Cardano’s 2020-Style Expansion Signal: ADA Targets Break Above $0.50 as Long-Term Cycle Hints at Major Rally

Cardano's price action is flashing a familiar signal—and it's one that could send ADA on a tear.

The Ghost of Bull Runs Past

Long-term technical cycles are hinting at a potential repeat of Cardano's historic 2020 expansion phase. Back then, ADA wasn't just climbing; it was rocketing, leaving skeptics and slow-moving portfolios in the dust. The same foundational patterns that set the stage for that parabolic move are quietly reasserting themselves on the charts.

The $0.50 Threshold: More Than a Number

All eyes are on the $0.50 level. It's not just another resistance point; it's the gateway. A decisive break and hold above this key psychological and technical barrier would confirm the strength of the underlying bullish structure. For traders, it's the line between consolidation and liftoff.

The Engine Beneath the Hood

This isn't about hype. It's about network momentum and a development pipeline that's been building through both bear and bull markets. While some projects promise the moon during rallies and go radio silent in downturns, Cardano's builders kept coding. That groundwork often fuels the most sustainable rallies—the kind that outlast a tweet.

A Word from the Cynics' Corner

Let's be real: in crypto, a 'long-term cycle' can sometimes just be a fancy way of saying 'we're due for a pump.' But when the charts start rhyming with a period that preceded a generational wealth transfer, even the cynics lean in and check their wallets.

The setup is there. The cycles are aligning. If history is any guide—and in finance, it's often the only guide we've got before the rules change again—ADA is priming for a significant move. The question isn't if, but when momentum fully takes the wheel.

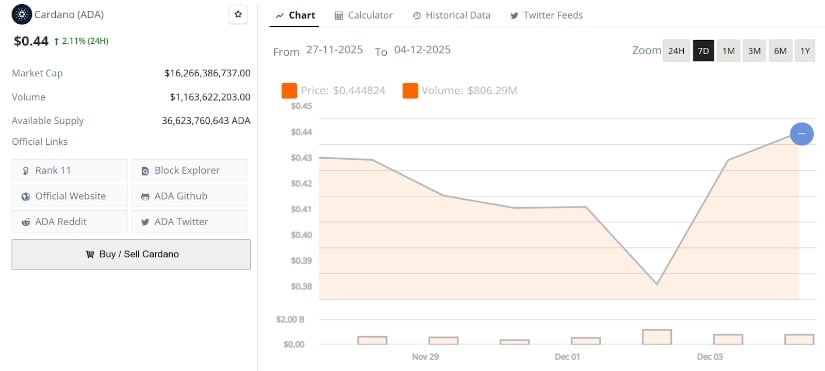

Cardano price is trading around $0.44, showing its first signs of stabilization after weeks of persistent downside pressure. The move comes at a time when sentiment is slowly shifting, backed by new institutional exposure, technical bounce signals, and a revisiting of major multi-year accumulation regions. While ADA Cardano price remains in a fragile position, market participants are increasingly eyeing whether this bounce can evolve into a more meaningful recovery phase.

Cardano price is trading around $0.44, up 2.11% in the last 24 hours. Source: Brave New Coin

Even with the latest uptick, ADA still needs stronger confirmation before declaring a trend reversal, especially given the heavy resistance overhead and its vulnerability to macro and Bitcoin-driven volatility.

Institutional Exposure Returns to ADA

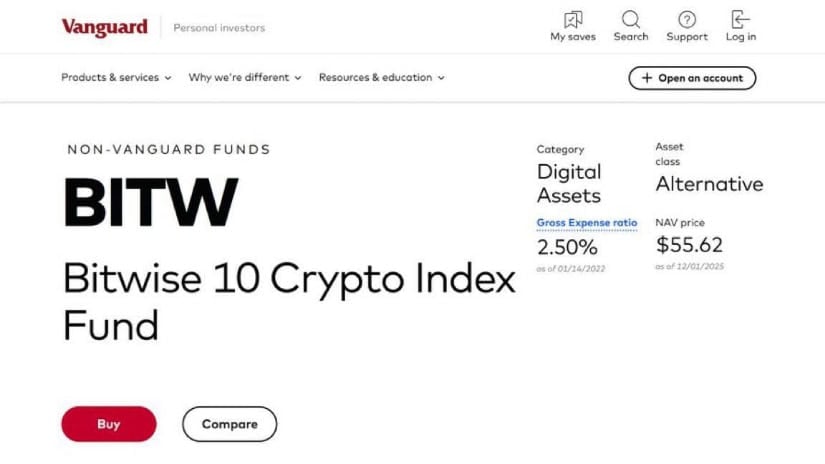

One notable development supporting sentiment came from MartyParty, who highlighted that Vanguard’s platform has now listed the Bitwise 10 crypto Index Fund (BITW), giving exposure to BTC, ETH, SOL, LINK, SUI, XRP, and ADA.

Vanguard’s BITW listing brings ADA back into institutional view, strengthening its large-cap presence. Source: MartyParty via X

While this doesn’t guarantee immediate inflows, being part of an index product accessible to mainstream investors helps reinforce ADA’s presence among large-cap crypto assets. Historically, index weighting has provided passive buying during recovery phases, and this could serve as a mild tailwind if broader market conditions improve.

This shift doesn’t change ADA’s technical barriers, but it does reintroduce a LAYER of institutional visibility that had faded over the past several months.

Short-Term Bounce Triggered by First “Super Signal”

A short-term spark emerged after Trend Rider flagged the first bullish Super Signal on ADA’s daily chart since it lost the critical $0.55 support in November.

These signals do not confirm trend reversals, but they historically increase the probability of 1–4 candle bounce attempts, often marking the beginning stages of relief phases. Price has reacted, printing its first meaningful push from the $0.39 to $0.41 zone after a prolonged bleed.

Trend Rider’s first bullish Super Signal in months sparks ADA’s initial bounce from multi-week lows. Source: Trend Rider via X

However, Trend Rider emphasized that cardano price must trade back above the blue trend-band before any talk of a proper bullish trend can begin. Until then, the market remains neutral to bearish, with the $0.55 region acting as the major threshold for sentiment change.

Long-Term Accumulation Zone Retest Mirrors Previous Cycle Behavior

A deeper perspective came from Eilert, whose chart compared ADA’s current cycle to its behavior during the 2019–2020 accumulation phase. Back then, ADA spent 550 days in the same lower accumulation zone before breaking out.

ADA revisits its multi-year accumulation zone after 430 days, echoing the structure that preceded its 2020 breakout. Source: Eilert via X

In this cycle, ADA has already spent 430 days in that identical region and is now retesting the bottom of the zone once again. Importantly, November closed with a bullish divergence on the monthly RSI, a signal that previously marked the start of ADA’s 2020 expansion leg.

Cardano Repeating 2020 Market Structure

A particularly bullish angle came from Wolf of Crypto, who highlighted that Cardano may be repeating the same shakeout–deviation structure that preceded its explosive 2020 rally. His chart shows ADA breaking slightly below its multi-year accumulation floor, flushing late sellers, and then snapping back above the zone.

ADA’s shakeout–deviation pattern mirrors its 2020 setup, hinting at a potential multi-stage breakout ahead. Source: Wolf of Crypto via X

If cardano price continues to build structure above $0.40 and takes out the $0.47–$0.50 resistance cluster, the deviation setup opens the way towards $0.62, $0.75, and $1.00. Meanwhile, in a full cycle extension, the historical deviation fractal points towards $1.75–$2.00 as the high-timeframe magnet zone.

Historical Context: ADA’s Best Rallies Have Often Started From Panic Zones

Across ADA’s history, multi-month rallies have always begun from periods of capitulation, long consolidations, and deviations beneath key support. These phases typically precede large expansions once liquidity dries up and sellers are exhausted.

The current environment, depressed sentiment, RSI divergence, long consolidation, and deviation wick, match that historical profile closely.

Final Thoughts

Cardano is showing its first cluster of constructive signals in weeks, driven by index fund exposure, technical bounce triggers, and long-term accumulation zone behavior. Still, ADA must reclaim critical resistances before any sustainable trend reversal can take shape.

The next major test lies between $0.47 and $0.50, and how ADA interacts with this region will likely define its path into early 2026. Until then, the market remains balanced between early signs of recovery and the risk of further downside if momentum fades.