Toncoin (TON) Price Prediction: TON Plunges 21% Amid $7B Market Carnage - Can Bulls Stage a Comeback?

Toncoin gets hammered as crypto markets bleed billions.

The $7 Billion Wipeout

TON slashes 21% of its value in a brutal market rout that vaporized fortunes overnight. The token briefly clawed back some losses during Wednesday's dead cat bounce, but momentum fizzled faster than a meme coin promise.

Technical Breakdown

Support levels crumbled like regulatory promises as selling pressure overwhelmed every defense. The brief recovery attempt barely registered on charts before bears mauled the rally into submission.

Market Psychology

Traders scrambled for exits while perpetual optimists mumbled about 'buying opportunities' - the same crowd that thought Luna was undervalued at $90.

Where Next for TON?

The path forward looks treacherous with resistance stacking up like Wall Street bonuses. Either TON finds solid footing here or risks testing depths that make submarine implosions look graceful.

The token’s dramatic rebound from steep intraday losses has reignited discussion around its recovery potential and the broader resilience of the TON blockchain ecosystem. Despite heavy selling pressure triggered by sudden macroeconomic shocks, Toncoin’s swift bounce back highlighted both market volatility and investor confidence in its long-term fundamentals.

Toncoin (TON) witnessed a remarkable rebound following one of the most turbulent days of the year. After plunging nearly 50% within 24 hours, the TON coin price quickly recovered from intraday lows around $1.53, showcasing its resilience in a market rattled by fear and forced liquidations.

The broader crypto sector suffered a massive jolt on October 10, 2025, after U.S. President Trump announced a 100% tariff on Chinese imports. The unexpected policy move sparked panic selling, liquidating over $7 billion in Leveraged crypto positions. Toncoin was among the hardest-hit altcoins, dropping 41% before swiftly rebounding, reaffirming its reputation as one of the most reactive and community-backed assets in the digital economy.

Understanding the Flash Crash

Analysts described the event as a “textbook liquidation cascade.” A mix of excessive leverage, low liquidity, and macroeconomic uncertainty triggered rapid sell-offs across major exchanges. Altcoins like Toncoin were particularly exposed due to their higher volatility and thinner trading books compared to leading digital assets like Bitcoin and Ethereum.

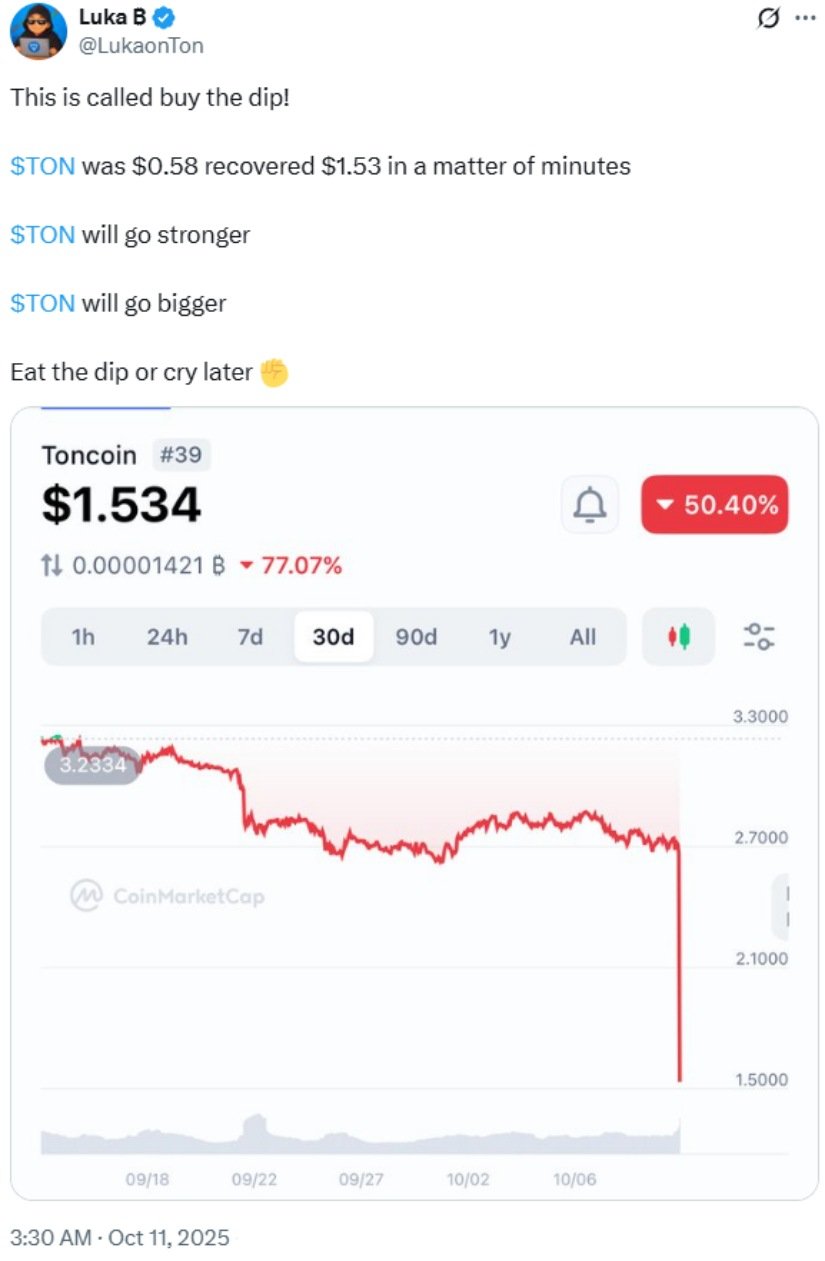

$TON surged from $0.58 to $1.53 within minutes, signaling a strong recovery and bullish momentum. Source: @LukaonTon via X

During the flash crash, some platforms briefly displayed Toncoin trading as low as $0.58, though corrected data later confirmed a more accurate floor NEAR $1.53. The quick rebound suggested robust buying interest from long-term holders and opportunistic traders who capitalized on the panic to accumulate positions.

Community Confidence Amid Chaos

Despite the steep decline, the TON blockchain community maintained an upbeat tone. Influencers such as @LukaonTon, a blockchain explorer and DeFi advocate, urged their followers to “buy the dip,” emphasizing Toncoin’s potential beyond short-term volatility. Many highlighted TON’s DEEP integration with Telegram, which continues to bolster its ecosystem through real-world use and user accessibility.

TON faces a potential drop from $2 to $1.88 after breaking its uptrend, though a recovery remains possible if it closes above the key resistance line. Source: CryptoandForexplus on TradingView

Meanwhile, @the_daily_ton shared a post reporting Toncoin’s partial recovery above $2, with a market cap of $6.58 billion and 24-hour trading volume near $151 million. Despite a 46% daily drop, community reactions leaned positive, underscoring TON’s reputation for resilience and its loyal holder base that has weathered similar storms before.

Toncoin Price Prediction: What’s Next for TON?

As volatility begins to subside, attention shifts to the TON price prediction for the coming weeks. Technical analysts suggest TON could stabilize within the $1.50–$1.80 range before attempting a new rally. A sustained break above $2.50 may pave the way toward the $3 mark—a psychological level closely watched by traders.

However, global macro risks remain a potential drag. Continued geopolitical uncertainty or fresh policy shocks could delay recovery. Still, with Telegram integration, growing DeFi projects, and active network participation, TON’s long-term prospects appear promising once broader market sentiment improves.

The Road Ahead for Toncoin

The October flash crash proved to be both a stress test and a testament to Toncoin’s endurance. Despite suffering one of its steepest daily drops in recent memory, the TON coin quickly regained traction, signaling faith among investors in its long-term trajectory.

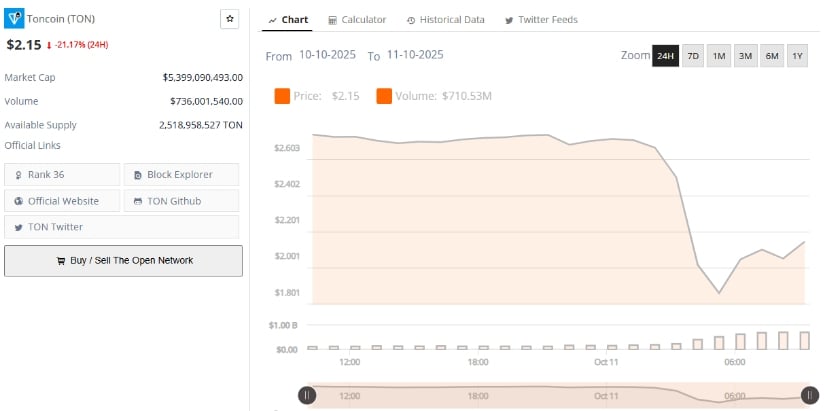

Toncoin was trading at around $2.15, down 21.17% in the last 24 hours. Source: Brave New Coin

As the TON blockchain continues to evolve—powering payments, decentralized applications, and in-chat financial tools—Toncoin’s role as a utility-driven crypto asset grows stronger. While short-term price swings remain inevitable, the speed of its recovery demonstrates that TON is more than just another altcoin; it’s a project backed by real-world integration, a vibrant community, and an ecosystem built for sustained relevance.

Toncoin’s rapid rebound amid chaos reveals both its volatility and its strength. As traders look beyond short-term shocks, confidence in the TON blockchain and its expanding use cases could drive TON’s next major move.