Gold Price Forecast and Prediction for 2025, 2026, 2030-Is Gold a Good Investment?

Gold is well-liked by investors and frequently acts as a “safe haven,” a type of financial asset that helps protect cash in times of economic uncertainty. A thorough examination of financial, political, and economic aspects as well as market and macroeconomic developments is necessary to forecast the price of this instrument.

This article aims to create scenarios for gold prices in 2025, 2026, 2027, and beyond by analysing the price history of XAU/USD and expert analyst insights.

Gold Price Forecast and Prediction for 2025

Let’s perform a technical analysis of the weekly time frame for the XAU/USD pair.

The asset’s current price is 2,916.46. Within the region of 2,588.61-2,767.08, the Three White Soldiers trend continuation pattern has formed, signalling strong bullish momentum for the trading instrument. Nevertheless, the asset’s price has displayed market uncertainty by forming a sequence of Doji patterns close to its historical high of 2,965.95.

Below the present market price, we can see the Volume Weighted Average Price (VWAP) and the 20-period Simple Moving Average (SMA20), which indicate that there is possibility for price appreciation. The market is dominated by long holdings, as indicated by the Money Flow Index (MFI), which measures active liquidity inflow.

The Relative Strength Index (RSI) is forming a bearish divergence, which indicates that the market is overbought and could lead to a price reversal. The trend strength is fading, as the Moving Average Convergence Divergence (MACD) values are declining slowly inside the positive zone.

The expected levels of the XAU/USD exchange rate over the next twelve months are displayed below.

| Month | XAU/USD projected values | |

|---|---|---|

| Minimum, $ | Maximum, $ | |

| April 2025 | 2,760.17 | 2,879.98 |

| May 2025 | 2,755.18 | 2,969.63 |

| June 2025 | 2,924.91 | 3,214.43 |

| July 2025 | 3,184.48 | 3,384.15 |

| August 2025 | 3,314.27 | 3,404.12 |

| September 2025 | 3,229.41 | 3,389.15 |

| October 2025 | 3,114.60 | 3,254.37 |

| November 2025 | 3,054.69 | 3,249.37 |

| December 2025 | 3,194.46 | 3,389.15 |

| January 2026 | 3,379.16 | 3,603.80 |

| February 2026 | 3,508.95 | 3,798.48 |

Long-Term XAU/USD Trading Strategy for 2025

According to the graphic, the asset is following a worldwide upward trend, which could continue in 2025. We have been able to determine important levels of support and resistance using this technical analysis, which will help us create a trading plan.

Trading Strategy for the Year

- According to candlestick analysis, the Three White Soldiers trend continuation pattern inside the price range of 2,588.61 to 2,767.08 is what is driving the bullish momentum. Doji patterns, on the other hand, indicate uncertainty and a potential downward price reversal.

- The market price is still higher than the SMA20 and VWAP, indicating bullish potential. An additional purchase signal is supported by the MFI, which shows liquidity input into the asset. A negative divergence on the RSI indicates a possible downward reversal. The waning trend strength is also reflected in the MACD values, which are falling in the positive zone.

- Base Scenario: Target the 3,220.90–3,845.07 range by initiating long positions above the 2,965.95 level.

- Alternative Scenario: Target the 2,588.61–1,966.52 range by initiating short positions below the 2,767.08 mark.

Analysts’ Gold Price Forecast and Prediction for 2025

In 2025, experts predict that the precious metal will continue its bullish climb.

WalletInvestor

As of March 12, 2025, the expected price range for 2025 is $2,865.42 to $3,077.76.

By the middle of 2025, WalletInvestor predicts that the price will increase to $2,961.40 per ounce. It is anticipated to hit $3,077.76 by December.

| Month | Opening price, $ | Closing price, $ | Min. price, $ | Max. price, $ |

|---|---|---|---|---|

| March | 2,870.09 | 2,931.37 | 2,865.42 | 2,931.37 |

| April | 2,931.37 | 2,946.87 | 2,931.37 | 2,948.87 |

| May | 2,946.80 | 2,960.38 | 2,946.03 | 2,960.38 |

| June | 2,962.09 | 2,961.40 | 2,961.40 | 2,964.91 |

| July | 2,961.63 | 2,999.63 | 2,961.63 | 2,999.63 |

| August | 3,001.16 | 3,037.69 | 3,001.16 | 3,037.69 |

| September | 3,039.78 | 3,036.73 | 3,036.72 | 3,043.57 |

| October | 3,036.99 | 3,060.60 | 3,036.99 | 3,060.90 |

| November | 3,059.58 | 3,064.40 | 3,056.44 | 3,064.40 |

| December | 3,066.01 | 3,077.76 | 3,064.91 | 3,077.76 |

CoinCodex

As of March 12, 2025, the expected price range for 2025 is $2,808.60 to $3,720.38.

CoinCodex analysts predict that in 2025, the asset’s price will fall between $2,808.60 and $3,720.38. Experts continue to predict a bull market with an average December closing price of $3,521.77.

The price of gold may rise steadily in 2025 due to inflationary pressures and geopolitical unpredictability. Prices will probably be supported by demand from central banks and the jewellery sector. Rising interest rates and a stronger dollar, however, might have a restraint.

| Month | Min. price, $ | Average price, $ | Max. price, $ |

|---|---|---|---|

| March | 2,808.60 | 2,876.01 | 2,907.64 |

| April | 2,816.24 | 2,885.74 | 2,965.60 |

| May | 2,941.20 | 3,072.51 | 3,149.75 |

| June | 3,008.76 | 3,071.64 | 3,149.99 |

| July | 3,020.67 | 3,117.98 | 3,219.90 |

| August | 3,193.40 | 3,336.89 | 3,419.83 |

| September | 3,312.34 | 3,444.21 | 3,568.53 |

| October | 3,481.69 | 3,595.69 | 3,720.38 |

| November | 3,406.44 | 3,547.22 | 3,661.05 |

| December | 3,465.56 | 3,521.77 | 3,628.23 |

Analysts’ Gold Price Forecast and Prediction for 2026

Expert predictions indicate that mixed dynamics will likely prevail in 2026.

WalletInvestor

The expected price range for 2026, as of March 12, 2025, is $3,079.95 to $3,319.45.

The analytical website WalletInvestor projects that the average price of XAU/USD will be $3,079.95 at the start of 2026. The price is expected to increase to $3,203.47 by the middle of the year. Analysts predict that the price will continue to rise, hitting $3,319.45 by December.

| Month | Opening price, $ | Closing price, $ | Min. price, $ | Max. price, $ |

|---|---|---|---|---|

| January | 3,079.95 | 3,127.10 | 3,079.95 | 3,127.10 |

| June | 3,203.40 | 3,203.47 | 3,203.33 | 3,207.00 |

| December | 3,307.99 | 3,319.45 | 3,306.93 | 3,319.45 |

CoinCodex

The expected price range for 2026 is $3,513.48 to $4,133.86 (as of March 12, 2025).

According to the analytical website CoinCodex, there is a good likelihood that gold prices will increase in 2026. They may range from $3,513.48 to $4,046.63 in the first half of the year, closing at $3,980.32 in June. A drop to $3,605.62 is predicted by experts for the second half of the year.

Analysts take interest rates, inflation, and geopolitical threats into account when predicting gold prices for 2026. Demand from central banks and the jewelry industry is also important. Estimates vary, but most experts expect moderate growth driven by ongoing economic uncertainty.

| Month | Min. price, $ | Average price, $ | Max. price, $ |

|---|---|---|---|

| January | 3,513.48 | 3,615.88 | 3,748.01 |

| June | 3,940.35 | 3,980.32 | 4,046.63 |

| December | 3,540.38 | 3,605.62 | 3,656.72 |

Analysts’ Gold Price Forecast and Prediction for 2027

The majority of analysts believe that the price of the precious metal will rise in 2027.

WalletInvestor

As of March 12, 2025, the expected price range for 2027 is $3,321.29 to $3,560.82.

At the start of 2027, WalletInvestor experts predict that the price of gold will be $3,321.29. The price will increase to $3,445.69 in the first half of the year. The positive trend will persist in the second half of the year, albeit more mildly, with notable volatility surges. By December’s conclusion, the asset’s quotes might be as high as $3,560.82.

| Month | Opening price, $ | Closing price, $ | Min. price, $ | Max. price, $ |

|---|---|---|---|---|

| January | 3,321.29 | 3,367.68 | 3,321.29 | 3,367.68 |

| June | 3,445.34 | 3,445.69 | 3,445.34 | 3,449.00 |

| December | 3,550.11 | 3,560.82 | 3,548.89 | 3,560.82 |

CoinCodex

The expected price range for 2027, as of 12.03.2025, is $3,573.10 to $4,613.24.

Analysts at CoinCodex predict that the price of the precious metal may hit $3,691.48 by the start of 2027. It is anticipated that the price of gold will continue to rise during the first half of the year, hitting $4,296.34 by the end of June. The upward trend will give way to a correction in the second half of the year, and by the end of December, the price will have stabilised at $3,876.77.

Depending on interest rates, inflation, and geopolitical concerns, the gold price projection for 2027 is still unknown. Although analysts’ views vary, most predict modest growth due to the limited supply and demand for safe-haven assets. There may be fluctuations, therefore caution is necessary.

| Month | Min. price, $ | Average price, $ | Max. price, $ |

|---|---|---|---|

| January | 3,573.10 | 3,691.48 | 3,785.02 |

| June | 4,072.70 | 4,296.34 | 4,472.89 |

| December | 3,800.18 | 3,876.77 | 3,964.64 |

Analysts’ Gold Price Forecast and Prediction for 2030

Many analysts predict that by 2030, gold prices will be on the rise.

CoinCodex

The predicted price range for 2030 is $4,277.51 to $5,226.77 (as of March 12, 2025).

Forecasts from the analytical website CoinCodex indicate that the asset will continue to rise in 2030, with the price beginning the year over $4,349.33. The lowest and greatest prices, according to analysts, are $4,277.51 and $5,226.77, respectively.

| Month | Min. price, $ | Average price, $ | Max. price, $ |

|---|---|---|---|

| January | 4,306.57 | 4,349.33 | 4,455.68 |

| June | 4,395.28 | 4,584.00 | 4,817.86 |

| December | 4,908.43 | 4,988.99 | 5,129.85 |

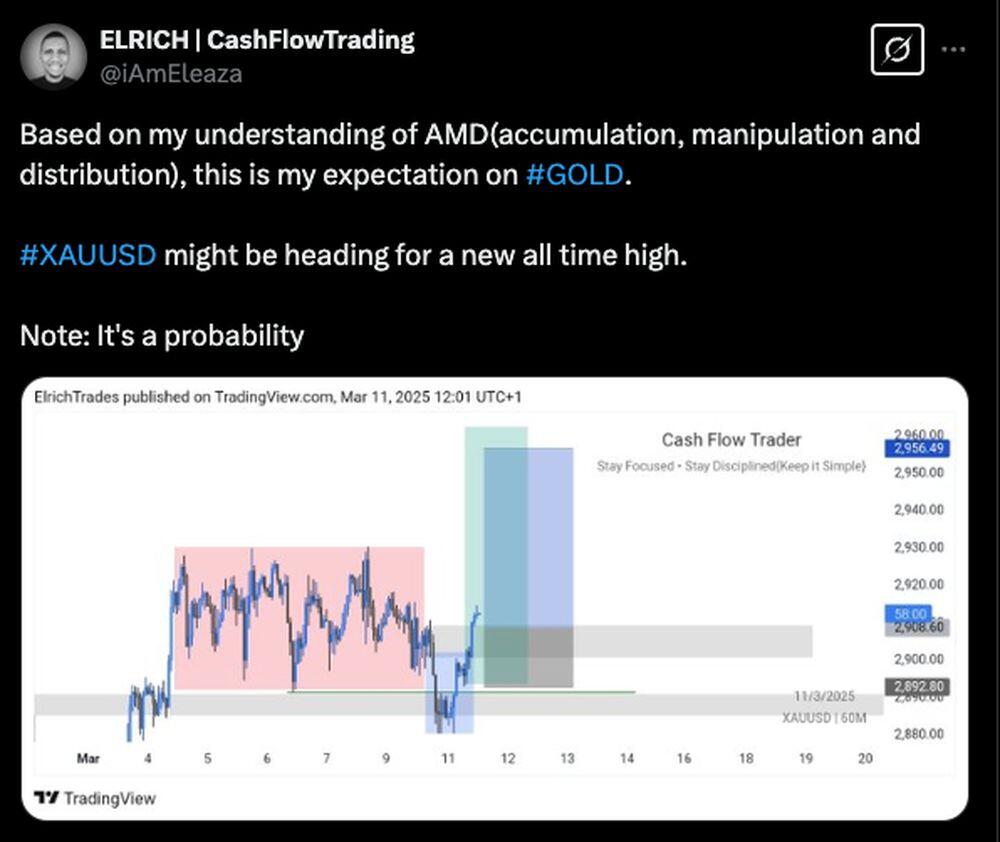

Gold Market Sentiment on Social Media (XAU/USD)

The term “media sentiment” describes the general public’s view of an asset as reported in the news and shared on social media. When news outlets report good things, demand and prices go up, and when news outlets report bad things, prices go down, reflecting the sentiments of investors.

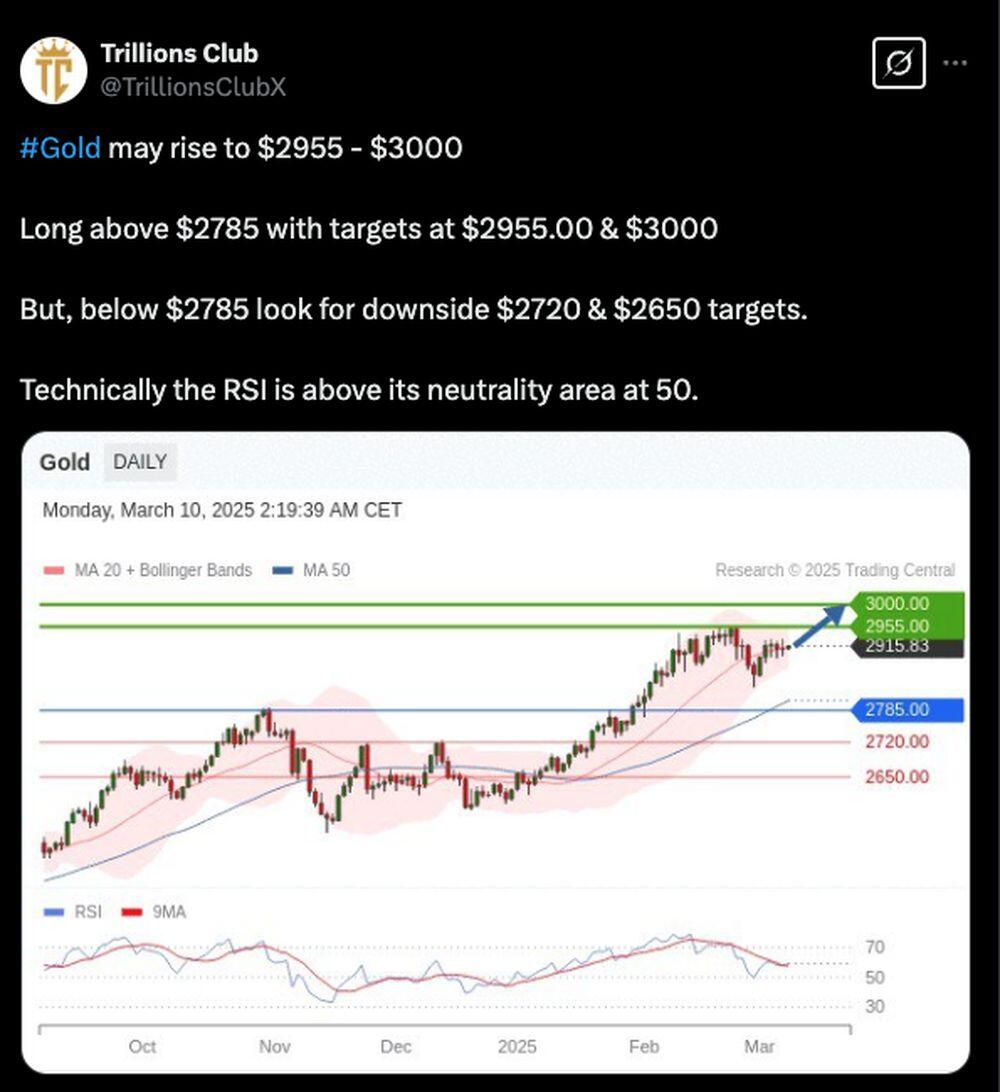

An RSI indicator reading above 50 lends credence to the prediction that the value of the precious metal would rise to the $2,955.00-$3,000.00 area in the near future, according to a user on the social network X (previously Twitter) with the handle @TrillionsClubX.

Gold Price History

On 01.04.2025, the price of gold hit a new record high of $3148.92.

Gold hit a low of $252.55 on 25.08.1999, the lowest price recorded.

The XAU/USD chart over the last decade is below. It is critical to estimate previous data in order to produce the most accurate predictions.

Gold prices moved wildly in 2021 due to changes in monetary policy from world’s leading central banks as inflation spiked and the global economy started to show signs of improvement. The value of gold was pushed down by the rising dollar.

Once again, geopolitical concerns in 2022—and the crisis in Ukraine in particular—pushed gold prices higher. As prices kept going up, governments tightened their grip on the money supply.

In 2023 and 2024, we saw a tug-of-war between the forecasts of inflation and rising interest rates. Bond rates and geopolitical developments continued to influence the price of gold.

Given the ongoing uncertainties surrounding the global economy and geopolitics, it is no surprise that gold is still performing admirably as of March 2025, continuing to be a crucial asset for diversifying portfolios.

/ You can claim a welcome reward of up to 10,055 USDT🎁\

Gold Price Analysis

The stock market, not precious metals, is usually what comes to mind when one thinks about fundamental analysis. Analysts following the XAU/USD pair keep an eye on global political and economic news as well as a number of predictions, while specialists study the financial accounts of individual organisations.

What Influences the Gold Price?

The elements that affect the price of XAU/USD will be looked at below.

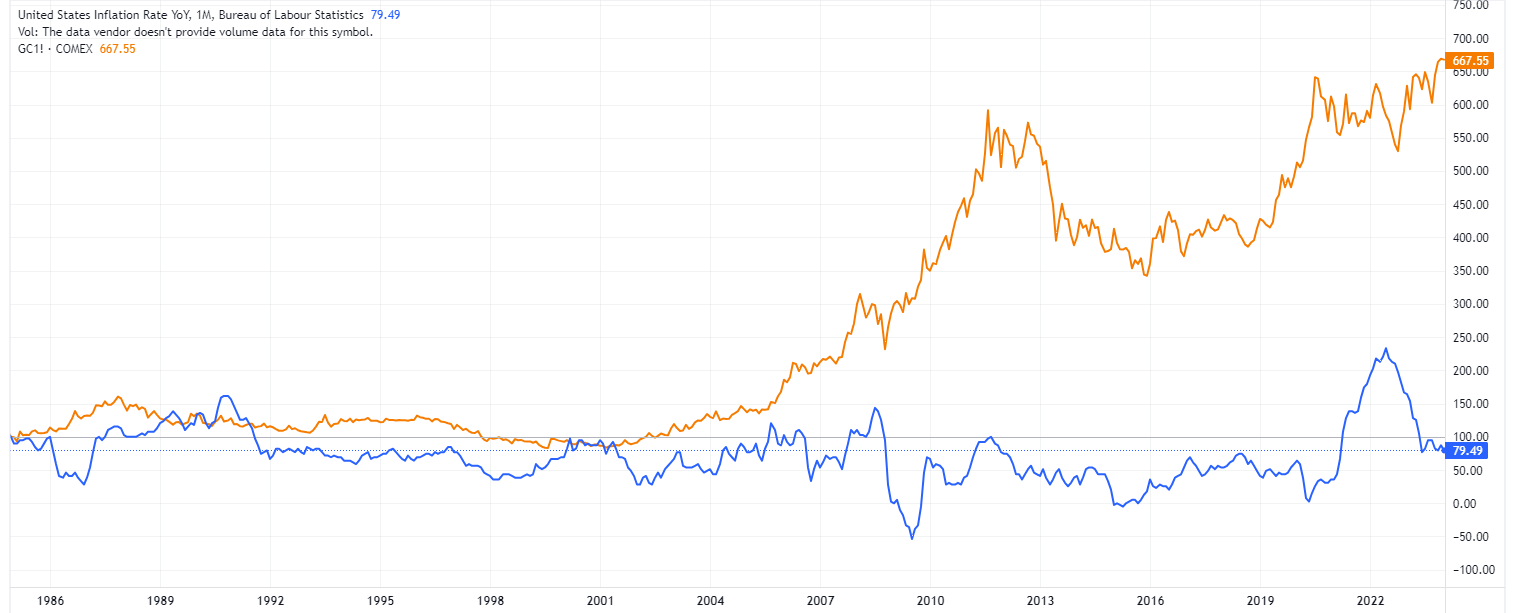

The rate of inflation

Many inexperienced investors mistakenly assume that inflation has a much larger impact on the value of XAU than it actually does. Since the devaluation of the US currency forces investors to pay more for an ounce of gold, the assumption is that the precious metal’s price should likewise climb if prices in the US do. On the other hand, inflation and the price of the precious metal do not show a strong relationship over the long term.

Two main reasons explain why there is no statistically significant relationship:

- In terms of strategy, gold is not important. So, changes in the buying power of a currency do not affect gold the same way they do oil or other commodities.

- During times of economic growth and stock market expansion, gold faces competition from other assets for investor attention and profitability. In addition, commodities prices tend to be higher during these times.

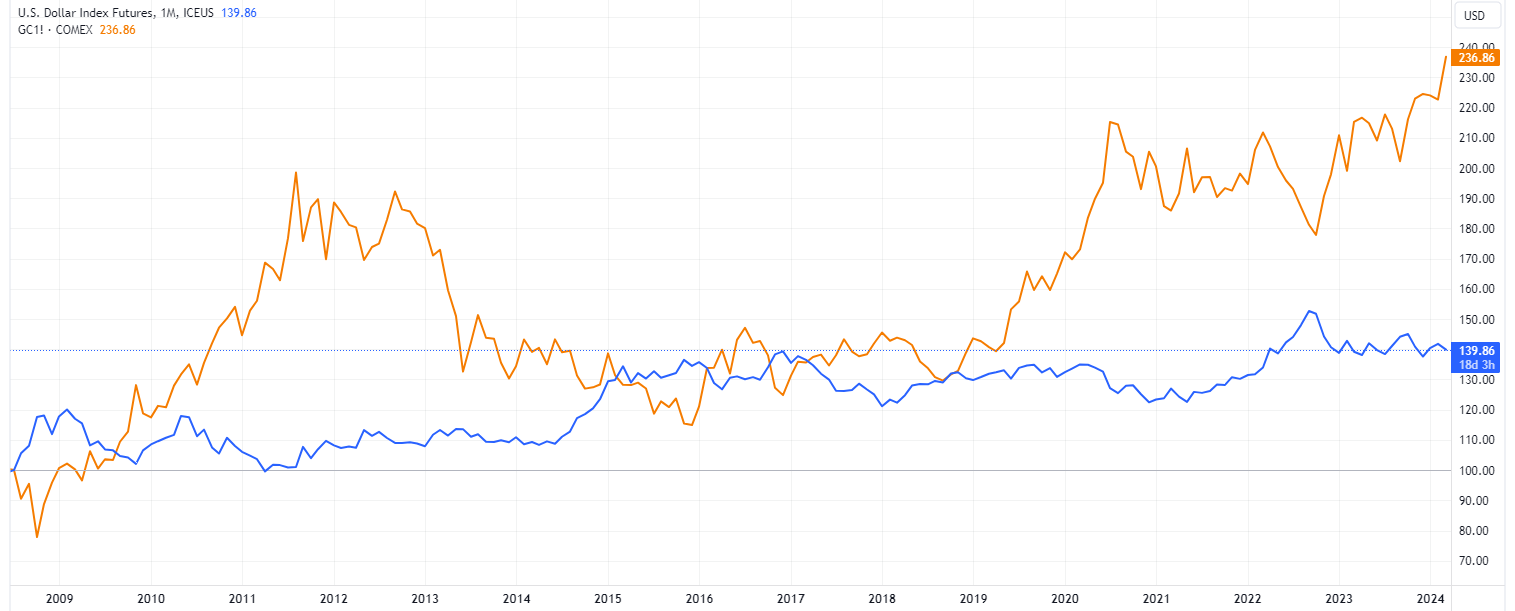

Changes in Currency Exchange Rates

Like the US dollar, gold is seen as a safe-haven asset. To that end, the value of gold rises relative to the depreciating currency since its buying power remains constant in other reserve currencies.

International Conflicts

Investors face a great deal of uncertainty if there is a financial crisis or a war. When markets are volatile, gold is a good hedge. A number of other factors also have a role in the growth of XAU, including inflation, political unrest, monetary expansion, and currency devaluation.

Rates of Interest

Changes in interest rates have the potential to affect the price of gold. Assets with the ability to provide income, such as bonds and dividend stocks, have a significant impact on precious metal prices. A negative association exists, which is not absolute but is noticeable. The price of gold is likely to remain flat or fall if yields on U.S. government bonds increase. In contrast, the XAU/USD exchange rate is usually boosted when yields decrease.

Supply and Demand

When trying to forecast the value of a precious metal’s exchange rate, the two most complicated variables are supply and demand. Central banks, the International Monetary Fund, and other prominent entities are major gold investors, and their actions have a substantial impact on market movements. The demand for gold investment instruments and jewellery can be significantly affected by their strategic actions.

It is almost impossible for an average investor to fully factor in the actions of major market participants. If you want a whole picture of the market balance, you need to know that investment instruments and jewellery make up about equal parts of the demand for gold.

[TRADE_PLUGIN]GOLDUSDT,ETHUSDT[/TRADE_PLUGIN]

Is Gold a Good Investment?

Gold is an excellent addition to a diversified portfolio because of its long history of use as a medium of exchange, protection against price increases, and buffer against economic volatility. Having said that, there are risks involved, just as with any investment. Its value might shift in response to changes in interest rates, market mood, and the value of the dollar.

You should know your individual financial situation, risk tolerance, and investment objectives before putting money into gold. You should consider your current situation and your expectations for the future when deciding whether or not to incorporate gold as an investment.

Why Choose BTCC?

Founded in 2011, BTCC is among the world’s oldest and most reliable bitcoin exchanges. Many traders use BTCC because it has established a solid reputation in the market for security and regulatory compliance over the years. The platform is especially well-suited for traders in North America and Europe, with presences in the US, Canada, and Europe.

In addition to bitcoin trading, BTCC provides traders with access to non-crypto assets including gold, silver, and U.S. equities through cutting-edge features like copy trading, perpetual futures, and tokenized stocks. Both novice and seasoned traders searching for a secure and regulated platform can benefit from BTCC’s range of offerings.

The firm’s products are designed to meet the needs and desires of both rookie and experienced traders. Here are five reasons for using the exchange:

- Numerous transferable assets

- Excessive trading leverage

- Strong copy trading capabilities

- Perfect security record

- Interface that is easy to use

- Accessible to traders in the US and Canada

[BTCC Bonuses and Special Offers]

(1) New User Welcome Reward: As a new user, you can claim a welcome reward of up to 10,055 USDT.

(2) Referral Program: You can earn up to 35% commission on your referrals, plus up to 10,060 USDT in rebates per referral.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]