Worldcoin (WLD) Defies Gravity: $2 Accumulation Zone Sparks Long-Term Bull Run

Worldcoin isn't just holding support—it's building a launchpad. As traditional markets wobble, WLD's technical foundation remains rock solid.

The $2 Sweet Spot

Analysts are circling $2 like sharks in chum-filled waters. This isn't just another price level—it's the accumulation zone where smart money positions for the next leg up. Forget the noise, focus on the chart: that support line isn't just holding, it's screaming 'buy opportunity.'

Long Game, Big Gains

While day traders chase pennies, institutional players are building positions for the 2026 cycle. The math is simple: accumulate at $2, target multiples higher. Because in crypto, patience isn't just a virtue—it's a profit strategy.

Meanwhile, traditional finance keeps pretending they understand blockchain while missing every major move. Some things never change—like bankers being late to the party.

Following months of corrective action, the token appears to be stabilizing around the $1.20 region, a zone that some traders believe could represent a key base before the next upward cycle.

Highlight Sees $2.05 as Key Entry for Next Bull Cycle

According to crypto analyst Coins on Coinbase, the coin presents a compelling long-term opportunity if price strength returns above the $2.05 level. In a recent X post, the analyst stated plans to “invest a huge amount in WLD at $2.05,” citing the potential for a 10x–100x return should market sentiment shift decisively bullish in the coming months.

Source: X

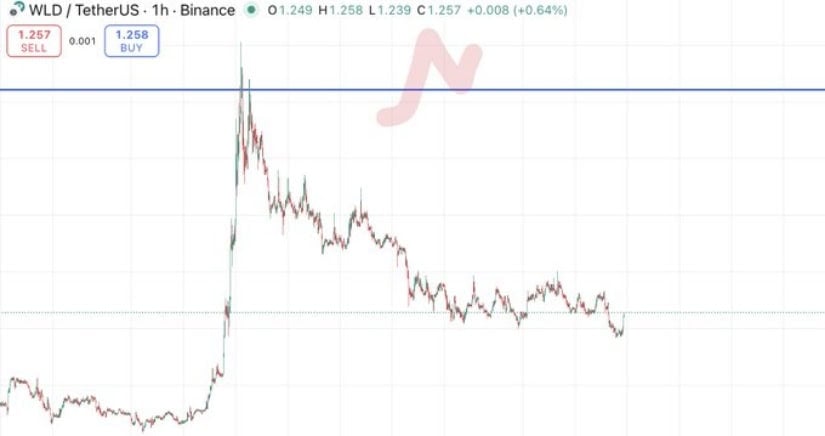

The accompanying chart from Coinbase shows the coin in a prolonged downtrend following an early-year breakout that failed to hold. Despite the correction, the analyst’s view frames the current setup as a potential accumulation zone — a phase where long-term investors could position for the next cycle’s expansion. Historically, such retests of post-hype support levels have often preceded major rallies, particularly when volume and network activity begin to rebuild from low baselines.

However, the analyst also cautions that patience is key. For this thesis to play out, the token must reclaim higher structural levels — beginning with $1.50 and later $2.05 — to confirm a macro reversal and reestablish sustained bullish momentum.

Market Data Reflects Stabilizing Conditions Amid Low Volatility

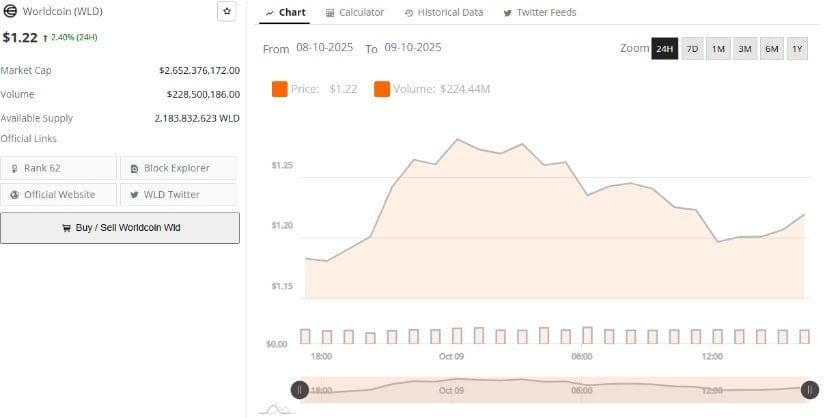

On one hand, BraveNewCoin data, Worldcoin is currently priced at $1.22, marking a 2.40% gain in the past 24 hours. The token’s market capitalization stands at $2.65 billion, supported by a 24-hour trading volume of $228.5 million.

With an available supply of 2.18 billion tokens, the token ranks 62nd by total market value, maintaining a moderate liquidity profile across exchanges.

Source: BraveNewCoin

Despite its relatively flat performance in recent sessions, analysts point out that the subdued price movement may actually be constructive after months of volatility. As speculative interest cools and Leveraged positions unwind, the coin’s order books appear to be resetting toward more organic trading activity.

Market watchers note that sustained volume stability above $200 million per day could signal a gradual return of accumulation and renewed investor confidence.

Open Interest Drop Signals Market Reset and Potential Accumulation

On the other hand, data from open interest metrics provides additional insight into the coin’s current phase. The daily WLD/USD chart shows that after a sharp spike above $2.40, price action swiftly retraced, forming a descending pattern that brought the token back toward $1.20.

During this period, open interest surged above $600 million, reflecting heightened speculative activity.

Source: Open Interest

However, as prices corrected, open interest declined sharply and has since stabilized NEAR $300 million, suggesting that excessive leverage has been flushed from the market.

This contraction in open interest typically precedes phases of consolidation and reaccumulation — conditions that often set the stage for the next directional move. For the asset, the current equilibrium suggests that neither buyers nor sellers are in full control, and that a breakout from this tight range will likely define the asset’s medium-term trajectory.

Traders are now watching for a clean reclaim above $1.35–$1.50 as a signal of renewed bullish intent. Failure to hold current support could, however, expose the price to retests of lower historical ranges before any sustainable recovery unfolds.