How High Can Ripple(XRP) Go in Q4 2025? Price Targets, Trends, and Market Drivers

Why Trust BTCC

With the final quarter of 2025 kicking off, once again, all eyes are on Ripple. That’s in part because the crypto market at large is on the rebound, and traders want to know whether or not XRP can keep the overall pace in November and December 2025.

After a year of ups and dips and a new regulatory windfall, then, Ripple looks set to pass yet another major test.

As many FX fans search for XRP price prediction November 1 2025, they’ll be hoping to see whether or not the momentum can continue into the final quarter. Still more will surely be looking beyond, with their fingers crossed that the XRP price prediction December 2025 will end the year on a high note.

Will XRP manage to overcome major resistance levels before 2025 is out, or instead settle for slow, sustained growth?

Table of Contents

- XRP Price Review: Q1–Q3 2025 Performance Recap

- Key Factors Influencing XRP’s Q4 2025 Price

- XRP Technical Analysis: Support, Resistance, and Volume Trends

- XRP Price Prediction Q4 2025: What Are the Prospects?

- FAQs – XRP Price Prediction for November and December 2025 and Beyond

- Conclusion: What’s the Potential for XRP by 2025?

- How to Trade Crypto on BTCC?

- BTCC FAQs

/ You can claim a welcome reward of up to 10,055 USDT\

XRP Price Review: Q1–Q3 2025 Performance Recap

Before covering what’s next for XRP, let’s take a brief look back at previous performances in the last few months. This would be a pointer to what to expect in the latter part of 2025 and beyond.

In Q1, Ripple (XRP) was about $1.78

- With SEC case resolved in its favor

- Investors confidence buoyed

- Multiple exchanges listed it

By Q2, XRP averaging $2.10

- Increased activity in cross-border lanes

- Institutional investors the charge

- Demand surge especially in Asia and Latin America

By Q3, saw XRP price up against resistance near the $1.90 level

- Things got a little choppier

- Establishes a strong baseline

- Momentum accumulation

With this buildup out of the way, what happens next?

Key Factors Influencing XRP’s Q4 2025 Price

Several big factors play a role here. For starters, global remittance activity is ramping back up. RippleNet (and thus XRP) is expanding to new regions propping up XRP’s real-world utility.

Second, the dust from the Ripple legal battle has finally settled. For the first time in forever, there is long-term regulatory certainty surrounding Ripple, which opens things up for bullish sentiment.

Third, institutions are getting way more active near Ripple’s network; big funds, big payment platforms, etc.

And last but not least, Bitcoin’s post-halving cycle is still in place.

The major drivers of XRP price prediction November 1 2025 include the following:

- Global remittance demand

- Regulatory clarity

- Institutional liquidity

- Bitcoin’s influence on market sentiment

All these will decide how strong XRP finishes the year.

XRP Technical Analysis: Support, Resistance, and Volume Trends

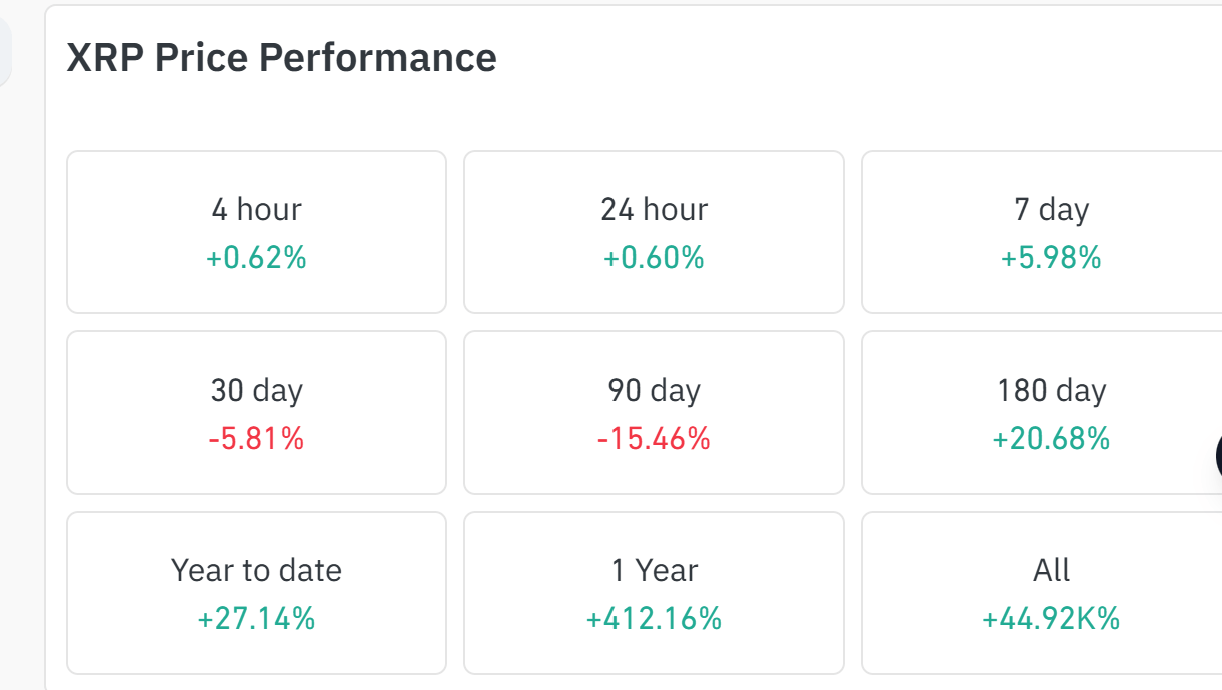

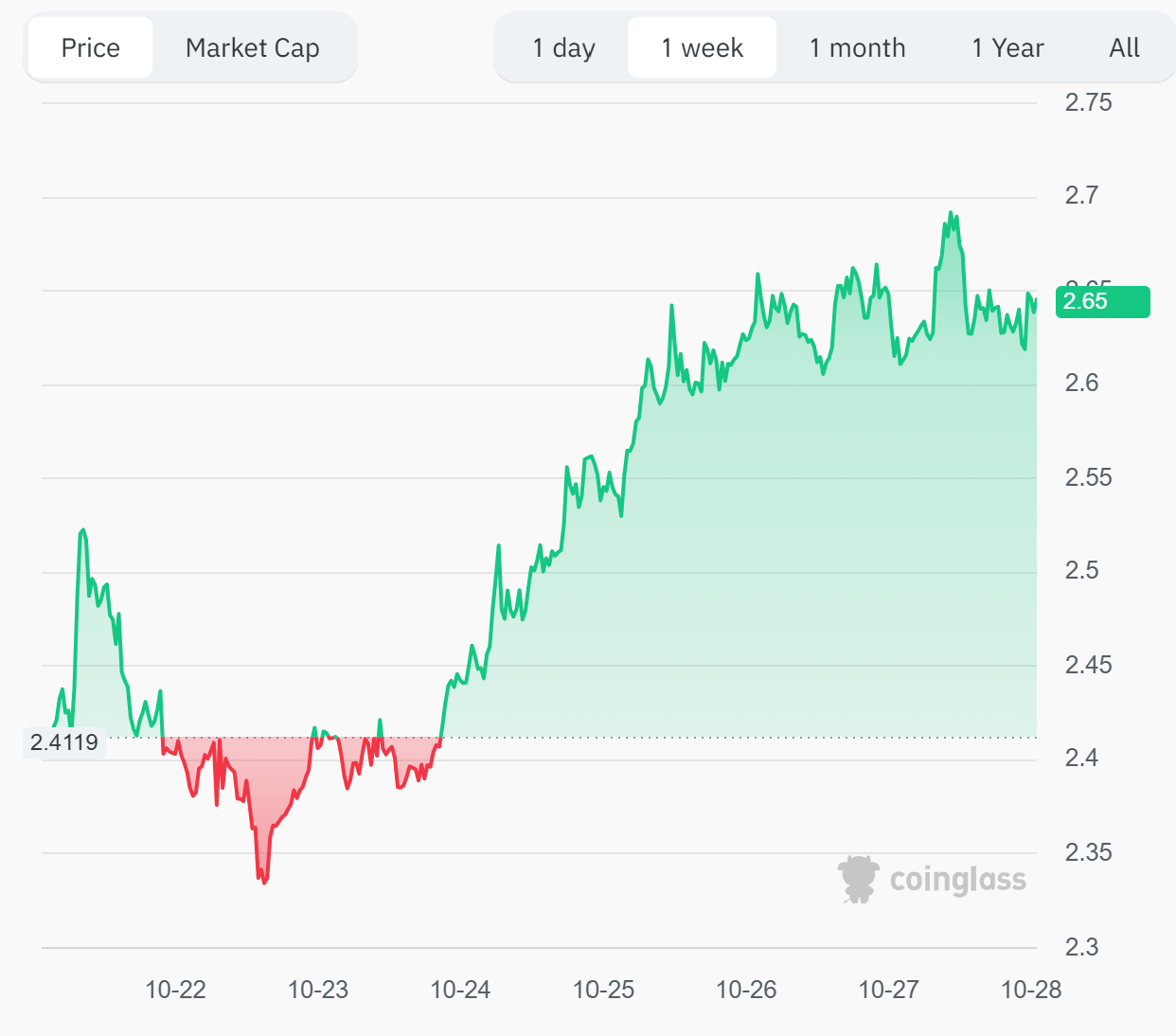

As we head into Q4, the XRP doesn’t look ruffled – steady, calm. Even now, according to CoinGlass, XRP trades above $2.65 with just over a 10% jump in the last seven days.

Strong support zones XRP has established itself between $0.80 and $1.00, a range traders refer to as its comfort zone and an area few expect it to break. Resistance, then, falls between $1.80 and $2.00, where sell pressure can often be overwhelming.

Volume has remained robust, indicating continuing interest from both retail and institutional investors. The RSI has fluctuated between 45 and 60, indicating that XRP is not overly overheated, it’s just gently gaining strength.

All-in-all, the technical analysis heading going into XRP price prediction for December 2025 is showing consolidation near key support levels suggesting a breakout if momentum holds up.

XRP Price Prediction Q4 2025: What Are the Prospects?

As we near the end of 2025, traders are divided on what’s next for XRP. Here are three potential scenarios: the bullish view, the balanced view and the souring-on-the-market view.

i. Ripple Price Prediction: Bullish Case

As mentioned previously, we may see a basing of XRP price for the next 3–6 months and it could range $4 at the extreme higher end to $3+, Ripples momentum takes aim at $2.60–$2.80

If the market continues to stay strong, XRP has room to try and make another run. RippleNet continues to gain traction, new banks join the network even on a monthly basis. Inflows from institutions are increasing as more and more firms experiment with Ripple’s liquidity tools.

This optimism backs the XRP price prediction November 1 2025, where some analysts expect XRP to reach a height that gets above $3.5 if not more. A decent breakout above $2.30 may open the doors for more buyers to jump in, similar to previous Bitcoin-driven pumps.

Main drivers:

- Strong global adoption

- Institutional inflows

- RippleNet volume surge

ii. Base: Consolidation Between $1.80-$2.60

From the derived daily chart, it can be observed that there has been a consolidation commencing at the beginning of March till now between $1.80 to $2.60.

In a more stable market, XRP could range. Prices might hang out between $2.30 and $2.70, reflecting healthy but not explosive growth. That would indicate that traders are confident, but not overly hyped.

Why it matters:

- Constant demand for international payments

- Stable regulation landscape

- Solid long-term structure

iii. Worst Case: Pull-back to $0.85–$1.00

If sentiment takes a hit or liquidity starts vanishing, XRP could fall. A break below $ 0.85–$1.00 would challenge support levels in the past.

That would be in line with a conservative XRP price prediction December 2025 considering market conditions cool off or investors book profits.

Possible triggers:

- Lower trading volume

- Weak macro conditions

- Uncertainty around crypto regulations

/ You can claim a welcome reward of up to 10,055 USDT\

FAQs – XRP Price Prediction for November and December 2025 and Beyond

- Will XRP price target $10 by the end of 2025?

It’s possible for a long-term target but may not be feasible in 2025. It needs an aggressive push to achieve.

- Is $100 XRP realistic?

With a current market cap of about $160B, reaching $100 would mean an unrealistic huge market cap for now.

- What factors could drive XRP past $4?

Global payments growth, strong demand and regulatory precision.

- What is XRP price prediction for November 1 2025

XRP price usd could hover around $2.5 – $2.9

- How will regulations affect Ripple (XRP) price prediction December 2025?

Clarity of regulations boost confidence and pull more investors’ interests.

Conclusion: What’s the Potential for XRP by 2025?

As the year 2025 comes to an end, XRP’s future price looks positive – though with some caution. Ripple’s lawsuit clarity vis a vis regulatory certainty may yet push its price beyond $3. For investors eyeing XRP price movement for the last quarter of 2025 and beyond, green candles could come up as momentum picks up.

Rate cut, inflation data and how Ripple progresses will dictate whether XRP November 2025 through December 2025 will end stronger or pull back. Either way, it’s definitely a good one to keep an eye on.

As for those looking to ice their digital assets trading skills, cryptocurrency update or blockchain trends, BTCC Academy is a formidable tool for free and simplified guides.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Scan to download