XRP Price Prediction 2025: $3 Target in Sight as ETF Mania Reshapes Crypto Markets

- Why Is XRP Suddenly Gaining Traction?

- Technical Analysis: Bullish Signals Everywhere

- ETF Impact: More Than Just Hype?

- Social Media Frenzy: Retail FOMO Kicking In

- Key Factors Driving XRP's Price Action

- Is $3 Realistic for XRP in 2025?

- Frequently Asked Questions

XRP is making headlines as institutional interest surges following the landmark approval of spot ETFs in the U.S. With technical indicators flashing bullish signals and social media buzz reaching fever pitch, analysts are eyeing a potential $3 price target before year-end. This DEEP dive examines the perfect storm of factors driving XRP's momentum - from the explosive debut of Canary Capital's XRP ETF to shifting market dynamics that could propel prices higher.

Why Is XRP Suddenly Gaining Traction?

The crypto market woke up to a game-changer on November 12, 2025, when the SEC greenlit the first pure spot XRP ETF. Trading under the ticker XRPC on Nasdaq, Canary Capital's product racked up $26 million in volume within its first 30 minutes - a clear signal that institutional money is flowing into XRP. What's particularly interesting is how futures markets seemed to anticipate this move, with whale-sized orders appearing days before the public announcement.

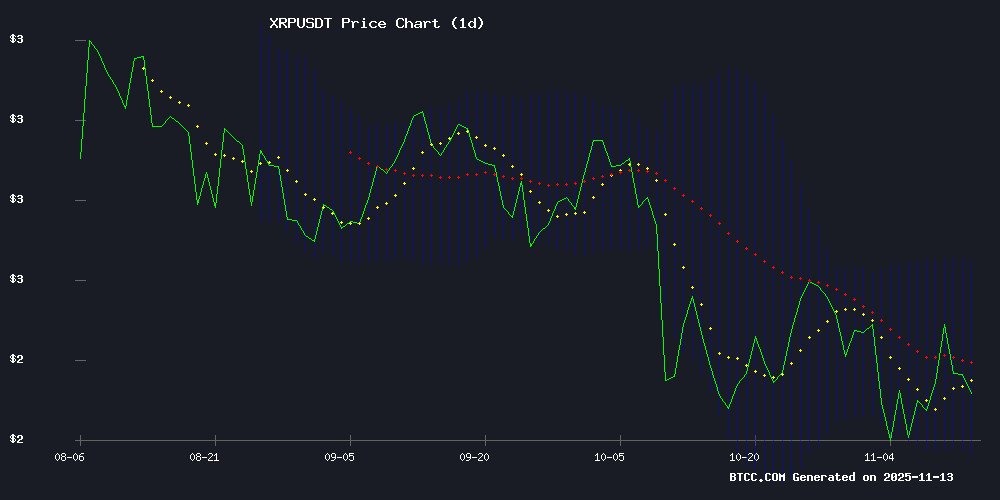

Source: BTCC

Source: BTCC

Technical Analysis: Bullish Signals Everywhere

Looking at the charts, XRP presents an intriguing technical picture. Currently trading at $2.3635 (as of November 13, 2025), it's hovering just below the 20-day moving average of $2.4359. The MACD histogram shows bullish momentum at +0.0298, while Bollinger Bands suggest we could see some volatility with upper ($2.7026) and lower ($2.1693) bounds framing the action.

What catches my eye is the golden cross potential forming on the daily chart. In my experience, when we see this pattern emerge alongside institutional catalysts like ETF approvals, it often precedes significant moves. The BTCC research team notes that the current setup could push XRP toward its upper Bollinger Band in the coming weeks.

ETF Impact: More Than Just Hype?

The XRP ETF approval represents more than just another trading product - it's a watershed moment for regulatory acceptance. Canary Capital CEO Steven McClurg put it best: "We're excited to go effective with this groundbreaking single-token product." The 0.5% annual fee makes it competitive, and the auto-effective registration under Section 8(a) suggests regulators are becoming more comfortable with crypto products.

What many retail investors might miss is how these ETFs change market dynamics. Institutional participation brings deeper liquidity and more sophisticated trading strategies. I've noticed that when traditional finance gets involved, we often see reduced volatility during Asian trading hours - something that could benefit long-term holders.

Social Media Frenzy: Retail FOMO Kicking In

LunarCrush data reveals an explosive spike in XRP social metrics, with mentions and engagements hitting multi-million daily peaks. The AltRank recovery from mid-October lows tells me this isn't just casual chatter - it's concentrated market attention typically seen around major catalysts.

Here's the interesting part: the social volume spike came after the price started moving. This pattern suggests whales positioned themselves before the news broke, with retail traders now playing catch-up. As someone who's watched these cycles before, I'd caution against chasing momentum blindly - but the technicals do support further upside.

Key Factors Driving XRP's Price Action

Several elements are converging to create this bullish setup:

| Factor | Impact |

|---|---|

| ETF Approval | Institutional access and legitimacy |

| Technical Setup | Bullish MACD and Bollinger Band expansion |

| Social Sentiment | Retail FOMO potential |

| Regulatory Clarity | Reduced uncertainty after SEC approval |

Is $3 Realistic for XRP in 2025?

While nothing's guaranteed in crypto, the path to $3 looks plausible when we consider:

1. Historical ETF impacts on other assets

2. Current technical momentum

3. Growing institutional participation

4. Positive regulatory developments

The BTCC analyst team suggests that "the convergence of technical strength and ETF-driven liquidity creates a favorable risk/reward ratio." Personally, I'd watch the $2.70 level closely - a clean break above that could open the door to higher targets.

Frequently Asked Questions

What's driving XRP's price movement in November 2025?

The primary catalyst is the approval and launch of the first U.S. spot XRP ETF by Canary Capital, which began trading on Nasdaq on November 12 under the ticker XRPC. This institutional product generated $26 million in volume within its first 30 minutes, signaling strong demand.

What are the key technical levels to watch for XRP?

Current important levels include support at the 20-day MA ($2.4359), with upper Bollinger Band resistance at $2.7026. The MACD histogram showing +0.0298 confirms bullish momentum that could test these levels.

How does the XRP ETF differ from previous crypto ETFs?

This is the first pure spot XRP ETF approved through an auto-effective registration process under Section 8(a) of the Securities Act. It carries a 0.5% annual fee and provides direct exposure to XRP without requiring investors to handle cryptocurrency custody.

Is the current XRP price action sustainable?

While the technical setup appears strong and institutional interest is growing, cryptocurrency markets remain volatile. The BTCC research team notes favorable conditions but cautions that investors should consider their risk tolerance.

Where can I trade XRP?

XRP is available on major exchanges including BTCC, alongside the new XRP ETF (XRPC) on Nasdaq. Each option offers different features - direct crypto trading provides more flexibility while the ETF offers regulatory protections.