Bitcoin’s Surge: Relief Rally or Real Recovery? What On-Chain Data Reveals

Bitcoin cuts through resistance levels—but is this rally built to last?

On-chain metrics never lie. They strip away the hype and show what's actually happening beneath Bitcoin's volatile surface. While traders chase green candles, blockchain data tells a different story—one of accumulation, distribution, and market sentiment you won't find on any exchange dashboard.

The Whale Watch

Large holders aren't just sitting tight—they're moving. Address activity reveals whether this is smart money accumulating or dumb money distributing at what feels like a local top. Follow the flows, not the headlines.

Exchange Exodus

Coins leaving exchanges signal long-term holding conviction. When Bitcoin flees trading platforms, it's not looking for a quick flip—it's going into cold storage for the next cycle. That metric alone often predicts sustainability better than any technical analysis.

Network Health Check

Hash rate doesn't care about price. Miners either secure the network or they don't—and their collective computing power shows fundamental strength regardless of daily percentage moves. A robust network supports higher valuations; a weakening one exposes rallies as temporary.

Sentiment vs. Reality

Social volume spikes during pumps, but on-chain activity either confirms or contradicts the excitement. When everyone's tweeting about Bitcoin while actual usage flatlines—that's your classic bear market rally in the making.

Remember: Wall Street analysts get paid to be wrong with confidence, while blockchain data just shows what happened. This rally either has on-chain confirmation or it's just another dead cat bounce in crypto's endless cycle of hope and despair.

BTC’s Recent Bounce A Mere Bear Market Relief Rally — Analyst

In a January 9 post on the X platform, crypto analyst Maartunn shared interesting data points to answer the question of whether Bitcoin’s latest price bounce is meaningful or just a relief rally. The market pundit anchored their answer on both on-chain and technical price data.

Firstly, Maartunn acknowledged that the recent jump was only bound to happen, as the bitcoin price found support around the ETF Realized Price at $85,000. This price level represents the average cost basis of BTC ETF investors, and as expected, the buyers defended their positions — leading to the price bounce.

This phenomenon is spotlighted by another on-chain metric, the Coinbase Premium Gap, which measures the difference between the Bitcoin price on Coinbase and global exchanges. According to Maartunn, the metric started to rise right after New Year’s Eve, signaling renewed buying activity from US-based investors.

Furthermore, the spot exchange-traded funds started seeing strong capital inflows days after this uptick in the Coinbase Premium Gap. “This looks more like strategic buying/portfolio rebalancing (new quarter, new year) than emotional FOMO,” Maartunn added.

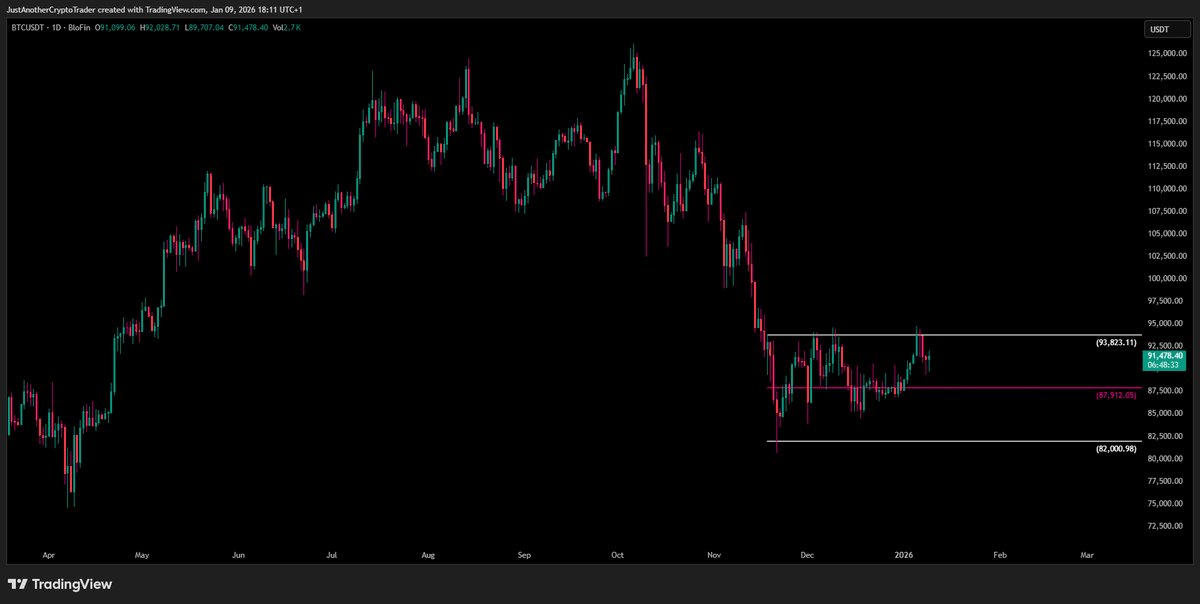

However, the crypto analyst noted that the rally only saw the Bitcoin Price climb to the range high at $94,000 before getting rejected. In essence, this suggests that the flagship cryptocurrency does not possess the bullish strength to breach that resistance.

Additionally, Maartunn mentioned that Bitcoin is still trading beneath crucial on-chain levels like the Short-Term Holder Realized Price and Whale Realized Price, both of which are acting as significant overhead resistance.

The on-chain analyst noted that the on-chain observations suggest that this recent bounce is merely a bear market relief rally, not a trend continuation — even though the price is up by about 10%. Only a clean break and sustained close above the $94,000 WOULD indicate the Bitcoin price’s strong intent to rebuild a bullish structure, Martunn concluded.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at $90,360, reflecting an almost 1% decline in the past 24 hours.