BNB Defies Market Volatility: Strong Buyer Support Keeps Price Above $1,000

BNB isn't backing down. Despite swirling market uncertainty, the token holds firm above the $1,000 threshold—buyers dig in like Wall Street bulls before a Fed meeting.

Defensive lines hold. The $1,000 level has transformed from psychological barrier to fortified support, with traders treating dips like Black Friday discounts.

Volume tells the story. Behind the price resilience? Relentless accumulation—smart money loading up while retail investors still debate 'crypto winter.'

Next resistance? Watch the $1,200 zone. Break that, and we're flirting with ATH territory—though some skeptics whisper about overleveraged longs (then again, when don't they?).

Closing thought: In a market where most alts bleed out, BNB's stand feels less like stability and more like defiance—the kind that either makes careers or breaks margin accounts. Choose your side.

Market participants are observing whether improving momentum can transition into a sustained breakout or whether consolidation will extend before the next directional move. The current price structure suggests cautious accumulation as buyers gradually regain presence NEAR established support zones.

Higher Lows Signal Support Strength, Notes Second Analyst

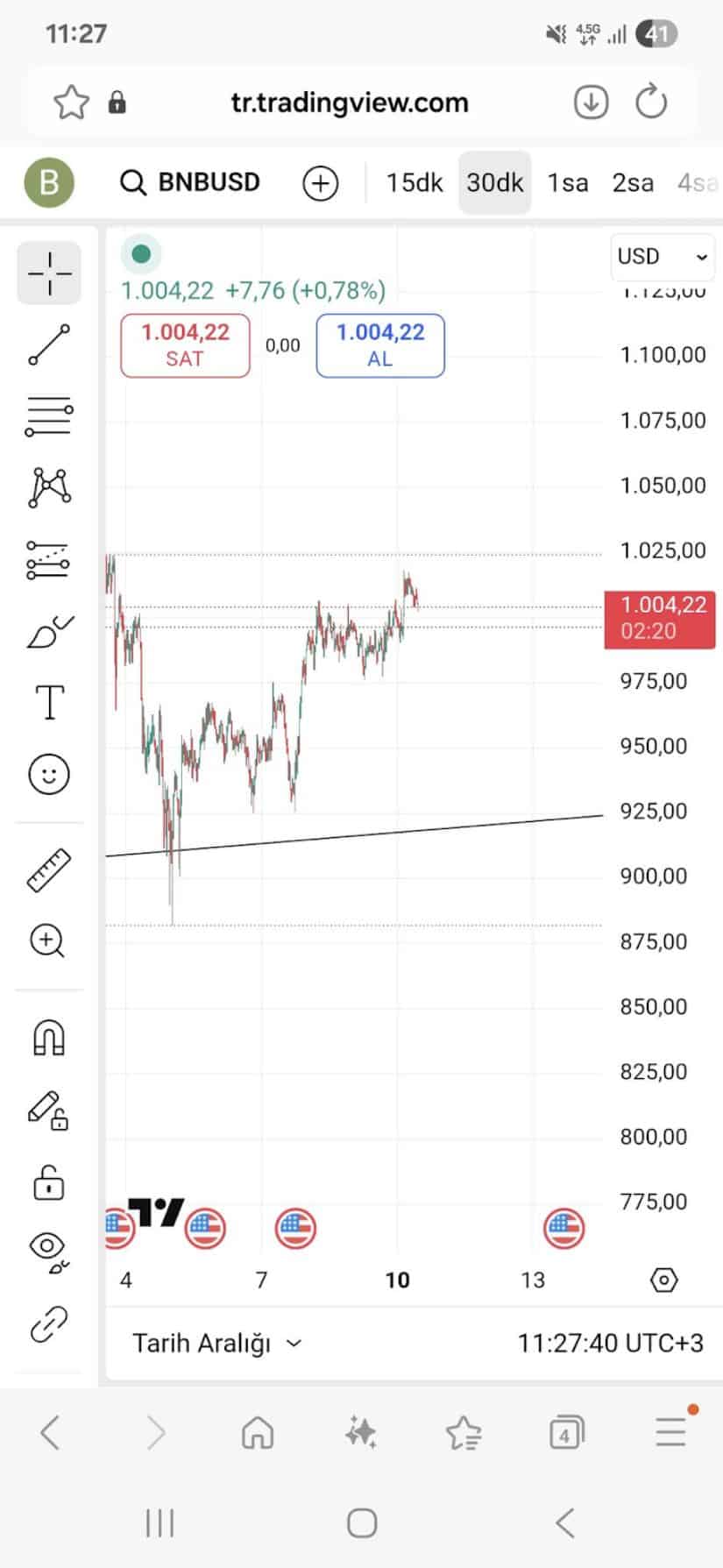

Analyst commentary from @hocca_official observed that at the time of reporting, the coin traded near $1,004.22, reflecting a 0.78% intraday gain. On the lower-timeframe structure, the coin appears to be consolidating above the $1,000 level following a breakout attempt, with short-term positioning showing measured profit-taking rather than active sell pressure.

Source: X

The ascending trendline support around $925 forms an important technical base. According to the analyst, any corrective MOVE is likely to revisit this area as a potential dip-buying opportunity. Price action continues to form higher lows, suggesting the presence of responsive buyers defending downside retracements.

However, resistance near $1,025 remains a notable cap on upward progression. A daily close above $1,025 may unlock an extension toward the $1,050–$1,080 region, while a failure to hold above $1,000 could lead to a measured pullback toward $975. As long as the ascending trendline remains intact, the short-term structure favors gradual upside continuation.

Market Data Notes: Strengthening Accumulation Zone

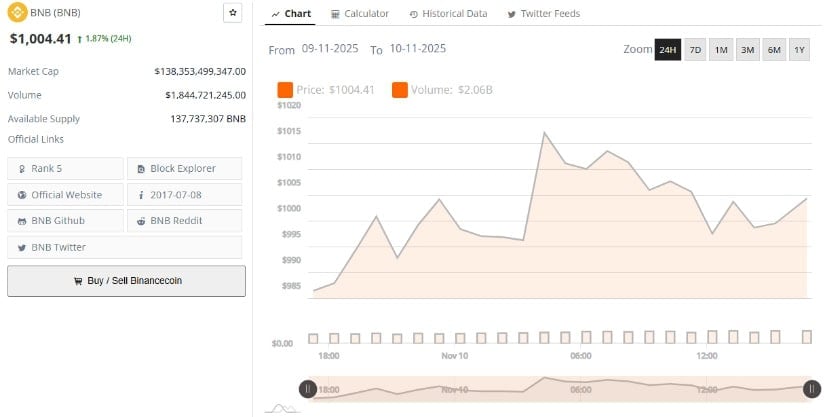

BNB is trading at $1,004.41, marking a 1.87% gain in the past 24 hours, according to data from BraveNewCoin. The token’s market capitalization currently stands at $138.35 billion, supported by a daily trading volume of $1.84 billion.

Source: BraveNewCoin

This upward move reinforces the coin’s stability among the top five cryptocurrencies by market cap, reflecting sustained investor confidence amid moderate market volatility.

The asset’s available supply remains steady at 137.73 million tokens, with trading activity showing resilience around the key psychological level of $1,000, where both buyers and sellers appear active. The recent price range between $975 and $1,020 highlights a tight consolidation phase that could precede a larger directional move.

Market Data Shows Reduced Volatility and Gradual Momentum Shift

According to TradingView, BNB is currently trading at $1,004, showing a +0.80% daily gain. The Bollinger Bands reflect reduced volatility, with price positioned near the middle band at $1,054, indicating a consolidation phase after the recent downtrend. The lower band near $921 provides short-term support, while the upper band near $1,186 marks the next major resistance threshold.

Source: TradingView

The Chaikin Money FLOW (CMF) has moved into positive territory at 0.07, signaling renewed capital inflow and early accumulation behavior. Although BNB remains slightly below the Bollinger midline, the improving CMF trend suggests steady buyer re-engagement.

A break above $1,050 could lead to a retest of the $1,150–$1,200 zone, while failure near resistance risks a return toward $950–$920 support. Market sentiment currently leans cautiously bullish as structure remains intact.