Optimism Price Eyes $0.43 Comeback as Open Interest Surges – Bullish Momentum Building

Optimism (OP) shakes off the bears as its price gears up for a potential rebound to $0.43. Open interest climbs—traders are betting big on this Layer 2 contender.

Why the sudden optimism? The market’s sniffing out a turnaround. After a rough patch, OP’s showing signs of life, and derivatives traders are piling in. Open interest doesn’t lie—well, usually.

Layer 2s aren’t dead yet. While Ethereum’s gas fees still annoy everyone, OP’s cheap transactions and growing ecosystem might just give it an edge. Or maybe traders just love a good underdog story.

Cynical take: Another day, another crypto ‘recovery’ narrative. But hey, at least this one’s got data—for now.

While the coin remains below its previous highs, the market structure shows early signs of rebuilding momentum as volatility eases

Price Overview and Market Data Outlook

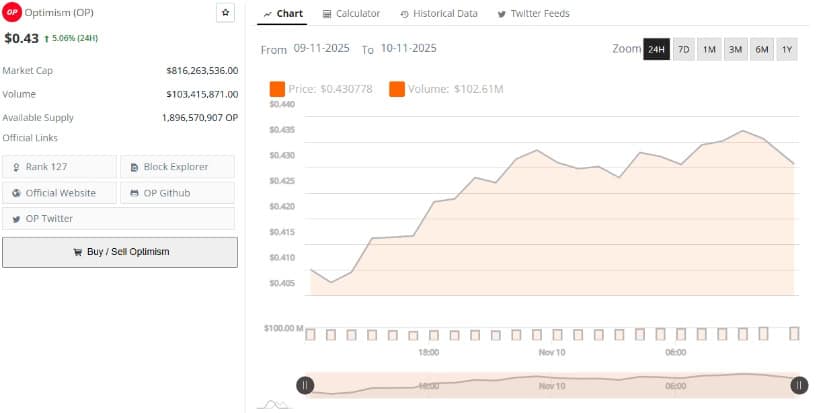

Optimism’s native token, the coin, is showing signs of a technical rebound after a volatile start to November. The price currently trades NEAR $0.43, marking a 5.06% gain over the past 24 hours, according to data from BraveNewCoin.

Source: BraveNewCoin

The asset’s market capitalization stands at $816.26 million, supported by a daily trading volume of approximately $103.41 million. Despite broader market uncertainty, the coin’s latest price action reflects a potential shift in sentiment as traders cautiously re-enter long positions following a multi-week downtrend.

Open Interest Suggests Renewed Trader Participation

Data from Coinalyze shows that aggregated open interest in OP futures markets has begun to stabilize around $57.08 million, after previously declining sharply during the early part of the month. This flattening of OI coincides with the coin’s rebound from the $0.32–$0.34 region, suggesting that the wave of liquidations seen earlier may have cleared out weak hands and set the stage for more sustainable trading activity.

Source: Open Interest

As price has moved higher, open interest has held steady rather than spiking — a signal that the market is shifting from speculative trading to gradual accumulation. Analysts interpret this as a constructive development, implying that recent buyers are positioning with stronger conviction rather than short-term leverage.

If OI begins to climb further alongside rising prices, it could confirm increasing bullish engagement, potentially supporting a continuation of the recovery rally toward higher resistance levels.

Technical Analysis: Bollinger Bands and CMF Indicate Strengthening Momentum

On the daily timeframe, the Bollinger Bands on the OP/USDT chart highlight a narrowing volatility range, with the basis line at $0.416 and the upper band near $0.481. The current price of $0.4337 sits slightly above the mid-band, indicating early signs of regained control by buyers.

Source: TradingView

A decisive close above $0.44 could open the path toward a test of the upper Bollinger Band at $0.48, which aligns with short-term resistance observed during prior consolidation phases. Conversely, failure to hold above the basis line may lead to a retest of support near $0.38–$0.40.

The Chaikin Money Flow (CMF) indicator currently reads +0.09, marking a positive shift in capital flow into the coin, suggesting that buying pressure is beginning to outweigh selling activity, reinforcing the bullish bias implied by the improving price structure. Sustained CMF values above zero WOULD further validate accumulation and enhance the likelihood of a continued upward trajectory.