🚀 STRC’s $2B Bitcoin Play Sends $HYPER to the Moon – Here’s Why It Matters

Wall Street's latest crypto gambit just went nuclear. STRC's share price rocketed to a $2B valuation overnight—fueling a massive Bitcoin acquisition spree. And the ripple effect? $HYPER is tearing through resistance levels like a bull in a china shop.

How one corporate maneuver flipped the script on crypto markets.

When traditional finance meets Bitcoin maximalism, things get spicy. STRC's board just turned their balance sheet into a rocket ship by converting cold hard cash into digital gold. Meanwhile, decentralized players like $HYPER are riding the wave—proving once again that crypto markets move faster than hedge fund analysts can say 'FOMO'.

The real kicker? This playbook isn't new—it's just the first time someone had the audacity to try it at scale. Cue the institutional FOMO and the inevitable 'this time it's different' chorus from suits who mocked crypto three years ago.

Strategy ‘Stretch’-es Series A Offering

The offering, dubbed Series A Perpetual Stretch (STRC) or simply ‘Stretch,’ consists of 5M shares priced at $90 each, representing a 9% initial dividend yield, and offering effective yields NEAR 9.5–10% for investors due to the discount to par.

Crucially, unlike conventional preferreds, Stretch features a variable monthly dividend rate tied to SOFR, aimed at incentivizing stable trading around the $100 par value.Stretch joins a growing family of BTC-backed preferred securities launched by Strategy this year, including Stride (STRD), Strife (STRF), and Strike (STRK).

Like its predecessors, the new issuance will funnel proceeds directly into Bitcoin purchases, boosting Strategy’s holdings to approximately 607,770 $BTC, valued at about $72B (roughly 3% of all Bitcoin mined globally).

Saylor’s financial design centers around a self‑reinforcing capital model: issue preferred equity, deploy proceeds to buy Bitcoin, maintain investor confidence to support valuations, and reduce reliance on convertible debt via equity appreciation and conversion.

Stretch’s flexible dividend structure should support this model – signaling stability and mitigating price swings ahead of future offerings, while also appealing to investors who prefer more stable returns.More speculatively, it may also be Saylor’s response to the recent growth of ethereum yield-generating treasuries.

Stretch: Vote of Confidence, or Major Gamble?

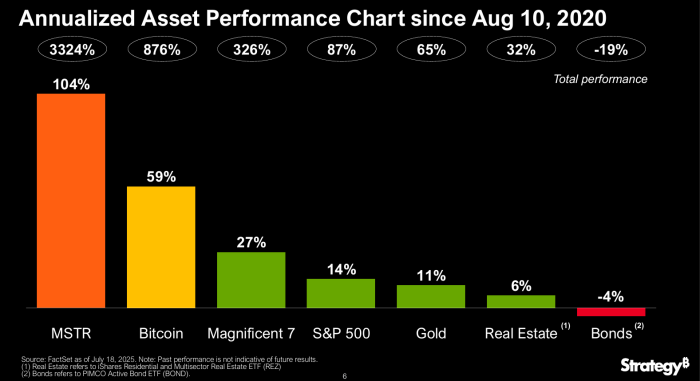

Strategy’s latest strategy isn’t without skeptics. The biggest criticism can be seen most clearly in Strategy’s own investor presentation:

Namely: if it looks like a bit of a pyramid scheme, then it might be a pyramid scheme. The structure heavily depends on continued bullish sentiment and access to capital markets.

The bottom two layers – Bitcoin’s token price and Strategy’s share price – are vulnerable to sentiment reversals or the sudden lack of capital.

While the preferred offering has been received enthusiastically, analysts warn that a liquidity risk remains if share prices slip below thresholds needed to convert existing debt.

In theory, that could force Strategy to sell Bitcoin in contradiction to its long‑term HODL ethos. Despite the outward momentum, there’s more than a bit of risk built into Strategy’s approach.

Will Bitcoin keep rising, paying off for Strategy? What’s next to Strategy – and what’s next for Bitcoin?

Well, irrespective of Strategy’s big plans, $BTC remains bullish in Q3, 2025. And blockchain-native projects like Bitcoin Hyper are here to boost the Bitcoin network to new highs.

Bitcoin Hyper ($HYPER) – Bitcoin’s Faster, Better Layer-2 Cheerleader

Bitcoin the original and best – at least of the Layer 1 blockchains. But the underlying technology has come a long way since Bitcoin launched, and $BTC isn’t easily integrated with DeFi, dApps, and the rest of the growing crypto economy.

Until now. With Bitcoin Hyper ($HYPER), that all changes. Leveraging the Solana VIRTUAL Machine (SVM) and a Canonical Bridge, $HYPER powers a Layer 2 with near-instantaneous finality.

You could soon bridge $BTC from Bitcoin LAYER 1 to Bitcoin Hyper Layer 2 and enjoy the latter’s faster transaction speeds and lower fees.

And on Bitcoin Hyper, you’ll be able to deploy both wrapped $BTC and $HYPER across the full range of DeFi platforms, whether it’s for lending, yield, or even NFT trading.

There’s intense interest in a protocol that can take Bitcoin to the next level. Most importantly, the L2 devnet is already in beta testing, so a meme-fueled Bitcoin upgrade may just be around the corner.

Buying the Bitcoin Hyper token early means you, too, could help support the project. The project has a dynamic staking pool, curently offering 204% APY for newcomers.

With $4.8M+ raised so far, HYPE for $HYPER is building. The token currently cost only $0.0124, but a successful rollout and listing could see $HYPER potentially reaching $0.32 in 2025.Visit the Bitcoin Hyper presale or learn more with our full Bitcoin Hyper guide.

Stretch Extends Strategy’s Bitcoin Reach

For now, Stretch cements Strategy’s formula: more equity raises, more Bitcoin buys, and more reliance on market confidence.

And if MSTR stock surges again, Strategy could raise additional equity and pay off the STRC raise; or simply buy back the equity.

The model thrives in bull phases; but it WOULD face its harshest test if investor sentiment retreats.

Meanwhile, more Bitcoin-focused initiates, like Bitcoin Hyper, add fuel to the bullish $BTC momentum.

As always, do your own research before investing in cryptocurrency presales or stocks. This isn’t financial advice.