Bitcoin Trends Will Shock Everyone by 2026

Forget the predictions. Ignore the analysts. The real Bitcoin story unfolding by 2026 isn't the one anyone's telling.

The Quiet Revolution

Institutional money isn't just knocking on the door—it's building a new entrance. Traditional finance's slow, lumbering embrace is about to turn into a full-scale sprint, driven by regulatory clarity that finally cuts through the fog. The old guard is learning a new language: blockchain.

Beyond the Price Tag

While everyone watches the ticker, the infrastructure beneath it is undergoing a silent metamorphosis. Scaling solutions are moving from whiteboard diagrams to live networks, promising to bypass the congestion and fees that have long been crypto's Achilles' heel. The user experience is shedding its tech-geek skin.

The Mainstream Tipping Point

This isn't about another speculative bubble. It's about utility seeping into the mundane. Think micropayments for digital content, seamless cross-border contracts, and asset tokenization moving from Wall Street experiments to local real estate deals. The use cases are shifting from theoretical to tangible.

A final thought for the skeptics: the biggest surprise might be watching traditional portfolio managers, who once scoffed, now desperately trying to explain their new 'digital asset allocation' to clients—all while quietly hoping their legacy systems don't implode.

2026 Cryptocurrency Markets

In recent months, experienced investors have been selling due to the anticipated repeat of the 2021 market cycle expected at the end of 2025. This steady market decline wasn’t supported by news events but was largely due to heavy sales by investors, particularly affecting the more cautious U.S. investors compared to their global counterparts.

The four-year cycle storyline predicted a peak in Bitcoin prices by the end of 2024 or 2025, which mirrored previous market cycle peaks in 2021. This alignment was largely a result of older market cycles harmoniously dancing with the Bitcoin cycle, leading to successful predictions.

Quinten argues, by sharing four key cyclic graphs, that those anticipating a repeat of 2022 by 2026 are likely misjudging the situation.

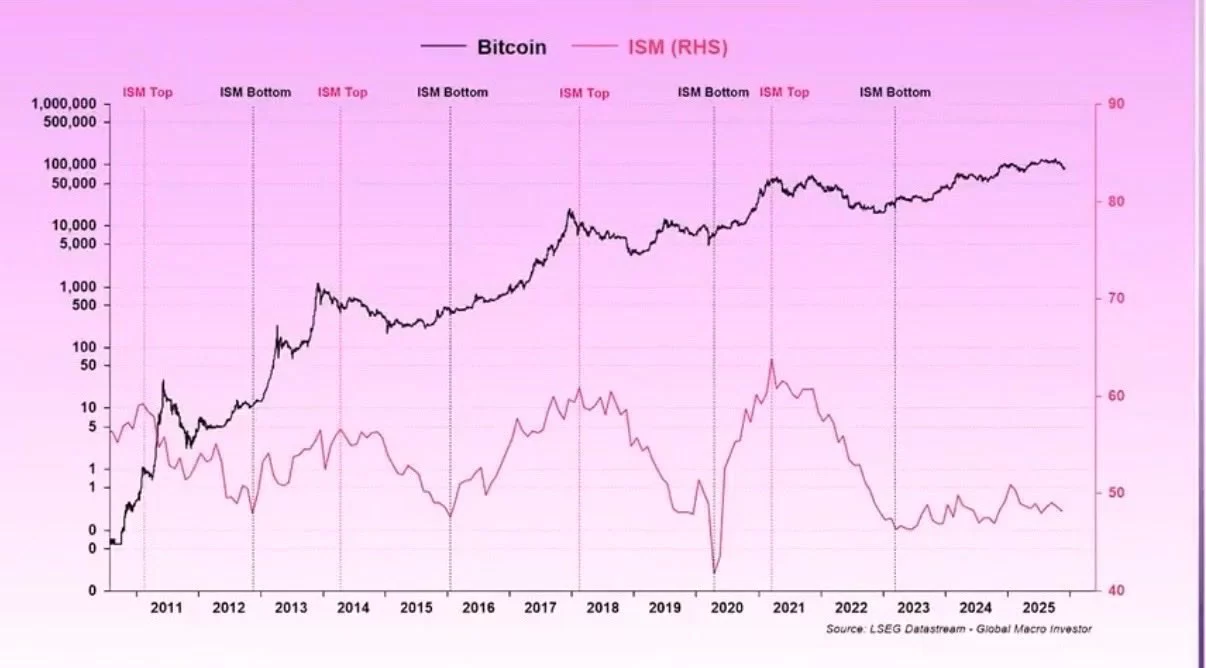

The first graph illustrates the “Business Cycle and bitcoin Correlation.” Delays in interest rate cuts by the Fed and anomalies caused by Trump have disrupted this relationship, pointing towards an upward trend in the coming year.

Bitcoin’s historical undervaluation against Gold suggests potential for significant future increases. The correlation cycle graph above also enhances hope for 2026.

The “18-Year Real Estate Cycle” implies that while a full bull market environment for cryptocurrencies hasn’t formed, upward trends have been observed, benefiting Bitcoin in the coming year.

Benner Cycle and Cryptocurrencies

Lastly, the 200-year “Benner Cycle Chart” indicates that “a peak may be reached in 2026,” followed by a potential decline phase. Proposed by Samuel Benner in 1875, this cycle identifies periods of panic, prosperity, and hardship.

According to the Benner Cycle, 2021 was a peak, and 2023 marked a recovery phase. While Bitcoin is known for its four-year cycle, the Benner Cycle relies on 8-10 year agricultural and industrial cycles, providing credible and macroeconomic trend observations for informed consideration.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.