Litecoin (LTC) Price Prediction: 23% Crash Sets Stage for 2017-Style Parabolic Rally - Is History Repeating?

Litecoin's brutal 23% collapse might just be the setup for something spectacular.

The Ghost of 2017 Returns

Chart patterns don't lie - LTC is tracing the exact same trajectory that preceded its legendary 2017 bull run. That crash? Just a classic shakeout before the real move begins.

Institutional Whispers Grow Louder

Smart money's circling while retail panics. Because nothing says 'buying opportunity' like watching amateur traders dump their bags at the bottom.

The Parabolic Countdown

Technical signals are flashing green while fundamentals strengthen. The only thing missing? The courage to buy when everyone else is selling.

Another crypto winter, another chance for the disciplined to get rich while the emotional get wrecked.

Despite the fear sweeping through the crypto market, data shows that smart money may be quietly accumulating LTC, setting the stage for a potential long-term rebound. Historical comparisons, on-chain trends, and technical patterns all point toward a scenario where the latest dip could be less of a collapse and more of a catalyst.

Litecoin Plunges but History Suggests a Familiar Setup

Litecoin (LTC) experienced a sharp 23% decline on October 10, 2025, dropping from around $134 to $85 amid a broader crypto-market liquidation that wiped out nearly $19 billion in open positions. The sell-off, reportedly triggered by renewed U.S.-China tariff tensions, shook investor confidence across the market.

However, some analysts believe this dramatic “flush” could mark the beginning of something much larger—mirroring Litecoin’s 2017 pattern, when a similar washout was followed by a parabolic rally to over $375.

Litecoin experienced a similar major flush in 2017 before launching into a parabolic rally—raising speculation that history may be repeating itself. Source: Minimilian via X

Crypto trader @DMinimilian compared the two events, highlighting nearly identical candlestick structures on the weekly logarithmic chart, suggesting that history could be preparing to repeat itself. “Litecoin in 2017 also had a big flush before it went parabolic,” he wrote on X.

Data Points to Accumulation, Not Capitulation

While the recent correction may look bearish on the surface, on-chain metrics tell a different story. According to analyst Erica Hazel, over $10.5 million worth of LTC moved off exchanges during the downturn—an indicator of long-term accumulation rather than panic selling.

“When coins leave exchanges, it usually signals that holders are storing them for the long term,” Hazel noted. “It’s textbook accumulation, not capitulation.”

Despite a 22% drop, on-chain data shows Litecoin in accumulation—not capitulation. Source: Erica Hazel

Supporting this view, trading volume spiked 125%, while Litecoin’s Relative Strength Index (RSI) approached oversold levels. These factors combined suggest that smart money could be quietly buying, anticipating a rebound in Litecoin price once market volatility cools.

Technical Structure: Wedge Breakout in Play

Trader CustomizedTrader highlighted a compelling technical setup on Litecoin’s weekly chart, showing a massive descending wedge formation—historically a bullish reversal pattern. The LTC price is now testing the upper boundary of the wedge between $130 and $150.

If Litecoin manages to break out from this resistance zone, Fibonacci projections point toward a long-term upside target NEAR $650. While that might seem ambitious, similar breakouts have marked the start of previous Litecoin bull runs, especially during Litecoin halving phases, which tend to reduce supply and boost investor sentiment.

Analyst Outlook: From Recovery to Potential Rally

Earlier this month, market analyst Arman Shaban noted that Litecoin’s value had already rebounded from $115 to $133, gaining more than 30% since his last analysis. He expects further continuation if momentum holds, identifying $155, $200, and $268 as the next bullish targets.

Litecoin (LTC) has surged over 30% from $115 to $133, with bullish targets ahead at $155, $200, and $268. Source: ArmanShabanTra via X

“Litecoin has regained strength above key moving averages, with RSI momentum improving,” Shaban explained. “Historically, these conditions have preceded parabolic expansions.”

What’s Next for Litecoin?

The combination of accumulation signals, wedge breakout potential, and historical pattern resemblance gives Litecoin a compelling setup heading into the year’s final quarter. However, speculators are eagerly waiting for confirmation—especially with the rumor of a possible Litecoin ETF (LTC ETF), which can boost institutional participation.

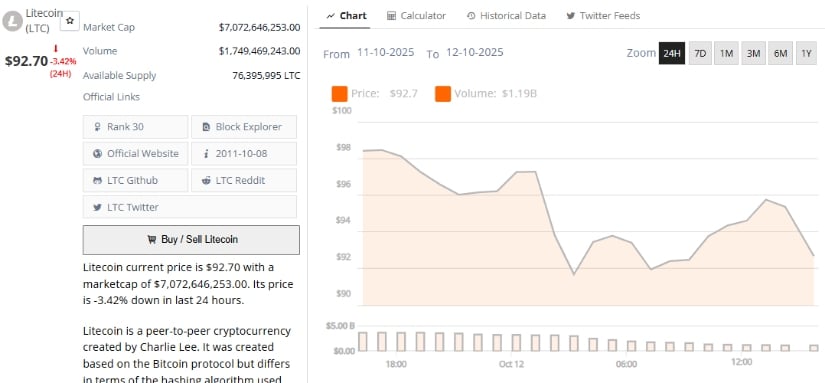

Litecoin was trading at around $92.70, down 3.42% in the last 24 hours at press time. Source: Brave New Coin

At the same time, on-chain data reflects heavy long positions, which suggests another round of volatility before a clear trend comes into view.

For the moment, Litecoin Price forecasts are cautiously bullish. While short-term vulnerability persists, the majority of analysts opine that LTC could be quietly setting the stage for its subsequent big cycle, such as the same conditions before its mythical 2017 spree.