Hyperliquid (HYPE) Price Prediction: Why Traders Are Betting Big on a 2025 Rally

Hyperliquid (HYPE) is flashing bullish signals—and traders aren’t ignoring them. Strong fundamentals and surging optimism suggest this altcoin might be gearing up for its next leg up. Here’s why.

The Case for HYPE’s Breakout

Market sentiment around Hyperliquid has shifted dramatically in recent weeks. Whispers of institutional interest and a rock-solid tokenomics model have traders piling in, betting on a repeat of its 2024 surge.

The Elephant in the Room

Let’s be real—crypto ‘fundamentals’ have a funny way of evaporating when Bitcoin sneezes. But for now, HYPE’s tech stack and liquidity depth make it one of the few altcoins with actual staying power. Or so the bulls claim.

The Bottom Line

If the macro gods cooperate, Hyperliquid could be primed for a serious run. Just don’t be shocked if some ‘unforeseen’ Fed announcement turns the whole rally into another ‘buy the rumor, sell the news’ circus.

HYPE trading activity and on-chain growth are accelerating again, hinting at a potential shift in momentum. Analysts point to rising fees and network usage as proof that interest is quietly returning, setting the stage for what could be a strong comeback phase for HYPE.

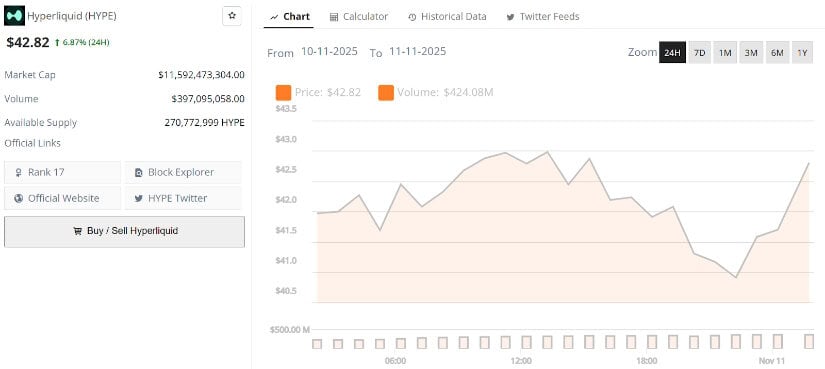

Hyperliquid’s current price is $42.82, up 6.87% in the last 24 hours. Source: Brave New Coin

Hyperliquid On-Chain Growth Reinforces Bullish Case

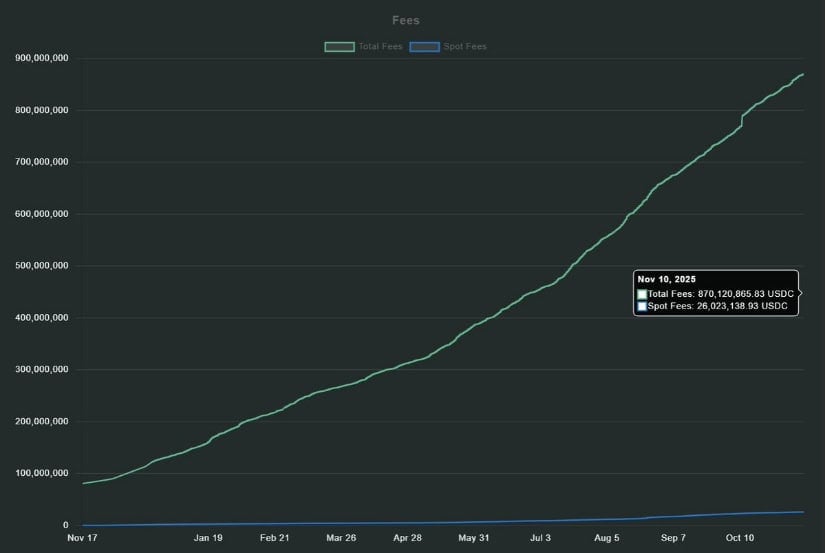

Hyperliquid’s network metrics continue to impress as total fees surpassed $870 million, with over $26 million generated in spot trading alone, according to Hyperliquid News. This steady rise in cumulative fees reflects not just increased usage, but also the growing trader participation across the platform. Sustained fee growth at this scale often signals strong protocol health and consistent liquidity, both of which historically precede market value appreciation.

Hyperliquid’s rapid fee growth highlights its expanding dominance in the DEX sector. Source: Hyperliquid News via X

Such on-chain strength positions Hyperliquid as one of the most actively used exchanges in 2025 and a key factor that could provide structural support to HYPE’s price trajectory moving forward.

HYPE Finds Support at a Critical Level

ShardiB’s chart highlights that HYPE is holding at an important technical zone near $42 to $43, after multiple sessions of consolidation. The price structure suggests a strong base forming above the 20-EMA, with volume starting to stabilize following recent volatility.

HYPE holds firm above key support NEAR $42, forming a strong technical base that could ignite its next bullish leg. Source: ShardiB via X

If HYPE maintains control above this level, the next upside target emerges around $50, where prior resistance and liquidity intersect. RSI readings hovering around neutral indicate there’s room for momentum expansion, hinting that this zone could serve as the launchpad for the next leg higher if confirmed by volume upticks.

Valuation Metrics Indicate Undervaluation

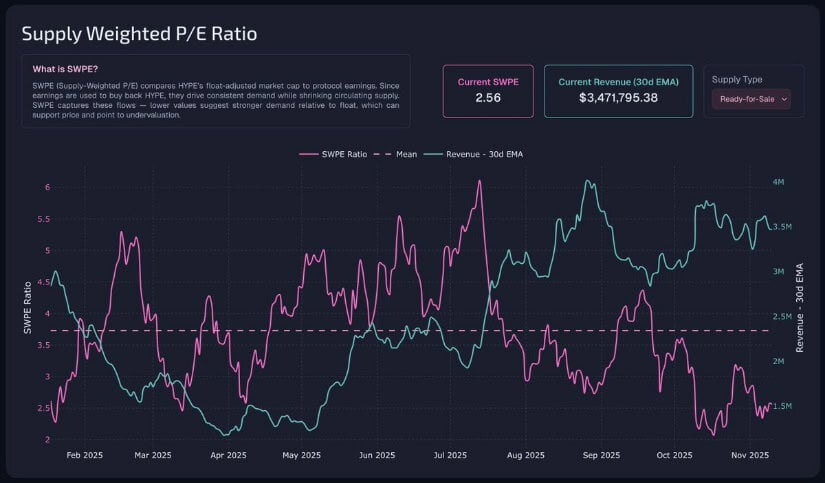

According to Tobias Reisner, Hyperliquid’s Supply-Weighted P/E Ratio (SWPE) has dropped below 3, a threshold that historically marks undervalued conditions for HYPE. The HYPE chart shows the SWPE ratio at 2.56, while the 30-day EMA revenue stands above $3.47 million, underscoring the project’s strong earnings relative to supply.

Hyperliquid’s SWPE ratio falling below 3 highlights clear undervaluation, with strong revenue signaling growing investor appeal. Source: Tobias Reisner via X

This combination of low SWPE and rising revenue typically signals accumulation opportunities. It suggests the market has yet to fully price in Hyperliquid’s profitability, reinforcing the case for a medium-term recovery as buying pressure strengthens around current valuations.

Hyperliquid Price Prediction: Impulse Wave Likely Forming

Whitey’s analysis points towards a potentially impulsive recovery wave developing on HYPE’s chart. After completing a corrective structure, price has rebounded strongly from its recent lows, with early wave formations now visible on shorter timeframes.

HYPE shows signs of an early impulse wave, with bullish momentum building towards the $52–$60 Fibonacci extension zone. Source: Whitey via X

Key upside zones sit around $52–$60, aligning with Fibonacci extensions at 1.414 and 2.0, respectively. Volume expansion supports the view that this is not merely a corrective bounce but the start of a more sustainable move. If momentum continues, this impulse could set the stage for a bullish HYPE price prediction.

Final Thoughts

Hyperliquid’s alignment of strong on-chain performance, undervaluation signals, and improving technical structure paints a distinctly bullish picture. Consistent fee growth highlights real network demand, while charts suggest accumulation phases may already be underway.

If HYPE maintains support near $42 and breaks above $50 with conviction, the broader market could soon recognize the token’s fundamental strength, paving the way for a potential climb towards the $60 region and beyond.