Institutional Players Pivot Strategies as Bitcoin Hits Key Resistance

Wall Street's crypto playbook is getting a rewrite. As Bitcoin grinds against a stubborn technical ceiling, the big money isn't just watching—it's repositioning.

The Hedging Game Intensifies

Gone are the days of simple buy-and-hold mandates. Institutions are now layering sophisticated options strategies, diving into DeFi yield protocols once deemed too risky, and quietly accumulating select altcoins. It's a classic diversification move, but with a crypto-native twist. The goal? To generate alpha while the flagship asset consolidates.

Infrastructure Bets Over Pure Speculation

Capital flows reveal a telling shift. Investment is increasingly funneling toward the picks and shovels—custody solutions, regulatory technology, and blockchain scaling infrastructure. This suggests a longer-term conviction in the ecosystem's survival, even if short-term price action stalls. After all, someone has to build the plumbing for the next bull run, even if the current one is taking a breather. It's the financial equivalent of selling blue jeans during a gold rush—arguably the smarter, if less glamorous, bet.

What This Means for the Market

This strategic pivot creates a new market dynamic. Volatility may become more nuanced, driven by derivatives flows and cross-asset correlations rather than just retail sentiment. Liquidity could fragment across more venues and asset classes within the crypto universe.

The big players are digging in, not pulling out. Their evolving tactics signal a market maturing under pressure, not one preparing to fold. As one fund manager quipped—between sips of a $20 artisanal coffee—'We're not here for the volatility; we're here despite it.' The institutions are playing a different game now. And they're just getting started.

Summarize the content using AI

ChatGPT

Grok

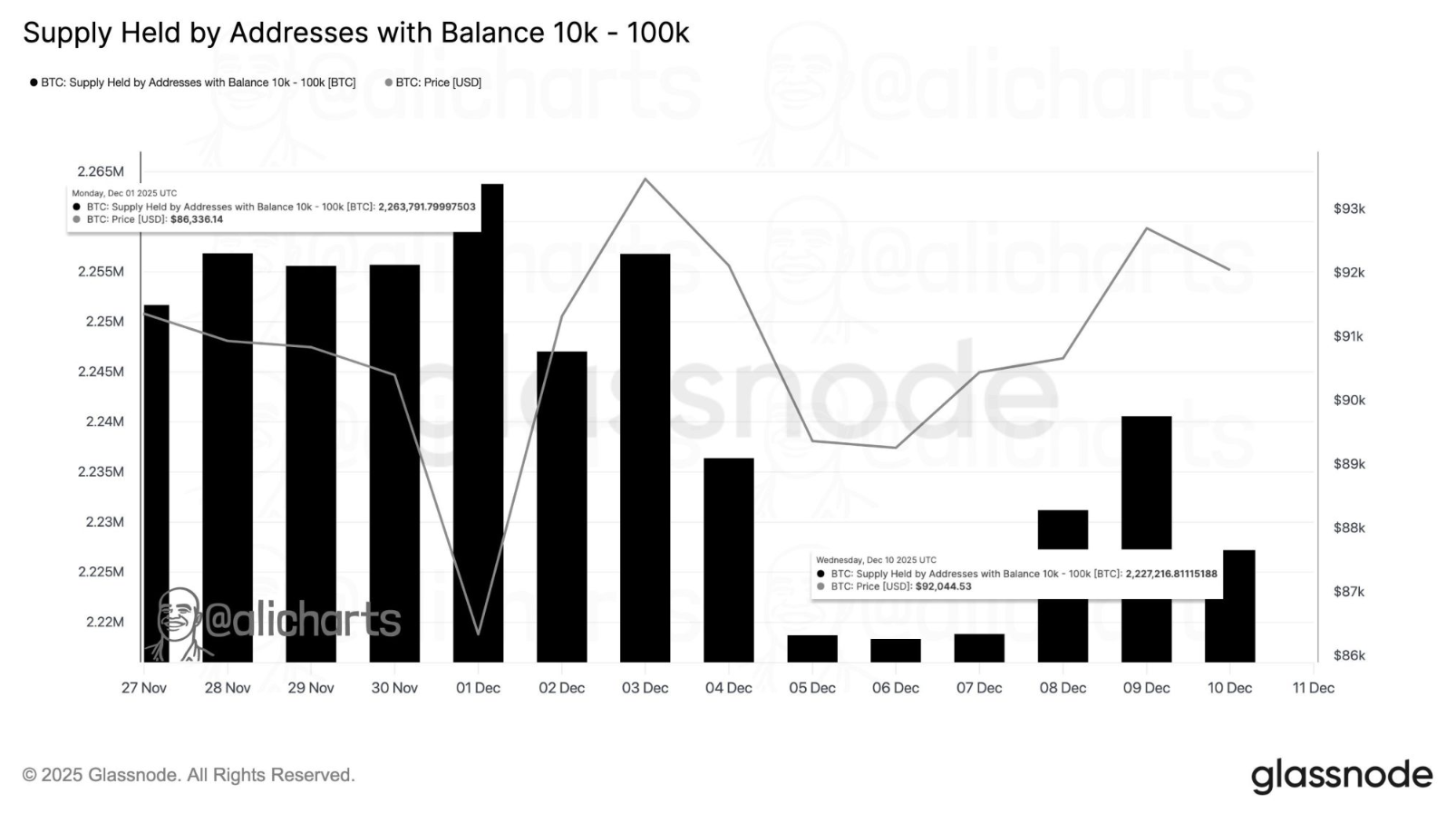

Recently, there has been a noticeable flurry of activity in the Bitcoin $92,420 market. Particularly, major institutional investors and early miners holding between 10,000 to 100,000 BTC have conducted sales or redistributions totaling 36,500 BTC (approximately $3.4 billion) since December 1st.

$92,420 market. Particularly, major institutional investors and early miners holding between 10,000 to 100,000 BTC have conducted sales or redistributions totaling 36,500 BTC (approximately $3.4 billion) since December 1st.

Institutional Sell-Off and Worsening Liquidity Issues

Data from Glassnode reveals that this group has abandoned its accumulation trend and is now adopting a more cautious strategy. Bitcoin’s struggle to surpass the $94,000 resistance despite the Federal Reserve’s interest rate cut supports this outlook.

Bitcoin traded horizontally at $92,250 on the last trading day of the week, with the sell-off pressure from these major wallets catching the attention of investors. The $3.37 billion outflow over 12 days suggests a growing “stepping aside” tendency, particularly in institutional circles. Detailed examination reveals individual investors maintain high expectations, despite “smart money” adopting a different perspective.

The liquidity scenario is also less than ideal. According to data from FX Leaders, the influx of stablecoins into exchanges has decreased by 50% since August. This indicates a weakening of new purchasing power. Mudrex’s Chief Quantitative Analyst Akshat Siddhant notes that while the Fed’s monthly $40 billion treasury bond purchase program will have positive long-term effects, the market needs to first absorb this new liquidity in the short term.

Despite these circumstances, inflows of more than $610 million into Bitcoin and Ethereum $3,237 ETFs over the past two days suggest that investor confidence hasn’t completely dissipated. However, closing above $94,140 remains crucial for achieving the $100,000 price target.

$3,237 ETFs over the past two days suggest that investor confidence hasn’t completely dissipated. However, closing above $94,140 remains crucial for achieving the $100,000 price target.

The Critical $88,000 Threshold

The main point of concern in the market is the differing perspectives between large and individual investors. While small investors focus on the Fed’s “turning point” narrative and maintain bullish expectations, major wallets view the current price range as an opportunity for redistribution. Both the $3.4 billion institutional outflows and the 50% reduction in stablecoin reserves indicate that the $88,000–$94,000 range has turned into a sales zone rather than a buying opportunity.

If bitcoin loses support at $88,000, a sharp increase in volatility is expected. Such a breakdown could lead to panic selling among short-term investors, whereas long-term players might seek new position opportunities.

Meanwhile, a similar pattern was observed with ethereum last week. Large addresses holding over 1,000 ETH sold around 220,000 ETH. Experts suggest that the cautious approach by large wallets in both Bitcoin and Ethereum will be decisive for the market’s short-term direction.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.