Metaplanet’s Bitcoin Strategy Hits Critical Juncture - Crypto Markets Watch Closely

Corporate Bitcoin adoption faces its biggest test yet as Metaplanet's ambitious crypto plan encounters serious regulatory and operational hurdles.

The Infrastructure Question

Massive energy requirements and technical complexities threaten to derail what was once hailed as a revolutionary corporate treasury move. Traditional finance skeptics are watching with barely-concealed satisfaction as another 'disruptive' crypto strategy hits real-world constraints.

Regulatory Minefield

SEC scrutiny intensifies while international compliance frameworks remain fragmented. The company's global expansion plans face unprecedented legal challenges that could redefine how corporations interact with digital assets.

Market Impact

Bitcoin prices show volatility as institutional confidence wavers. Trading volumes spike amid speculation about whether this represents a temporary setback or fundamental flaw in corporate crypto adoption models.

Yet somehow, Wall Street analysts still manage to charge seven-figure consulting fees for 'strategic crypto guidance' while maintaining perfectly straight faces.

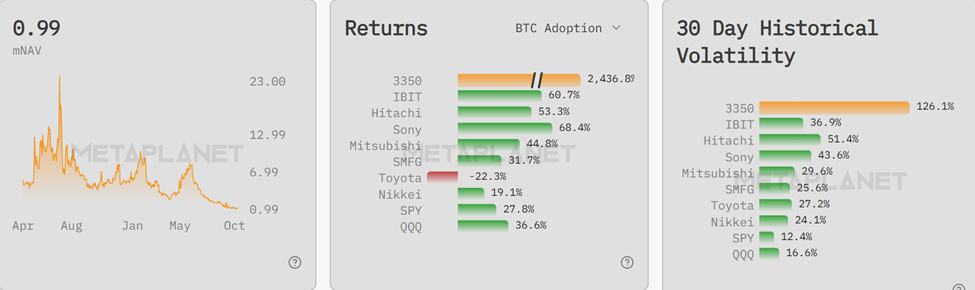

Crypto News of the Day: Metaplanet mNAV Falls Below 1 As Bitcoin Faith Breaks

Japan’s bitcoin standard-bearer, Metaplanet Inc., has entered rare territory, trading below the value of its BTC reserves for the first time.

The Tokyo-listed firm, which holds 30,823 BTC, now has an mNAV of 0.99, signaling that investors are assigning less value to its stock than to the Bitcoin it owns outright.

The decline comes despite strong fundamentals:

- 115.7% growth in Q3 Bitcoin-related revenue.

- Raised 2025 guidance to ¥46 billion ($302.5 million), and

- A cleaner balance sheet after redeeming bonds and paying down debt.

However, since hitting an all-time high in June, Metaplanet’s shares have plunged around 70%, wiping out the premium that once made it one of the most-watched Bitcoin treasuries in Asia.

“Why did my Metaplanet models fail?… All my models were based on mNAV premium arbitrage before compression to 1, but the compression occurred very quickly. Tons of new companies didn’t help as everyone fought for inflows,” wrote pseudonymous analyst Climb the Ladder on X.

According to the analyst, while the company may still outperform Bitcoin, the rapid unwind exposed how fragile the treasury-company trade can be when sentiment shifts.

The drop comes only days after Metaplanet President Simon Gerovich said the firm was temporarily suspending certain stock acquisition rights to refine its capital strategy.

“We are now temporarily suspending the 20th-22nd Series of Stock Acquisition Rights as we optimize our capital raising strategies in our relentless pursuit of expanding our Bitcoin holdings and maximizing BTC Yield,” he shared in a post.

Still, the mNAV inversion represents a profound test of faith in Metaplanet’s business model and the broader thesis that Bitcoin-rich companies can act as superior long-term vehicles for BTC exposure.

The company heads toward a pivotal Extraordinary General Meeting on December 22, but is this moment just a correction or a deeper reckoning for the corporate Bitcoin standard itself?

Q4 marks a critical stretch for Metaplanet, as we continue to execute our vision. As such, we are calling an Extraordinary General Meeting of Shareholders on December 22, 2025, with October 24, 2025 set as the record date for voting eligibility. More details to come. https://t.co/fRKEguQdl6

— Dylan LeClair (@DylanLeClair_) October 8, 2025Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- BNB donation for Malta Cancer Fund swells to $39 million, but its status will surprise you.

- Bitcoin price has been bearish since the great reset, but one level could change that.

- Elon Musk endorses Bitcoin over fiat in bold new statement.

- Why analysts say now could be the smartest time to buy altcoins.

- Dogecoin’s corporate arm merges with Brag House for 2026 Nasdaq listing.

- Bitcoin confidence crumbles as market enters longest-ever hesitation phase.

- Is Binance finally stepping into the Korean market?

- OpenSea users are urged to link EVM wallets before the SEA airdrop deadline.

- Vitalik goes to Bhutan, where Ethereum just became a national standard.

- Polymarket’s silent gold rush: How sharp traders earn risk-free profits.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 13 | Pre-Market Overview |

| Strategy (MSTR) | $315.47 | $299.30 (-5.13%) |

| Coinbase (COIN) | $356.99 | $340.84 (-4.52%) |

| Galaxy Digital Holdings (GLXY) | $41.23 | $38.00 (-7.83%) |

| MARA Holdings (MARA) | $20.24 | $19.15 (-5.39%) |

| Riot Platforms (RIOT) | $21.70 | $20.44 (-5.81%) |

| Core Scientific (CORZ) | $19.21 | $18.49 (-3.75%) |