23,000 Bitcoin Frozen in Legal Chaos as China Arrests Alleged Scam Kingpin Chen Zhi

Crypto markets shudder as Chinese authorities seize control of 23,000 BTC—currently valued at over $1 billion—from detained entrepreneur Chen Zhi. The digital assets remain locked in regulatory purgatory while investigations continue.

Behind the Scenes: How a 'Blockchain Visionary' Became a Target

Once hailed as a crypto pioneer, Chen's empire crumbled overnight when Beijing's cyber police raided his offices. Sources claim the arrest stems from alleged Ponzi scheme operations masked as decentralized finance platforms.

The Ripple Effect

Market analysts warn the frozen BTC could trigger volatility if suddenly liquidated—though skeptics note governments always find ways to monetize seized assets (usually at retail investors' expense). Meanwhile, crypto traders watch nervously as another chapter unfolds in China's love-hate relationship with digital currencies.

Final Thought: In crypto, the line between visionary and villain often depends on who's holding the handcuffs.

Bitcoin Windfall For China?

For Bitcoin, the immediate hook is the size and apparent stasis of the remaining BTC footprint that Galaxy Digital’s head of firmwide research Alex Thorn says can be traced to Chen’s orbit. In a series of posts on X, Thorn highlighted that US authorities previously seized 127,000 BTC connected to the group, information that was unsealed in October 2025, but that Chen “still has more than $2bn in BTC.”

pig-butchering scam king Chen Zhi arrested in Cambodia, extradited to China. the US previously seized 127k BTC from wallets associated with this group (info unsealed in october 2025)

but zhi still has more than $2bn in BTC. that’s a nice pile of corn for the chinese![]() pic.twitter.com/jPQaflER8i

pic.twitter.com/jPQaflER8i

— Alex Thorn (@intangiblecoins) January 7, 2026

Thorn added: “we identified 23,191 BTC associated with him,” split between 7,234 BTC still sitting in wallets tagged to Prince Group/LuBian and 15,957 BTC that, he said, was moved out of OFAC-sanctioned wallets into new addresses shortly after the October unsealing.

Thorn framed the jurisdictional dilemma bluntly. “The US has an indictment for him but now that China is holding him there’s no way the US will seize him,” he wrote. “Remains to be seen what happens with these 23k BTC we’ve identified. None of it has moved since he was arrested or extradited.”

Thorn also pointed back to a detail that has lingered over the US forfeiture: the “Milk Sad” weak-entropy issue tied to LuBian wallets, which created a long-running theory that the 2020 compromise of a major mining wallet cluster was less straightforward than it appeared.

A Galaxy Research brief published in October described the DOJ’s action as its “largest-ever asset forfeiture,” saying US authorities seized 127,271 bitcoin and centered the case on Chen, whom prosecutors accused of running a “vertically integrated criminal conglomerate” spanning online gambling, forced-labor compounds, and pig-butchering scams.

The brief argued that the court documents listed wallet addresses that matched “1-for-1” a set of weak-entropy LuBian wallets identified by cybersecurity researchers, but that those wallets “had nearly zero bitcoin in them at the time of seizure,” with the seized BTC coming “almost exclusively from wallets associated with the Lubian.com exploiter.”

That history matters because it reframes the open question around the 23,191 BTC Thorn says remains identifiable today. If Thorn’s tracking is right, the next MOVE is about which jurisdiction, if any, can actually reach the coins.

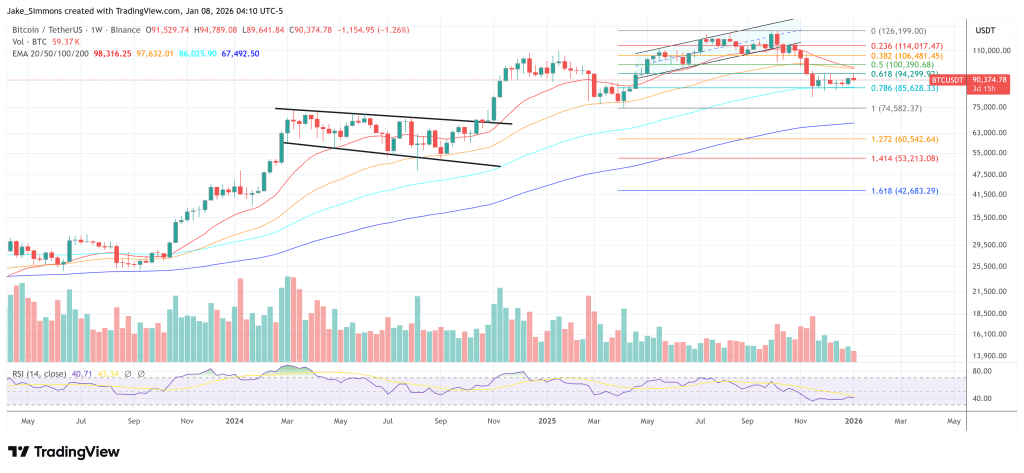

At press time, BTC traded at $90,374.