🚀 Skycorp Solar Soars 8.39% on Bold Ethereum Bet—Wall Street Scrambles to Keep Up

Clean energy meets crypto chaos as Skycorp Solar jolts markets with its Ethereum pivot.

The catalyst: A single press release about treasury diversification into ETH sent shares rocketing—proving once again that nothing pumps a stock like blockchain buzzwords.

Behind the surge: That 8.39% pop wasn’t just retail FOMO. Institutional algos likely front-ran the news, creating the kind of volatility that makes traditional asset managers clutch their pearls (and spreadsheets).

Bigger picture: Another blue-chip flirts with decentralized finance—while carefully avoiding the word ‘speculation.’ Smart move. The SEC hasn’t yet figured out how to regulate solar panels holding digital assets.

Cynic’s corner: Nothing solves a company’s fundamentals like announcing a crypto investment during earnings season. Bonus points if they call it ‘Web3 infrastructure.’

Public Companies Accelerate Push to Buy Ethereum

In the latest press release, the firm highlighted that it will use partial cash reserves and renewable energy project returns to finance its ETH purchases. Skycorp Solar also revealed that it will accept Bitcoin (BTC), Ethereum, and stablecoins such as USDC (USDC) and Tether (USDT) as payment methods for international transactions starting August 1.

The company stated that licensed RWS providers specializing in blockchain forensics will handle all digital currency payments. Moreover, the transactions will adhere to the regulatory guidelines set by the Monetary Authority of Singapore (MAS) and the Financial Action Task Force (FATF).

“The recent GENIUS Act establishes regulatory foundation for stablecoins and provides the trust and stability needed to seamlessly adopt digital payments. We believe investments in clean energy infrastructure and ETH staking align with long-term growth opportunities,” Chairman and CEO Weiqi Huang stated.

Following the announcement, the firm’s stock prices rose to $3.10, marking an appreciation of 8.39%. However, Google Finance data showed that PN wiped out nearly all these gains in pre-market trading as it dropped 6.13%.

As new players continue to enter the market, pioneers are also doubling down on their ETH strategy. SharpLink Gaming highlighted that as of July 20, its holdings have reached 360,807 ETH valued at over $2 billion.

Nonetheless, others aren’t falling behind. BeInCrypto reported yesterday that Cathie Wood’s Ark Invest purchased over 4 million shares of BitMine Immersion Technologies (BMNR). The firm noted that it plans to use funds from the latest stock sale to buy more Ethereum.

“We are delighted that Cathie Wood’s ARK Invest is taking a substantial stake in BitMine as she sees the exponential opportunity ahead as we target reaching 5% of ETH,” Tom Lee remarked.

While these two public companies remain the largest corporate ETH holders, a new firm could threaten their position. The Ether Machine, a newly formed firm, announced plans to go public with over 400,000 ETH on its balance sheet.

This move WOULD make it the largest publicly traded vehicle providing institutional-grade exposure to Ethereum. Backed by $1.5 billion in committed capital, the firm aims to generate returns by leveraging Ethereum’s staking, restaking, and decentralized finance strategies.

“We have assembled a team of ‘Ethereum Avengers’ to actively manage and unlock yields to levels we believe will be market-leading for investors,” The Ether Machine’s co-founder, Andrew Keys, said.

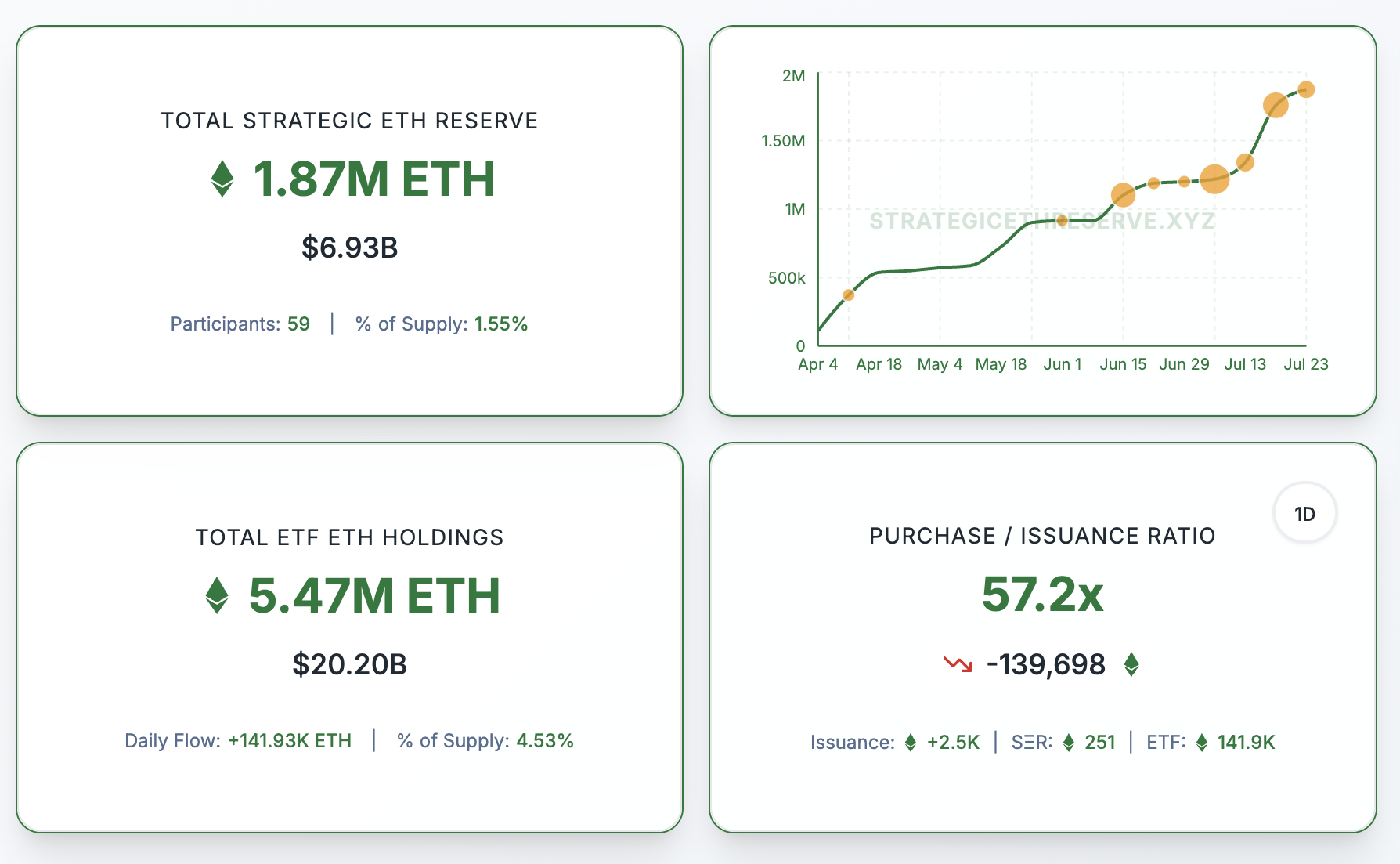

Meanwhile, according to the latest data from the Strategic ETH Reserve, firms collectively hold 1.87 million ETH worth nearly $7 billion in their treasuries.

BeInCrypto highlighted in May that experts anticipated the reserve to cross 10 million ETH by 2026. With the rapid pace at which companies are adopting and buying Ethereum, this prediction doesn’t seem far-fetched.