Ran Neuner’s Bold Crypto Call: 2025 is a Mirage, Real Bull Market Hits in 2026

Forget the hype. A prominent voice just slashed expectations for a 2025 crypto surge, labeling it a market mirage. The real fireworks, he argues, are timed for 2026.

The 2025 Mirage

Analysts and traders chasing quick gains next year might be chasing ghosts. The forecast cuts through the noise of perpetual bullishness, suggesting the macro setup and typical cycle timelines don't support a major breakout so soon. It's a classic case of hope outpacing reality—a familiar tune in speculative finance where narratives often get priced in before the fundamentals arrive.

Why 2026 Makes the Cut

The logic points to historical patterns. Crypto markets move in multi-year waves, and the complex dance of institutional adoption, regulatory clarity, and technological maturation needs more time. Rushing the process usually ends with over-leveraged portfolios and underperforming assets. The call bypasses short-term noise to focus on the deeper, structural drivers that have historically fueled sustained rallies.

Navigating the Interim

So what happens between now and then? Expect consolidation, building, and the occasional fake-out rally that separates disciplined investors from the crowd. It’s the phase where real projects build utility while the memecoins and vaporware slowly fade—a necessary cleanse for the ecosystem. Smart money isn't sitting idle; it's positioning for the longer game, often with a cynical eye on the 'greater fool' theory that still propels too much capital.

The bottom line: patience isn't just a virtue in this market; it's a strategy. While the crowd fixates on quarterly gains, the next cycle is quietly setting its foundation. Just remember, in crypto, a 'sure thing' is often just a story waiting for a greater fool to buy it.

Summarize the content using AI

ChatGPT

Grok

In a recent analysis, Ran Neuner tackled the fundamental reasons behind this year’s crypto failures and shared his predictions for the coming years, asserting that a genuine bull market will emerge in 2026. He identified six critical factors that will lead to this development. But what was missing in 2025, causing the delay of a crypto bull run until 2026?

Contents2025 Crypto Bull Market DeceptionCrypto Bull Market Anticipation for 20262025 Crypto Bull Market Deception

Trade relations between the U.S. and China are reverting to previous levels, with exporters already selling 132,000 soybeans to China, and Nvidia accelerating its H200 production to meet Chinese demand. The chaos of tariffs will not affect China for another year, and 2026 marks mid-term elections for both the Senate and the House of Representatives. Despite some Fed members suggesting that current interest rates are nearly neutral or even stretched, the Fed continues to cut rates.

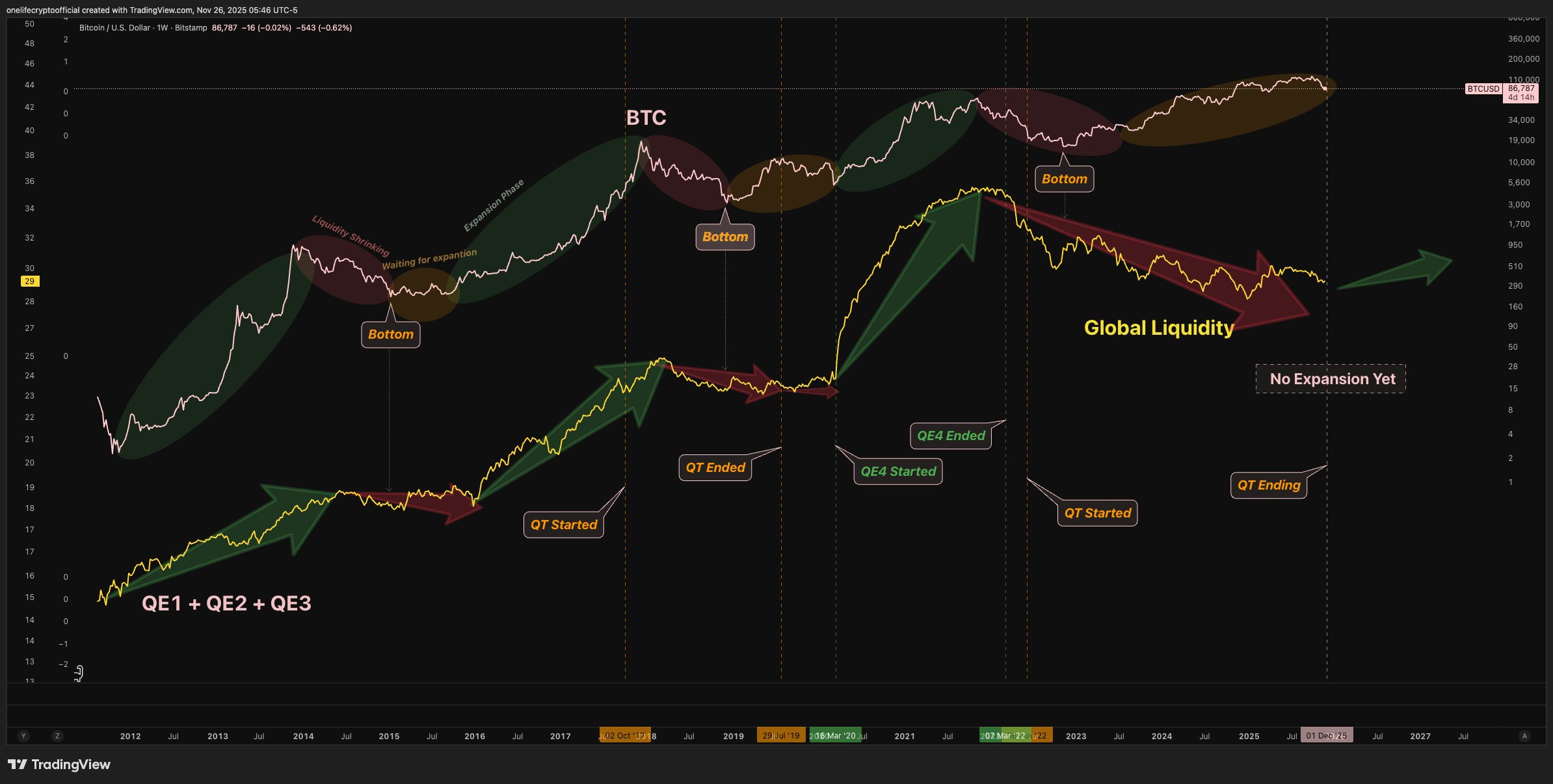

Ran Neuner believes that 2025 was a delusion because the necessary conditions to foster a crypto bull market were absent. By analyzing macroeconomics, liquidity models, and past cycles, he argues that the year’s lack of “fuel” led to a fool’s paradise scenario instead of a true bull market.

- Headline M2 increased while net liquidity continued to decline, contrary to M2’s behavior.

- PMI persisted in contracting.

- Quantitative Tightening (QT) still persisted.

- Economic expansion never began this year. December’s sales halt was a start, but the $40 billion short-term bond purchase announced on Wednesday doesn’t equate to monetary expansion.

The narrative for 2025 was excellent, with Trump’s presidency offering a significant opportunity. However, as Ran described, “there was no fuel,” resulting in the anticipated bull market not materializing. Thus, he perceives the 2025 crypto bull market as a deception that distracted people.

Crypto Bull Market Anticipation for 2026

So, can we discuss positive prospects? Despite prevalent negativity for 2026, why does Ran believe that a bull market will arise in an environment where “everyone unanimously predicts a downturn”? Even facing many negative events in the first quarter, such as the Supreme Court’s tariff decision and MSCI’s delisting of crypto reserve companies on January 15, what fuels his optimism?

The year 2026 will be the first time in years that conditions conducive to initiating a bull market will manifest.

In practical terms:

- QT is ending.

- Interest rates are decreasing.

- TGA pressure has lifted.

- Net liquidity hit bottom and is set to recover.

- PMI is on the rise.

- Institutions are gearing up for a second wave of capital influx.

- Regulations are pending. (If drafts aren’t agreed upon by the first quarter, voting won’t conclude until July, and crypto laws won’t appear until after the mid-term elections, dimming the regulatory outlook, here’s an editor’s note.)

Historically, Bitcoin $0.00000000000000 has never entered a bear market when liquidity rises. While there were many reasons for a bullish outlook in 2025, the genuine rise is expected in 2026. This is what we will witness if Ran’s insights prove correct.

$0.00000000000000 has never entered a bear market when liquidity rises. While there were many reasons for a bullish outlook in 2025, the genuine rise is expected in 2026. This is what we will witness if Ran’s insights prove correct.