Investors Pull Back from Bitcoin ETFs as Market Jitters Grow – A Temporary Retreat or Long-Term Exodus?

Bitcoin ETF holdings see sharp outflows as volatility rocks crypto markets. Institutional players appear to be taking chips off the table amid regulatory uncertainty and macroeconomic headwinds.

The big question: Are we seeing a healthy correction or the start of a more sustained capital rotation? Traders note the irony of 'risk-off' behavior in what was supposed to be Wall Street's shiny new hedge against traditional finance.

One thing's certain – when even crypto's institutional darlings get cold feet, it pays to watch the tape carefully. The market's next move could define the 2025 investment landscape.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

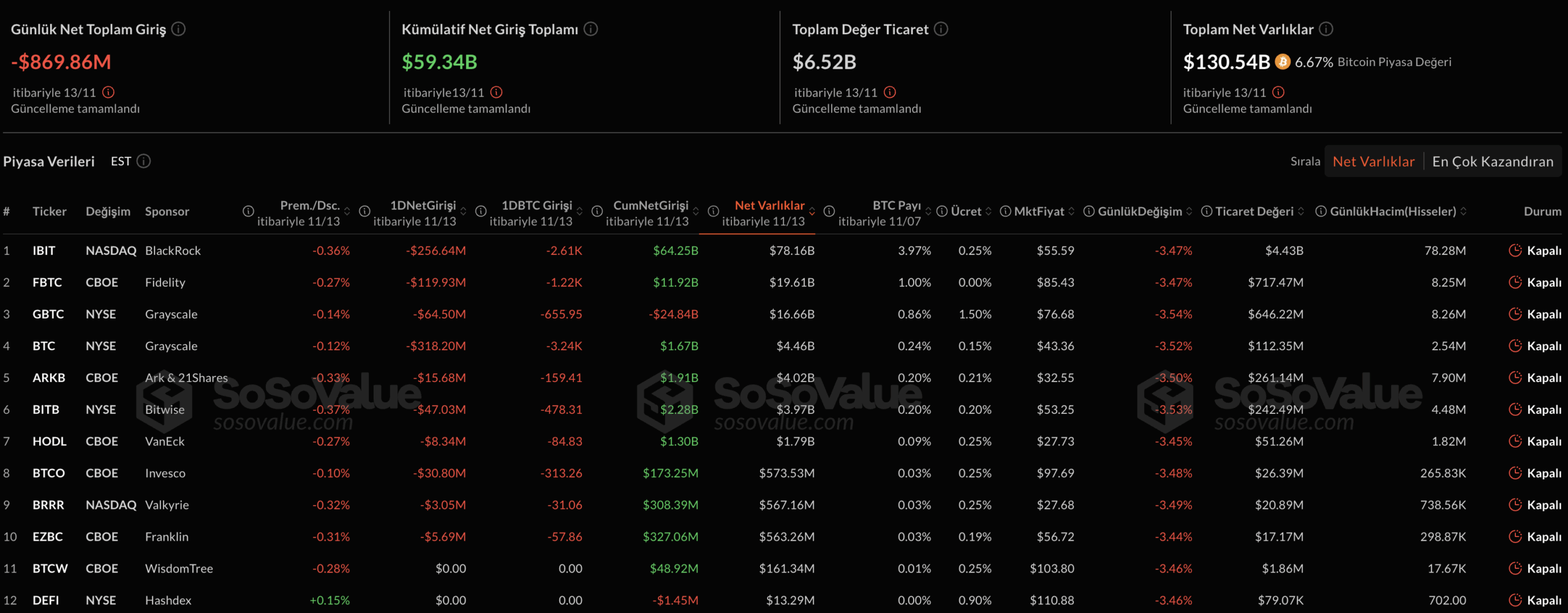

In a significant development in the cryptocurrency market, spot Bitcoin![]() $99,306 ETFs in the United States have witnessed substantial outflows. A total net outflow of $869.86 million was recorded from 11 ETFs on Thursday, marking the second-largest capital loss in their history. The cumulative outflows of $2.64 billion over three weeks highlight investor caution and diminishing confidence in market directions.

$99,306 ETFs in the United States have witnessed substantial outflows. A total net outflow of $869.86 million was recorded from 11 ETFs on Thursday, marking the second-largest capital loss in their history. The cumulative outflows of $2.64 billion over three weeks highlight investor caution and diminishing confidence in market directions.

Institutional Investors Flee Bitcoin Investment

According to data from SoSoValue, the 11 spot Bitcoin ETFs experienced an outflow of $869.86 million on November 14th. This figure stands out as the second-largest collective outflow since the launch of these ETFs in January 2024. Institutional investors are reducing their Bitcoin positions due to increased volatility and a global trend of risk aversion.

The total net outflow of $2.64 billion over a three-week period indicates a prevailing cautious mood in the cryptocurrency market. The decline of bitcoin below the $100,000 threshold has especially led long-term investors to withdraw from ETFs. Enhanced uncertainty in the market has reduced trading volumes in both spot ETFs and derivative products, deepening short-term selling pressure. Analysts caution that a sustained movement under $100,000 could result in further institutional withdrawals.

Concurrent Withdrawals in Ethereum ETFs

Withdrawals are not limited to Bitcoin, with Ethereum![]() $3,220-focused spot ETFs also recording substantial outflows. A $259.72 million outflow marks their highest daily exit since October 13th. This parallel movement indicates that investors are leaning towards a general risk reduction strategy in cryptocurrencies.

$3,220-focused spot ETFs also recording substantial outflows. A $259.72 million outflow marks their highest daily exit since October 13th. This parallel movement indicates that investors are leaning towards a general risk reduction strategy in cryptocurrencies.

At the time of writing, Bitcoin was trading around $97,500. The largest cryptocurrency has lost 5% in the past 24 hours and 11% since the beginning of the month. Analysts suggest that outflows from ETFs might continue with the price decline, but the low levels may eventually present opportunities for new entries in the long term.

Despite the outflows observed on the institutional front, some analysts argue that such corrections in ETFs should be considered within the “natural liquidity cycle.” The general consensus, however, is that investor confidence is unlikely to recover unless the $100,000 threshold is regained.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.