XRP and Dogecoin Surge: Decoding the 24-Hour Market Frenzy That Has Traders Buzzing

Two unlikely contenders just stole the spotlight. Over a single trading day, XRP and Dogecoin executed moves that left the market scrambling to keep up—proving once again that in crypto, the narrative is just as powerful as the tech.

The Ripple Effect Isn't Just a Metaphor

Forget the legal noise for a second. XRP's latest price action cut through the static, showcasing a resilience that bypasses traditional asset logic. It's a stark reminder that regulatory clarity, or the fierce pursuit of it, can be its own catalyst. While bankers debate yield curves, this asset moves on a different set of rules entirely.

The Meme That Refuses to Die

Dogecoin, the perpetual underdog, flipped the script again. Its volatility isn't a bug; it's the core feature. This 24-hour spike wasn't about white papers or roadmap updates—it was pure, unadulterated market sentiment and community momentum in action. It’s the asset that constantly reminds portfolio managers why they get paid the big bucks to manage "risk."

What's Fueling the Fire?

The synchronized movement begs the question: is this coordinated, or coincidental? Look beyond the charts. Liquidity shifts, derivatives market positioning, and that ever-present search for the next narrative play are all in the mix. In a sector obsessed with 'the next big thing,' sometimes the current things stage a formidable comeback. It’s enough to make a traditional quant analyst reach for something stronger than coffee—perhaps realizing their elegant models didn’t account for a Shiba Inu.

One day of intrigue doesn't define a trend, but it sure redefines attention. As these two assets demonstrate, in the digital markets, yesterday's joke can be today's juggernaut, and yesterday's legal battleground can be today's momentum trade. The only constant? The market's endless appetite for a compelling story, even if that story is written in price charts and Twitter hashtags.

Summarize the content using AI

ChatGPT

Grok

In the last 24 hours, both XRP and Dogecoin $0.140425 have demonstrated noteworthy movements in the cryptocurrency market. While XRP maintained its tight trajectory near critical levels, developments within the Ripple

$0.140425 have demonstrated noteworthy movements in the cryptocurrency market. While XRP maintained its tight trajectory near critical levels, developments within the Ripple $2 ecosystem have kept investor interest alive. Conversely, Dogecoin has resurfaced as a topic of interest, influenced by whale activities and ETF implications, although its price fluctuations remained limited. Despite short-term uncertainties, both assets continue to highlight their medium-term potential.

$2 ecosystem have kept investor interest alive. Conversely, Dogecoin has resurfaced as a topic of interest, influenced by whale activities and ETF implications, although its price fluctuations remained limited. Despite short-term uncertainties, both assets continue to highlight their medium-term potential.

XRP Moves Within a Narrow Range

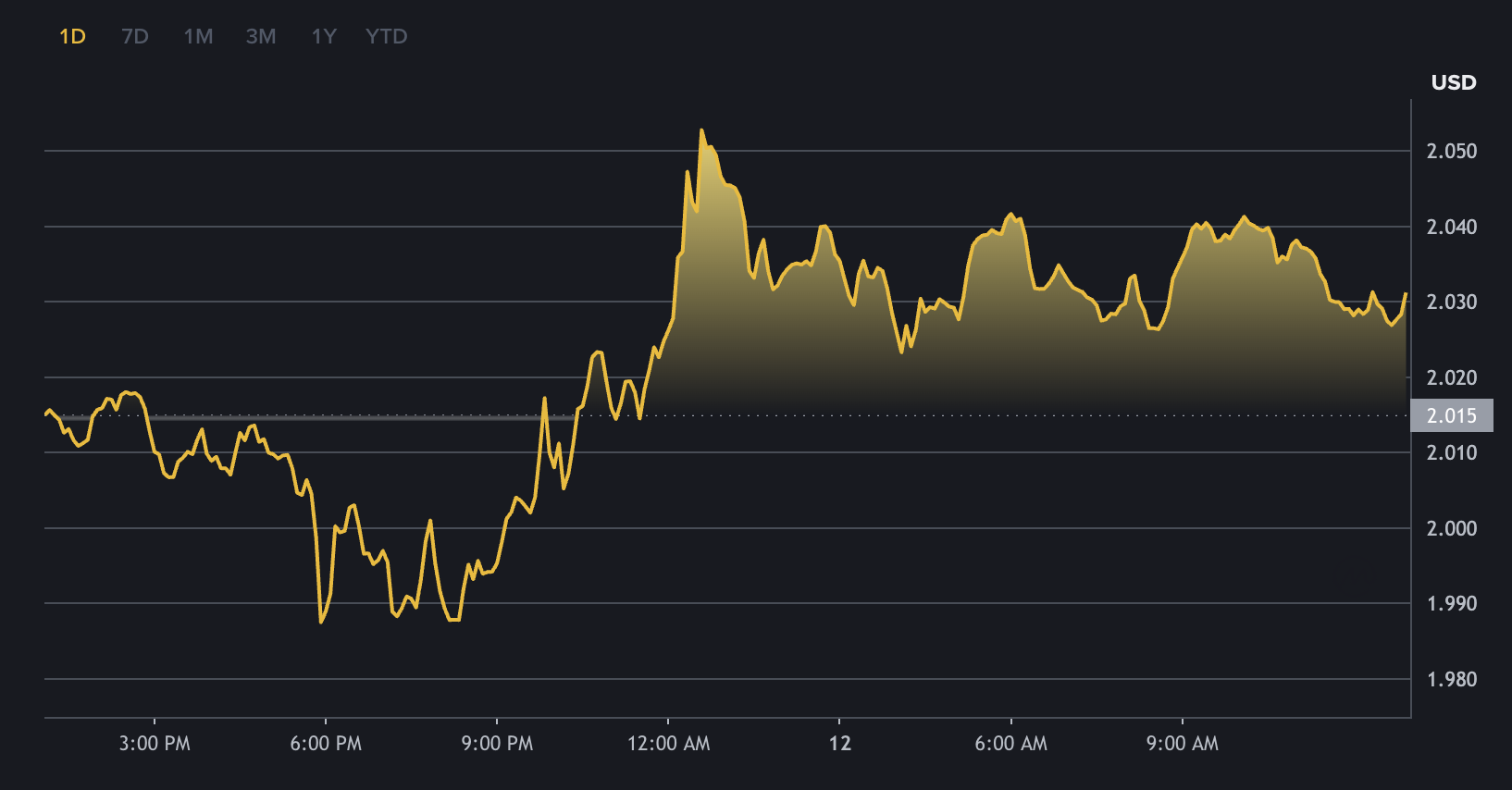

The xrp price moved within a narrow band, fluctuating between $1.99 and $2.05. It consolidates around the psychologically significant support level of $2.00.

Additionally, XRP remains the fourth-largest crypto asset by market capitalization, signifying its enduring strength. This high market value suggests that XRP continues to attract significant investment interest.

Conversely, crucial wallet activities and a slight price increase of around 1% were observed in the Ripple ecosystem recently. Technical indicators present uncertain signals in the short term, yet ETF launches and potential regulatory developments have increased institutional interest in XRP.

Moreover, some ambitious investment models suggest that XRP prices could rise significantly from current levels by the end of the year, aiming for targets between $4 and $8.

However, analysts note that XRP remains constrained within classic resistance and support zones in the short term. Still, macro catalysts such as ETF and bank acceptance keep its upward potential vibrant in the medium to long term.

Dogecoin: Price Movements and Developments in 24 Hours

Dogecoin showed a nearly 2% limited price change, trading between $0.136 and $0.142 over the last 24 hours. The market’s general calmness reflects on DOGE‘s price.

Furthermore, Doge maintains its position as the ninth-largest cryptocurrency by market capitalization, thereby sustaining its place in the top ten. Despite the strong meme coin community, DOGE exhibits higher volatility in price movements compared to traditional altcoins.

Additionally, reports suggest that whale activities in the DOGE market have resurfaced, affecting liquidity and volatility levels.

The introduction of Dogecoin ETFs could serve as a positive catalyst for DOGE in the medium term, granting institutional access.

Finally, DOGE analysts highlight the coin’s reliance on overall market sentiment. Trends in Bitcoin $92,420 and major altcoins have a direct influence on DOGE. If critical resistance levels are surpassed, a short-term rally towards the $0.20 to $0.30 range becomes a possibility.

$92,420 and major altcoins have a direct influence on DOGE. If critical resistance levels are surpassed, a short-term rally towards the $0.20 to $0.30 range becomes a possibility.