What Is GAIB Crypto: Everything You Need to Know About It

The cryptocurrency landscape continues to evolve, paving the way for innovative crypto projects. GAIB, a next-generation cryptocurrency that connects real-world AI and robotics infrastructure with blockchain technology, has recently attracted a great deal of attention. It isn’t just another token; it combines smart blockchain concepts with an actual growing community, not just hype.

So, what is GAIB Crypto? Could it be a good investment in 2025? In this article, we break down everything about GAIB Crypto, including how it works, its utility, its tokenomics, as well as its price prediction. Let’s take a closer look at this innovative crypto project.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is GAIB?

GAIB is the world’s first economic layer for AI infrastructure, transforming real-world AI assets such as GPUs, robotics and AI energy systems into tradable, reward-bearing on-chain instruments. By connecting decentralized finance (DeFi) liquidity with AI infrastructure assets, GAIB creates a trillion-dollar opportunity at the intersection of AI, robotics, real world assets (RWAs) and DeFi.

GAIB converts AI assets such as GPUs into tokens, creating a new range of financial products on the blockchain. It is essentially an economic layer built for AI infrastructure. Rather than remaining on the sidelines, investors can participate in the AI industry by purchasing assets that generate yield from GPU power and the revenue generated by these machines. GAIB aims to connect DeFi with real-world AI hardware to provide data centers with better funding options and investors with access to a new type of investment.

GAIB is expanding globally, having secured over $2.5 billion worth of GPU assets from more than a dozen data centers across ten-plus countries. It has also established strategic partnerships with leading institutional investors, Web3 projects and traditional cloud companies, with the aim of bringing the AI infrastructure economy on-chain.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

How Does GAIB Work?

GAID converts investors’ stablecoins into real-world AI infrastructure. Investors receive AID tokens, which become sAID tokens when staked. These provide proportional ownership of revenue from GPUs, data centres or robotics. The protocol tokenizes the assets, manages returns and distributes them to investors. This process is secured by third-party auditors and insurers.

GAIB operates on a blockchain-agnostic framework, ensuring its applicability to a wide range of blockchain ecosystems. Acting as the financial backbone for AI infrastructure, it is transforming the way AI resources are valued and traded.

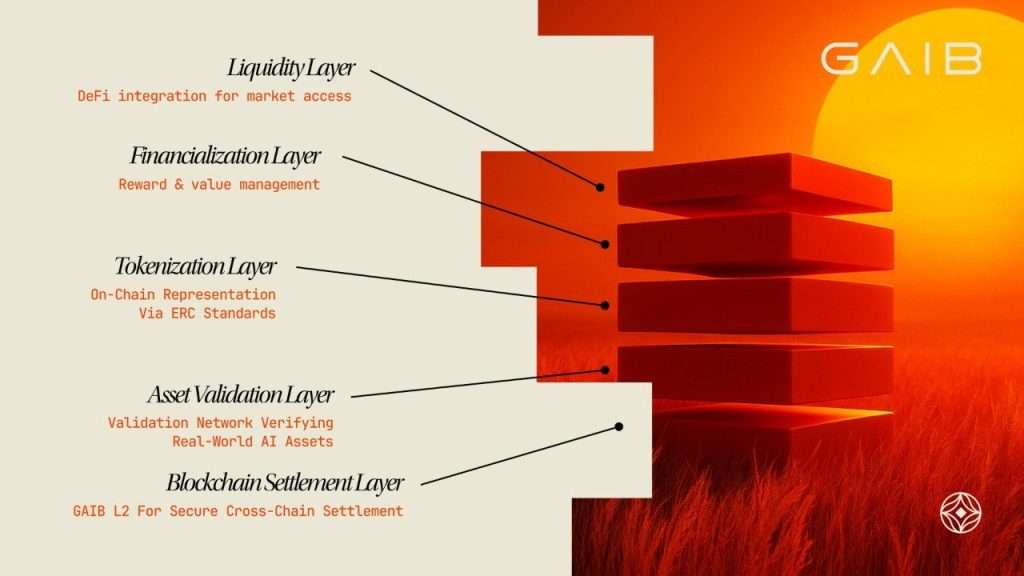

Specifically, the GAIB protocol uses a multi-layer setup to connect blockchain technology with real-world AI infrastructure. Here’s how it all fits together:

- Blockchain Settlement Layer (NETWORK): This is where all the records are stored. It’s GAIB’s official, permanent, censorship-resistant ledger. Every verified asset state and economic event is recorded here. Its purpose is to secure On-Chain Asset Representation (OAR) objects, originating from the Asset Validation Layer, on a transparent, auditable blockchain.

- Asset Validation Layer (PROOF): It operates as the GAIB Validation Network, which is an Actively Validated Service (AVS). It taps into the security of restaking protocols such as EigenLayer and Symbiotic. Its main function is fairly straightforward. It verifies the existence of real-world AI assets, monitors their performance and checks their operational status. All of this happens before anything is locked in permanently on the Settlement Layer.

- Tokenization Layer (ONRAMP): Designed for flexibility and adherence to clear standards, it enables a wide range of AI-related assets to seamlessly integrate into the decentralized economy. In doing so, GAIB establishes a universal digital language that enables physical infrastructure to interact directly with global capital markets.

- Financialization Layer (REWARD): This is basically the protocol’s economic engine. It takes real, off-chain work from AI infrastructure and turns it into programmable value on the blockchain. This is where decentralized capital meets real-world operations. It keeps everything inside GAIB transparent, rule-based, and easy to verify with cryptography.

- Liquidity Layer (LIQUID): It is designed to keep tokenized AI infrastructure fluid and accessible. Once the system has validated, tokenized, and synchronized assets from a financial perspective, this layer ensures they remain liquid and easy to use across global on-chain markets.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is the GAIB Token?

The GAIB token is the native utility and governance token of the GAIB ecosystem, playing a significant role within the ecosystem. It aligns validators, users, and partners through integrated utility mechanisms.

As per its whitepaper, its key use cases include:

- Governance and Participation: Users can lock GAIB into ve-tokens (vote-escrowed tokens) to gain governance rights and voting power. Votes can be cast on critical decisions such as approving new real-world asset classes (e.g., GPUs, robotics, energy), deciding on new chain deployments, and adjusting protocol fee structures.

- Network Security & Validation: GAIB token forms the economic security backbone of the GAIB Active Validator Se (AVS) through staking and restaking. Staked tokens back the GAIB Validator/ Orchestration Network, securing cross-chain transactions and asset attestations (proof-of-location, proof-of-custody, proof-of-workload). Misconduct triggers automatic slashing, maintaining cryptoeconomic integrity.

- Ecosystem Access: Stakers gain priority access and allocations in tokenized GPU tranches, robotics vaults, and AID/sAID. Active participants and veGAIB voters may receive community and ecosystem rewards.

- Economic Incentives/Rewards: A portion of protocol fees funds validator rewards, treasury reserves, and ecosystem incentives. GAIB will be distributed to encourage users to exert efforts towards contribution and participation in the ecosystem on GAIB, thereby creating a mutually beneficial system where active participants are fairly compensated for their efforts.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

GAIB Tokenomics

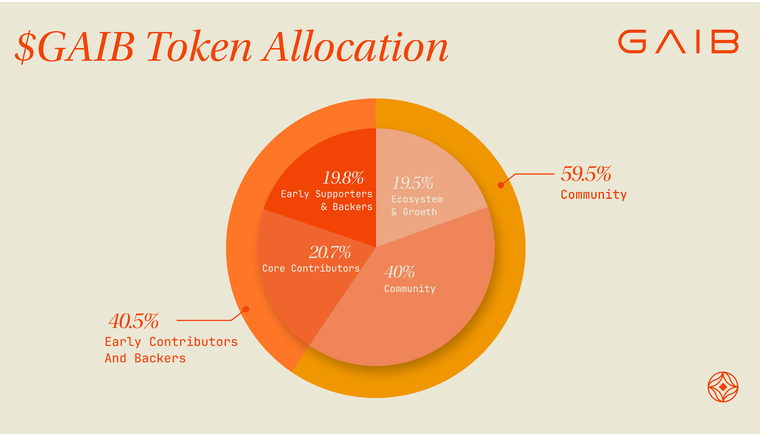

The GAIB tokenomics model is carefully designed to encourage balanced participationbetween contributors, validators and community members, thereby ensuring the sustainable growth of the GAIB Economic Layer ecosystem.

The total supply of GAIB is capped at 1,000,000,000 tokens. Its initial token distribution is set as below:

- Early supporters and backers – 19.82%

- Core contributors (team, advisors) – 20.7%

- Community – 40% used for airdrops, staking rewards, participation incentives

- Growth and ecosystem – 19.48% for partnerships, liquidity, and ecosystem expansion

The vesting structure of the GAIB token is designed to encourage long-term commitment while maintaining controlled circulation during the protocol’s early growth phase. The chart below sets forth the details about GAIB token vesting schedule.

| Allocation | % OF ALLOCATION AT TGE | LOCKUP (MONTHS) | UNLOCK (MONTHS) | FULLY UNLOCKED (MONTHS) | |

|---|---|---|---|---|---|

| Early Supporters & Backers | 19.82% | 0.00% | 12 | 24 | 36 |

| Core Contributors | 20.70% | 0.00% | 12 | 36 | 48 |

| Community | 40.00% | 10.00% | 0 | 60 | 60 |

| Ecosystem & Growth | 19.50% | 10.48% | 0 | 60 | 60 |

| Total | 100.00% | 20.48% |

\Unlock Up To 10,055 USDT In Welcome Rewards!/

GAIB Token Price Analysis & Prediction

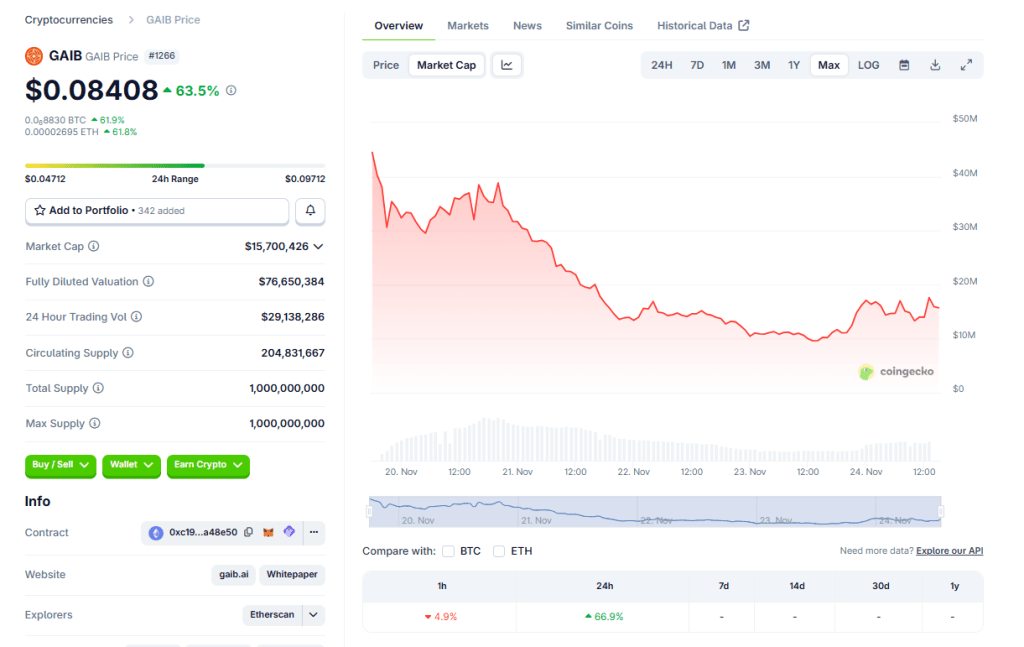

The GAIB TGE took place on 19 November 2025. The team launched the GAIB token on several exchanges, including Kraken, MEXC and Bitget. GAIB debuted on Binance Alpha (Nov 19) and Bitrue, with 40x leveraged futures. Notably, the GAIB token has experienced a massive price rally since its debut on crypto exchanges, despite the weak crypto market conditions.

Initial trading saw volatility between $0.14 and $0.28. As of writing the article, GAIB coin is traded at $0.08408, boasting a market cap of $15.7 million, and witnessing a 24-hour trading volume of $ 29.1 million. GAIB Token saw a 24-hour change of +66.9%, with minor fluctuations of -4.9% in the past hour.

The following sets forth the GAIB to USD Chart:

GAIB Token Price Prediction

As GAIB is a newly launched project, its value depends heavily on the adoption of AI infrastructure, market sentiment and protocol execution.

If GAIB successfully tokenizes a broad portfolio of GPU, data center, and robotics assets, and yields begin to flow to sAID and stakers, demand for GAIB (for governance and staking) could increase significantly. In that case, GAIB could reach a peak value of $0.50, especially if demand for AI infrastructure surges.

However, delays in infrastructure tokenization, weak yield generation or token unlock dumps could undermine its value, causing GAIB to drop to a minimum price level of $0.04.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Is GAIB Crypto a Good Investment?

GAIB combines AI and RWA with the aim of simplifying access to AI computing power, providing liquidity to physical assets and establishing a decentralised governance model at the intersection of crypto and AI. The price of GAIB will likely fluctuate based on the momentum of the AI narrative and macroeconomic headwinds. Short-term volatility from derivatives and airdrop claims may precede steadier movements if GPU tokenisation scales up.

While GAIB offers exciting opportunities, it also carries risks. Its success hinges on the performance and verification of real-world assets, and macroeconomic or regulatory changes could affect outcomes. Nevertheless, GAIB is a notable project that merges AI, real-world infrastructure, and DeFi, creating a bridge between innovative technology and blockchain-based investing.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

How to Buy the GAIB Token?

As of press time, GAIB token is available on leading crypto exchanges such as Kraken, MEXC, Bitget, etc., where interested traders can invest in this promising coin.

Unfortunately, $GAIB tokens are not available on BTCC platform for now. However, it is worth mentioning that BTCC supports trading for large variety of popular coins, such as BTC, ETH, PEPE, DOGE, etc., with a leverage up to 500x. If you are interested in these popular coins, you can make a purchase on BTCC exchange with highest security level and a most competitive fee.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

GAIB is a groundbreaking infrastructure innovation that connects the trillion-dollar AI economy with decentralized finance by providing the world’s first economic layer for AI assets. GAIB’s listing comes at a time when AI infrastructure is emerging as one of the dominant narratives in the crypto space.

The token aims to distinguish itself from purely conceptual AI projects by focusing on verifiable computing productivity. By transforming enterprise GPUs and robotics into verifiable, yield-bearing tokens backed by actual computing demand, GAIB solves critical problems for both crypto investors seeking real returns and AI infrastructure operators requiring flexible capital.

However, the crypto landscape is volatile. Could GAIB be the next cryptocurrency to explode? Only time will tell. As always, all investors are advised to do their homework and proceed with caution before making any decisions regarding GAIB crypto.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Why Choose BTCC?

Founded in 2011, BTCC stands out as a trusted and well-respected exchange due to its unwavering commitment to security and transparency. Since its establishment in 2011, BTCC has boasted an impeccable security track record, with zero reported hacks or breaches. Holding licenses in the U.S., Canada, and Europe, BTCC provides a comprehensive suite of trading features within a secure and regulated platform.

With a mission of providing a trading platform that is fair and reliable in every sense, BTCC platform supports spot trading for over 360 cryptocurrencies, crypto futures trading with leverage up to 500x, crypto copy trading that allows users to follow experienced traders, demo trading accounts pre-loaded with $100,000 in virtual funds, and tokenized futures for stocks and commodities. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms for crypto trading. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High liquidity & volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

How to Earn Your 10,055 USDT Welcome Bonus on BTCC: A Complete Guide To Maximize Your Crypto Return

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

How To Get Free Bitcoin & Other Cryptos Instantly No Deposit: A Complete Guide in 2025

Best Free Crypto Sign-Up Bonus Australia 2025

Top Free Crypto Sign-Up Bonuses In Canada For November 2025

Top Free Crypto Mining Apps for Android and iOS Canada 2025

What Is Exovum (EXO) Crypto: Everything You Need To Know About It

LivLive ($LIVE) Review & Analysis: Next Big 100x Gem?

Digitap ($TAP) Crypto Review & Analysis: Next Big 100× Gem?

IPO Genie ($IPO) Review & Analysis: Best Crypto Presale In 2025?

AlphaPepe (ALPE) Meme Coin Review & Analysis: Next 100x Gem?

EcoYield ($EYE) Review & Analysis: Best Crypto Presale In 2025?

What Is United States Crypto Reserve (USCR): Everything You Need To Know About It

VWA Crypto Price Prediction 2025, 2026 And 2030: Is It A Good Investment In 2025?

Monad Airdrop Guide: How To Claim Your MON Token?

Aster Airdrop Guide & Tips: How to Claim The AST Token?

How To Buy VWA Crypto: A Comprehensive Guide For All Traders

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Unich Airdrop Guide: How To Earn $UN Tokens?

Barron Trump Crypto: How Dose He Amass $150 Million Fortune From Crypto?

AlgosOne Token (AiAO) Review & Analysis: Next 100x AI Token?

Zexpire (ZX) Coin Review & Analysis: Next 100× Big Token?

DeepSnitch AI (DSNT) Coin Review & Analysis: Next 100x Gem?

Layer Brett ($LBRETT) Review & Analysis: Next 100x Meme Coin?

Pepe Heimer ($PEHEM) Review & Analysis: Next 100x Meme Coin on Ethereum?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Klarna Stock Price Prediction: How High Will It Go Post IPO?

Figure (FIGR) IPO Price Prediction: Will It Explode After IPO?

Gemini Stock Price Prediction: Will It Skyrocket Post IPO?

American Bitcoin (ABTC) Stock Price Prediction 2025, 2026 And 2030: Is ABTC Stock A Buy Now?

Bullish Stock Price Prediction & Forecast 2025 To 2030: Is BLSH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

Cristiano Ronaldo Meme Coin $CR7: Everything You Need To Know About It

Kanye West Launches YZY Crypto: Everything You Need To Know About It

What Is Hemi (HEMI) Crypto: Everything You Need To Know About It

Pendle (PENDLE) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can PENDLE Hit $10?

Aerodrome Finance (AERO) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can AERO Hit $2?

Pepe Heimer ($PEHEM) Review & Analysis: Next 100x Meme Coin on Ethereum?

Sapien (SAPIEN) Price Prediction: How High Can SAPIEN Go Post Binance Listing?

OKZOO (AIOT) Price Prediction 2025, 2026 And 2030: Can AIOT Hit $5?

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]