Chainlink (LINK) Whales Defy Market Headwinds, Fueling Bullish Potential

Big money moves in while retail panics—the classic crypto playbook gets another chapter.

The Whale Signal

Forget the daily chart noise. When deep-pocketed investors—the so-called 'whales'—start accumulating an asset during a downturn, it's a tell. Their buying pressure creates a floor, a level of support that often precedes a significant move. It's a high-stakes bet on future utility over present sentiment.

Beyond the Price Tag

The real narrative isn't just about price appreciation. It's about infrastructure. The underlying protocol's role in connecting smart contracts to real-world data remains its core thesis. Whale accumulation suggests a vote of confidence in that long-term utility, a belief that the network's fundamental use cases will eventually outweigh short-term market volatility. They're not trading memes; they're positioning for the next cycle of decentralized application development.

The Contrarian Take

Let's be cynical for a second. Sometimes a 'whale' is just a fund rebalancing its portfolio, or one over-leveraged entity trying to prop up its own bags. The finance world loves a good narrative to sell. But sustained accumulation from multiple large wallets? That's harder to fake. It hints at institutional-grade research, at capital allocating based on a roadmap, not Reddit hype.

The market throws tantrums. Whales, with their glacial moves and cold calculus, often get the last laugh. Whether this is smart money front-running the next rally or just sophisticated bag-holding remains the multi-million dollar question.

Whale Activity in Chainlink (LINK)

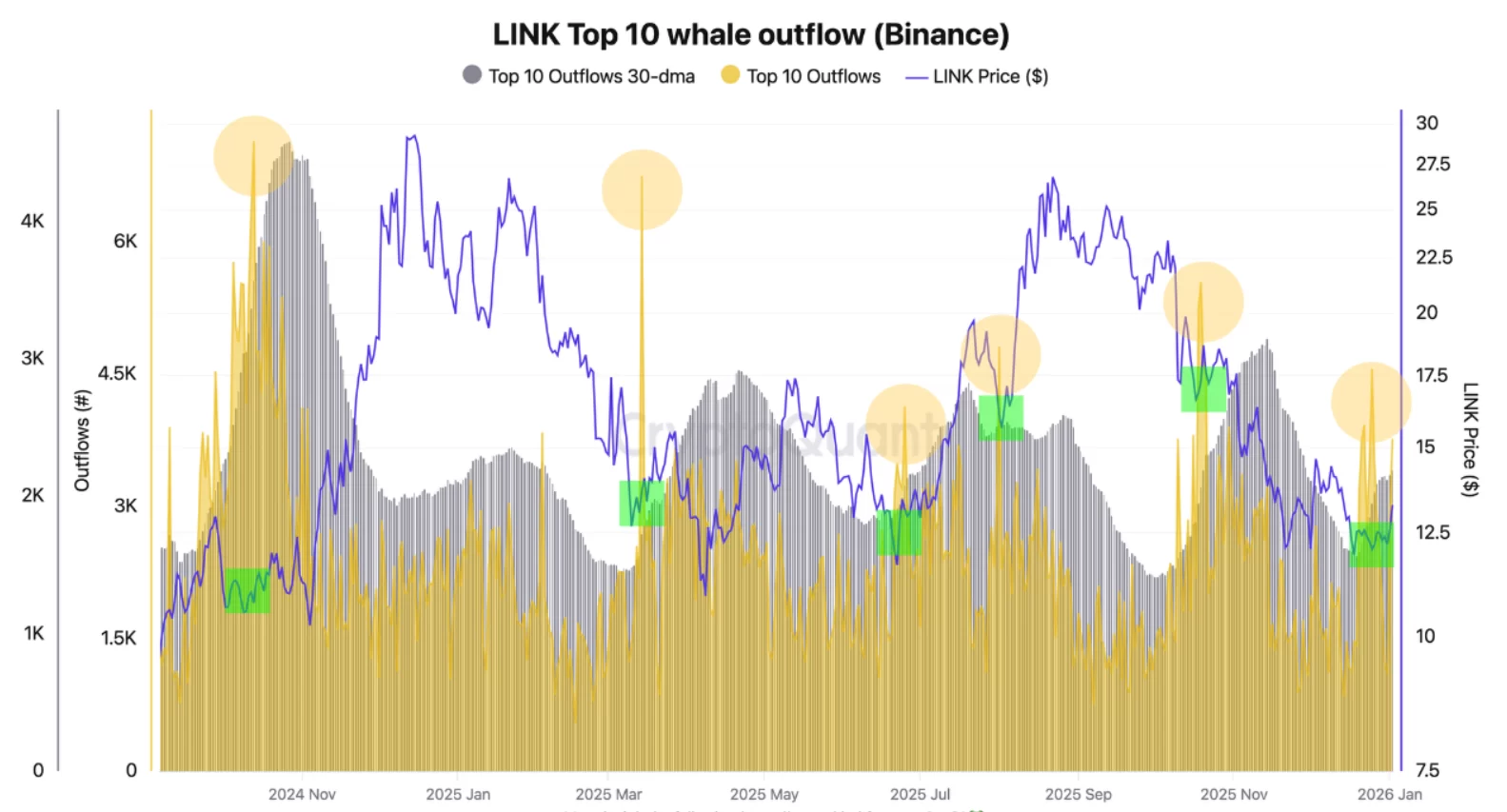

Darkfost, a CryptoQuant analyst, recently highlighted the increasing activity of LINK Coin whales in a market evaluation. Although the price has not met expectations, whale activity has ramped up. Particularly on the Binance exchange, whale movements have led to a sharp increase in LINK Coin withdrawals.

The analyst noted that the daily average withdrawal of LINK Coins from Binance, usually around 1,500, has surged to 4,500. This pattern started taking shape as LINK traded between $12 and $13 following a significant correction of approximately 50%.

Historically, such behavior occurs after strong correction phases. As prices significantly decrease, whales intensify their activity, seizing lower-cost opportunities to bolster their positions. If this accumulation persists, it could establish a definitive bottom for LINK, potentially leading to an uptrend.

The downturn has presently paused, and the increase in whale withdrawals is interpreted as movement of exchange assets to cold wallets. If market sentiment remains robust, with whale support, LINK Coin may climb back above $20.

LINK Coin ETF Aspirations and Price Dynamics

At $13.31, LINK Coin has not fully capitalized on the surge seen in meme coins, which gained an average of 6%, while DePIN achieved a 4% increase. AI and NFT tokens have also risen more on average compared to LINK Coin.

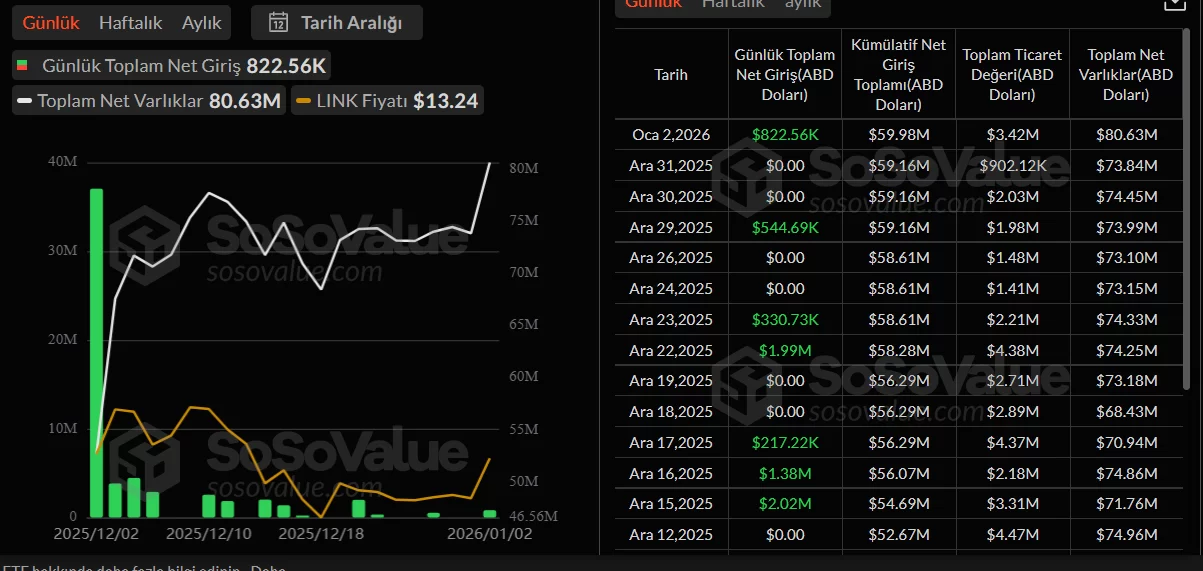

Friday’s ETF data were anticipated to be significant. The January uptick across cryptocurrencies did not significantly excite ETF channel investors, with only $822,000 in inflows according to SoSoValue data. Although it’s the largest inflow since December 22, the spot price for LINK Coin has yet to make a move, deterring ETF channel investors from seeing potential opportunities.

Long-term institutional investment in Chainlink is anticipated to flow through the regulated LINK Coin ETF, potentially creating a rally. However, such circumstances have yet to materialize.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.