Bitcoin OG From 2011 Awakens, Banks Staggering 322,000x Profit in 2025

A Bitcoin pioneer from 2011 just shook off the dust—and walked away with a life-changing payday. Talk about sleeping on a goldmine.

From Obscurity to generational wealth

Fourteen years after stacking sats, this hodler’s patience paid off with a 322,000x return. Wall Street fund managers are punching air right now.

The ultimate ‘I told you so’

While traditional finance was busy dismissing crypto as a fad, early adopters like this one were quietly building fortunes. Now they’re cashing out while banks scramble to offer Bitcoin ETFs.

Crypto’s revenge on the old system

One sell order later, and the game’s rigged in their favor. The irony? This profit could’ve been made by any skeptic who bought lunch money’s worth of BTC in 2011—if they hadn’t been too busy ‘doing their own research.’

Bitcoin Whale Has Shown Movement After 14.5 Years Of Silence

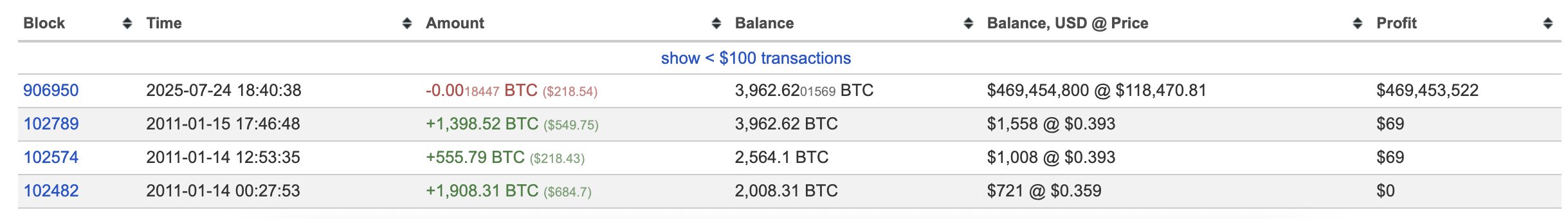

In a post on X, on-chain sleuth Lookonchain pointed out how a bitcoin whale wallet silent since 14.5 years ago finally broke its dormancy today. The wallet in question received 3,962 BTC back in January 2011.

At the time, the cryptocurrency was trading around $0.37, so this amount would have only been worth about $1,460. After amassing this sum, the investor’s address went completely cold.

It’s possible that the wallet became lost, either by having its existence forgotten or keys misplaced. This is generally the likely reason behind wallets going dormant for long periods. The less probable explanation could be that the silence corresponded to willful HODLing by the investor.

Whatever the case be, the wallet finally showed activity earlier today and made a test transaction of 0.0018 BTC.

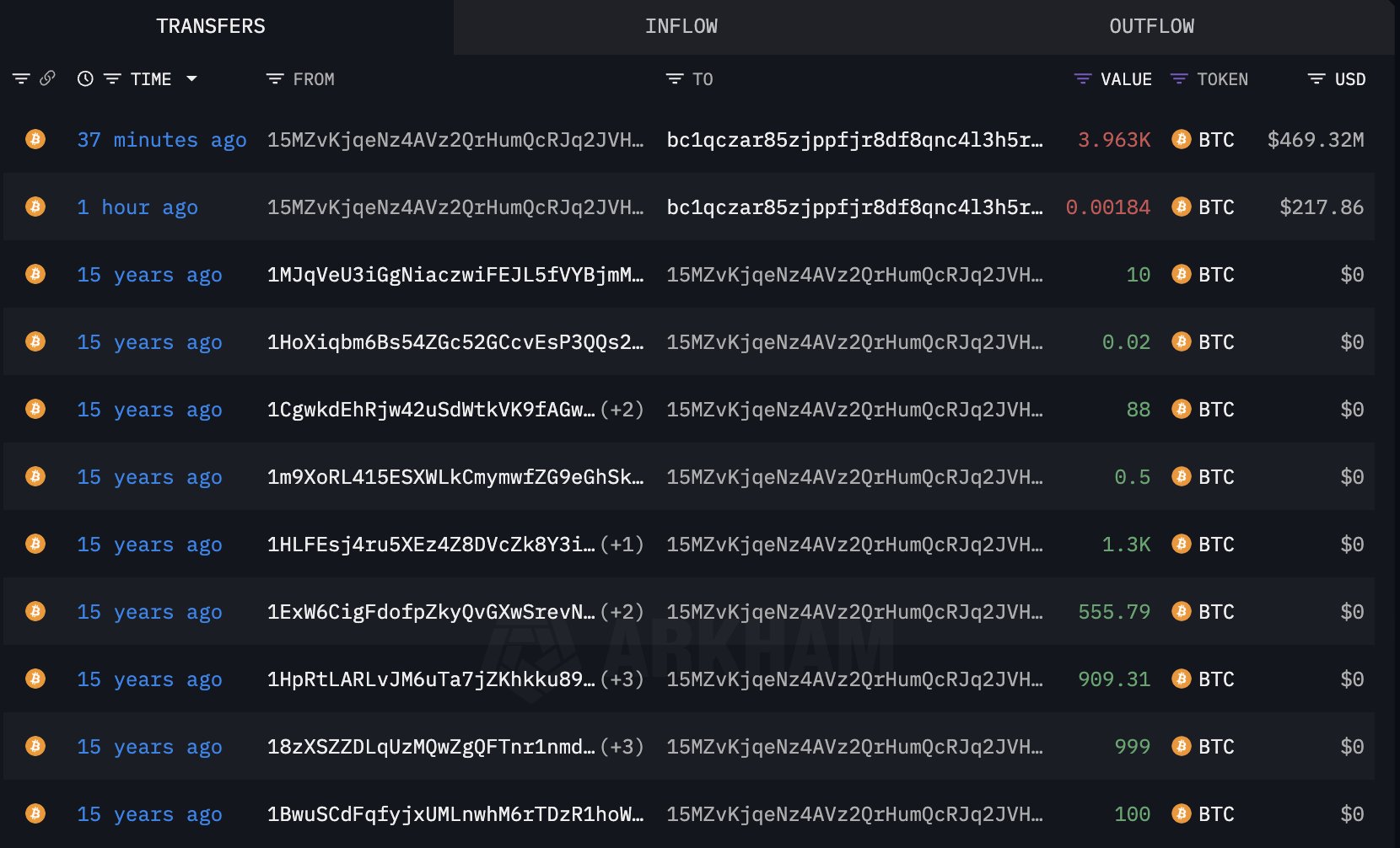

And now, it has completely emptied itself out, shifting coins to a new wallet.

At the time of this new transaction, the wallet’s 3,962 BTC stack was worth a whopping $469 million. Given that the initial investment was of just around $1,460, this humongous amount is practically all profit.

Generally, when dormant wallets MOVE their coins, it’s a sign that they are planning to sell. If this is the case for the current address, the question may be: why now of all times, 14.5 years later? Assuming that the wallet was indeed lost, it’s possible that it has just now been rediscovered. Thus, it may have simply been impossible to shift these coins until now.

But in the scenario that the Bitcoin wallet was rediscovered earlier or the investor never actually lost access to it, then the reason may be that the current bull run highs have just looked like a convenient window for finally cashing in.

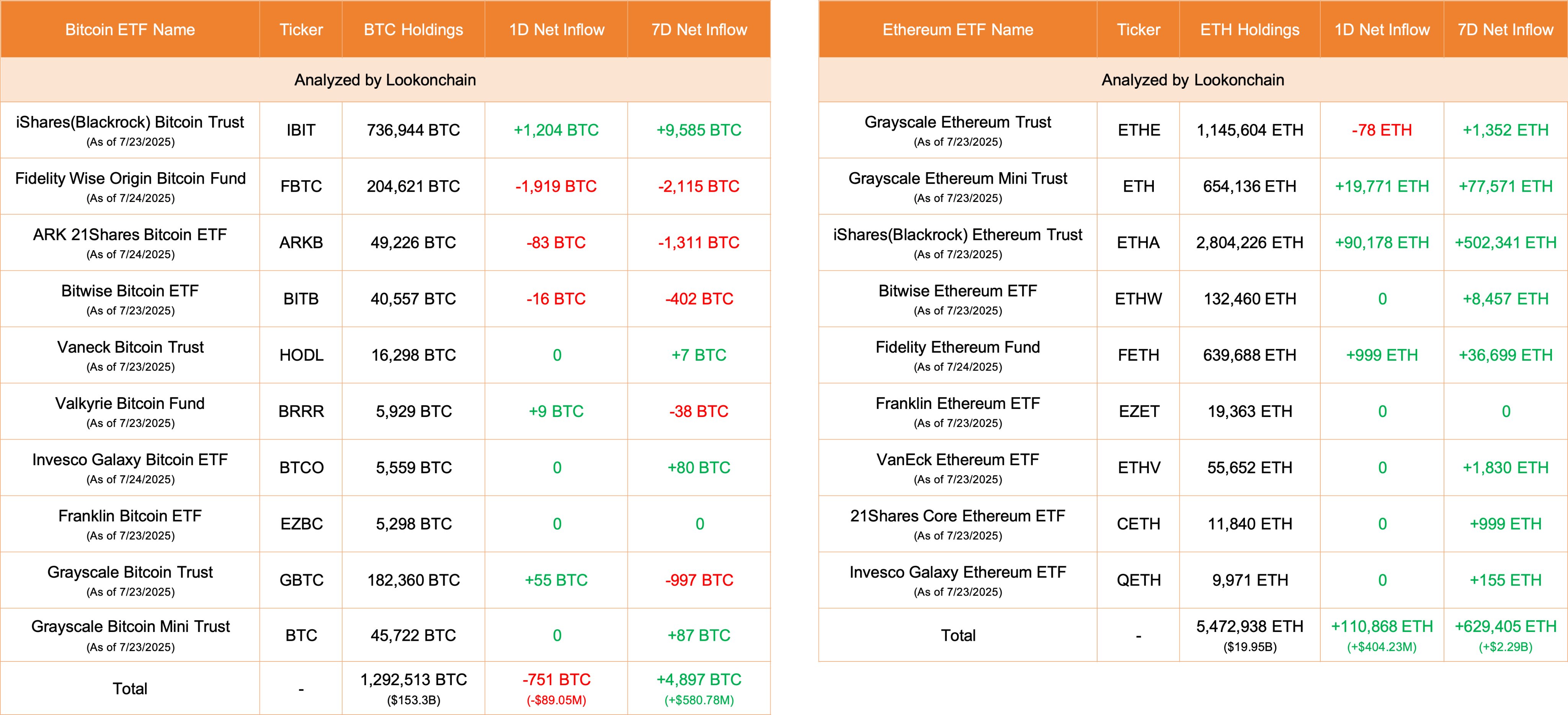

In another X post, Lookonchain shared the latest inflow/outflow data for the Bitcoin and ethereum exchange-traded funds (ETFs).

As is visible above, the 7-day ETF netflow currently stands at positive for both Bitcoin and Ethereum, but the daily netflow has printed a negative value for the former. In total, 751 BTC ($89 million) has left the ETFs over the past day. Fidelity’s FBTC has led the outflows, with 1,919 BTC ($227 million) exiting the fund.

In contrast, ETH ETFs have seen a significant inflow of 110,868 ($404 million) tokens in the same window.

BTC Price

At the time of writing, Bitcoin is floating around $118,900, unchanged from one week ago.