Altcoins Explode in 2026 Rally as Aster and HYPE Coins Target New All-Time Highs

Forget the boring old guard—the real action is in the altcoin arena. While Bitcoin holds steady, a fresh wave of digital assets is posting double-digit gains, rewriting the playbook for crypto returns in early 2026.

The New Contenders

Aster and HYPE aren't just riding the wave; they're aiming to create it. Both projects are breaking past key resistance levels, with chart patterns suggesting a sprint toward previous peak valuations. It's a high-stakes race against their own historical data, fueled by developer updates and swelling community sentiment.

Anatomy of a Surge

This isn't random. The momentum follows a familiar script: niche protocol upgrades, a spike in active wallet addresses, and that ever-reliable catalyst—speculative frenzy from traders bored with single-digit moves. The smart money watches volume, and right now, it's pouring into these smaller caps.

The Bigger Picture

Altcoin seasons have a habit of making and breaking portfolios. This surge signals a robust risk-on appetite, a bet that the next generation of blockchain utility will emerge from these experimental networks. Of course, for every genuine innovator, there's a tokenomics paper masquerading as a business plan—the timeless dance of finance.

One thing's clear: the market's attention has decisively shifted. The question is no longer if alts will move, but which ones have the legs to sustain the climb once the initial hype—pun intended—wears off.

Aster Coin Price Forecast

According to DefiLlama data, while perpetual contract volumes recover, the Total Value Locked (TVL) for Aster remains relatively stable. The open positions for Aster are still far from their lows, standing at $2.5 billion. Aster Coin is expected to demonstrate considerable rallies in the new year as its revenue trajectory hints at a robust recovery.

Leading into the weekend, Aster aims for a 4% increase, yet it struggles to surpass the $0.78 mark. Should Aster manage to break this resistance, the target price range could shift to between $0.91 and $1.39. Depending on market sentiment in January, Aster’s ceiling might reach up to $1.39.

HYPE Coin Price Prediction

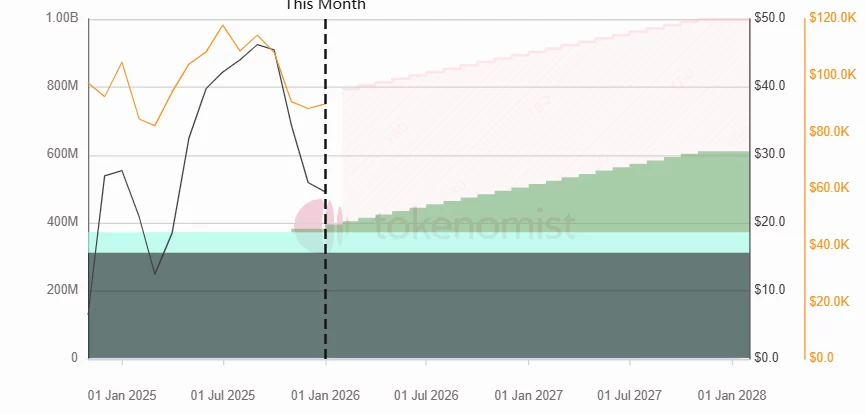

Hyperliquid protocol sees an increase in open positions, with DefiLlama data showing positive trends in earnings compared to Aster. The open positions approach $7.5 billion. Hyperliquid is set to benefit from being the first new-generation decentralized exchange (DEX) for some time. On January 6, a 12.46 million HYPE token unlock will take place, with these unlocks continuing throughout the year, pushing circulating supply to 903 million. Although current circulation stands at 339 million, this could be balanced through token burns, among other strategies.

If consistent token burns occur, the price impact of the unlocks, which amount to 3.61% of the supply, might be mitigated, potentially leading to deflation. However, as the main token unlocks commence this year, achieving deflation seems challenging due to the rapid increase in supply, though negative effects might be limited.

Regarding its price, the $24 valuation holds strong with considerable buyer enthusiasm. Investors with long-term targets for HYPE Coin may overlook the risks associated with significant token unlocks. Many altcoins face issues with annual double-digit inflation.

In the short term, HYPE hopes to overcome fears around token unlocking and reclaim $26.2. Should market sentiment turn positively, $29.5 could become an attainable target. Consistent and substantial token burn announcements could elevate the target price to $35, shifting focus from technical patterns to the dynamics within the token’s economy.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.