Ethereum ETF Frenzy: $141M Floods In as Bull Flag Signals Imminent $6,000 Breakout

Wall Street's betting big on Ethereum—massive institutional money pours into ETH ETFs while technical patterns scream bullish momentum.

The $141 Million Stampede

ETF inflows hit staggering levels this week as traditional finance finally wakes up to Ethereum's potential. Institutional investors are diving in headfirst, pushing daily inflows to levels that would make traditional asset managers blush.

Technical Breakout Imminent

That classic bull flag formation? It's pointing toward a massive $6,000 price target. Chart analysts are circling the date on their calendars while traders position for what could be Ethereum's next major leg up.

Meanwhile, the old guard still debates whether crypto is 'real'—as $141 million quietly moves from their pockets into digital assets. Some things never change in finance.

Analysts are closely watching the $3,600 support zone, where ethereum continues to consolidate in a textbook bull flag formation that could set the stage for a rally toward $6,000 by the end of 2025.

Institutional Demand Strengthens as ETF Inflows Rebound

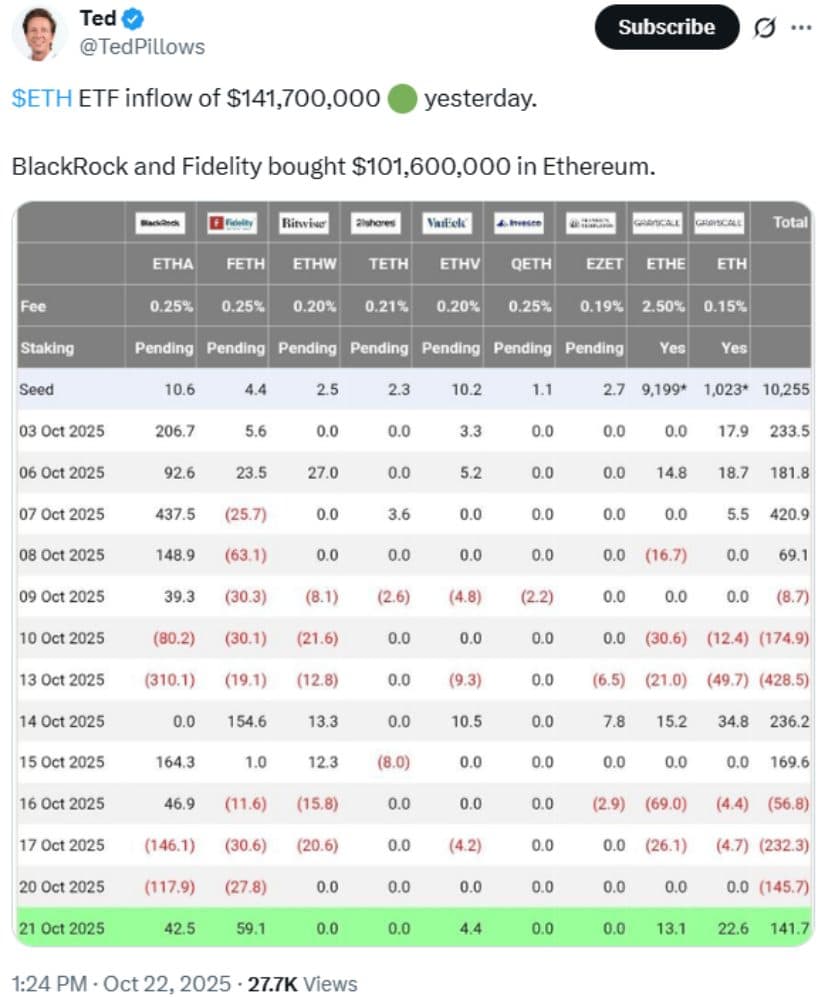

According to on-chain and ETF data shared by market analyst @TedPillows, spot Ethereum ETFs recorded a combined $141.7 million in net inflows on October 21, 2025, signaling renewed institutional interest after several days of outflows.

Ethereum ETFs saw $141.7M in inflows as BlackRock and Fidelity led with $101.6M in fresh ETH purchases. Source: @TedPillows via X

BlackRock’s ETHA and Fidelity’s FETH products led the surge, contributing $42.5 million and $59.1 million, respectively. Other issuers like VanEck, Bitwise, and Grayscale also posted modest gains, confirming positive flows across all nine U.S.-listed Ethereum ETFs that day.

This uptick in institutional activity coincides with broader strength in crypto investment vehicles—Bitcoin ETFs also saw inflows of over $477 million, suggesting a market-wide improvement in sentiment. Historically, sustained inflows in Ethereum ETFs have preceded 5–10% price gains within a week when accompanied by stable market liquidity.

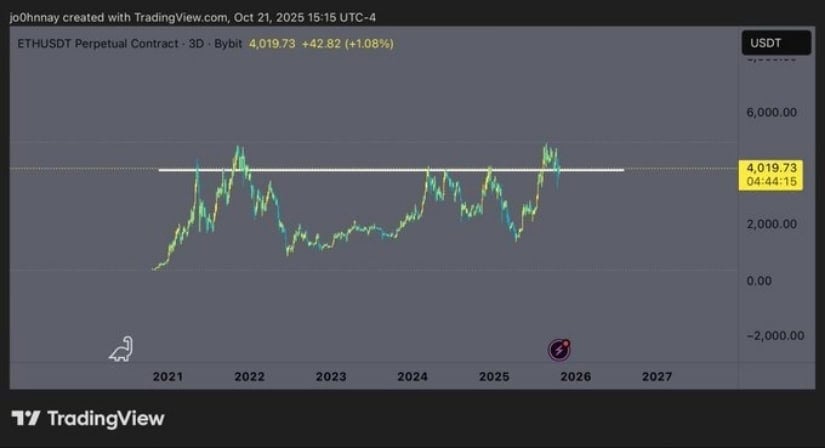

Ethereum Forms Bull Flag as Analysts Target $6,000

Ethereum’s technical structure continues to favor the bulls. Popular analyst @EtherWizz_ highlighted a well-defined bull flag on the weekly ETH/USD chart, with price consolidation above the $3,600 support zone. “As long as Ethereum holds this support zone, there’s no reason to be bearish,” the analyst noted, projecting a potential MOVE toward the $6,000–$8,000 range** by year-end**.

Ethereum forms a bullish flag pattern, holding key support as traders eye a potential rally toward the $6,000–$8,000 range by year-end. Source: @EtherWizz via X

As of October 22, 2025, ETH trades around $3,850, slightly lower over the past 24 hours but maintaining structure above its key horizontal support. Technical models suggest that a confirmed breakout above the $4,100–$4,200 resistance area could open a path toward the $4,500–$5,200 range in the short term.

Echoing the bullish sentiment, trader @CryptoGodJohn remarked, “It’s hard to be bearish on ETH when weekly support is still holding. A little more consolidation around these levels, and I’m expecting price discovery to begin towards $6K.”

This view aligns with current ethereum price analysis showing steady accumulation by long-term holders, while recent on-chain data highlights increased staking participation and reduced exchange balances—both typically seen before price expansion phases.

Market Sentiment and On-Chain Dynamics

Community sentiment across X leans broadly optimistic, with many traders pointing to institutional accumulation, ETF inflows, and DeFi sector growth as key drivers behind Ethereum’s strengthening structure.

Ethereum holds firm at weekly support, with analysts expecting consolidation to give way to a breakout toward $6,000. Source: @CryptoGodJohn via X

At the same time, market watchers remain cautious about potential near-term volatility. Some analysts warn of short-term pullbacks toward $3,700–$3,800, citing overextended technical indicators and the need for additional momentum from macro catalysts, such as U.S. rate cuts or renewed interest in Ethereum staking.

Ethereum Price Outlook

The current confluence of strong ETF inflows and bullish technical structure supports a constructive outlook for Ethereum heading into late 2025. If buying momentum continues and the bull flag pattern confirms on higher volume, Ethereum could make a sustained run toward the $6,000 level—marking a new multi-month high and signaling renewed institutional confidence in the world’s second-largest crypto asset.

Ethereum (ETH) was trading at around $3,859, down 0.52% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

However, failure to hold above $3,600 could delay the bullish setup, potentially leading to a retest of lower support zones around $3,200–$3,400 before recovery resumes.

Overall, Ethereum’s medium-term forecast remains positive, supported by ETF-driven capital inflows, steady network activity, and a solid technical base that may soon translate into another major upward leg for the ETH price.