Orca (ORCA) Price Prediction 2025, 2026 And 2030: Can ORCA Hit $20 Again?

Orca is a decentralized exchange (DEX) built on the Solana blockchain, designed to offer fast, user-friendly token swaps with minimal fees. On Nov. 27, Upbit, which is basically South Korea’s biggest crypto exchange, got hit with a major hack. Most traders basically saw ORCA was one of the stolen tokens and immediately started shorting it.

Notably, ORCA’s price surged by over 70% following the significant short squeeze. Now, many traders are considering this a potential short opportunity. As ORCA re-enters the spotlight as a top-performing altcoin, investors are turning their attention to its long-term outlook. This article explores the reasons behind ORCA’s recent price increase and provides price forecasts for the period from 2025 to 2030, thus assessing whether ORCA can realistically revisit the $20 level.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Orca (ORCA): A Brief Overview

| Cryptocurrency | Orca |

| Token | ORCA2 |

| Price | $ 1.0952 |

| Rank | 511 |

| Market Cap | $ 0 |

| 24H Trading Volume | $ 10.9M |

| All-time High | $ 20.2819 |

| All-time Low | $ 0.3674 |

| 24 High | $ 1.1667 |

| 24 Low | $ 1.0720 |

| Cycle High | $ 8.9438 / 2024-12-06 13:20:00 |

| Cycle Low | $ 0.3674 / 2022-06-19 19:45:00 |

| Update Time | 2026-01-19 17:47:01 |

Orca is a user-friendly decentralized exchange (DEX) built on the Solana blockchain that uses an automated market maker (AMM) system to offer fast trades with low fees, all while giving its community a real voice in how the platform evolves. It is best known for its innovative “Whirlpool” concentrated liquidity pools, which enable liquidity providers to deploy capital more efficiently by focusing it within specific price ranges. Overall, Orca isn’t just about making money but about building something sustainable and positive for the broader world.

The ORCA token functions as the platform’s native utility and governance asset. Holders can participate in protocol decisions through governance voting and can stake ORCA to earn additional rewards. The platform’s DeFi incentives, such as yield farming opportunities and governance rewards, offer users several reasons to hold and use ORCA tokens other than speculation. As of late 2025, Orca has established itself as a core component of the Solana DeFi landscape, with hundreds of millions in cumulative trading volume and a growing user base.

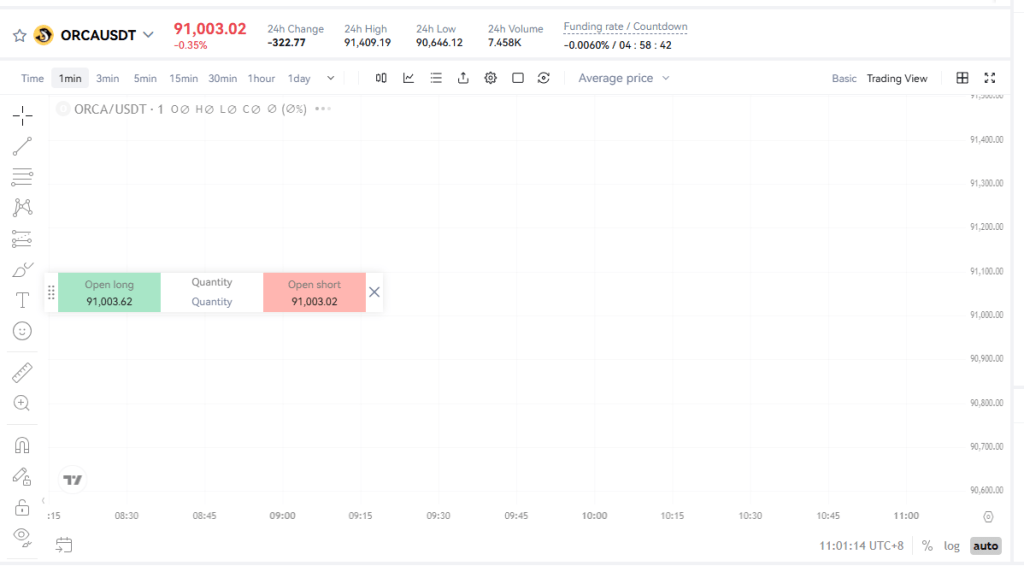

ORCA USDT-margined perpetual futures contract with a leverage of up to 50x is available on BTCC, you can directly click the button below to buy ORCA coin⇓

[TRADE_PLUGIN]ORCAUSDT,ORCAUSDT[/TRADE_PLUGIN]

Why ORCA Explode in Late November?

ORCA’s price surge in November 2025 was primarily driven by a combination of renewed speculative interest, increased trading volume, and community-driven optimism surrounding forthcoming governance proposals. On November 27, Upbit—South Korea’s largest cryptocurrency exchange—suffered a significant hack. Many traders perceived ORCA as one of the stolen tokens and promptly began shorting it. Notably, ORCA’s price surged by over 70% following this substantial short squeeze.

After weeks of subdued activity, the token more than doubled in value, reaching a local high exceeding $2.00. This unexpected movement occurred without any major exchange listings or high-profile partnerships, indicating that the rally was fueled by market momentum and bolstered by developments at the protocol level.

Central to this renewed enthusiasm is a proposal from the Orca DAO to initiate a series of token buybacks and enhance validator staking incentives using assets held within the project’s treasury. The plan includes deploying SOL and USDC reserves to purchase ORCA from the open market, generating bullish sentiment among holders who anticipate reduced token supply and stronger ecosystem alignment. As signs of recovery emerge within the broader Solana ecosystem, traders appear to be rotating back into DeFi-native tokens like ORCA in anticipation of further upside potential.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Orca (ORCA) Price Prediction 2025

As of writing the article, ORCA coin is traded at $ 1.0952, boasting a market cap of $ 0, and witnessing a 24-hour trading volume of $ 10.9M. ORCA Token saw a 24-hour change of -5.65%, with minor fluctuations of 0.17% in the past hour.

The following sets forth the ORCA to USD Chart

After rallying sharply in November 2025, ORCA is now trading in the $1.2–$1.5 range. The token’s short-term trajectory will depend largely on the success of proposed buybacks, the wider DeFi outlook, and whether the Solana ecosystem continues its recent recovery.

For the rest of 2025, if Orca DAO successfully implements its treasury-backed buybacks and staking incentives, and if Solana DeFi sees a resurgence in total value locked (TVL), ORCA could reach the highs seen in March. In this scenario, the token could reach a peak of $5.00 by the end of the year, particularly if new exchange listings or significant ecosystem partnerships are realized.

Conversely, if market conditions deteriorate, governance proposals stall, or Solana suffers another technical or reputational setback, ORCA could lose its current momentum. Under bearish conditions, the token could fall to a low of $0.8, especially if liquidity dries up or community confidence wanes.

[TRADE_PLUGIN]ORCAUSDT,ORCAUSDT[/TRADE_PLUGIN]

Orca (ORCA) Price Prediction 2026

Looking ahead to 2026, the performance of ORCA will likely depend on how effectively the protocol builds on its recent momentum. Key factors will include the outcome of current governance proposals, the actual implementation of token buybacks and Orca’s ability to compete with other Solana-based DEXs for liquidity and user retention. Market sentiment surrounding Solana and the wider DeFi sector will also be crucial.

If ORCA solidifies its position as a leading DEX on Solana, introduces governance-backed incentives to attract new liquidity and the overall crypto market enters a bullish phase, the token could experience sustained growth. Under these conditions, the token could reach a target price of $6.00 in 2026, especially if the total value locked (TVL) and trading volume continue to grow significantly.

However, if Orca fails to execute its roadmap, loses market share to more aggressive competitors or the broader market experiences another contraction, ORCA could struggle to maintain its gains. A retracement to the $1.60 level is possible, particularly if token buybacks are underfunded or community participation declines.

[TRADE_PLUGIN]ORCAUSDT,ORCAUSDT[/TRADE_PLUGIN]

Orca (ORCA) Price Prediction 2030

As Orca matures in the second half of the decade, its long-term valuation will depend on real-world usage, the sustainability of the protocol, and the wider development of decentralised finance. Investors will expect consistent utility, strong governance engagement and measurable on-chain growth to justify holding ORCA by this point.

If Orca emerges as a dominant Solana DEX, attracts institutional liquidity and introduces additional utility, such as cross-chain integrations or advanced staking models, the ORCA price could increase significantly by 2030. In a bullish long-term environment, the token could reach a maximum price of $12.00, especially if crypto adoption accelerates globally and regulatory clarity boosts investor confidence.

However, if Orca’s innovation lags, new competitors dominate Solana’s liquidity landscape or if macroeconomic conditions suppress crypto growth, ORCA may underperform. In a bearish scenario, the token could slump to a low of $2, reflecting limited utility growth and a declining ecosystem presence.

Potential Highs & Lows of ORCA

There is large uncertainty about the future price of $ORCA, as the cryptocurrency market changes rapidly. With this in mind, we have made both more bullish and more bearish forecasts for $ORCA based on a variety of different scenarios.

Based on BTCC’s technical analysis, here are our projected highs and lows for ORCA from 2026 to 2050:

| Year | Yearly Low | Yearly Average | Yearly High |

| 2027 | $ 1.2399 | $ 2.0322 | $ 2.2698 |

| 2028 | $ 1.4582 | $ 1.8325 | $ 2.0788 |

| 2029 | $ 2.3588 | $ 3.5753 | $ 4.3608 |

| 2030 | $ 2.2551 | $ 3.4172 | $ 3.9764 |

| 2031 | $ 2.0630 | $ 3.2635 | $ 3.9171 |

| 2032 | $ 3.1077 | $ 4.2975 | $ 4.8975 |

| 2035 | $ 2.6323 | $ 3.9771 | $ 4.6326 |

| 2040 | $ 3.7390 | $ 5.3993 | $ 6.5409 |

| 2045 | $ 4.1453 | $ 6.3130 | $ 7.6754 |

| 2050 | $ 4.2830 | $ 6.8556 | $ 8.2280 |

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Key Factors Influencing ORCA’s Future Outlook

Several interlinked variables will determine whether ORCA can sustain long-term value appreciation or fade into obscurity. Understanding these drivers is critical for evaluating the token’s outlook from now until 2030.

Solana Ecosystem Growth

Orca’s fortunes are closely tied to the health of the Solana blockchain. If Solana continues to attract developers, scale DeFi applications, and regain institutional interest, protocols like Orca are likely to benefit from network effects. Conversely, any prolonged technical issues, outages, or loss of developer engagement could undermine ORCA’s potential.

Protocol Governance and Buyback Mechanisms

ORCA’s tokenomics are evolving through active governance proposals. The most notable initiative currently under discussion involves deploying treasury-held assets—including SOL and USDC—to repurchase ORCA tokens from the open market. If implemented, this strategy could reduce circulating supply and exert upward pressure on prices. The community’s engagement in and execution of these proposals will play a direct role in shaping the token’s value.

Competitive Landscape in DeFi

Orca faces intense competition from other Solana-based decentralized exchanges (DEXs) such as Raydium, as well as emerging multi-chain platforms. To retain its market share, Orca must continue innovating—through liquidity tools like Whirlpool, enhanced user experience (UX), and future product offerings. Falling behind in functionality or losing key integrations could hinder its growth prospects and price performance.

Broader Crypto Market Cycles

Like most altcoins, ORCA’s long-term price trajectory will be influenced by overall sentiment within the cryptocurrency market. During bullish phases, capital rotation into high-potential DeFi tokens typically boosts ORCA’s value. In contrast, risk-off environments or global regulatory tightening may diminish speculative flows and depress prices across the board.

[TRADE_PLUGIN]ORCAUSDT,BTCUSDT[/TRADE_PLUGIN]

Can ORCA Hit $20 Again?

Based on current price predictions, it is unlikely that ORCA will reach $20 before 2030. However, it is still possible for ORCA to reach $20 in the future, although this is not guaranteed. This would likely require a strong crypto bull cycle, renewed DeFi expansion, consistent Solana network performance and Orca maintaining its position as a top-tier DEX.

While the $20 price target is ambitious, it is not unrealistic under ideal conditions. Nevertheless, investors should recognise that recovering past highs often requires a significantly greater capital inflow than the initial rally. Therefore, ORCA should be viewed as a speculative long-term investment rather than a certainty.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

How to Buy the ORCA Token?

Currently, ORCA USDT-margined perpetual futures contracts with a leverage of up to 50x are now available on BTCC platform. The following sets forth the guidance for trading ORCA USDT-margined perpetual futures contracts on cryptocurrency exchange BTCC:

Step 1: Create a BTCC account

Step 2: Complete BTCC’s identity verification

Step 3: Fund your BTCC account

On the BTCC official homepage, choose “Deposite”, and then fund your account with your preferred method

Step 4: Place your crypto futures order on BTCC

Go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find ORCA trading pair.

You can also click the button below to enter ORCA trading page⇓

[TRADE_PLUGIN]ORCAUSDT,ORCAUSDT[/TRADE_PLUGIN]

Then, choose the contract trading order type. Futures contract orders on BTCC platform include market orders, limit orders and SL/TP orders.

- Market Order: users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit orders are a type of order to buy or sell futures at a price more favourable than the market price. When you buy at a price lower than the market price or sell at a price higher than the market price, the order will be in the form of a limit order.

- SL/TP Order: SL/TP orders are a type of order to buy or sell futures at a price less favourable than the market price. When you buy at a price higher than the market price or sell at a price lower than the market price, the order will be in the form of a SL/TP order.

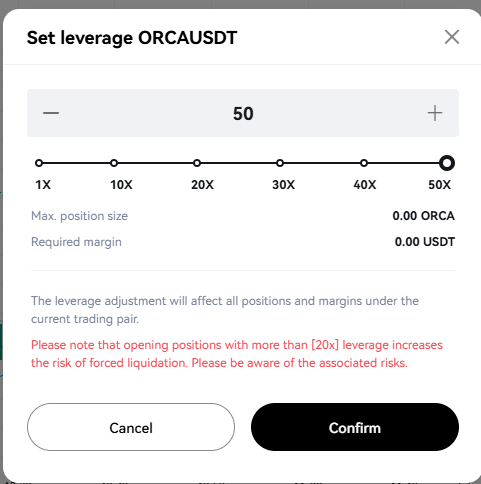

Next, adjust the leverage multiple.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

Then, choose the lot size and set the SL/TP price. After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Traders should remind that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform.

Finally, click the buy or sell button, and ORCA futures contract order is completed.

[TRADE_PLUGIN]ORCAUSDT,ORCAUSDT[/TRADE_PLUGIN]

Conclusion

ORCA’s surge in price in November 2025 has reignited interest in Solana-based DeFi and brought the token back into the spotlight. Looking ahead to the period from 2025 to 2030, ORCA’s price outlook varies considerably. In bullish scenarios supported by successful governance execution, growing liquidity and favourable market conditions, the token could reach double digits by the end of the decade.

While a return to $20 is still possible for ORCA, this depends on favourable conditions, and its long-term success is closely tied to Solana’s performance and Orca’s ability to innovate. For investors with a high risk tolerance and a long-term outlook, ORCA represents a potential opportunity for growth. However, as with all DeFi assets, thorough research and disciplined risk management are essential.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Why Choose BTCC?

Founded in 2011, BTCC stands out as a trusted and well-respected exchange due to its unwavering commitment to security and transparency. Since its establishment in 2011, BTCC has boasted an impeccable security track record, with zero reported hacks or breaches. Holding licenses in the U.S., Canada, and Europe, BTCC provides a comprehensive suite of trading features within a secure and regulated platform.

With a mission of providing a trading platform that is fair and reliable in every sense, BTCC platform supports spot trading for over 360 cryptocurrencies, crypto futures trading with leverage up to 500x, crypto copy trading that allows users to follow experienced traders, demo trading accounts pre-loaded with $100,000 in virtual funds, and tokenized futures for stocks and commodities. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

How to Earn Your 10,055 USDT Welcome Bonus on BTCC: A Complete Guide To Maximize Your Crypto Return

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

How To Get Free Bitcoin & Other Cryptos Instantly No Deposit: A Complete Guide in 2025

What Is GAIB Crypto: Everything You Need to Know About It

Best Free Crypto Sign-Up Bonus Australia 2025

Top Free Crypto Sign-Up Bonuses In Canada For November 2025

Top Free Crypto Mining Apps for Android and iOS Canada 2025

What Is Exovum (EXO) Crypto: Everything You Need To Know About It

BeCexy (CEXY) Airdrop & Price Prediction: How High Will CEXY Go Post Listing?

Janction (JCT) Airdrop & Price Prediction: How High Can JCT Go Post Binance Listing?

Sapien (SAPIEN) Price Prediction 2025, 2026 And 2030: How High Can SAPIEN Go Post Binance Listing?

Momentum (MMT) Airdrop & Price Prediction: How High Will MMT Go Post Binance Listing?

What Is United States Crypto Reserve (USCR): Everything You Need To Know About It

Aster Airdrop Guide & Tips: How to Claim The AST Token?

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Anoma Roadmap Explained: Is an Airdrop Coming?

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

Best Free Bitcoin Accelerators 2025

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

What Is SUV Bitcoin Miner APK: Everything You Need To Know About It

Coinbase vs. CoinSpot: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

eToro vs. CoinJar: Which Is A Better Crypto Trading Platform For Australian Traders In 2025

Coinspot vs. Swyftx: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

Arctic Pablo Coin (APC) Review & Analysis: Next 100x Token?

What Is Crundle (CRND) Crypto: Everything You Need To Know About It

Toshi (TOSHI) Price Prediction 2025, 2026 And 2030: Can TOSHI Hit $1?

How To Stake XYO For Earning $XL1: A Useful Guide For All Users

Zexpire (ZX) Coin Review & Analysis: Next 100× Big Token?

BullZilla ($BZIL) Meme Coin Review & Analysis: Everything You Need To Know About It

Layer Brett ($LBRETT) Review & Analysis: Next 100x Meme Coin?

Pepe Heimer ($PEHEM) Review & Analysis: Next 100x Meme Coin on Ethereum?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Klarna Stock Price Prediction: How High Will It Go Post IPO?

Figure (FIGR) IPO Price Prediction: Will It Explode After IPO?

Gemini Stock Price Prediction: Will It Skyrocket Post IPO?

Bullish Stock Price Prediction & Forecast 2025 To 2030: Is BLSH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

American Bitcoin (ABTC) Stock Price Prediction 2025, 2026 And 2030: Is ABTC Stock A Buy Now?

What Is Rizenet ($RIZE) Crypto: Everything You Need To Know About It

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Anoma Roadmap Explained: Is an Airdrop Coming?

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]