OpenLedger (OPEN) Price Prediction: How High Will OPEN Go Post Binance Listing?

OpenLedger is the next-generation blockchain network for AI, designed to unlock liquidity and monetize data, models, apps, and agents. OpenLedger (OPEN) recently joined the spotlight after a high-profile Binance listing and accompanying HODLer airdrops. The token’s debut on major venues has already produced sharp price moves—and with greater exchange access comes both liquidity and volatility.

As it draws more attention, OpenLedger (OPEN) is expected to witness steady price appreciation over the coming years. Then, what is OpenLedger (OPEN)? Is it a good investment in 2025? This article explores what OpenLedger is, how the protocol works, the OPEN token’s utility and tokenomics, the recent airdrop/listing events, and data-driven price forecasts for the near and medium term.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is OpenLedger?

OpenLedger is a blockchain platform designed specifically for AI. The platform allows users to collect and share data, develop AI models and earn rewards for their contributions. In traditional systems, AI data and models are typically controlled by large organisations, meaning contributors often receive inadequate credit.

Unlike traditional blockchains designed for DeFi or NFTs, OpenLedger makes every step of the AI lifecycle transparent and rewardable, including data contribution, model training, inference and deployment. Its core innovation is Proof of Attribution (PoA), which tracks how data influences model outputs and distributes rewards accordingly.

The platform provides the infrastructure to support each stage of the AI process. Datanets are used to organise and contribute specialised datasets. ModelFactory offers a simple interface for creating and training models. OpenLoRA enables the efficient deployment of multiple models on limited hardware. Together, these tools aim to make building and using AI more open and accessible.

[TRADE_PLUGIN]OPENUSDT,OPENUSDT[/TRADE_PLUGIN]

How does OpenLedger Work?

Datanet

Datanets are community-driven networks designed for the collection, sharing, and validation of data to train artificial intelligence models. Rather than relying on broad and generalized datasets, Datanets emphasize information that is specific to particular fields or domains. This targeted approach enhances the accuracy of AI models, mitigates bias, and improves overall efficiency.

OpenLedger’s framework revolves around “datanets”—curated and incentivized datasets that empower specialized models. Contributors have the opportunity to submit, audit, and stake their claims regarding the quality of these datasets. Furthermore, models trained on such datasets can be registered and monetized through blockchain technology. The design seeks to align incentives among data providers, labelers, model builders, and validators so that high-quality content is rewarded while low-quality submissions are filtered out through economic mechanisms.

Proof of Attribution

The Proof of Attribution mechanism ensures transparency and accountability for contributions within OpenLedger. Whether you provide data, develop models, or assist in verifying results, your activities are permanently recorded on the blockchain. Your efforts are acknowledged; rewards are distributed based on the value of your contribution.

Additionally, this system evaluates the impact of your data on a model’s performance. If your contribution enhances the model’s utility and effectiveness, you will receive greater rewards. Conversely, if the provided data is deemed low quality or detrimental in nature, it may be flagged for penalties. This methodology fosters fairness throughout the process while facilitating the development of AI models grounded in reliable information.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is the OPEN Token?

The OPEN token is the native token of the OpenLedger network. It is used within the OpenLedger ecosystem for the following utilities:

Gas fees: OPEN is used to cover transaction costs on the network, including transfers, smart contract execution, and AI-related on-chain activities.

Governance: OPEN holders can vote on key decisions, such as model funding, AI agent regulations, treasury management, and protocol upgrades.

Staking: AI agents are required to stake OPEN to provide services within the ecosystem. Underperformance or malicious behavior may lead to slashing, while reliable and high-quality contributions are rewarded.

Rewards: Data contributors, AI developers, and validators earn OPEN based on the impact of their attribution and model engagement. Rewards are distributed according to data quality, model utility, and overall contribution to the ecosystem.

OPEN USDT-margined perpetual futures contracts with a leverage of up to 50x are now available on BTCC platform. Click the buttom below to buy⇓

[TRADE_PLUGIN]OPENUSDT,OPENUSDT[/TRADE_PLUGIN]

$OPEN Tokenomics

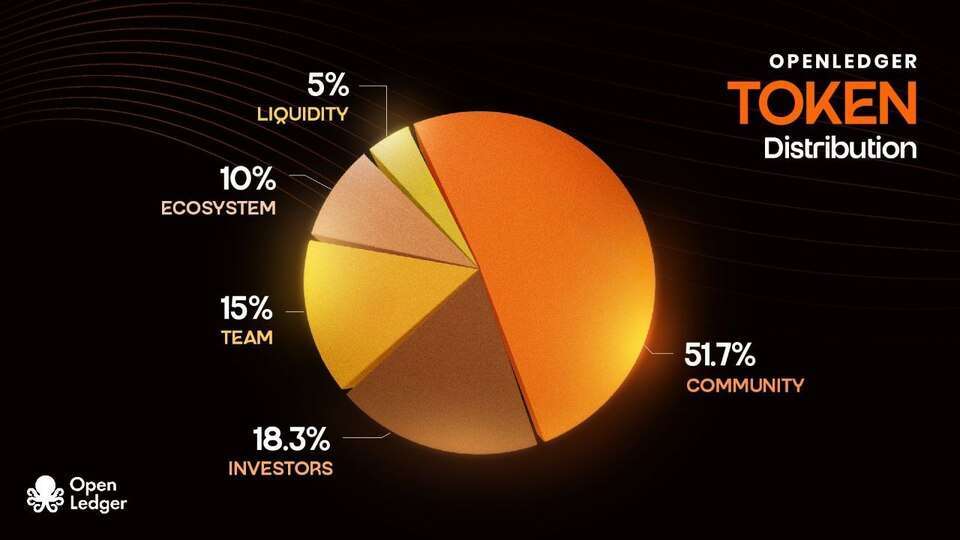

OpenLedger’s tokenomics are structured to prioritize ecosystem growth and community participation. OpenLedger’s total supply is 1 billion OPEN tokens. With a total supply of 1 billion tokens, only 21.55% (215.5 million) were in circulation at launch, providing initial liquidity for exchanges like Binance. The remaining supply is allocated as follows:

- Community: 51.7%

- Investor: 18.29% (locked with a 12-month cliff and 36-month vesting period)

- Team: 15% (locked with a 12-month cliff and 36-month vesting period)

- Ecosystem: 10%

- Liquidity: 5%

$OPEN Airdrop

On September 5, 2025, Binance announced OPEN as the 36th project on the Binance HODLer Airdrops. Users who subscribed their BNB to Simple Earn and/or On-Chain Yields products from August 18 to 21 were eligible to receive OPEN airdrops. A total of 10 million OPEN tokens were allocated to the program, accounting for 1% of the total token supply.

This airdrop not only rewarded existing BNB holders but also injected immediate liquidity into the market. The token became tradable on Binance at 13:00 UTC the same day, trading against major pairs like USDT, USDC, and BNB.

The airdrop’s success was further amplified by a follow-on distribution of 15,000,000 tokens scheduled for six months later, ensuring sustained community engagement. For investors, this dual-phase approach reduces short-term selling pressure while incentivizing long-term holding—a critical factor in assessing OPEN’s investment potential.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

OpenLedger (OPEN) Price Prediction

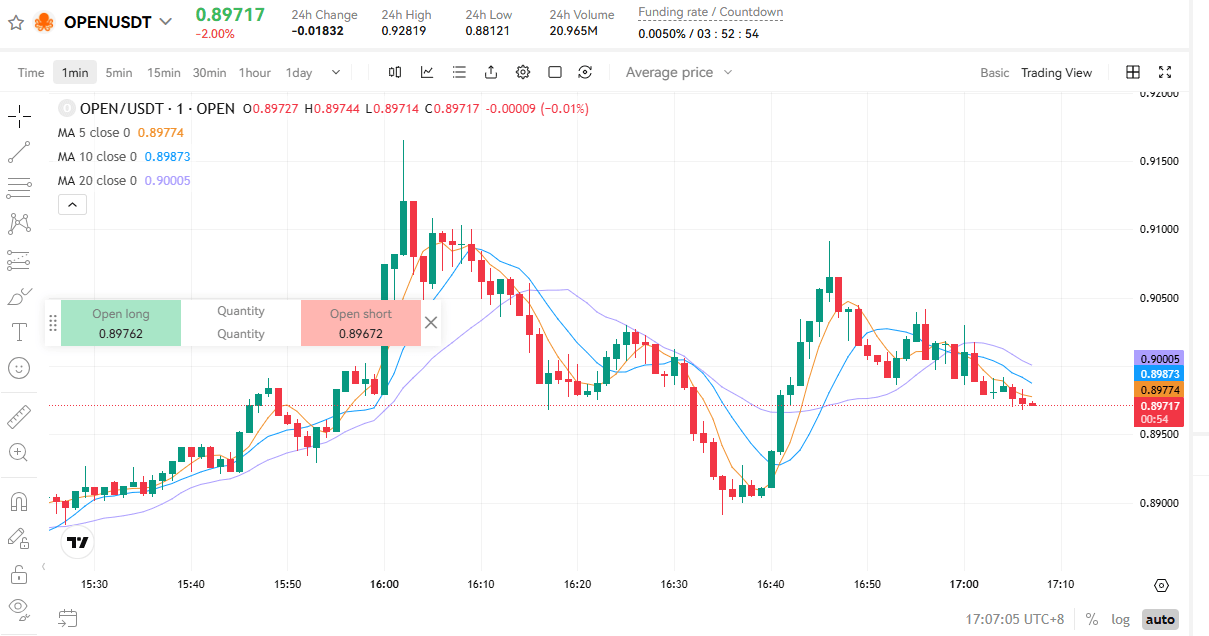

Since its launch on Binance, OpenLedger (OPEN) has garnered significant interest from both retail and institutional investors. The token initially experienced a surge in value, primarily driven by the excitement surrounding its listing and the increasing popularity of decentralized trading platforms. Following the typical post-listing volatility, OPEN underwent fluctuations as early investors liquidated their holdings while new participants entered the market. Despite these short-term corrections, trading volumes have remained consistently high, reflecting ongoing demand and market confidence in the project’s fundamentals.

The following stes forth the OPEN to USD Chart

In the short term, the OPEN token is anticipated to sustain its current momentum, contingent upon robust trading activity on Binance and continued growth within its ecosystem. Should market conditions remain favorable, analysts project that the token could stabilize at approximately $2.20 to $2.80 by the end of 2025. Under a bullish sentiment—potentially fueled by new product integrations or partnerships—OPEN is expected to reach a maximum price level of $3.00 in 2025. Conversely, if there were to be a correction in the broader cryptocurrency market, OPEN might experience a decline to around $0.30.

In terms of 2026, OpenLedger’s expansion plans and potential advancements in decentralized exchange solutions could facilitate substantial growth. Assuming consistent adoption and ongoing innovation, it is predicted that the token could be traded between $1.00 on the lower end and $6.50 on the higher end by 2026.

Looking even further ahead to 2030, should the project achieve large-scale integration and significant market penetration, OPEN may ascend towards $10.00 or higher by 2030. While much will depend on overall cryptocurrency market cycles, fundamental indicators suggest that OPEN has strong potential to establish itself as a leading token within the decentralized finance sector.

[TRADE_PLUGIN]OPENUSDT,OPENUSDT[/TRADE_PLUGIN]

OpenLedger (OPEN) Future Outlook

OpenLedger, with its innovative vision for AI model development and data compensation, as well as the support of leading investors, ensures its future growth momentum. Specifically, this innovative platform is creating a decentralized ecosystem that enables AI models to generate benefits while ensuring that data contributors receive fair returns. In addition, it has a powerful infrastructure that can obtain high-quality data through DataNets and is equipped with a flexible revenue mechanism, providing complete solutions for developers, enterprises and data contributors.

Although the token may experience significant fluctuations in the short term in the early stage, this project has the potential to become an important player in the fields of artificial intelligence and blockchain in the long term, thanks to the successful launch of its mainnet, the expansion of its ecosystem, and the clarification of the purpose of its tokens. Therefore, it is crucial to monitor the implementation of the project roadmap and the actual adoption rate from a long-term perspective.

[TRADE_PLUGIN]OPENUSDT,OPENUSDT[/TRADE_PLUGIN]

How to Buy the OPEN Token?

The OPEN token has secured listing on a mix of centralized exchanges (like BTCC, MEXC, Bitget, etc.), where interested investors can trade this promising crypto now.

Currently, OPEN USDT-margined perpetual futures contracts with a leverage of up to 50x are now available on BTCC platform. The following sets forth the guidance for trading OPEN USDT-margined perpetual futures contracts on cryptocurrency exchange BTCC:

Step 1: Create a BTCC account

Step 2: Complete BTCC’s identity verification

Step 3: Fund your BTCC account

On the BTCC official homepage, choose “Deposite”, and then fund your account with your preferred method

Step 4: Place your crypto futures order on BTCC

Go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find OPEN trading pair.

You can also click the button below to enter OPEN trading page⇓

[TRADE_PLUGIN]OPENUSDT,OPENUSDT[/TRADE_PLUGIN]

Then, choose the contract trading order type. Futures contract orders on BTCC platform include market orders, limit orders and SL/TP orders.

- Market Order: users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit orders are a type of order to buy or sell futures at a price more favourable than the market price. When you buy at a price lower than the market price or sell at a price higher than the market price, the order will be in the form of a limit order.

- SL/TP Order: SL/TP orders are a type of order to buy or sell futures at a price less favourable than the market price. When you buy at a price higher than the market price or sell at a price lower than the market price, the order will be in the form of a SL/TP order.

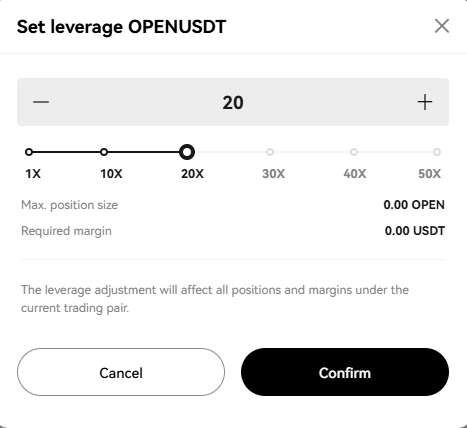

Next, adjust the leverage multiple.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

Then, choose the lot size and set the SL/TP price. After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Traders should remind that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform.

Finally, click the buy or sell button, and OPEN futures contract order is completed.

[TRADE_PLUGIN]OPENUSDT,OPENUSDT[/TRADE_PLUGIN]

Conclusion

OpenLedger (OPEN) represents a distinctive convergence of artificial intelligence and blockchain technology, effectively addressing both the technical and economic challenges associated with AI development. The recent Binance airdrop has significantly enhanced its visibility and liquidity, while its tokenomics and practical applications in AI establish a robust foundation for sustainable long-term growth. For investors who are prepared to navigate the risks inherent in this volatile and emerging sector, OPEN presents a compelling opportunity to engage in the advancement of decentralized AI infrastructure.

That’s all information about OpenLedger (OPEN). If you want to know more information about OpenLedger (OPEN) coin and other cryptocurrencies, please visit BTCC Academy.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Why Choose BTCC?

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

Investing Guide:

MYX Finance (MYX) Airdrop & Price Prediction: Can MYX Hit $20?

Linea (LINEA) Airdrop & Price Prediction: How High Will LINEA Go Post Binance Listing?

What Is Holoworld AI (HOLO) Crypto: Next 100× Token Post Binance Listing?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Vision (VSN) Price Prediction: Can VSN Hit $1?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

Best Free Bitcoin Accelerators 2025

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

SKALE (SKL) Price Prediction 2025 To 2030: Can SKL Hit $1?

Klarna Stock Price Prediction: How High Will It Go Post IPO?

Figure (FIGR) IPO Price Prediction: Will It Explode After IPO?

QMMM Holdings Limited (QMMM) Stock Price Prediction 2025, 2026 And 2030: Is QMMM Stock A Buy Now?

Eightco (OCTO) Stock Price Prediction 2025, 2026 And 2030: Is OCTO Stock A Buy Now?

American Bitcoin (ABTC) Stock Price Prediction 2025, 2026 And 2030: Is ABTC Stock A Buy Now?

Bullish Stock Price Prediction & Forecast 2025 To 2030: Is BLSH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It