Top Legit 100x Leverage Crypto Trading Platforms Canada 2026

When it comes to maximizing the benefits of crypto trading, high-leverage platforms are a key element of one’s trading journey. Crypto leverage enables traders to access substantial capital, with positions of up to 100x leverage requiring an initial margin of just 1%.

This article explores some of the most reputable crypto trading platforms offering up to 100x leverage that are commonly used by Canadian traders, focusing on legitimacy, trading features, and risk management tools. Read on to discover more about the top 100x leverage trading crypto sites in Canada for 2026.

Table of Contents

- What is 100x Leverage in Crypto?

- Pros and Cons of 100x Leverage Trading

- Best 100x Leverage Crypto Trading Platforms Ranked: A Brief Summary

- Best 100x Crypto Leverage Trading Platforms Canada: A Detailed Review

- How to Trade Crypto With 100x Leverage: A Step-by-Step Guide

- Conclusion

- FAQs About 100x Crypto Leverage Trading

What is 100x Leverage in Crypto?

Before we explore the top 100x leverage crypto trading platforms, it is important to understand the concept of 100x leverage in crypto. In general, 100x leverage refers to crypto trading positions that require an initial margin of just 1%. Put simply, 100x leverage boosts your actual trading capital by 100 times. Consequently, profit margins also increase by 100 times, making leverage an attractive option for traders targeting substantial returns.

To use 100x leverage, traders use derivative products rather than traditional spot exchanges. There is no asset ownership because derivatives are simply exchange-backed contracts that track prices. Common derivatives for 100x trading include options, delivery futures, leveraged tokens and perpetuals.

Leverage remains one of the most popular ways to speculate on market movements, as successful traders can significantly increase their profit margins. However, 100x leverage crypto trading magnifies profits and invites liquidation risks. To mitigate these risks, traders must familiarize themselves with the associated risks, platform limitations, and the tools available to assist them in managing volatile market movements.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Pros and Cons of 100x Leverage Trading

Trading with 100x leverage can significantly amplify potential profits and risks alike. While this may be appealing to experienced traders seeking high returns with limited capital, it is not suitable for everyone. The key pros and cons are outlined below.

| Pros | Cons |

|

|

Best 100x Leverage Crypto Trading Platforms Ranked: A Brief Summary

If you don’t have time to read the full review, here is a brief summary to help you familiarize yourself with the best 100x leverage crypto trading platform exchanges.

| Exchange | Number of Tradable Coins (with Leverage) | Maximum Leverage | Min. Margin Requirement | Best For |

| CoinFutures | 11 | 1,000x | 0.1% | Overall best 100x crypto exchange |

| BTCC | 360+ | 500x | 0.2% | Reliable crypto futures trading |

| MEXC | 950+ | 500x | 0.2% | Wide asset support |

| Bybit | 700+ | 200x | 0.5% | Trading delivery futures |

| Margex | 55+ | 100x | 1% | Avoiding KYC verification |

| KuCoin | 700+ | 100x | 0.1% | Avoid liquidity risks |

| OKX | 350+ | 125x | 0.8% | Grid bots, automation tools, and flexible order types |

Best 100x Crypto Leverage Trading Platforms Canada: A Detailed Review

Before you trade crypto with 100x leverage, it’s essential to choose the right platform. Below, we present the top legit 100x leverage crypto trading platforms that we have tested based on key metrics such as available markets, fees, exchange security, deposit methods and overall trust. Each one supports high-leverage positions and provides tools to help you manage risk, automate trades, and scale into volatile markets. Read on for our impartial lists.

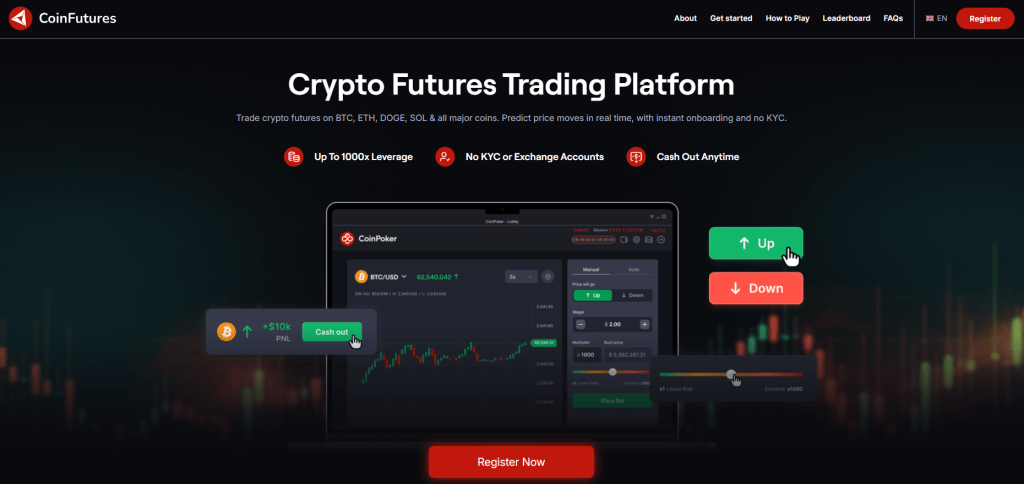

CoinFutures—The overall best platform due to its highest simulated leverage (up to 1000x) with instant access and no KYC

CoinFutures is the fastest and most accessible way to trade with up to 1000x leverage. There is no need for KYC, deposits or delays. Accessible on desktop and mobile devices, CoinFutures’ native software includes Windows, Mac and Android (an iOS version will be available soon). First-time users can get started in seconds by simply providing an email address and password to register. As a no-KYC platform, CoinFutures ensures privacy and anonymity.

It offers simulated futures with 100x leverage on some of the best cryptocurrencies to buy, including Bitcoin, Ethereum, Solana, BNB and Cardano. This makes it ideal for practicing high-leverage setups without risking real assets. Although CoinFutures does not have demo accounts, the low $1 trade minimum helps traders minimize risk. All trading markets are paired with USDT, although balances and profit/loss figures are shown in USD for added convenience.

Traders can go long or short and positions are executed instantly, without the need to rely on order books, liquidity or market participants. In terms of reputation, CoinPoker, a regulated provider established in 2017, backs the CoinFutures platform. It ensures transparency through audited proof of reserves, which users can review at any time. CoinPoker safeguards customer deposits via Fireblocks, an institutional-grade custodian that serves tier-one exchanges and banks.

To have a better understanding of CoinFutures, the chart below sets forth its pros & cons.

| Pros | Cons |

| ✅ No KYC required; start trading instantly | ❌ Trades are simulated, not live market execution |

| ✅ Up to 1000x leverage with built-in stop-loss and auto cashout | ❌ Does not support algorithm trading bots |

| ✅ Simulated products ensure instant execution without liquidity demands | |

| ✅ Works on desktop and mobile without downloads |

BTCC—A crypto futures-focused trading platform with a leverage of up to 500x

BTCC is one of the most reliable 100x leverage crypto exchanges, boasting an impeccable security record and state-of-the-art protection features. Founded in 2011, BTCC stands out as a trusted and well-respected exchange due to its unwavering commitment to security and transparency.

With a mission of providing a trading platform that is fair and reliable in every sense, the BTCC platform supports spot trading for over 240 cryptocurrencies, crypto futures trading with leverage up to 500x, crypto, copy trading that allows users to follow experienced traders, demo trading accounts pre-loaded with $100,000 in virtual funds, and tokenized futures for stocks and commodities.

Furthermore, BTCC clients have the option of undergoing KYC verification. Unverified users can access on-chain deposits and have a daily crypto withdrawal limit of $10,000. Another notable feature is BTCC’s advanced trading interface and indicators. Powered by TradingView, the charting interface provides traders with high-level tools and trackers to help them better manage risk and find the best market opportunities in real time.

To have a better understanding of BTCC, the chart below sets forth its pros & cons.

| Pros | Cons |

| ✅ Maximum leverage of 500x on top cryptocurrencies | ❌ KYC required for fiat on-ramping |

| ✅ Zero security breaches since its launch in 2011 | ❌ Lack crypto earnings/staking features |

| ✅ Supports 360+ futures pairs | |

| ✅ Copy trading and demo mode for skill-building |

\Unlock Up To 30,000 USDT In Welcome Rewards!/

MEXC—A platform that provides real 100x to 500x leverage on hundreds of altcoin pairs with ultra-low fees

Launched in 2018, MEXC is a global exchange with over 40 million active traders. This popular exchange offers over 950 futures pairs that can be traded long or short as perpetual contracts. Traders can increase their leverage limit to 500x when trading large-cap assets such as Bitcoin and Ethereum. Users can also get leverage of between 100x and 300x on other markets, including meme coins such as Dogecoin and Floki.

MEXC’s extensive trading features include automated futures bots, copy trading tools and over 100 technical indicators. Another top perk is the demo account. Traders can buy and sell futures contracts without risking any money, and the platform mirrors real trading conditions.

MEXC is also an excellent choice for technical traders. Its native charting dashboard offers an excellent trading experience with dozens of built-in drawing tools and indicators. Traders can customise their charting screen and access MEXC order books in real time.

To have a better understanding of MEXC, the chart below sets forth its pros & cons.

| Pros | Cons |

| ✅ Large-cap pairs provide 500x leverage | ❌ Does not support delivery futures |

| ✅ Supports 900+ perpetual pairs with low fees | ❌ Too advanced for complete crypto beginners |

| ✅ No KYC required for daily withdrawals under $20,000 | |

| ✅ Native charting dashboard caters to serious technical traders |

Bybit—A platform engineered for automated leverage strategies through Bots & Copy Trading

As the world’s second-largest cryptocurrency exchange, Bybit offers high trading volumes and liquidity. It remains the best option for trading delivery futures with leverage. It provides access to multiple futures markets for Bitcoin, Ethereum and Solana, which trade against USDT with linear settlement.

Bybit lists over 700 perpetual futures, which are available as linear or inverse contracts. The maximum leverage is 200x for major pairs, with reduced limits for smaller-cap altcoins. Bybit also provides automated bots for a wide range of futures trading strategies. These include grid trading, dollar-cost averaging, and Martingale. These bots trade 24/7 and users can set risk management parameters such as stop-losses and maximum leverage limits.

To have a better understanding of Bybit, the chart below sets forth its pros & cons.

| Pros | Cons |

| ✅ 700+ markets and 24/7 automated bot support | ❌ Reputational concerns since Bybit was hacked in early 2026 |

| ✅Trade cryptocurrencies with an initial margin of just 0.5% | ❌ High fees when using fiat to buy crypto |

| ✅ Manual tools with TradingView charting | |

| ✅ Provides KYC-free accounts with large withdrawal limits |

Margex—A platform ideal for beginners with liquid staking rewards

Margex is a top-rated exchange offering 100x leverage with no KYC requirement. As a no-KYC exchange, Margex is popular with traders based in countries with strict crypto derivative regulations. The platform accepts cryptocurrency payments and fiat deposits via over 150 convenient methods, including Visa, Mastercard and PayPal.

However, with only around 55 perpetual futures markets listed, the range of assets supported is much smaller than on many other platforms. However, it offers the most popular cryptocurrencies by market capitalisation, including Solana, BNB, Polygon and Shiba Inu.

Margex also stands out for its staking tool. It lets users stake cryptocurrencies while using the funds as margin collateral. Top altcoins such as Ethereum, USDC and USDT offer yields of up to 7%, while Bitcoin remains competitive at 6%. Staking rewards are distributed daily, providing users with higher margin balances on leveraged positions.

To have a better understanding of Margex, the chart below sets forth its pros & cons.

| Pros | Cons |

| ✅ Earn staking rewards while you trade crypto with 100x leverage | ❌ Above-average trading fees |

| ✅ Open an account with an email address only | ❌ Limited selection of tradeable coins |

| ✅ Buy crypto instantly with over 150 local payment methods | |

| ✅ Email-only sign-up; no KYC required |

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

KuCoin—A platform ideal for traders looking to avoid liquidity risks

KuCoin has been one of the world’s leading crypto exchanges since its founding in 2017. Known for its wide range of supported cryptocurrencies and a huge range of services, KuCoin is a favorite trading platform for many crypto traders worldwide. Its features go from spot and futures trading to advanced trading bots. Such features have made it one of the most versatile crypto platforms for both beginners and expert traders.

As a tier-one exchange gloablly, KuCoin is one of the best crypto leverage trading platforms for avoiding liquidity risks. This is because KuCion offers tracked leveraged tokens. It means users profit and losses will be amplified by the chosen leverage limit. KuCoin is ideal for traders looking to avoid liquidity risks.

KuCoin also offers perpetual futures trading, allowing leverage up to 100x on major cryptocurrencies. Futures contracts can be settled in USDT or the underlying asset, providing flexibility for traders. With over 30 million users in more than 200 countries, KuCoin is a popular platform for traders looking for a wide range of leveraged products with global accessibility.

To have a better understanding of KuCoin, the chart below sets forth its pros & cons.

| Pros | Cons |

| ✅ Supports crypto leverage without liquidation risks | ❌ Doesn’t offer delivery futures |

| ✅ Also offers perpetual futures with 100x leverage | ❌ Leveraged tokens are limited at 3x |

| ✅ Contracts can be settled in USDT or the underlying crypto | |

| ✅Covers a wide range of leveraged markets |

OKX—A platform Known for its grid bots, automation tools, and flexible order types

OKX started as a trading platform and has layered on Web3 services until it became an exchange + wallet + launchpad setup. As a pro-grade venue with deep perp liquidity, unified margin, and an integrated Web3 wallet, OKX offers over 350 futures markets with up to 125x leverage and strong support for institutional-grade traders.

Although users must first complete a quick Know Your Customer (KYC) process, verified accounts can make fee-free banking deposits via ACH, SEPA and other networks. Instant deposits are also allowed with Visa and MasterCard, but the fees are higher than those of other exchanges. OKX is also renowned for its grid bots, automation tools, and flexible order types for both delivery and perpetual contracts.

As a tier-one platform, OKX serves both retail and institutional clients. Its robust licensing structure and security-first systems ensure a safe trading experience. However, KYC is required for OKX users to unlock full trading access, and leveraged markets are blocked to U.S. residents.

To have a better understanding of OKX, the chart below sets forth its pros & cons.

| Pros | Cons |

| ✅ Supports 350+ futures pairs with deep liquidity | ❌ Mandatory KYC to unlock leverage access |

| ✅ Up to 125x leverage and automated trading tools | ❌ U.S. traders are limited to non-leveraged markets |

| ✅ Free ACH and SEPA deposit methods | ❌High debit/credit card transaction fees |

| ✅ Strong regulation and security standards |

How to Trade Crypto With 100x Leverage: A Step-by-Step Guide

Learn how to trade Bitcoin and popular altcoins with 100x leverage in this beginner’s walkthrough. As the leading platform for beginners with 100x leverage, this guide uses BTCC to explain each step.

Step 1: Create a BTCC account

BTCC Benefits⇓

BTCC offers a sign-up bonus for new users. Register now and start trading to receive your welcome rewards of up to 30,000 USDT. Additionally, VIP menbers can enjoy more benefits. Please note that your VIP level will increase based on your deposit amount. The more you deposit, the higher your level will be.

Step 2: Complete BTCC’s identity verification

Step 3: Fund your BTCC account

On the BTCC official homepage, choose “Deposite”, and then fund your account with your preferred method

Step 4: Place your crypto futures order on BTCC

Go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find the crypto trading pair that you want to trade.

Then, choose the contract trading order type. Futures contract orders on BTCC platform include market orders, limit orders and SL/TP orders.

- Market Order: users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit orders are a type of order to buy or sell futures at a price more favourable than the market price. When you buy at a price lower than the market price or sell at a price higher than the market price, the order will be in the form of a limit order.

- SL/TP Order: SL/TP orders are a type of order to buy or sell futures at a price less favourable than the market price. When you buy at a price higher than the market price or sell at a price lower than the market price, the order will be in the form of a SL/TP order.

Next, adjust the leverage multiple.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

Then, choose the lot size and set the SL/TP price. After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Traders should remind that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform.

Finally, click the buy or sell button, and the crypto futures contract order is completed.

\Unlock Up To 30,000 USDT In Welcome Rewards!/

Conclusion

100x leverage remains the most effective way to gain substantial market exposure on a small budget. Traders must familiarize themselves with maintenance margin, liquidation risks, stop-losses, and other risk management tools. It is also essential to choose the right platform, with key metrics including user-friendliness, available markets and security.

Taking all these factors into account, the top legitimate 100x leverage crypto trading platforms in Canada in 2026 are CoinFutures, BTCC, MEXC, Bybit, Margex, KuCoin and OKX. For Canadian traders seeking a wider selection of tradable coins, a competitive fee structure, and robust security, BTCC is the clear choice for crypto leverage trading.

\Unlock Up To 30,000 USDT In Welcome Rewards!/

FAQs About 100x Crypto Leverage Trading

What does 100x leverage do?

100x leverage boosts trade values by 100 times. Traders provide a 1% margin on the overall position size, which means $10 amplifies to $1,000.

Can you trade with 100x leverage?

Yes, you can trade with 100x leverage on most crypto futures platforms, as long as you meet margin requirements. Just be aware that high leverage increases both profit potential and liquidation risk.

Is 100x crypto leverage trading risky?

Yes, market risks increase dramatically when 100x leverage crypto trading. The trader loses their initial 1% margin if the trade liquidates, which happens when the position declines by just 1%.

How can you limit risk in crypto high leverage trading?

Stop-losses and take-profits help traders mitigate the risks of high leverage positions, as trades close automatically when the target price triggers. Limiting trade sizes to 1% of the overall balance protects trading capital during losing runs.

\Unlock Up To 30,000 USDT In Welcome Rewards!/

BTCC Guide:

How to Earn Your 30,000 USDT Welcome Bonus on BTCC: A Complete Guide To Maximize Your Crypto Return

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2026

BTCC Referral Code 2026: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2026

Best Crypto Exchanges Offering Free Sign-Up Bonus 2026: No Deposit Required!

How To Get Free Bitcoin & Other Cryptos Instantly No Deposit: A Complete Guide in 2026

How to Earn $20 Free No Deposit Crypto Bonus in Canada: A Useful Guide for Beginners

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2026

Best No Deposit Instant Withdrawal Crypto Casinos Without Verification Canada

How to Cash Out Crypto Legally Without Paying Taxes in Canada: A Complete Guide

Best Crypto Exchanges With Lowest Fee In Canada (2026 Guide): Which One Is Your Best Pick?

Top Free Crypto Sign-Up Bonuses In Canada For 2026

Best Crypto Trading Bots In Canada For 2026

Coinsquare Review 2026: A Comprehensive Guide For All Canadian Crypto Traders

Newton Crypto Review 2026: Best Platform For Crypto Trading In Canada?

Bitbuy Review 2026: Best Crypto Exchange In Canada?

NDAX Review 2026: A Full Breakdown of its Services, Safety, Fees, and Canadian Alternatives

Best Free Crypto Sign-Up Bonus Australia 2026

Top Free Crypto Mining Apps for Android and iOS Canada 2026

What Is GAIB Crypto: Everything You Need to Know About It

Best Crypto Exchanges Canada 2026

Best Crypto Exchanges Australia 2026

How To Start Crypto Copy Trading: A Useful Guide To Maximum Your Return

Who Is Lazarus Group: Unraveling the Mystery Behind Bybit’s $1.4B Hack

Bybit Hack: Everything You Need To Know About It

8 Types of Crypto Scams to Avoid in 2026

How To Withdraw Money From Binance In Canada: A Useful Guide For 2026

How To Use Pi Network’s Mainnet In Canada: An Ultimate Guide In 2026

Best Ethereum ETFs In Canada For 2026

What Is Exovum (EXO) Crypto: Everything You Need To Know About It

Coinspot vs. Swyftx: Which Is A Better Crypto Trading Platform For Australian Traders In 2026?

Best Crypto & Bitcoin Casinos Australia 2026

BTCC vs. NDAX: which is a better choice for crypto trading in Canada?

How to Choose Best Crypo Exchanges in Canada

BTCC vs. Bybit vs. eToro:which is the best choice for you?

Compare BTCC vs. Binance: Which is a Better Choice for Canadian Traders in 2026?

BTCC vs. NDAX: which is a better choice for crypto trading in Canada?

BTCC vs. Coinbase vs. Crypto.com

Compare BTCC vs. BitMart 2026: Which is a Better Choice for Your Demand

Compare BTCC vs Pionex: Crypto Exchange Comparison 2026

BTCC vs CoinJar: Which One is Better?

Compare BTCC vs Gate.io: Which is Best in 2026

BTCC vs. MEXC: A Complete Comparison In 2026

Coinbase vs. CoinSpot: Which Is A Better Crypto Trading Platform For Australian Traders In 2026?

eToro vs. CoinJar: Which Is A Better Crypto Trading Platform For Australian Traders In 2026

Coinspot vs. Swyftx: Which Is A Better Crypto Trading Platform For Australian Traders In 2026?

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]