XRP ETF Approval Date (Dec 2025 Update): Timeline, Price Reaction & & How to Prepare for Launch

This article breaks down:

- Confirmed XRP ETF Launch Date (December 2025 Update)

- XRP ETF Timeline

- Why This ETF Matters

- Understanding What These Filings Mean (for Beginners)

- Issuer-by-Issuer Status

- XRP Price & Investor Sentiment Reaction

- Beginner’s Guide — How to Prepare for XRP ETF Launch

- ETF Launch-Day Order Checklist

- What Happens After Approval

- Why BTCC Is the Best Platform for XRP & ETF Traders

- FAQs — XRP ETF Approval Explained

- Conclusion

- How to Trade Crypto on BTCC?

- BTCC FAQs

Confirmed XRP ETF Launch Date (December 2025 Update)

The 21Shares Spot XRP ETF (Ticker: TOXR) is scheduled to begin trading in the U.S. on December 1, 2025.

This is confirmed through:

•SEC EDGAR filings (S-1 & amendments)

•Form 8-A / listing documentation references

XRP ETF Timeline

Below is the verified timeline leading to the confirmed launch date:

•July 13, 2024 — SEC & Ripple regulatory clarity improves following case updates.

•Mid-2025 — The first U.S. XRP ETF proposals begin gaining traction.

•November 28, 2025 — 21Shares submits key listing and registration updates (S-1/8-A).

Why This ETF Matters

1. Easier access to XRP

ETF investors can simply use their normal brokerage accounts—no wallets, no private keys.

2. New institutional liquidity

XRP ETF products have already accumulated hundreds of millions in inflows, highlighting growing institutional interest.

3. Regulatory clarity

4. More stable long-term participation

ETFs attract pension funds, asset managers, and long-term holders—historically improving market maturity.

/ You can claim a welcome reward of up to 10,055 USDT🎁\

Understanding What These Filings Mean (for Beginners)

If you’re new to ETFs or SEC processes, here’s a quick decoding guide:

The official prospectus describing what the fund holds, who manages it, and how fees are charged. Every ETF must have an active S-1 before shares can be sold.

Filed when an ETF is ready to list on a U.S. exchange. It’s the bridge between SEC registration and live trading.

Issuer-by-Issuer Status

Here’s a verified summary of the leading XRP ETF filings and where each stands:

| Issuer | Form(s) Filed | Exchange | Current Status |

|---|---|---|---|

| Canary Asset Management | S-1/A, Form 8-A | Nasdaq | DTCC pre-launch; awaiting exchange CERT notice |

| 21Shares XRP Trust | S-1, Form 8-A | Cboe BZX | Filed Oct 24; pre-launch readiness confirmed |

| VanEck XRP Trust | S-1 amendment | NYSE Arca | In review under streamlined listing rules |

| Franklin Templeton | S-1 initial | Nasdaq | Awaiting amendment per Sept SEC rule |

| ARK/21Shares Joint ETF | S-1/A | Cboe BZX | Filed with minor custodial updates |

XRP Price & Investor Sentiment Reaction

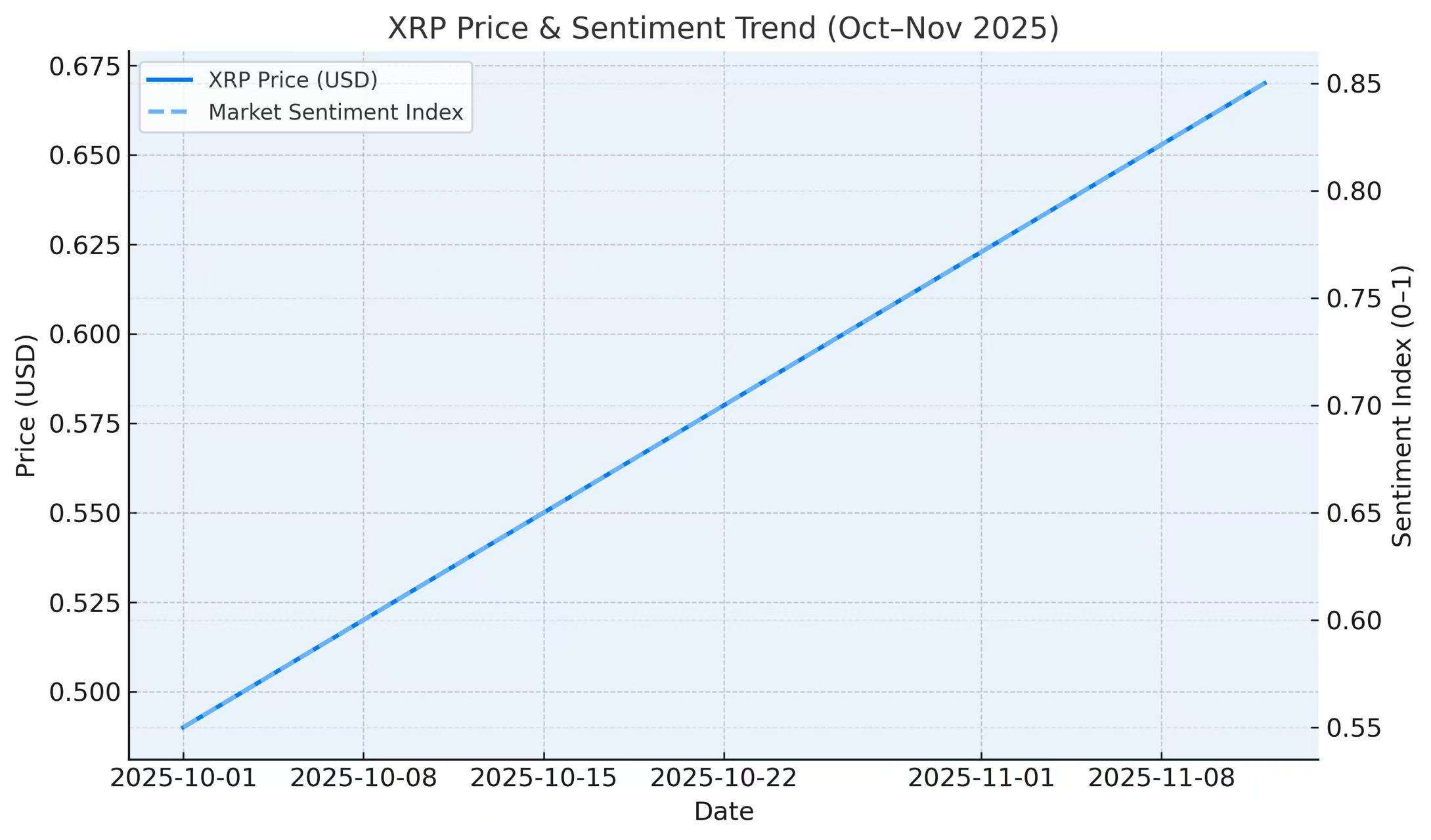

Between Oct 1 and Nov 12, 2025, XRP’s market price rose gradually from $0.49 to $0.67, representing a 36% increase amid ETF optimism.

Beginner’s Guide — How to Prepare for XRP ETF Launch

Step 2: Create and verify your BTCC account

Step 3: Decide your trading strategy

•Spot strategy: Buy XRP or ETFs directly and hold.

•Derivative strategy: Use BTCC’s perpetual futures to hedge or amplify exposure.

Monitor:

•Fund NAV vs. market price

•Premium/discount percentage

/ You can claim a welcome reward of up to 10,055 USDT🎁\

ETF Launch-Day Order Checklist

When the XRP ETF goes live, follow this structured checklist to stay safe and efficient:

1.Confirm official trading notice (via exchange press release).

2.Double-check the ETF ticker (e.g., XRPC or XRPT).

3. Review NAV and creation unit size in the S-1.

4.Log in to BTCC — ensure your balance is ready.

5.Place limit orders with defined risk.

6.Record trade details for taxation and tracking.

What Happens After Approval

Once approved, expect:

•Institutional inflows: Funds and wealth managers gain regulated access.

•Liquidity uplift: XRP markets could deepen across exchanges.

•Potential revaluation: Price discovery often follows early inflows, as seen with Bitcoin ETFs.

Strategic Insight — What Traders Should Focus On

•Macro signals: Watch U.S. inflation and rates; ETF inflows correlate with macro liquidity.

•Altcoin correlation: Solana and ADA tend to follow XRP momentum post-ETF announcements.

Why BTCC Is the Best Platform for XRP & ETF Traders

Founded in 2011, BTCC is one of the world’s longest-running digital asset exchanges, known for:

FAQs — XRP ETF Approval Explained

Sources (verified & cross-checked)

1.Reuters — “SEC simplifies spot crypto ETF process,” Sept 18, 2025.

2.CoinDesk — “DTCC lists multiple XRP ETFs as pre-launch,” Nov 10, 2025.

3.Bloomberg — “Issuers file XRP ETF 8-A for Nasdaq listing,” Nov 11, 2025.

4.SEC EDGAR Database — S-1/A and Form 8-A filings (Canary, 21Shares, VanEck).

Conclusion

The XRP ETF journey is entering its final chapter. With DTCC entries, issuer filings, and exchange readiness, approval appears imminent — but the exact launch moment depends on exchange certifications.

Next Step for Traders:

For more detailed market analysis, strategies, and educational resources, visit BTCC Academy and stay ahead of the curve in the rapidly evolving crypto space.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2025,2026, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2025, 2026,2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2025, 2026,2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2025, 2026,2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2025,2026,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2025, 2026,2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]