MEI Pharma Bets Big on Litecoin: $100M Treasury Move Sends Stock Soaring

Biopharma meets blockchain—MEI Pharma just made Wall Street blink. The clinical-stage oncology player dropped a crypto bombshell today, allocating $100 million of its treasury to Litecoin in a bold hedge against fiat volatility.

Market Reaction: Shares spike 18% pre-market

Traders are scrambling as MEI's LTC gambit—the largest corporate crypto allocation since MicroStrategy's Bitcoin play—signals growing institutional appetite for digital assets. The move comes as Litecoin flirts with yearly highs, though skeptics note the 'silver to Bitcoin's gold' still trades 60% below its 2021 peak.

Finance veterans are split: 'Either visionary asset diversification or a desperate pivot from their failed Phase III trials,' quipped one hedge fund analyst. Either way, MEI just wrote the playbook for biotechs navigating the digital age—prescription: 100mg of pure volatility.

MEI Pharma Commits $100 Million to Buy Litecoin

According to the official press release, MEI Pharma entered into securities purchase agreements with investors on July 18. The private investment in public equity (PIPE) deal involved the sale of approximately 29.2 million shares of common stock at $3.42 per share.

For context, a PIPE is a financing method where a public company sells shares or other securities directly to a select group of private investors. This helps the company raise capital without going through a public offering.

The offering closed on July 22, generating gross proceeds of $100 million. Notably, Litecoin creator Charlie Lee and crypto trading firm GSR were the lead investors.

Additional investors included the Litecoin Foundation and several prominent firms such as MOZAYYX, ParaFi, HiveMind, Primitive, and more. Titan Partners Group, a division of American Capital Partners, acted as the offering’s placement agent.

The firm noted that it will use all the proceeds to buy Litecoin as part of its treasury strategy. MEI Pharma said that this move WOULD make it the first and sole publicly traded company on a national exchange to hold LTC as a treasury reserve asset.

With the closing, MEI Pharma has also appointed GSR as the digital asset and treasury management advisor. Moreover, Lee joined the firm’s Board of Directors.

“Litecoin was designed to be fast, secure, and decentralized – and it’s exciting to see those principles now being embraced by a public company like MEI. This milestone not only reflects growing institutional confidence in LTC but also sets the stage for broader adoption in traditional capital markets,” Lee noted.

Meanwhile, David Schwartz, Projects and Strategic Partnerships Director at Litecoin Foundation, highlighted that MEI Pharma is eying another $100 million to boost its LTC purchases.

“The 8-K is for another $100 million raised through equity outside of the original $100 million investment already announced through a PIPE. Two separate $100 million efforts to buy litecoin. That equals $200 million total,” Schwartz explained.

Oh, you thought they were done?https://t.co/PU6mAzJWvT pic.twitter.com/fk07soi40I

— Litecoin (@litecoin) July 23, 2025The decision to adopt Litecoin has proven favorable for MEI Pharma. After the initial announcement on July 18, the stock surged to $9, a level last seen in September 2022. Moreover, Google Finance showed that over the past five days, MEIP’s value has risen by 111.08%.

As of the latest data, MEIP traded at $6.86 at market close, up 4.73%. In pre-market trading, the prices dipped 3.79%.

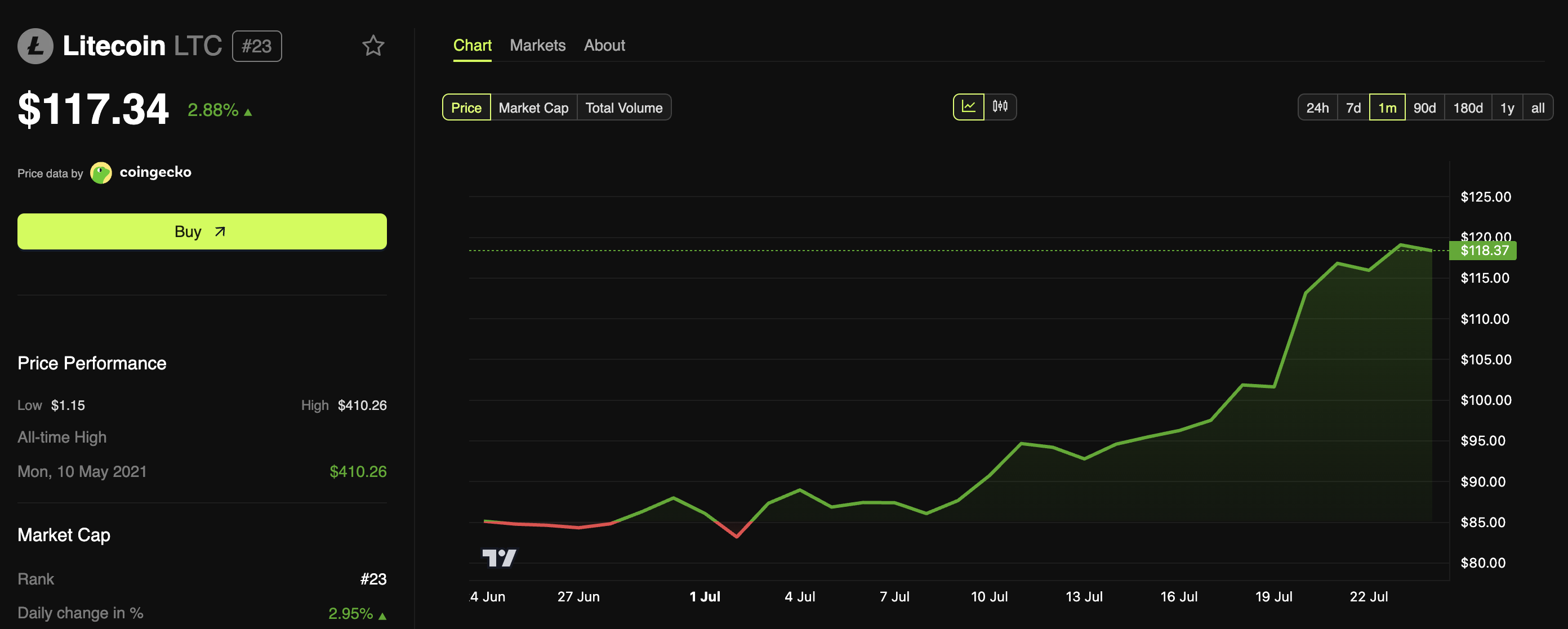

Litecoin itself has also been on a notable rally lately. According to BeInCrypto, the altcoin has seen a 21.9% increase over the past week. At the time of writing, it was trading at $117.3.

Analysts are also displaying high Optimism regarding LTC’s potential. In a recent post on X (formerly Twitter), Bitcoinsensus observed that the coin is nearing a breakout from a 7-year-long compression channel. If Litecoin breaks out, it could signal a strong price rally.

“This is one of the most bullish looking charts in crypto right now,” the post read.

Another analyst also suggested that Litecoin has the potential for significant growth.

“Litecoin remains the best risk/reward high liquidity widely known crypto. If we have ETF approval, mid alt season, this bull cycle. EXPECT 10x,” Crypto Snorlax added.

Whether LTC can actually reach new highs remains to be seen. However, the rising institutional interest does paint a favorable picture for its future.