Worldcoin’s WLD Token Soars as Major Wallet Makes Aggressive Accumulation Move

WLD price action just got a massive vote of confidence—and a single wallet is writing the check.

The Whale's Bet

Forget retail FOMO. When a major, identified wallet starts gobbling up a token in size, the market pays attention. This isn't speculative day-trading; it's a strategic position being built, signaling a belief in future upside that the average trader might not yet see. The move instantly creates a supply shock on exchanges, tightening available liquidity and forcing the price needle to move in one direction: up.

Anatomy of a Pump

The mechanics are brutally simple. Large-scale buying eats through sell-side order books, triggering algorithmic trades and momentum signals. This pulls in short-term traders, creating a feedback loop. The resulting surge often breaks key technical resistance levels, which then becomes a self-fulfilling prophecy as chart watchers pile in. It's a reminder that in crypto, capital concentration can move markets faster than any fundamental news.

Context is Everything

Worldcoin, with its unique biometric identity premise, has never been a quiet project. A major accumulation like this doesn't happen in a vacuum. It often precedes a catalyst—or insider confidence that one is coming. Whether it's a protocol upgrade, a major partnership, or simply a bet on the next wave of AI-crypto narrative, big money usually has a reason. The rest of the market is left to decipher the move in real-time.

The Cynical Take

Let's be real: this is how the game is played. A whale makes a move, the crowd follows the splash, and everyone pretends it's about the 'technology' until the next big wallet decides to cash out. Finance in the digital age—still just watching the rich get richer, but now with fancier graphs.

The real question isn't why the price is pumping now, but where that wallet's sell order is hiding. Every massive buy has its eventual exit. For now, the trend is your friend—just remember who your friend really is.

Institutional Wallet Activity and Volume Increase

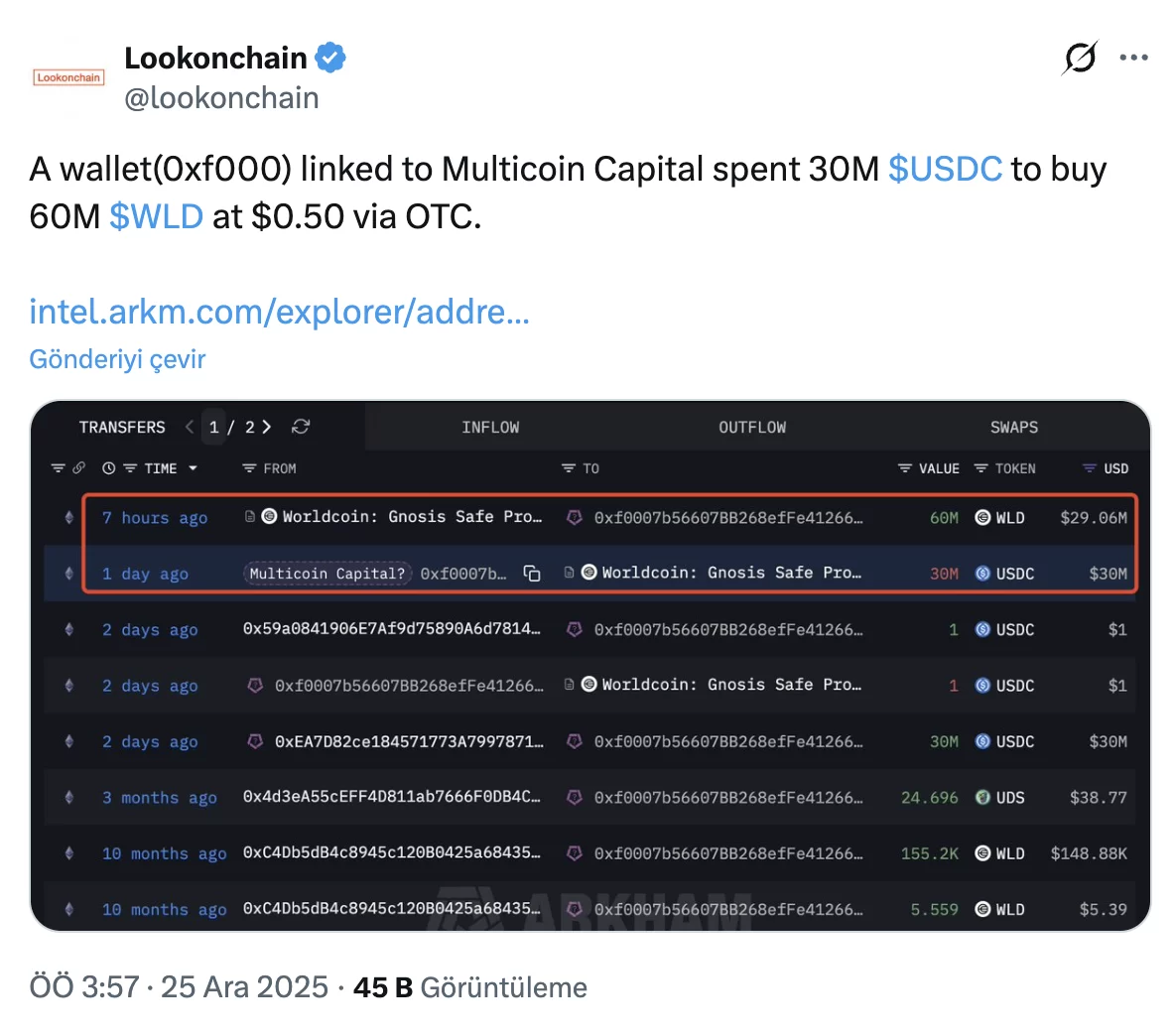

According to the on-chain data platform Lookonchain, a wallet linked to Multicoin Capital executed an over-the-counter (OTC) transaction, spending 30 million USDC to acquire a total of 60 million WLD. The purchase, made at an average price of $0.50, signals a strong institutional demand in the eyes of market observers. OTC transactions often aim to conduct large-volume purchases without directly impacting the market, possibly suggesting a long-term investment strategy.

On the other hand, data from Santiment reveals that WLD’s trading volume witnessed a dramatic surge, reaching $1.46 billion on Wednesday—a record high for the year and activity not seen since July 2024. This spike in volume indicates growing interest not just from individual investors but also from substantial market players. Furthermore, whales holding between 1 million and 100 million WLD have reportedly accumulated over 150 million tokens in the recent price pullbacks.

Technical Outlook and Market Agenda

Technically, the market’s mood is cautiously optimistic. Although the overall structure of the WLD/USDT pairing remains weak in four-hour charts, the recent upswing strengthens the possibility of a short-term recovery. Should the price surpass the daily resistance around $0.56, the 50-day exponential moving average at $0.63 could become the new target. The RSI indicator moving upward at 49 also suggests that buyers are regaining strength. However, it’s crucial for the RSI to cross above 50 for sustained momentum.

These dynamics align with a broader narrative of rising institutional interest in the crypto market. A similar buzz recently surrounded another popular altcoin experiencing substantial fund acquisitions. Particularly, projects centered around artificial intelligence and identity verification are coming back into the spotlight, aligning with 2025 expectations. This context shows that projects like WLD are evaluated for their long-term narratives, not just short-term price movements.

In summary, the rally in WLD is fueled not only by speculative buying but also by substantial volume and institutional interest. Yet, the lack of a clear confirmation of an upward trend in technical indicators warrants caution among investors. The market’s response to crucial resistance levels in the coming days will determine the longevity of this momentum.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.