Solana’s Unbelievable Surge Leaves Centralized Exchanges Struggling: The 2026 Tidal Wave

Centralized exchanges are scrambling. Solana's parabolic move isn't just a rally—it's a stress test for the old guard.

The Infrastructure Crunch

Order books are lagging. Withdrawal queues are lengthening. The sheer velocity of Solana's price action and the flood of capital moving on-chain is exposing the brittle plumbing of traditional trading hubs. They were built for a different era of crypto—slower, more contained. This is different.

Decentralization's Litmus Test

Ironically, the very exchanges that once listed SOL are now being bypassed by it. Traders are fleeing to on-chain perpetuals and DEX aggregators native to Solana's ecosystem, seeking the speed and finality the L1 provides. Why wait for a CEX's confirmation when the settlement happens in seconds for pennies? It's a real-time demonstration of a core crypto thesis: superior technology can, and will, disintermediate inefficient intermediaries. (Take that, legacy finance bros still trying to price crypto with discounted cash flow models.)

The New Equilibrium

This isn't a fleeting glitch. It's a signal. The surge is forcing a reckoning. Exchanges must innovate their infrastructure at blockchain speed or become mere on-ramps to a financial system that increasingly operates without them. Solana's moment is proving that the most profound surges aren't just on the chart—they're in the shift of underlying power dynamics.

Why is Solana Better?

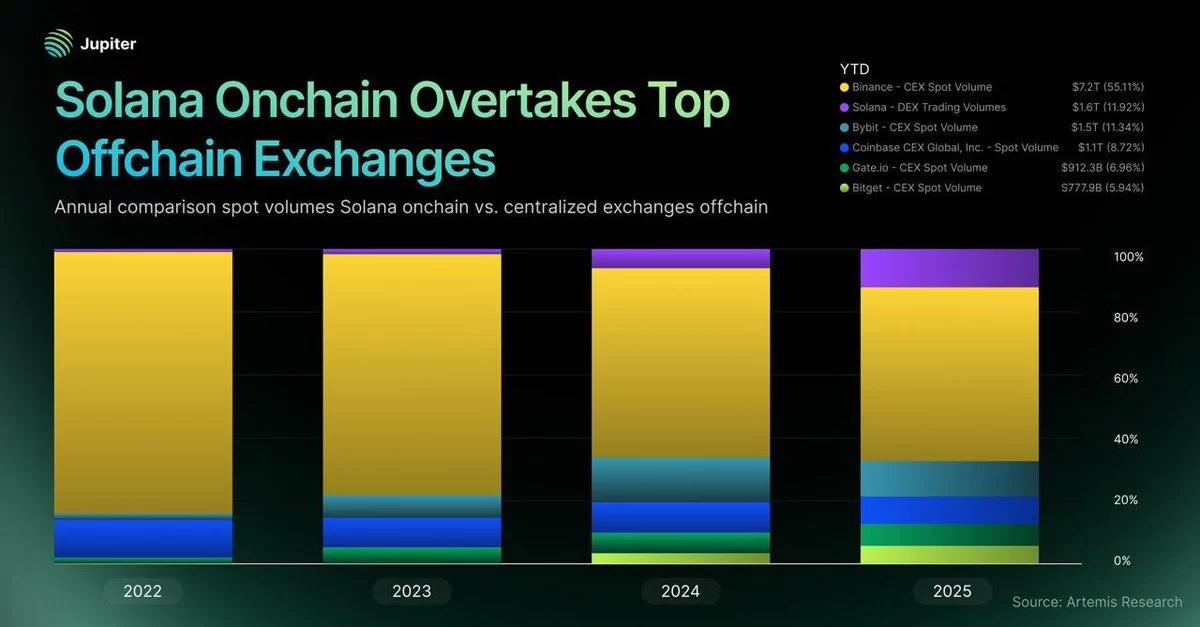

In the first quarter of 2025, the Solana network experienced an explosive memecoin craze, leading to massive volumes. Prominent figures within the community manipulated the hype, earning hundreds of millions of dollars unjustly. The volume increased to astonishing levels. Furthermore, Solana’s on-chain spot volume exceeded $1.6 trillion in 2025.

The Kobeissi Letter highlighted this fascinating data, noting that Solana’s network surpassed all centralized exchanges except Binance;

“In 2025, Solana on-chain spot volume officially surpassed all off-chain exchanges, except Binance, with a total of $1.6 trillion. According to JupiterExchange, Solana’s on-chain volumes have risen from 1% of total volume in 2022 to 12%. In 2025, Solana officially surpassed Bybit, Coinbase Global, and Bitget in terms of total volume. Meanwhile, Binance’s market share dropped from 80% in 2022 to 55%. crypto activity is swiftly moving on-chain.”

Cryptocurrencies Set to Rise

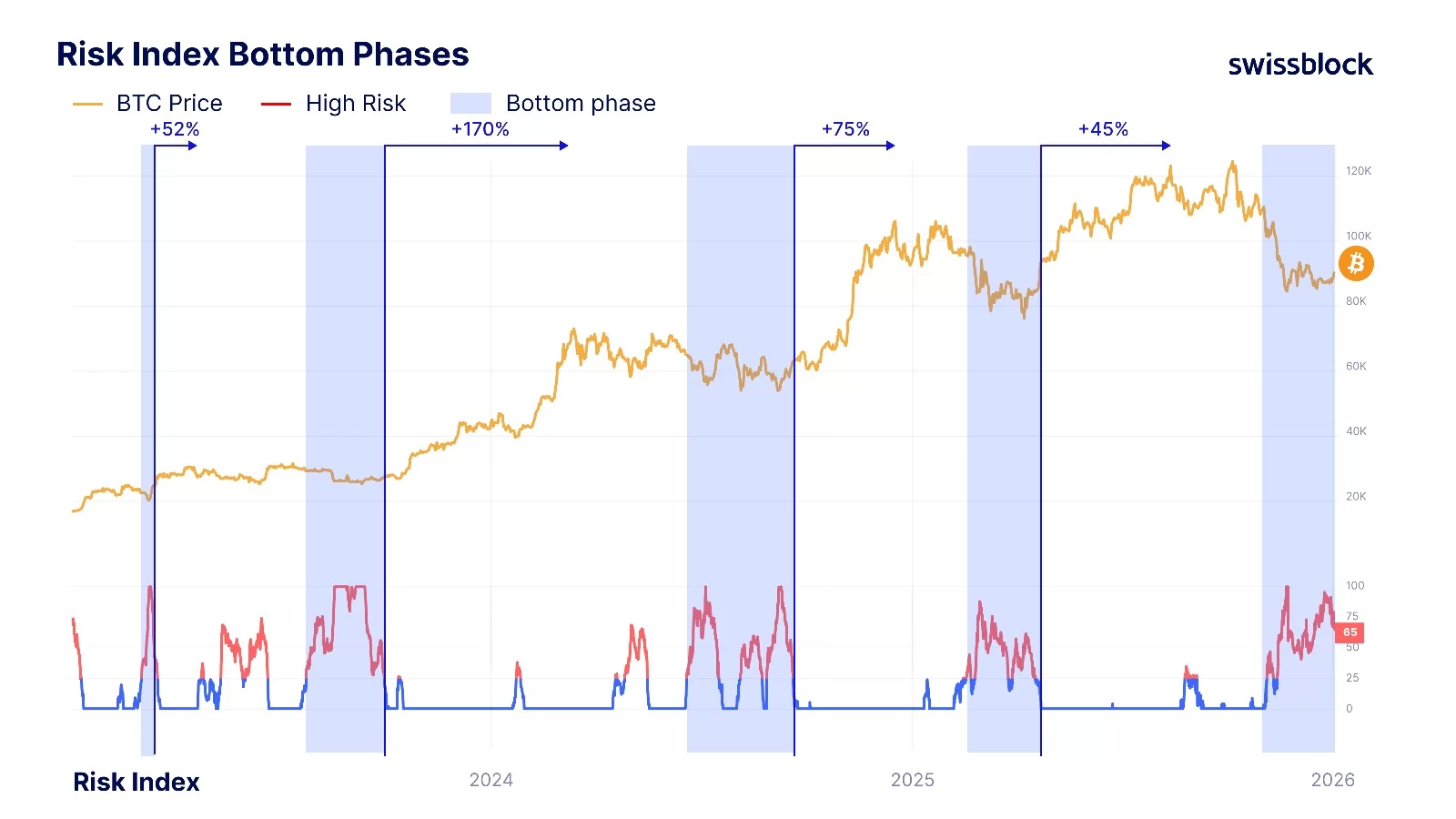

Swissblock, known for its on-chain analysis and unique metrics, has recently shifted its stance. Despite publishing numerous bearish reports, the situation appears to be changing. Today, the team highlighted changes in risk indices, stating that Bitcoin has identified its bottom and is now poised to continue its upward trajectory.

“In November 2025, our Risk Index reached extreme levels and remains in the High Risk area. Historically, these levels indicate the formation of a definitive bottom phase, often followed by strong, long-term uptrends. We remain in the High Risk area, but the question is: for how long? Are we witnessing the final preparations before a near-term breakout?”

With Swissblock involved, cryptocurrencies really might be on the rise.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.