Yala (YALA) Debuts On Binance Alpha: Everything You Need To Know About This Crypto And Its Airdrop

Yala is a modular, decentralised protocol that is built directly on the Bitcoin blockchain. It is attracting a great deal of attention from crypto enthusiasts as it is the latest addition to Binance Alpha’s growing portfolio of emerging tokens. Binance has announced that it will be the first platform to feature YALA, with trading officially kicking off on 22 July.

With its ongoing airdrop and listing on Binance Alpha, YALA is emerging as a project of interest to investors. So, is this cryptocurrency worth investing in? What is its future outlook? This article provides a detailed introduction to Yala, including what it is, YALA tokenomics, its airdrop, price prediction, and an analysis of this token’s future potential.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Yala?

Yala is a modular, decentralized protocol built directly on the Bitcoin blockchain. The protocol builds on years of development, including testing phases and community engagement initiatives, such as Yeti Footprints and mainnet trials—crucial for establishing credibility before launch.

Yala allows users to deposit their BTC and mint $YU, a dollar-pegged stablecoin that is over-collateralized by Bitcoin. This opens the door for BTC holders to participate in DeFi and RWA (Real World Asset) ecosystems while maintaining full exposure to Bitcoin’s price.

As a Bitcoin-native liquidity layer protocol that aims to improve decentralized finance (DeFi) by bridging Bitcoin’s liquidity through innovative mechanisms, Yala integrates with Bitcoin’s ecosystem, setting it apart among emerging blockchain projects. By integrating Bitcoin into the broader decentralized finance world, Yala bridges the gap between capital preservation and capital productivity.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

What is the YALA Token?

$YALA serves as both the governance and utility token within the Yala ecosystem, playing a pivotal role in supporting its vision of a decentralized liquidity infrastructure anchored by Bitcoin. As the core asset of the protocol, $YALA facilitates decentralized governance, underpins critical utilities, and acts as a mechanism for system recapitalization during periods of financial stress.

Key Use Cases of the $YALA Token:

- Stability Pool Incentives: At the heart of Yala’s risk mitigation framework, the Stability Pool allows users to deposit $YU tokens to absorb system debt during liquidations. In return, participants receive $YALA token rewards, a portion of the liquidated collateral, and stability fees—reinforcing the protocol’s financial resilience.

- Cryptoeconomic Security: $YALA also plays a critical role in securing Yala’s underlying infrastructure. Token holders can stake their tokens to validator nodes supporting the Notary Bridge for cross-chain operations. Additionally, staked $YALA helps safeguard the $YU stablecoin through a decentralized verifier network powered by LayerZero.

- Governance and Protocol Evolution: As Yala transitions toward full decentralization, $YALA becomes a core instrument for protocol governance. Holders can vote on key parameters, propose upgrades, and participate in emission distribution through $veYALA gauge-weighted voting—ensuring community-driven decision-making and incentive alignment.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

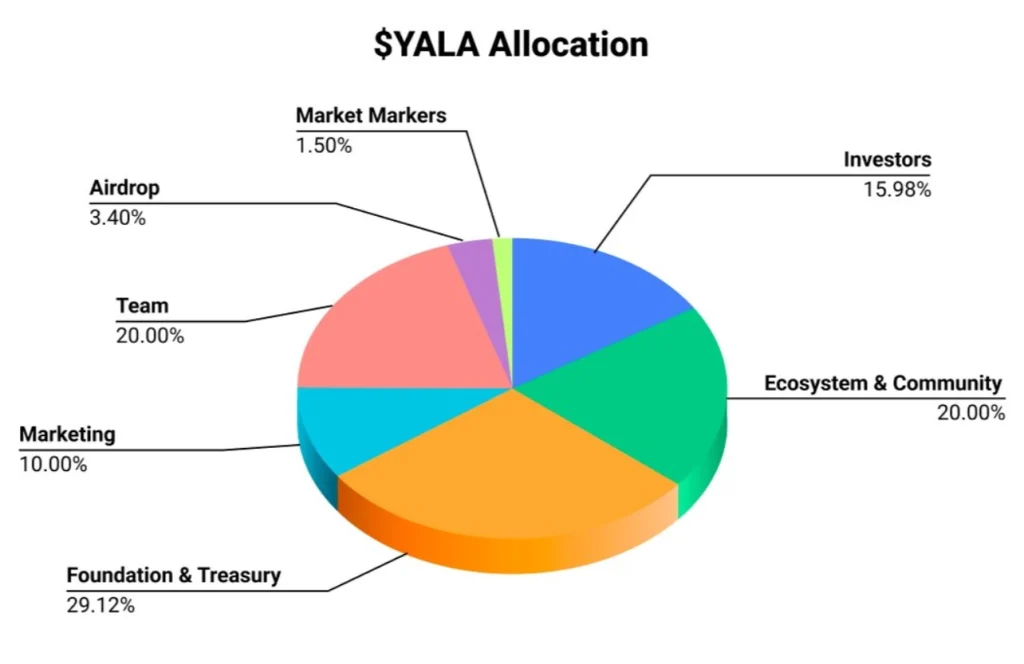

YALA Tokenomics

With a total supply of 1 billion tokens, the tokenomics of $YALA is designed to ensure long-term sustainability and alignment between all stakeholders in the Yala ecosystem.

Its initial token distribution sets as below:

| Category | Allocation | Vesting Schedule |

|---|---|---|

| Investors | 15.98% | 1-year cliff, followed by 18-month quarterly vesting |

| Ecosystem & Community | 20% | 45% at TGE, remaining vested linearly over 24 months |

| Foundation & Treasury | 29.12% | 30% at TGE, 1-year cliff, then 36-month linear vesting |

| Marketing | 10% | 20% at TGE, 1-year cliff, then 24-month linear vesting |

| Team | 20% | 1-year cliff, followed by 24-month linear monthly vesting |

| Airdrop | 3.4% | Fully unlocked at TGE |

| Market Makers | 1.5% | Subject to market-making agreements |

Yala Airdrop

With the launch of the YALA coin on the Binance Alpha platform and its official listing scheduled for July 22, the YALA airdrop campaign has become a major focus in the market. The airdrop operates on a first-come, first-served basis and will remain open until the allocation is fully claimed or the event period ends. Users must redeem a specified number of Alpha Points via the Alpha Events page once trading goes live and confirm their claim within 24 hours.

Beyond the Binance Alpha initiative, the Yala Protocol also incentivizes early and active participants through additional reward mechanisms. In the first quarter, 3.4% of the total YALA supply—equivalent to 34 million tokens—was distributed to builders, testers, liquidity providers, and early community supporters. Now in its second season, the airdrop campaign continues to expand, offering new opportunities for users to earn rewards and contribute to the ongoing development of the Yala ecosystem.

Binance Alpha has also announced the listing of Yala (YALA) on July 22, 2025, with the exact timing to be announced. Eligible users can claim their airdrop using Binance Alpha Points on the Alpha Events page once trading opens. Further details will be announced soon.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Yala (YALA) Price Prediction

YALA coin remains in its price discovery phase, with limited concrete market data currently available.As it enters public trading, short-term price performance and initial market capitalization will largely depend on liquidity levels and the behavior of early holders—particularly those unlocking tokens from airdrop distributions.

Since the token is still in its early stages of market entry, reliable pricing data has yet to stabilize. However, preliminary estimates can be made based on its total supply of 1 billion tokens and the initial circulating supply, which is influenced by airdrops and partial unlocks during the TGE (Token Generation Event).

With this strategic tokenomics structure in place, traders are closely watching for signs of early momentum. Analysts suggest the initial trading price may fall within the $0.03 to $0.05 range, driven by opening demand and available liquidity. Should early trading volumes remain high, projections indicate the price could climb to between $0.08 and $0.12 within the first month.

Achieving a $1 target would require significant traction—widespread adoption, major exchange listings, compelling real-world use cases, and potentially deflationary measures such as token burns. This could take up to 3-4 months based on the project’s growth and market trends.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Yala (YALA) Future Outlook

Yala’s debut on Binance Alpha marks strong institutional endorsement and ensures access to liquidity and visibility. If the protocol delivers its promised Bitcoin-based liquidity layer, and community engagement remains strong, YALA could attract continued interest, potentially expanding across multiple exchanges like MEXC upon launch day.

Although the Yala protocol boosts huge potential, the DeFi market is highly competitive, and there are also other projects aimed at solving the liquidity problem of Bitcoin. In addition, factors such as the inherent volatility of the cryptocurrency market, risks associated with smart contracts, and regulatory uncertainties will all have an impact on the future performance of YALA coin.

Overall, YALA token represents the potential to integrate Bitcoin into the DeFi field, and its innovative technology and strong team lay the foundation for its future development. However, early-stage tokens carry inherent risks—price swings, regulatory changes, and execution hurdles. Due diligence is essential.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Conclusion

Yala’s Binance Alpha listing and airdrop represent a significant moment in its lifecycle, offering early access and rewarding community participation. Key strengths include:

- A solid tokenomics framework with strategic vesting.

- Airdrop rewarding engaged users.

- Unique Bitcoin-centric utility.

Success will depend on technical delivery, wider adoption, and continued traction. For those prepared, YALA offers a compelling speculative opportunity with a structured launch.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

About BTCC

Fully licensed and regulated in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

You May Like:

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

Eclipse Airdrop Now Live: How to Claim ES Tokens?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Best Free Bitcoin Accelerators 2025

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

What Is SUV Bitcoin Miner APK: Everything You Need To Know About It

How To Mine Bitcoin: A Comprehensive Guide For Beginners In 2025

Best Cryptos To Mine In 2025: A Complete Guide For Beginners

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Earn Free Cryptos: A Comprehensive Guide For Beginners In 2025

Best Crypto & Bitcoin Casinos Australia 2025

Top Crypto & Bitcoin Casinos Canada 2025

Investing.com Review: A Full Guide For Users In 2025

Paisaperreels Full Review 2025: Is It Legit or Scam?

Inevitrade Review 2025: A Full Guide For Users

5StarsStocks.com Platform Review 2025: A Comprehensive Guide For Users

Binozy Review: Is Binozy.com Legit or Scam?

What Is eCryptobit.com Invest: A Comprehensive Review & Investment Guide In 2025

What is Etherions.com Tech: Something You Need To Know About It

What Is SUV Bitcoin Miner APK: Everything You Need To Know About It

What Is Fintradix: Everything You Need To Know About It

What Is Webtoon XYZ: Everything You Need To Know About It

What Is Crypto30x.com ASX: Everything You Need To Know About It

What Is Fintradix: Everything You Need To Know About It

What Is Webtoon XYZ: Everything You Need To Know About It

How To Maximize You Investment Return With Investiit.com Tips: A Complete Guide For Users In 2025