Fed’s Goolsbee Draws Line in Sand: No Rate Cuts on His Watch

Another Fed official pushes back against the market's rate-cut fantasies.

The Hawkish Stance

Chicago Fed President Austan Goolsbee just threw cold water on the Wall Street party. In a clear signal to traders betting on imminent monetary easing, he's taken a firm stand against lowering interest rates. The message is blunt: the inflation fight isn't over, and the data doesn't justify a pivot.

Market Implications

This isn't just central bank chatter—it's a direct challenge to the 'higher for longer' narrative that's been rattling traditional markets. Every utterance from the Fed sends shockwaves through bond yields and equity valuations, forcing a recalibration of risk. It's the old game of managing expectations, where words are as powerful as policy moves.

The Cynical Take

Let's be real—this is classic Fed theater. Talk tough, scare the markets, then maybe, just maybe, ease up later and take credit for a 'soft landing.' Another masterclass in jawboning from the world's most influential financial institution.

For crypto, this hawkish noise is just more background static. Digital assets operate on a different clock, driven by adoption and tech cycles, not the whims of a committee trying to fine-tune a legacy system. While TradFi frets over basis points, the decentralized economy keeps building.

Summarize the content using AI

ChatGPT

Grok

One of the Federal Reserve members opposing the interest rate cuts, Goolsbee, has taken a surprising stance given his previous statements. Although seen as a more moderate figure, Goolsbee stands among the 19 Federal Reserve members—of which 12 are committee members—resisting rate cuts. Notably, seven out of these 19 members, including Goolsbee, oppose any reductions in the forthcoming year.

ContentsLatest News from the FedConcerns About Inflation and Interest RatesLatest News from the Fed

Following his opposition to the interest rate decision, Fed memberhas made significant remarks two days post-decision. Understanding why a previously supportive member has shifted views is essential, especially since at least seven members share his perspective, desiring no more than two cuts in 2026.

Goolsbee emphasized the risks associated with front-loaded rate cuts, a concern echoed by significant segments of the market. Previous inflation data before closures were troubling, revealing only a modest cooling in the labor market. Goolsbee highlighted that awaiting updated economic data could prove advantageous.

Concerns About Inflation and Interest Rates

Inflation has exceeded targets for four and a half years, with progress stalling, and businesses and consumers viewing prices as a primary concern. Few indicators suggest a drastic deterioration in the labor market or that the Fed won’t be able to wait until early 2026 for rate reductions. Current high inflation, potentially temporary due to tariffs, could pose a prolonged danger.

Adopting a cautious approach by waiting might involve fewer risks. Most data point to only a mild cooling in the labor market alongside stable economic growth. Despite concerns over recent years’ inflation, Goolsbee remains optimistic about a significant drop in rates next year.

Opposing the rate cut, Goolsbee believes theshould wait for more information, particularly on inflation.

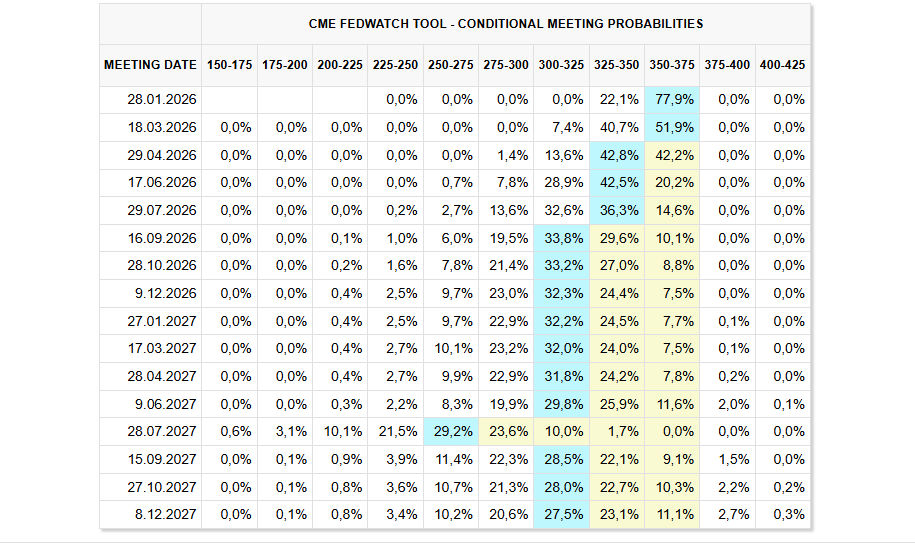

The first interest rate decision of 2026 is set for January 28, by which time several crucial data points from employment to inflation will have been released. Currently, there’s a 77% expectation that rates will remain steady in January. However, should employment shrink further and limited inflation growth indicate easing, more cuts could occur over the next 12 months. This scenario may positively impact risk markets, including.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.