Binance Dominates Bitcoin Futures, Surpassing CME

Crypto's retail giant just left Wall Street's favorite playground in the dust.

Binance has officially overtaken the Chicago Mercantile Exchange in Bitcoin futures trading volume—and the gap isn't subtle. The exchange built for the masses now commands the market that institutions once claimed as their own.

Retail Flips the Script

For years, CME's Bitcoin futures were the bellwether for institutional adoption. Regulated, traditional, and comfortably nestled within the existing financial framework. Then Binance's product—accessible, leveraged, and open 24/7—started eating its lunch.

The surge wasn't a fluke. It was a direct result of a global user base acting faster than any pension fund committee could dream of. While suits debate position limits and quarterly reports, the crypto crowd just clicks 'buy.'

The Liquidity Engine

Dominance in futures isn't just a bragging right—it's a flywheel. Higher volume begets tighter spreads, which attracts more traders, which pumps the volume even higher. Binance locked into that cycle, turning its spot market dominance into derivative supremacy.

It's the kind of market-making efficiency that would make a traditional exchange head spin—if they could even see it through their legacy clearing systems.

A New Benchmark

Forget the 'institutional approval' narrative. This flip signals a power shift. Price discovery and market sentiment are increasingly set by platforms operating at crypto-native speed, not by contracts settled in cash on a quarterly schedule.

One cynical take? The 'smart money' from Chicago is now just following the momentum created by the 'dumb money' online—proving once again that in markets, liquidity is the only intelligence that truly matters.

The throne has a new occupant. And it doesn't wear a tie.

Binance Leads in Bitcoin Futures Market

In a noteworthy development within the global cryptocurrency derivatives market, Binance has claimed the top spot from CME according to CoinGlass data. The open positions of Bitcoin futures on Binance have surged to 129,080 BTC, amounting to approximately $11.28 billion, eclipsing CME Group’s open positions, which have decreased to 112,340 BTC or $9.81 billion. This marks the first time since the beginning of 2024 that CME’s figures have fallen below $10 billion, reflecting a shift in the market’s center of gravity from institutional-focused US platforms to global exchanges with more retail participation.

The decline at CME began prior to the significant correction experienced in the cryptocurrency market in early October. The allure of the “basis trade” strategy, which takes advantage of the premium between Bitcoin’s price and futures contracts, has rapidly dwindled. The return on investment for institutional investors buying BTC in the spot market and selling it in futures has decreased, leading to a faster unwinding of open positions. Velo data highlights that the annualized basis rate has plummeted from 15% to around 3%.

Conversely, while open positions on Binance also fell after October, they showed signs of recovery in December. Market participants note the growing influence of retail investors, who view price pullbacks as buying opportunities. This trend has made the divergence between institutional and retail investor behaviors more apparent.

Continued Outflows from Spot Bitcoin ETFs

In the US, the selling pressure on spot bitcoin ETFs persists. According to Farside Investors data, ETFs recorded a net outflow of $19.3 million on the week’s first trading day, marking the seventh consecutive day of negative flows. BlackRock’s iShares Bitcoin ETF saw an investor outflow of $7.9 million, while Fidelity’s FBTC ETF diverged with an inflow of $5.7 million. Institutional withdrawals were also notable in ARK 21Shares ARKB and Invesco Galaxy BTCO.

Experts attribute these ETF sales to more cautious price expectations and year-end tax loss realization strategies. The reduction in institutional positions aligns with the diminishing influence of CME in futures trading.

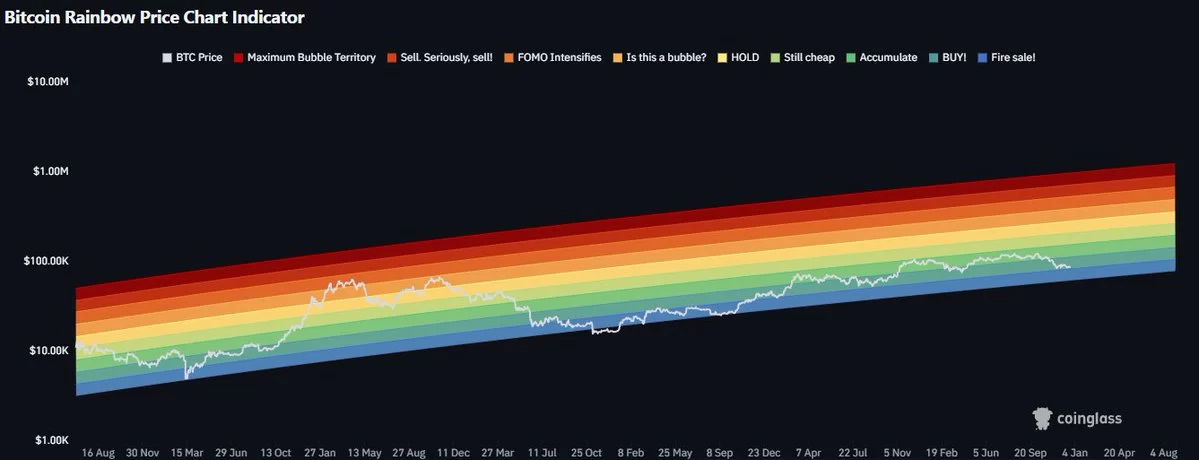

Bitcoin Rainbow

Bitcoin Rainbow

Meanwhile, Bitcoin’s price has declined by over 2% in the last 24 hours, stabilizing around $87,200. Intraday trading tested the $86,717–$90,299 range, with trading volume increasing by 40%, indicating that the market is still dynamic. Analyst Dan crypto Trades points out that Bitcoin is approaching the lower band of regression and rainbow chart models, historically corresponding to the $60,000–$80,000 range. CoinGlass data suggests indecision in the derivatives market, with a decline of over 5% in total open positions in the last 24 hours, accelerated at CME but showing short-term recovery at Binance.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.