Users Are the Best Investors to Have: Why Crypto’s True Believers Outperform Wall Street

Forget the suits. The real alpha isn't on Wall Street—it's in the wallets of the people actually using the network.

Product-Market Fit as the Ultimate Investment Thesis

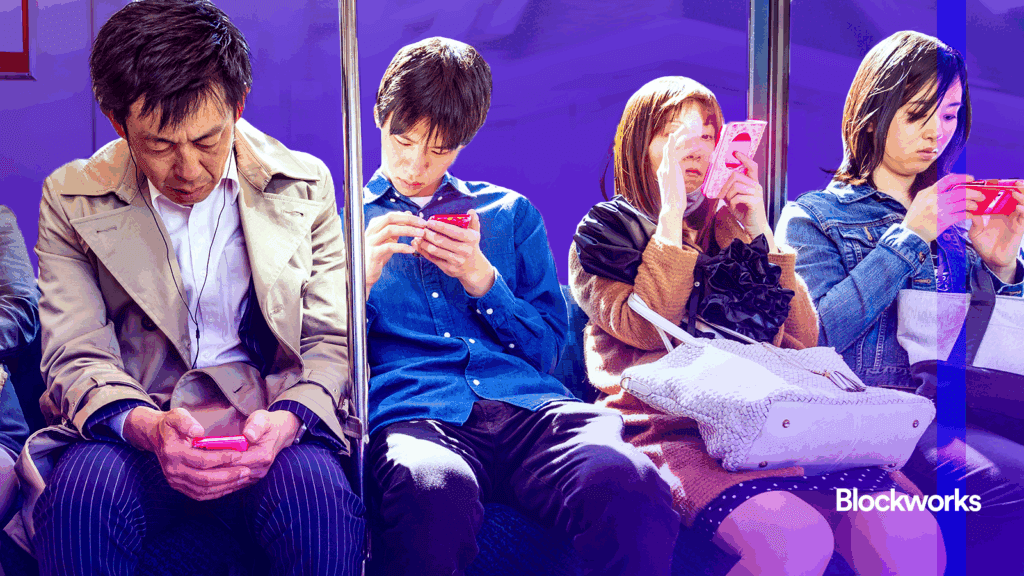

Traditional finance obsesses over spreadsheets and quarterly reports. Crypto's most successful projects measure success by daily active addresses and protocol revenue. Users don't just hold tokens; they stake, swap, lend, and build. That engagement creates a flywheel of value that no hedge fund can replicate through passive ownership alone.

The Network Effect's Compounding Returns

Every new user joining a decentralized application doesn't just increase the token's potential buyer pool—they expand the entire ecosystem's utility. More developers build, more liquidity pools form, more use cases emerge. This organic growth cycle turns users into evangelists and evangelists into the most committed capital allocators imaginable.

Skin in the Game Beats Analyst Reports

While traditional investors read prospectuses, crypto users test smart contracts with real funds. They experience gas fees, governance proposals, and upgrade cycles firsthand. This creates market intelligence no Bloomberg terminal can provide—the kind that spots fundamental shifts weeks before traditional analysts catch up. (Take that, overpaid research departments.)

When your investors are also your customers, your community, and your stress-testers, you're not just building a product—you're building an economic organism that grows stronger with every interaction. That's the decentralized advantage no centralized entity can manufacture, no matter how many zeroes they have under management.