Bitcoin Plunges: Will Aster and HYPE Coin Ride the Storm or Get Washed Away?

Bitcoin just took a nosedive—and the whole crypto market is holding its breath. The big question isn't just about BTC's chart; it's about what happens next to the ambitious altcoins trying to carve their own path.

The Domino Effect

When Bitcoin sneezes, the altcoin market catches a cold—or worse. A major BTC correction doesn't just wipe out portfolio value; it triggers a massive risk-off shift. Liquidity vanishes, leverage gets liquidated, and the 'flight to quality' begins. For projects like Aster and HYPE Coin, this isn't a minor headwind; it's a stress test of their core utility and community conviction.

Aster's Make-or-Break Moment

For Aster, this volatility is the ultimate proving ground. Does its ecosystem offer enough real-world utility to keep users engaged when speculative gains dry up? A dip separates the tourists from the citizens. If activity on its network stalls, it's just another token. If usage holds or grows? That signals something foundational—a project people use, not just trade. Watch the transaction metrics, not just the price.

HYPE Coin's Reality Check

HYPE Coin, by its very name, lives on sentiment. Market-wide fear is its kryptonite. Its performance now hinges on whether its community is built on memes and momentum or something more durable. Can it maintain its narrative while traders panic? The next few days will reveal if it's a resilient brand or a fair-weather phenomenon. Remember, in a bear swing, hype often gets revalued to zero—a classic finance tale as old as tulips.

The Silver Lining Playbook

History shows these shakeouts create opportunities. Weak hands sell; builders keep building. Projects with solid fundamentals, clear roadmaps, and managed treasuries often emerge stronger. They accumulate talent, forge partnerships, and capture market share while the noise fades. The key is survival—staying liquid, engaging the core community, and executing the plan while everyone else is staring at charts.

Forget predicting the absolute bottom. Watch for stabilization in Bitcoin first—that's the tide that lifts or sinks all boats. Then, monitor which altcoins recover their value fastest. That's your signal for real strength. In the meantime, the entire sector gets a brutal lesson in beta and correlation, much to the delight of every traditional financier sipping a latte and saying 'I told you so.'

Bitcoin's dip isn't an endgame. It's a filter. It pressures every assumption and rewards genuine innovation. For Aster, HYPE Coin, and every other project, the message is clear: adapt fast, prove your worth, or get flushed out with the leverage. The market's memory is short, but its punishments are swift.

Massive Billion-Dollar Transfers

Recently, massive bitcoin transfers have come under the spotlight. Typically, such significant movements precede an increase in volatility, often serving as a warning signal for potential declines. Bitcoin’s price movement from $88,000 and potential rebound over $94,000 has prompted major investors to prepare for further dips throughout the rest of the year.

Given the tonal implications of Friday’s upcoming news and the uncertainty it may trigger, there exists a risk of significant drops in both stock and cryptocurrency markets. An hour prior, Darkfost issued a major transfer alert, urging cautiousness.

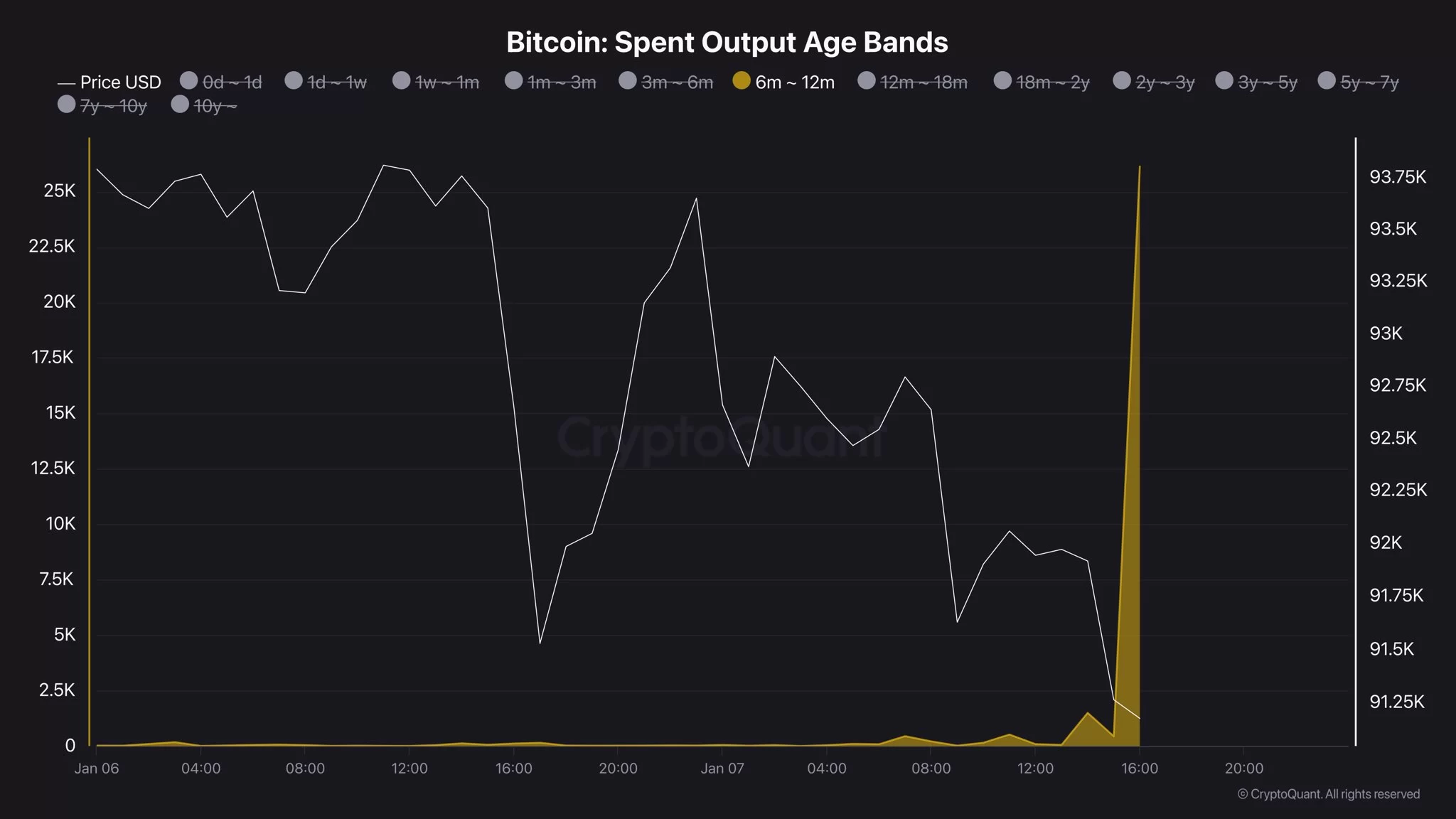

“CURRENTLY: 26,141 BTC added to 6-12 month movements. This equates to $2.3 billion. Numerous significant movements are ongoing, so stay vigilant.” – Darkfost

Despite the overall negative sentiment in the market, Poppe shared the above chart, indicating a continued consolidation process with no need for panic.

“Bitcoin remains in consolidation after being rejected at $94,000. I anticipate a rebound in the next 1-2 days, with another attempt at $94,000 by the weekend.”

Should the 21-day moving average be lost, the optimistic scenario weakens, suggesting Bitcoin might test $91,000 with potential for further decline.

Insights on Aster and HYPE Coin

Despite receiving visible support from Binance founder CZ, Aster Coin has struggled to establish new highs. Historically, ambitious altcoins establish peaks not less than half of their ATH after prolonged lateral movements.

For Aster Coin, the anticipated new year rise aimed to test the $1.84 resistance level. Following the recent Bitcoin sell-off, the price now targets the $0.66 support, with potential for new all-time lows if Friday’s news does not bear disturbing results. A rapid recovery to $1 is expected if the news is less alarming.

HYPE Coin, on the other hand, faces a more favorable outlook. As the first significant player in the new generation of DEX, it enjoys substantial profits. Despite token inflation, long-term investors were keen to buy at $35 last year. At present, it retreats to $24.3 after rejection at $28. While HYPE Coin typically responds swiftly during bullish periods, current market conditions remain unfavorable.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.