Watch Large Investors Drive Bitcoin’s Unseen Movements: The Hidden Market Forces

Bitcoin's price chart tells only half the story. The real action happens off-screen, where large investors—whales, institutions, dark pools—execute moves that ripple through the market long before retail catches on.

Follow the Money, Not the Hype

Forget the social media noise. The true market narrative is written in block transfers and OTC desk flows. These players don't move with the herd; they move the herd. Their capital allocations create support and resistance levels that technical analysts later 'discover' on their screens.

The Mechanics of Stealth Accumulation

Sophisticated accumulation strategies bypass spot exchanges entirely. Think direct purchases, algorithmic slicing across derivatives, and private transactions that never hit a public order book. This activity leaves a footprint in on-chain data—large UTXO creation, exchange outflow spikes—not in the ticker price. It's market-moving capital flowing under the radar.

Why Visibility Lags Reality

By the time a major price move is obvious, the strategic positioning is often complete. The market then spends days or weeks rationalizing a move that was engineered weeks prior. It's a classic Wall Street playbook, just with a digital asset wrapper—the ultimate irony for a 'transparent' ledger.

The takeaway? Price is a lagging indicator. To understand where Bitcoin is going, you need to watch where the big money is flowing, not where it's already been. Because in crypto, as in traditional finance, the house always wins—they just use a different kind of wallet.

On-Chain Data Insights: Large Wallets Spring into Action

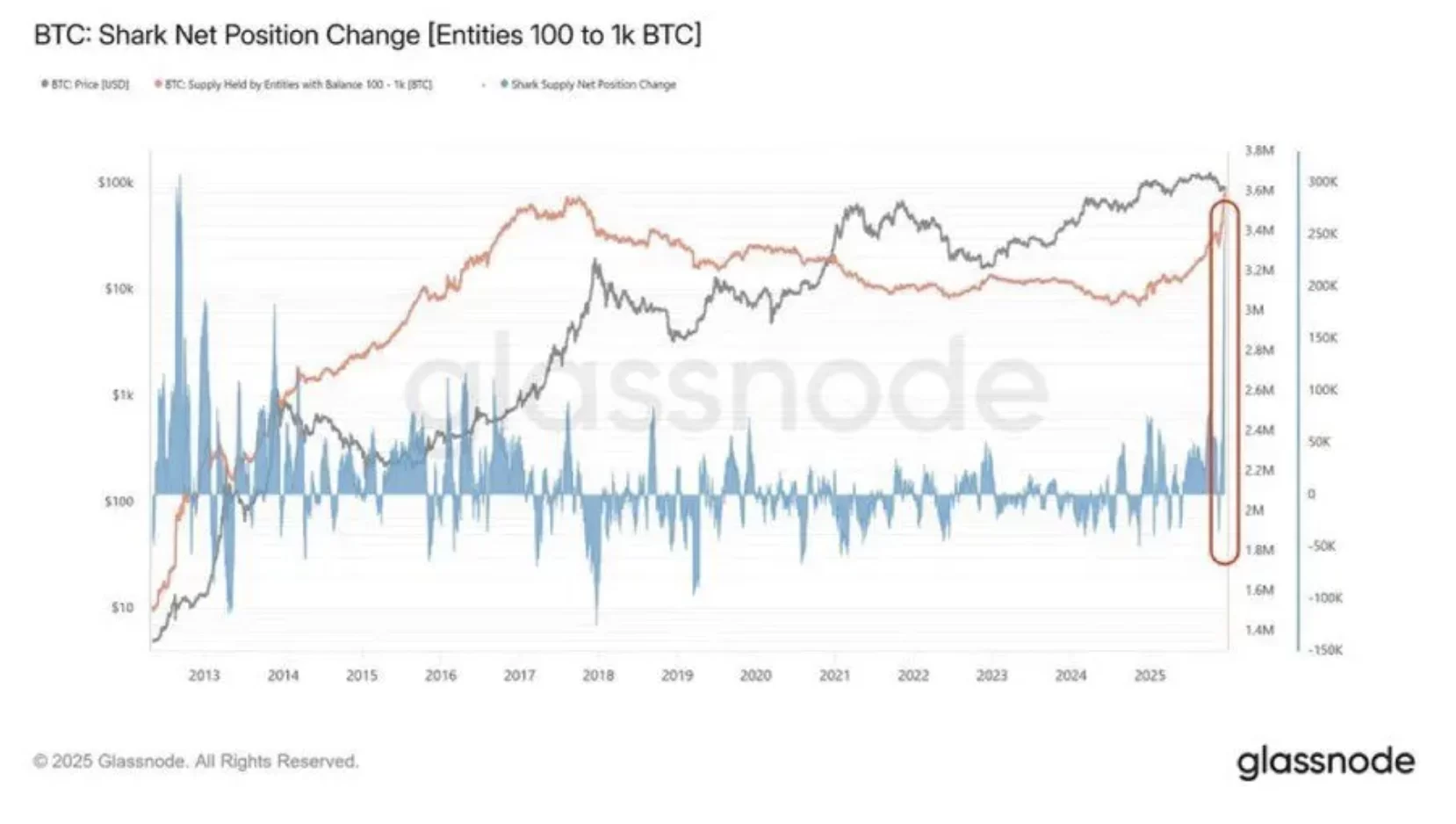

According to Glassnode data, the final months of 2025 have witnessed a noticeable increase in net purchases by addresses holding between 100 and 1,000 BTC. Known as “Sharks,” this investor group increased their holdings, forming a new peak in total supply as bitcoin prices hovered near cycle highs. Some analyses suggest that whales collected approximately $23.5 billion worth of Bitcoin during this period.

Nevertheless, charts indicate aggressive accumulation rather than consistent distribution at this time. Factors like exchange wallet restructuring or custodian address consolidation might affect the data. However, the overall picture implies that large investors’ long-term outlook remains robust. This scenario suggests that “smart money” is taking positions in an environment where smaller investors stay cautious.

Gold and Silver Shine, Bitcoin Lags Behind

Price comparisons over the past six months reveal a clear advantage in favor of traditional commodities over cryptocurrencies. Gold has appreciated by approximately 38%, while silver has soared over 100%, effectively experiencing a rally. In contrast, Bitcoin’s market value, approaching $1.8 trillion, has declined by roughly 17%. This development indicates a shift toward safer assets by investors amid growing global uncertainties.

Moreover, another noteworthy development involves renewed interest in spot Bitcoin ETFs in the United States. Net inflows into certain funds highlight that institutional interest has not disappeared entirely, and despite price pressure, infrastructural demand persists. From a technical standpoint, Bitcoin retraced sharply from its peak above $110,000 and is now trapped between $85,000 and $92,000. Experts believe such prolonged consolidations often herald significant movements.

To sum up, while Bitcoin may appear to have lost its appeal in the short term, a different narrative unfolds behind the scenes. Large investors’ accumulation, institutional interest in ETFs, and technical consolidation collectively suggest that the next market move is crucial. The strong performance of gold and silver casts a shadow over Bitcoin, but directional changes in cryptocurrency markets often occur unexpectedly.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.