Tether’s $500M Bitcoin Bet: Acquiring 8,888 BTC Signals Major Crypto Confidence

Tether just dropped half a billion dollars on digital gold—and the market's paying attention.

The Strategic Stack

Forget dipping a toe—this is a cannonball into the deep end. The stablecoin giant's latest treasury move isn't just a purchase; it's a statement. Adding thousands of Bitcoins to its reserves screams long-term conviction while traditional finance hedges with endless committees and risk assessments.

Why This Number Matters

Eight thousand, eight hundred and eighty-eight. In many Asian cultures, that sequence screams prosperity and infinite fortune. Coincidence? In crypto, there are no accidents—only calculated narratives. This purchase volume telegraphs a bullish outlook that bypasses Wall Street's usual quarterly myopia.

The Ripple Effect

Watch other major players follow suit. When the largest stablecoin issuer makes a move this public, it creates a gravitational pull. Expect treasury diversification talks to shift from 'if' to 'how much' across boardrooms that still can't quite explain blockchain but love the sound of appreciating assets.

One cynical finance jab? It's almost refreshing to see a half-billion dollar bet that doesn't involve layers of fees, middlemen, and prospectuses thicker than a brick. Tether just cut through the usual noise—buying hard assets while traditional funds were busy over-engineering another synthetic ETF derivative.

The message is clear: sometimes the best hedge against uncertainty isn't another complex financial instrument—it's simply stacking more Satoshis.

Tether Expands Bitcoin Holdings

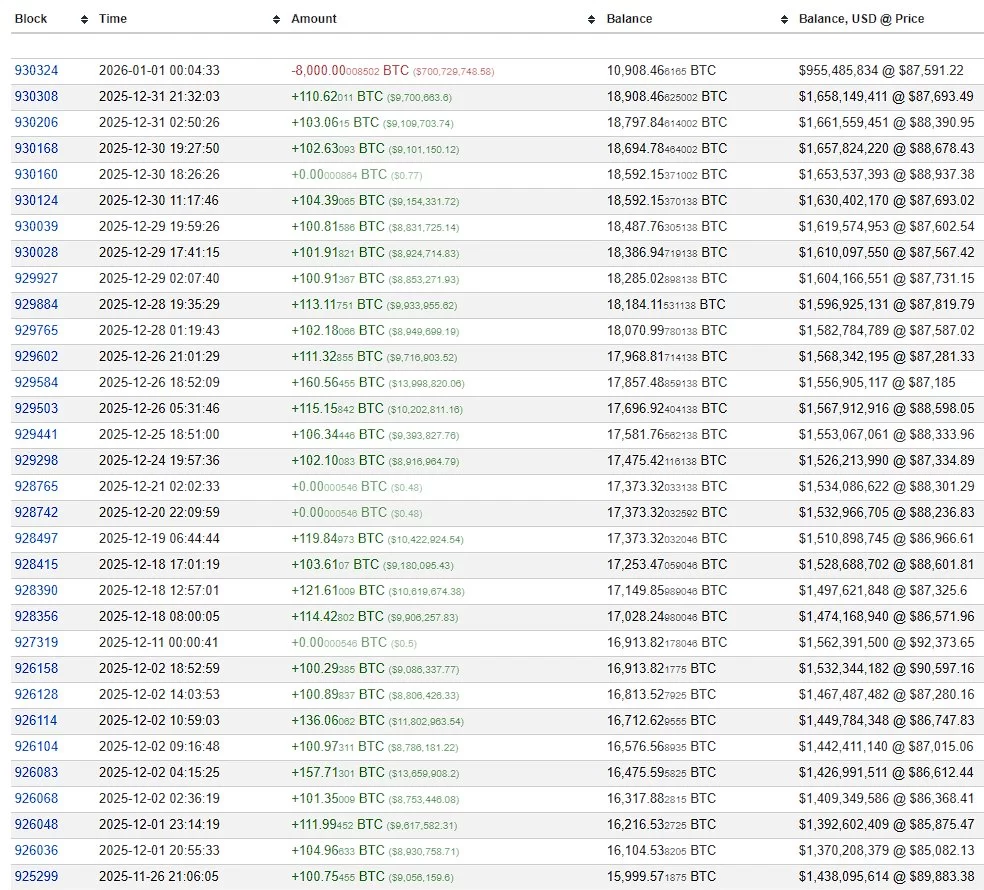

In the early moments of the New Year, alerts triggered among wallet trackers as on-chain analyst Anlcnc1 reported an acquisition of 8,888 Bitcoins by Tether. The stablecoin giant opting to start the year with such a substantial acquisition underlines its commitment to increasing its bitcoin reserves. The numerology behind the figure 8 symbolizes infinity, suggesting Tether’s unwavering confidence in Bitcoin.

Strategic Ventures and Investments

With a valuation of 500 billion dollars, Tether continues its ambitious fundraising endeavors. The company strategically increases its gold reserves while also diversifying investments across various sectors, including mining. Notably, Tether holds a significant share in Liverpool, marking its influence in the sports arena as well.

Following this recent acquisition, Tether has increased its reserves to a total of 96,370 Bitcoins. Presently holding a reserve valued at approximately 8.44 billion dollars, Tether is anticipated to expand further by 2026. The company’s surplus cash flow—generated from consistent revenue multiplication each quarter—facilitates continued investments in gold, company assets, and its growing Bitcoin reserves.

This strategic decision marks Tether’s ongoing commitment to strengthening its position within the crypto market, leveraging diverse investment avenues to ensure sustainable growth and stability.

The MOVE represents a pivotal moment, reflecting a broader trend among stablecoins towards integrating major cryptocurrencies into their investment portfolios.

Tether’s methodical approach to asset acquisition and investment diversification signals a robust tactic in navigating and reinforcing its market standing in the ever-evolving landscape of digital finance.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.