Bitcoin ETFs Bleed $826 Million as Selling Pressure Mounts—A Temporary Drain or Structural Shift?

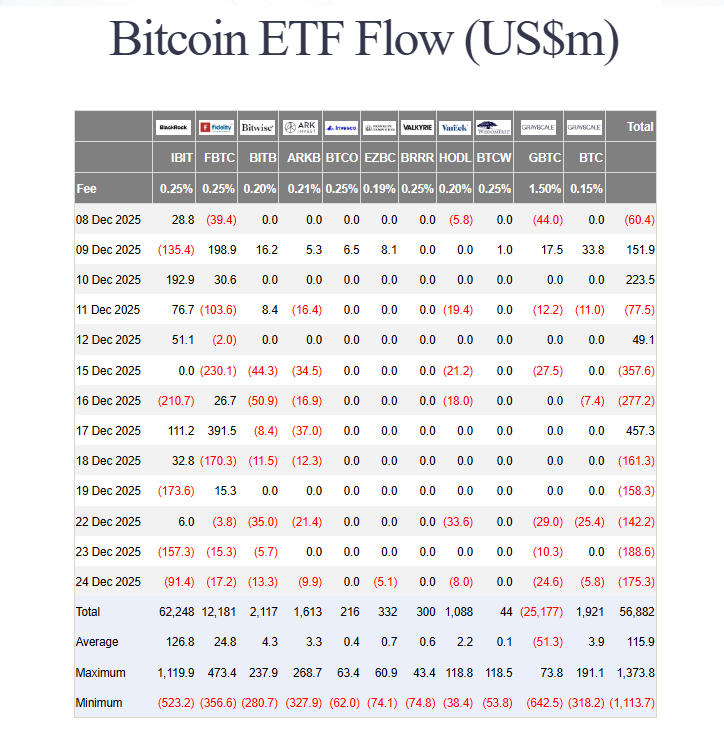

Bitcoin exchange-traded funds just hit a massive liquidity drain. The numbers don't lie: $826 million walked out the door. This isn't a trickle—it's a wave.

The Mechanics of the Move

Where's the money going? Not into mattresses. This capital is rotating—finding new homes in direct asset holdings, alternative crypto products, or just plain old profit-taking. The ETF wrapper, once hailed as the gateway for Wall Street, is now showing its seams under pressure.

Reading the Tape

This outflow tells a story of shifting sentiment. It's a classic case of 'sell the news' meets institutional repositioning. The easy money from the initial ETF euphoria has been made. Now comes the hard part: weathering volatility and proving long-term viability beyond the hype cycle.

The Bigger Picture

Don't mistake a liquidity event for a fundamental breakdown. Bitcoin's network chugs along, unbothered. This is a tale of traditional finance products grappling with a native digital asset's volatility—a reminder that wrapping crypto in old-world paper sometimes creates more friction than it solves. After all, on Wall Street, a 'product' is often just a fee structure in a trench coat.

So, is the ETF experiment failing? Hardly. It's just entering its first real stress test. The $826 million question is whether this is smart money exiting or dumb money getting scared.

Institutional Outflows

Market participants pointed to routine year-end moves as a major factor. Reports have disclosed that tax-loss harvesting — where traders sell positions to realize losses for tax purposes — has been heavy this month.

One trader on X, using the name Alek, said most selling is tied to tax reasons and may fade within a week. Traders also flagged a record options expiry on Friday as a force that can sap appetite for risk ahead of large settlements.

Pressure In US Trading Hours

Data showed downside was strongest during US trading sessions. The Coinbase Premium — a measure comparing Coinbase’s BTC/USD price to Binance’s BTC/USDT — spent much of December below zero, signaling weaker buying in the US market.

Crypto analyst Ted Pillows summed up the flow pattern, saying the US had become the biggest seller while Asia played the role of the main buyer. That split can limit how high bitcoin holds during rallies if US demand doesn’t return.

Other traders contend that negative ETF FLOW numbers don’t mean the cycle is over. Based on reports shared on social channels, the path back usually goes price first, flows then.

Price finds a base and then flows flatten, before fresh inflows appear. In this view, current liquidity looks inactive rather than broken. That leaves room for a bounce once seasonal selling subsides.

Since early November, the 30-day moving average of US spot ETF net flows has stayed negative for both Bitcoin and Ethereum.

This means that, on average, more capital has been leaving these ETFs than entering them for several weeks in a row.

This is important because ETFs are… pic.twitter.com/qR1bMQNqxe

— BitBull (@AkaBull_) December 24, 2025

On-Chain SignalsOn-chain metrics offer some comfort. Long-term holders are not rushing to sell at once. Realized gains show some profit-taking, but not the kind of extreme that marks a terminal peak. That pattern fits the idea that selling is being absorbed by other hands. If selling is NEAR exhaustion, larger buyers could step in when ETFs turn neutral or positive.

Outlook For The Coming MonthsInvestors will watch ETF flows closely after the holidays. If flows MOVE toward neutral, price could stabilize and then climb without needing huge new demand. The mix of tax selling and options-related positioning suggests some of the current weakness may be temporary. Still, traders should expect choppy moves while US buyers remain sidelined.

Featured image from Pexels, chart from TradingView