XRP Rockets Back to $2.46: Defiant 42% Recovery After Trump’s Tariff Tumble

XRP stages dramatic comeback as market shakes off political shockwaves

The Phoenix Rises From Tariff Ashes

Digital asset XRP just pulled off one of the most impressive recovery acts in recent crypto memory—soaring back to $2.46 after getting hammered by a 42% flash crash. The trigger? Another round of presidential tariff announcements that sent traditional markets reeling and crypto spiraling in sympathy.

Resilience Meets Opportunity

While Wall Street analysts were busy downgrading Chinese export stocks, crypto traders spotted the bounce play of the week. The swift rebound demonstrates what veteran crypto investors have known for years: digital assets don't just follow traditional market patterns—they create their own momentum.

Meanwhile, traditional finance pundits are still trying to explain why their precious tariff hedges underperformed... again. Some things never change in the land of quarterly reports and committee meetings.

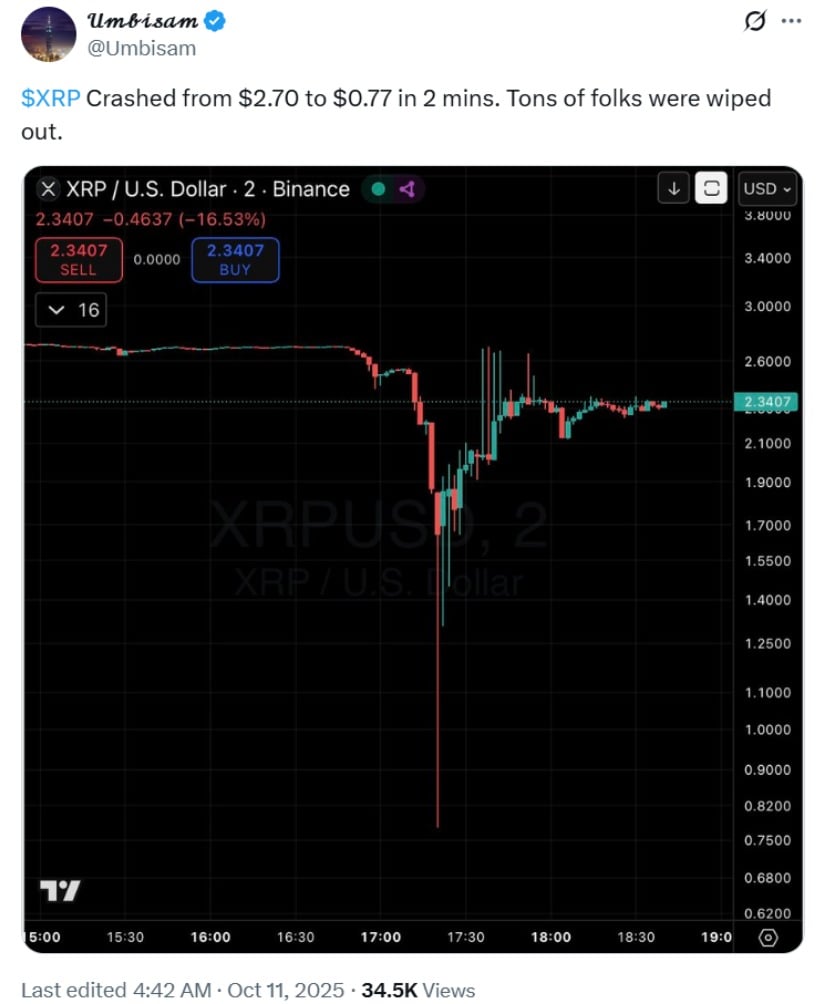

The xrp price briefly collapsed from $2.70 to as low as $0.77 on Binance within just two minutes, before recovering to $2.46 by the following day. The sharp decline was part of a wider $19 billion liquidation cascade triggered by President Donald Trump’s announcement of 100% tariffs on Chinese imports, sending shockwaves across the entire digital asset market.

XRP Price Crash: What Triggered the Sudden Drop?

The sudden price drop caught many traders off guard. At its lowest point, the XRP current price plunged nearly 42%, wiping out billions in market capitalization and liquidating Leveraged positions at record speed. According to data from CoinDesk, open interest in XRP futures contracts contracted by $150 million during the sell-off, reflecting massive deleveraging across the market.

XRP plunged from $2.70 to $0.77 within two minutes, triggering massive liquidations and wiping out countless leveraged positions. Source: @Umbisam via X

This flash crash coincided with a surge in trading volume—164% above the 30-day average—signaling intense institutional or whale activity. A candlestick chart from Binance showed a single long red candle representing the rapid collapse amid thin liquidity.

Market analysts pointed to macroeconomic catalysts behind the move. Trump’s tariff announcement fueled a wave of risk-off sentiment, pushing investors out of crypto assets and into cash or safer instruments. Bitcoin fell sharply to around $113,000, while ethereum sank below $4,000, amplifying downward pressure on altcoins like XRP.

Massive XRP Sell-Off Amid Wider Crypto Weakness

The selloff in XRP was part of a larger market downturn. In the hours following the tariff news, global risk assets slid sharply. The stronger U.S. dollar, rising Treasury yields, and heightened geopolitical tensions added to the selling pressure. Technical breakdowns further worsened the drop as XRP slipped below key support levels at $2.75 and $2.50.

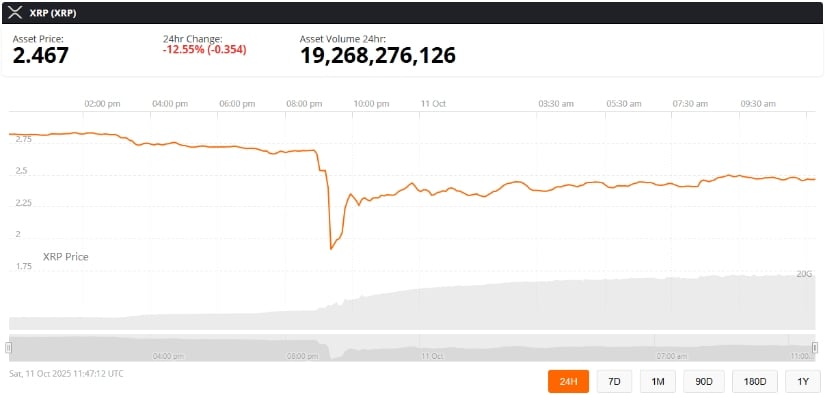

XRP was trading at around $2.46, down 12.55% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Despite the steep drop, some long-term holders reportedly increased their positions during the crash. Accumulation patterns on-chain suggested growing confidence among certain investors who viewed the dip as a buying opportunity rather than a signal to exit.

What’s Next for XRP After the Sudden Plunge?

Market watchers are now closely monitoring whether XRP can sustain its position above the $2.30 support level. A breakdown below this zone could expose the token to further downside toward $2.00 or even $1.80. On the flip side, if bulls manage to reclaim $2.75, analysts believe momentum could quickly shift back toward the $3.00 mark.

XRP swiftly recovered nearly 50% of its earlier crash, signaling a sharp rebound after extreme volatility. Source: @Morecryptoonl via X

Technical indicators show that XRP faces strong resistance at $2.75, while immediate support remains at $2.20. The XRP chart also highlights a descending trendline rejection NEAR $3.00, confirming short-term bearish sentiment.

This price volatility comes at a crucial time as the market anticipates developments around potential XRP ETF products and increased institutional interest. Analysts suggest that a period of consolidation may follow before the next significant move.

Final Thoughts

The latest XRP flash crash is a reminder of just how quickly sentiment can shift in the cryptocurrency market. While the XRP price today reflects a strong rebound from its intraday lows, the broader market remains sensitive to geopolitical and macroeconomic developments.

Despite short-term uncertainty, Ripple’s legal resolution and institutional expansion continue to strengthen its long-term fundamentals. Whether this will translate into sustained price recovery depends on how global markets digest ongoing tariff tensions and whether confidence returns to risk assets.

For traders and investors alike, volatility remains the key theme. The XRP price prediction in the coming weeks may hinge not only on technical levels but also on the evolving geopolitical landscape and investor sentiment.