Bitcoin Shatters $94K Barrier as Record ETF Inflows Signal Unstoppable Institutional Stampede

Forget the old ceiling. The new floor is somewhere in the stratosphere.

The ETF Engine Is Redlining

This isn't retail FOMO—it's a calculated capital avalanche. Wall Street's long-awaited on-ramps are now superhighways, funneling institutional billions directly into the digital asset. The ticker tape tells the story: unprecedented, consecutive daily inflows that make previous bull runs look like timid experiments. The gates are open, and the herd is charging.

Demand That Defies Gravity

What's driving it? Call it a perfect storm of validation. After years of sidelined skepticism, major allocators are finally executing their mandates. Treasury strategies are being rewritten, balance sheets diversified. The narrative has irrevocably shifted from 'if' to 'how much.' The demand isn't just renewed; it's structural, embedded, and seemingly insatiable—proving once again that nothing attracts capital like capital already in motion.

The New Price Discovery Playbook

Traditional resistance levels? They melted like ice in a forge. The market is now operating on a different set of mechanics, where ETF flow data is the new leading indicator and quarterly rebalancing memos from pension funds move the needle more than any crypto influencer tweet ever could. The playbook has been torn up and replaced with one written by CFA charterholders.

So, where does it end? If history is any guide—and in finance, it rarely is, except when it justifies the current bubble—the momentum has a way of outrunning even the most bullish models. The cynical take? The smart money got in early, the big money is getting in now, and the dumb money will be left holding the bag... just like always. But for now, the only direction is up.

Bitcoin climbed above $94,000 on Monday for the first time in 30 days as institutional demand surged through spot ETFs and sentiment indicators signaled a decisive shift in market positioning.

The benchmark cryptocurrency reached $94,634 during the session, and traded at $93,584 on Tuesday as time of publication, representing a gain of 0.8% over 24 hours. Ethereum traded at $3,228, up 1.76%, while XRP posted an 9.49% gain to reach $2.34, its highest level since November.

Record ETF Demand Returns

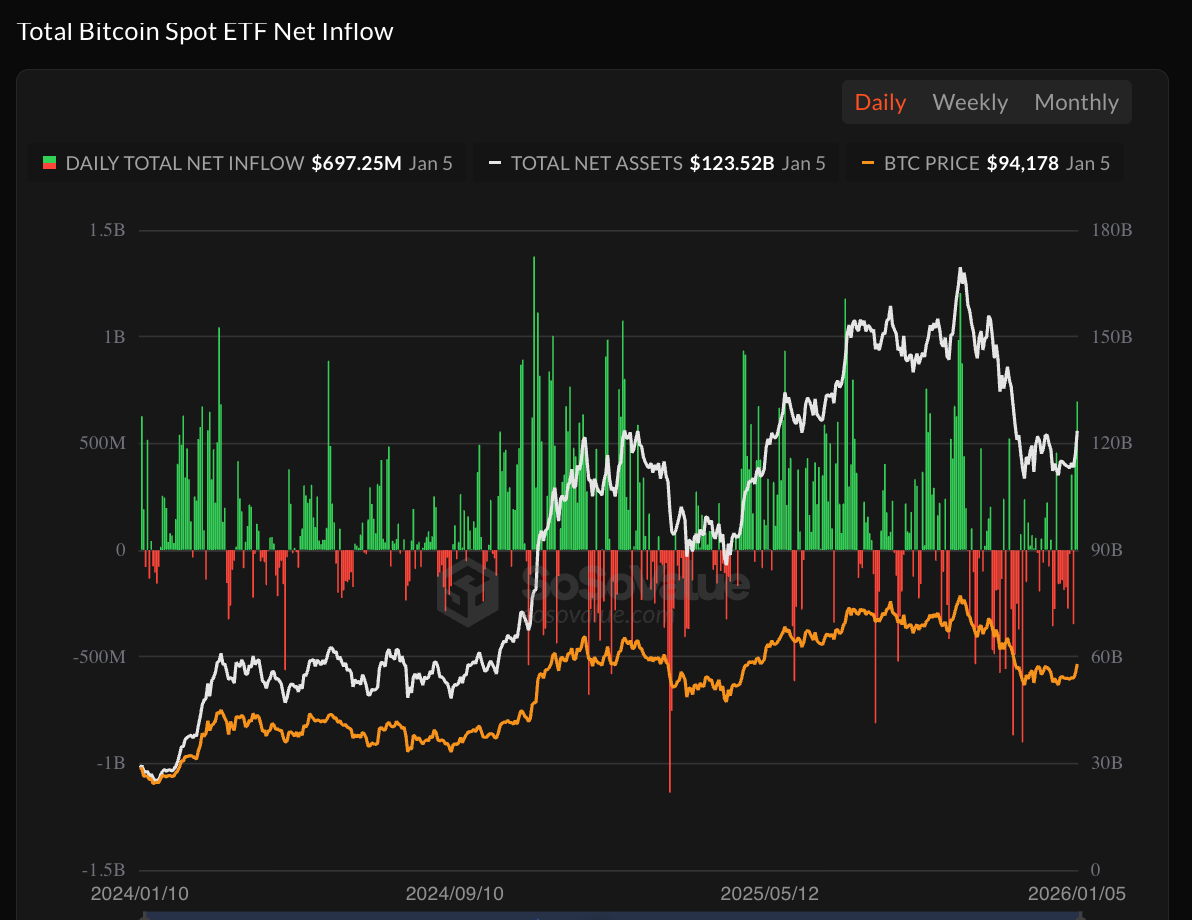

U.S. spot Bitcoin ETFs recorded $697 million in net inflows on January 5, marking the largest single-day inflow in over three months, per Sosovalue data. BlackRock's IBIT ETF led with $372 million in inflows, bringing its total historical net inflow above $62.7 billion.

The surge in institutional investment signals renewed appetite for bitcoin exposure through regulated investment vehicles following the year-end holiday period when flows had stagnated.

Sentiment Indicators Flip Bullish, Crypto Stocks Rally

After 22 consecutive days in negative territory, the Coinbase Bitcoin Premium Index turned positive, indicating buying pressure during U.S. market hours is increasing and signaling a return of dollar-based capital to the market.

Options traders are positioning aggressively for further upside, with open interest for call options at the $100,000 strike price for January expiry now more than double the next most popular contract, according to Bloomberg data.

Crypto-related equities posted broad gains Monday. Coinbase ROSE nearly 8% to close just under $255, while Robinhood gained almost 7% to finish at $123. Mining firm BitMine Immersion Technologies climbed 7%, and Bitcoin treasury company Strategy advanced nearly 5%.

Macro Narratives Build

Market participants are citing several developing macro narratives as potential tailwinds. Unconfirmed rumors suggest Japan may be preparing to launch its own Bitcoin ETF, sparking speculation about a new major pool of institutional capital.

Analysts also point to the geopolitical situation following Venezuela's Maduro capture as a potential catalyst. Some theorize that U.S. control of Venezuelan oil could lead to lower energy prices and support monetary easing, benefiting risk assets. Additionally, speculation persists around Venezuela's rumored holdings of over 600,000 BTC, which if seized and held as a strategic asset could create significant supply constraints.

➢ Stay ahead of the curve. Join Blockhead on Telegram today for all the latest in crypto.+ Follow Blockhead on Google News