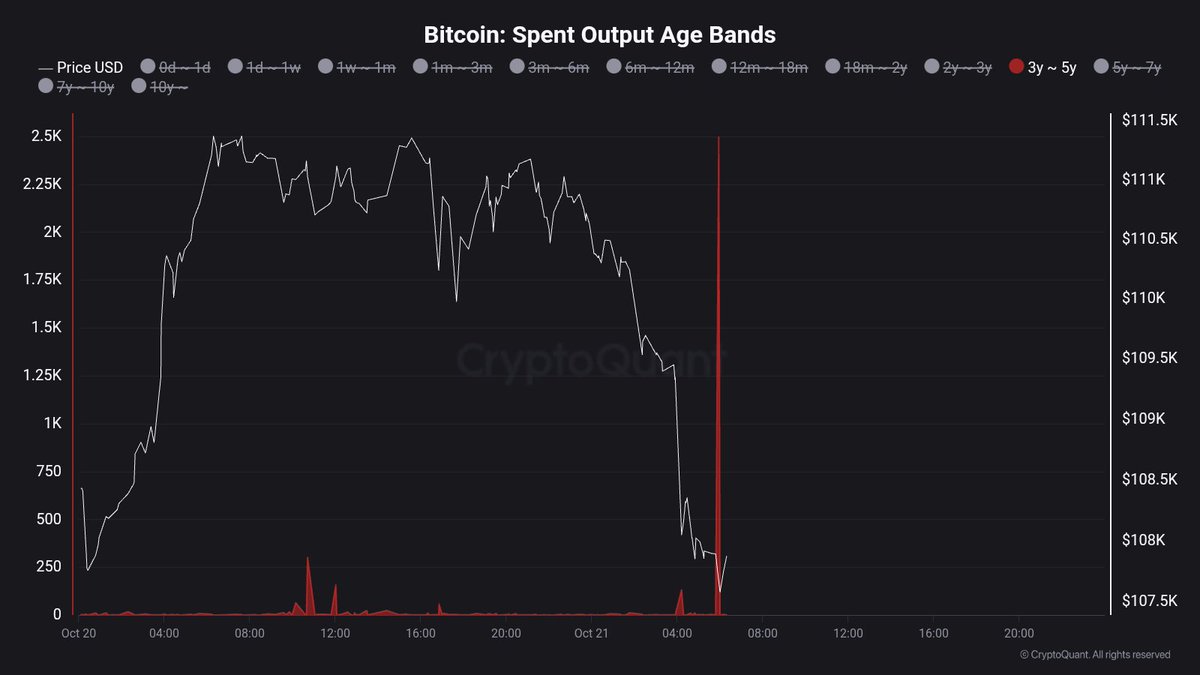

2,496 Bitcoin Suddenly Awaken After Years of Dormancy - Long-Term Holders Make Their Move

Bitcoin's sleeping giants are stirring.

Massive Movement After Years of Silence

Exactly 2,496 BTC just changed hands after gathering digital dust for years—long-term holders finally breaking their HODL mentality. These aren't rookie traders making impulse moves; these are veterans who've weathered multiple market cycles watching their assets appreciate roughly 500% since acquisition.

Strategic Shifts or Profit-Taking?

While some analysts scream 'distribution phase,' others see sophisticated portfolio rebalancing. The timing couldn't be more intriguing—right as traditional finance institutions scramble to explain why their 'diversified portfolios' underperformed Bitcoin... again.

When whales this size move, the entire ocean feels the waves.

Long-Term Holders Move Supply as Selling Pressure Builds

Top analyst Maartunn shared data revealing a notable spike in long-term holder activity, with 3–5-year-old BTC spent jumping to 2,496 BTC — a significant MOVE considering the typically dormant nature of this cohort. These “old coins” represent Bitcoin that hasn’t moved in years, often held by investors with high conviction. When this group becomes active, it usually signals a major shift in market dynamics.

Historically, such spikes in long-term holder activity tend to occur NEAR macro turning points, either as a sign of distribution during local tops or early reaccumulation phases after deep corrections. In the current context, this rise in aged coin movement could mean two things. First, it might reflect profit-taking from early holders who are capitalizing on gains as market volatility intensifies. Second, it could indicate reallocation or strategic rotation, where coins move between wallets as investors prepare for renewed market turbulence.

This comes amid a backdrop of persistent selling pressure, with Bitcoin struggling to hold above the $110K level. The broader market remains cautious, as liquidity thins and short-term traders react to each downside move.

While long-term holders moving supply can appear bearish in the short run, it’s also a natural part of market cycles — often preceding phases of redistribution that ultimately strengthen long-term structure. If Bitcoin can absorb this supply and maintain support above $106K–$108K, it could set the foundation for a more sustainable rebound. However, failure to do so might confirm a deeper correction, potentially testing the $100K zone once again.

Testing Support Amid Renewed Weakness

Bitcoin is struggling to find momentum after days of selling pressure, currently trading around $107,800. The 3-day chart shows BTC fighting to stay above the 200-day moving average (green line) near $106,000, a crucial support that has historically served as a base during major corrections. The bounce from the recent $103K low suggests some buying interest, but momentum remains fragile as bulls attempt to defend this key zone.

The 50-day moving average (blue line), sitting above $112,000, now acts as short-term resistance, with a broader supply area forming around $117,500 — the same level that capped previous rallies. A close above this threshold could confirm a short-term reversal, signaling renewed buyer confidence. However, repeated failures to reclaim it may invite another wave of selling pressure.

Market structure remains neutral-to-bearish, with volatility compressing following the October 10 flash crash. If BTC loses the $106K–$107K zone, downside targets could extend toward $100K, where the yearly average offers the next LAYER of support.

Featured image from ChatGPT, chart from TradingView.com