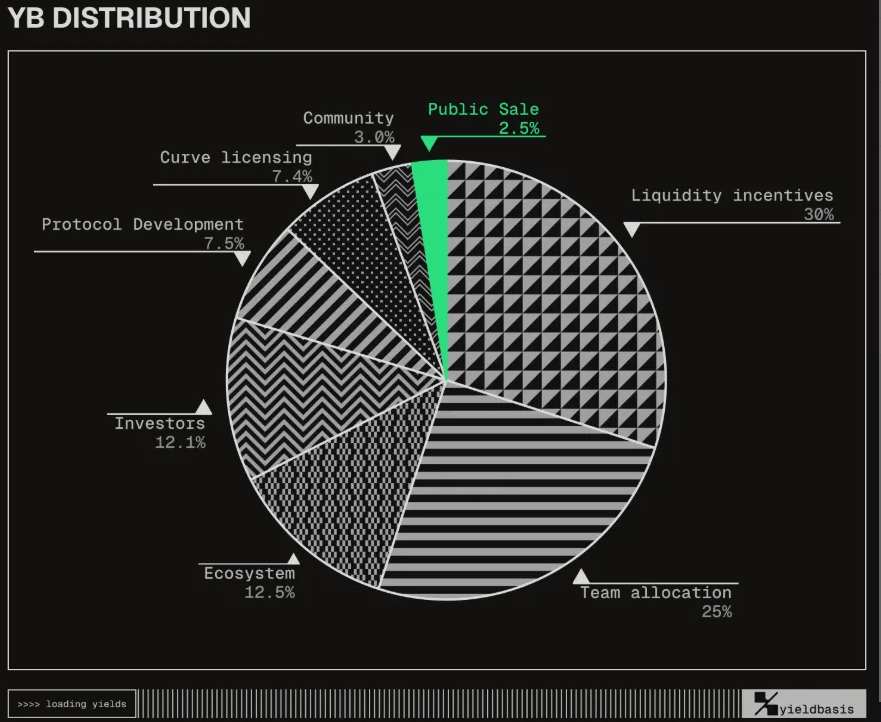

$YB Tokenomics

The total supply of YB is 1 billion tokens. Below is the allocation breakdown:

- 30%: Liquidity Incentives

- 25%: Team

- 12.5%: Ecosystem

- 12.1%: Investors

- 7.5%: Protocol development

- 7.4%: Curve Technology Licensing

- 3%: Community

- 2.5%: Public sale

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Yield Basis (YB) Airdrop

On 14 October, Binance announced that it would add Yield Basis (YB) — a DeFi protocol which aims to provide yield to liquidity providers while mitigating impermanent loss through the use of leverage — as the 53rd project in its HODLer Airdrop program. Users who subscribed their BNB to Simple Earn (Flexible and/or Locked) and/or On-Chain Yield products between 00:00 (UTC) on 9 October and 23:59 (UTC) on 11 October can receive the airdrop distribution.

Binance would then list YB at 2025-10-15 11:00 (UTC) and open trading against USDT, USDC, BNB, FDUSD, and TRY pairs. The seed tag would be applied to YB. Users can start depositing YB at 2025-10-14 12:00 (UTC).

YB HODLer Airdrops Details

Token Name: Yield Basis (YB)

Total Token Supply at Genesis: 700,000,000 YB

Max Token Supply: 1,000,000,000 YB

HODLer Airdrops Token Rewards: 10,000,000 YB (1.00% of max total token supply)

Circulating Supply upon Listing on Binance: 87,916,667 YB (~12.56% of total token supply at Genesis)

Smart Contract/Network Details:

- BNB Smart Chain (0xFB93EE8152dd0a0e6F4b49C66c06d800Cf1Db72d)

- Ethereum (0x01791F726B4103694969820be083196cC7c045fF)

Listing Fee: 0

Research Report: Yield Basis (YB) (will be available within 48 hours of publishing this announcement)

BNB Holding Hard Cap: User’s Average BNB Holding / Total Average BNB Holding * 100% ≤ 4% (If the holding ratio is greater than 4%, the BNB holding ratio will be calculated as 4%).

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Is Yield Basis (YB) a Promising Investment?

While Yield Basis (YB)’s prospects are compelling, they are not without considerable risks. The chart below outlines the benefits and risks associated with Yield Basis (YB).

| Benefits | Risks |

| Innovative Design to Mitigate Impermanent Loss: The key promise of offering yield without losing exposure is compelling. If the leveraged + rebalancing architecture works reliably, it could differentiate Yield Basis from traditional AMMs.

Strong Launch Support & Visibility: Being the 53rd project in Binance’s HODLer Airdrops ensures early exposure to a large user base. Binance’s promotional backing and listing schedule help bootstrap liquidity and awareness. Commitment to Governance & Token Synergy: The protocol’s token model ties governance, yield distribution, and protocol revenue together (via veYB), aligning long-term holders with ecosystem success. Solid Partnerships & Research Foundations: Reports that the protocol benefits from guidance by Michael Egorov (founder of Curve) lend credibility. Also, a $5 million funding round has been publicly disclosed. |

Architecture Complexity & Risk: The leveraged model and rebalancing mechanisms introduce complexity. If market moves are too swift or stress testing is weak, rebalances could fail or create losses.

Competition & Alternatives: Many AMMs, DeFi protocols, and liquidity solutions are already established. Yield Basis must prove it can outperform or offer unique advantages. Token Unlocks & Dilution: Early supply control, vesting schedules, team allocations, and emission curves all need disclosure. Heavy unlocks could cause downward pressure. Volatility & Seed Tag Risk: Binance’s Seed Tag means users should expect significant price swings and that the listing is viewed as higher risk. Adoption & Real Usage: The protocol’s long-term success depends on genuine adoption — meaningful deposit amounts, active trading volume, diverse pool participation, and sustained governance engagement. |

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Conclusion

Yield Basis (YB) carries considerable promise as a next-generation DeFi protocol aiming to combine yield generation with full exposure and minimized impermanent loss. With Binance’s backing through its HODLer Airdrops program, the token launch is positioned to gain early visibility and liquidity. Yet the success of YB hinges on whether its leveraged + rebalancing architecture functions robustly under stress, whether the tokenomics remain favorable, and whether the community embraces the governance model.

For investors and enthusiasts willing to remain engaged with the project, Yield Basis (YB) offers an exciting opportunity. If you participate in the airdrop or plan to acquire YB, treat it as a speculative infrastructure play — potentially rewarding, but risky. It is important to note that the cryptocurrency landscape is highly volatile. All investors are strongly advised to conduct thorough research and exercise caution before making any decisions regarding Yield Basis (YB).

That’s all information about Yield Basis (YB). If you want to know more information about Yield Basis (YB) coin and other cryptocurrencies, please visit BTCC Academy.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Why Choose BTCC?

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Barron Trump Crypto: How Dose He Amass $150 Million Fortune From Crypto?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

VWA Crypto Price Prediction 2025, 2026 And 2030: Is It A Good Investment In 2025?

Monad Airdrop Guide: How To Claim Your MON Token?

Aster Airdrop Guide & Tips: How to Claim The AST Token?

How To Buy VWA Crypto: A Comprehensive Guide For All Traders

SuperVerse (SUPER) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can SUPER Hit $5?

What Is Plasma (XPL) Crypto: Everything You Need To Know About It

What Is Hemi (HEMI) Crypto: Everything You Need To Know About It

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

Pendle (PENDLE) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can PENDLE Hit $10?

Aerodrome Finance (AERO) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can AERO Hit $2?

Sapien (SAPIEN) Price Prediction: How High Can SAPIEN Go Post Binance Listing?

OKZOO (AIOT) Price Prediction 2025, 2026 And 2030: Can AIOT Hit $5?

Layer Brett ($LBRETT) Review & Analysis: Next 100x Meme Coin?

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

SKALE (SKL) Price Prediction 2025 To 2030: Can SKL Hit $1?

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

Bullish Stock Price Prediction: Will It Explode Post IPO?

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

What Is Rizenet ($RIZE) Crypto: Everything You Need To Know About It

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Anoma Roadmap Explained: Is an Airdrop Coming?

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is Redakciya.info Crypto: Is It Legit Or A Scam?

What Is Swapfone: Everything You Need To Know About This US-Based Crypto Exchange

Eli Regalado Crypto: Who Is He & Why Is He Involved In The Crypto Scam?

FaZe Banks Crypto: Who Is He & Why Is He Involved In The Crypto Scadal?